Flipping HIVE:HBD - market review over the last 6 days

I've been getting more and more into trading these days, particularly flipping between HIVE and HBD. I've been trying to understand the numbers around it better, and thought that trying to review the past 6 days worth of data in a post would be a good exercise for me !

This weeks data

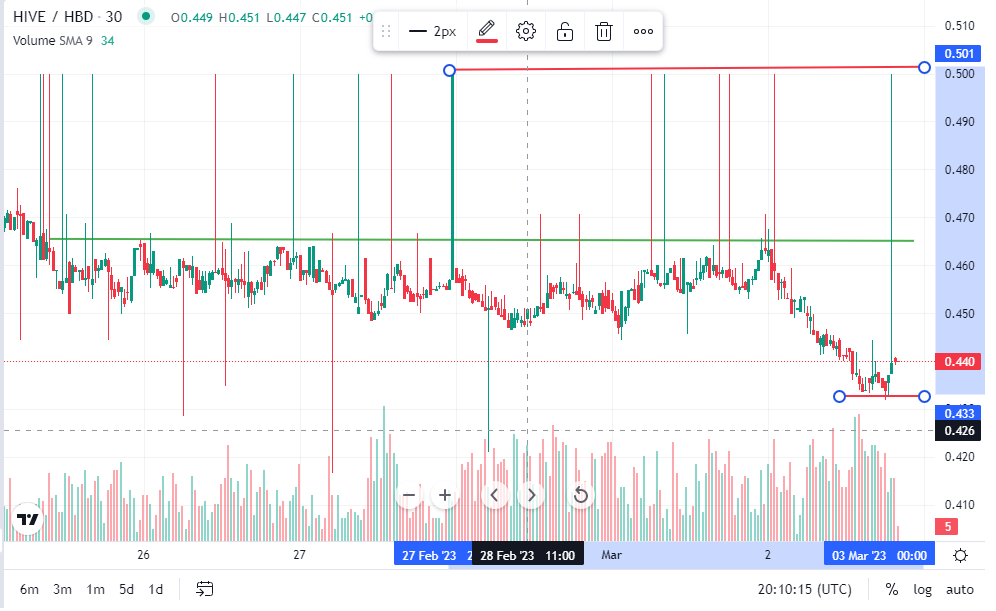

[Credit: Hivehub.dev HIVE:HBD price - taken within an hour of posting]

The above chart shows the price over the last 6 days, and I've added a few horizontal lines:

- Red shows the range, the highest ($0.50) and lowest ($.43) prices,

- Blue shows the main band where the price stayed for most of the time period ($0.445 to $0.465),

- Green is drawn to show the mid-point of the main band ($0.455).

So apart from that one very quick spike to $0.50 mid week, and then this later dip below the $0.445 mark, there have been very few opportunities for trading this week (for me atleast).

The variation in the main band is very low, only $0.02, or 4.49% of the lowest value. Flipping in that band would have allowed for trading margins per trade of around 2.25% (based on half of the range) - which is not great. But looking at the number of times it properly cross the middle (by a decent amount), there were quite a few opportunities to do that during the week (6+ and maybe higher).

I normally have my margins set at around 5% (that is, I want to make around 5% per trade). As a result, I had very few trades go through this week, and only had some today when the price started going down.

How many flips are needed ?

And another piece of info I've been looking at this week is how many flips at a certain margin are needed to double your money. That is, if I started of with a trading pot of $100 - how many times would I have to flip/trade at a certain margin to double my money to $200. So heres some stats of interest:

- @1% = 70 flips are needed

- @2.25% = 32 flips are needed [which was the trading opportunity in the main band this week]

- @3% = 24 flips needed,

- @5% = 15 flips are needed,

- @10% = 8 flips are needed.

So what does this all tell me ?

- If I wanted to make more trades this week I would have needed to use a tighter margin than I'm used to - in the order of 2.25% - but I would have needed twice as many flips to get the same amount of return, and I would have had to have been online a lot more organising the flips (I would not have been able to catch them all),

- Lets say I did, and I caught about 5 trades - that would have worked out at a potential gain of around 14%,

- If I did want to get more, then my standard 5% was too high, on the whole for this week,

- So its drawing me to think that I maybe should try some trading pots, with a range of target margins, just to see how I get on.

This weeks extremes

[Credit: Hivehub.dev HIVE:HBD price - taken within an hour of posting]

Now if we focus on the the largest spread - highest ($0.50) and lowest ($0.43), and the mid-point ($0.465) then its quite different:

- The range is $0.07, equating to 16.85% of the lowest price, giving a potential trading opportunity of around half that (8%) for flipping. However, there would have only been about 2 opportunities to make that in the week. Now that would have been easy to catch both, because there was a lot of time between them, and you could have set up your trades and waited. And if both were caught - it would have worked out at around a gain of 16% !

Although its worth noting that the large peak in the middle of the week was very short lived, and to have caught that would have required some luck - even if you had the trades set up and waiting to be filled. I did have my orders set up, and mine didnt get filled, as it was just a short spike.

In conclusion

Overall, when I sum it all up I think I will set up a number of trading pots with a range of margins, and see how that pans out for a number of weeks. To be fair, I would argue that I do have that, but the lowest is 5% - so I'll add some others at 4%, 3% and say 2.5% and see how I get on for a few weeks. I think the lowest at 2.5% might be too much work to manage manually and I'll end up missing opportunities and making very little - but I'll give it a try and see how it goes !

Anyway, thats my summary for the week. I have to say that making the post has helped me to think about the margins, and this is definitely work in progress, so I'll have to see if it works out like I think it will !

And if you have any good tips or suggestions - then I'm all ears !

Posted Using LeoFinance Beta

Congratulations @hoosie! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 18000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out our last posts: