Long term investing in ETFs and stock market funds - saving for retirement

I'm a member of the saturday savers club, and each week there is a challenge (link to this weeks post). This week's challenge was:

"tell us your thoughts about investing in stocks and shares. Is it part of your regular savings plan? Would you like it to be? What would be your concerns?"

I do invest in the stock market, and I thought I would expand on what I do in this post, because I saw a few queries in the responses to the post, and this may help.

Disclaimer: This is just what I do and I am ++NOT++ an expert. Do your own research, etc.

I'm based in the UK, and use a company called Fidelity International for my stocks and shares investments:

- Their website is easy and well set up,

- Their fees are pretty good,

- You can choose from lots of funds from a number of different providers and across different markets and countries,

- You can link multiple accounts,

- They offer specialist UK accounts which are tax efficient , eg, ISAs, SIPPs, etc,

- You can invest in fairly small amounts (eg, £100 at a time).

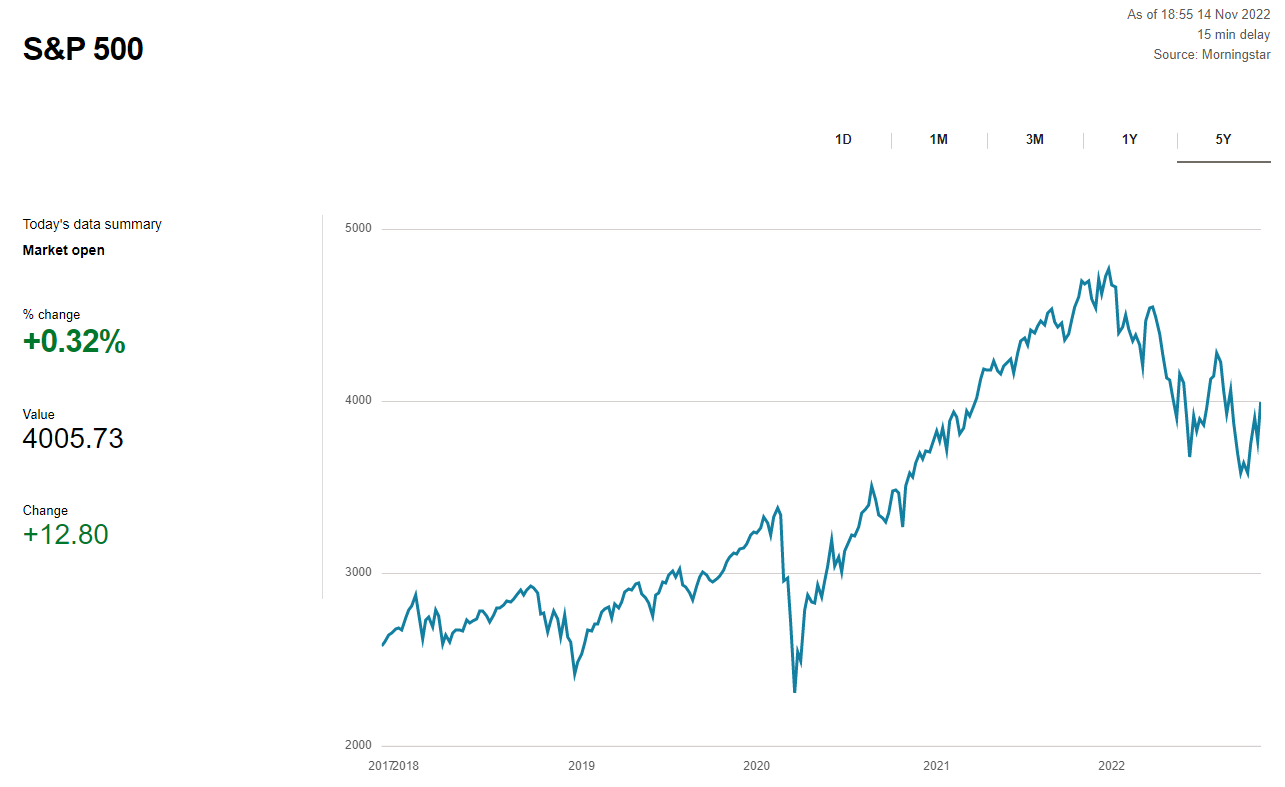

And the following graph explains why I'm investing in stocks and shares:

Source: BBC News Market Data, accessed on 14th Nov 22 @18:55.

This is a 5 year view of the S&P 500 index that tracks the stock of 500 large companies in the US. You can pull up other indexes like the Nasdaq, Dow Jones, FTSE 100, etc, and you will see similar patterns. For me, I see bumps in the road, but with a general upward trend. If you go back further than 5 years, you'll really see what I mean.

In the graph above there are two very telling dips for me. The one in 2020 = Covid, and the one we are in now = everything thats going wrong in the world. Interestingly the current dip hasnt even got close to the covid dip. And who knows if the current dip has bottomed out yet or not. I dont know, but I'm confident it will at some point, and then it will be onwards an upwards, when the world sorts some of its sh1t out and gets back to the good times.

So for me its all about the long game. I tend to try the DCA method, of buying in over time, because I believe it is impossible to time the market consistently (well I'm 100% sure its impossible with my brain power). Therefore DCA'ing into an upward trend over a long period should see me good in the long term.

Then the other important aspect of my stock and shares investments is that I never buy into single stocks. Its just too risky for me, its putting all your eggs into one basket. If the stock goes south, then you are done. Instead I buy into Exchange Traded Funds or just stocks and shares funds.

These are, if you like, baskets of stocks. So for example, I could buy into a S&P 500 tracker. And it would invest my money in each of those 500 shares that are tracked by the index. If one or two go down - hey ho, no big deal, because the rest are hopefully ok. In this case I feel the risk is much less.

You can also buy non-tracker funds, that are managed. In this case a fund manager manages the fund and picks the shares to invest in and hold in the fund. To be honest, the performance of fund managers can vary significantly so you do have to watch what you pick.

And you can invest in different markets from across the world, and within different sectors across those markets, eg, banking, energy, tech, etc.

I tend to stick to tech, UK, Europe and US. I find these are less volatile, and hence less risky.

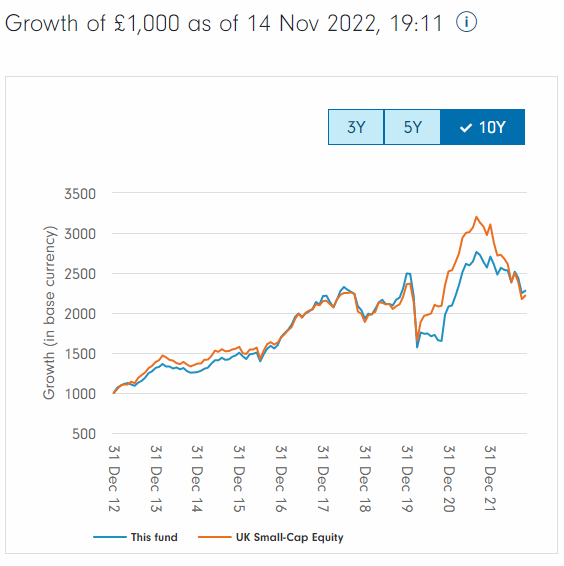

Artemis UK Smaller Companies Fund (ATUSA) is an example of one of the funds invest in.

Source: Fidelity International UK website, accessed on 14/11/22 @19:15.

I started buying into this a few years ago. My whole portfolio has taken a hammering this year due to the events in the world, but this is the one on which I'm loosing the least. I'm only down 4.44% on it, and am confident it will recover, when the world starts to recover.

Again looking at the graph, over 10 years this time - you can see an obvious trend.

This fund contains 75 shares, mostly in the UK. The blurb on the fund is:

"The fund aims to grow capital over a five year period. The fund invests 80% to 100% in shares of smaller companies and up to 20% in bonds, cash and near cash, other transferable securities, other funds (up to 10%) managed by Artemis and third party funds, money market instruments and derivatives. The fund may use derivatives for efficient portfolio management purposes."

Its fees are a little high at 0.86%. Its an accumulation fund so any dividends it makes are put back into the fund to improve the fund price, instead of being given out to investors.

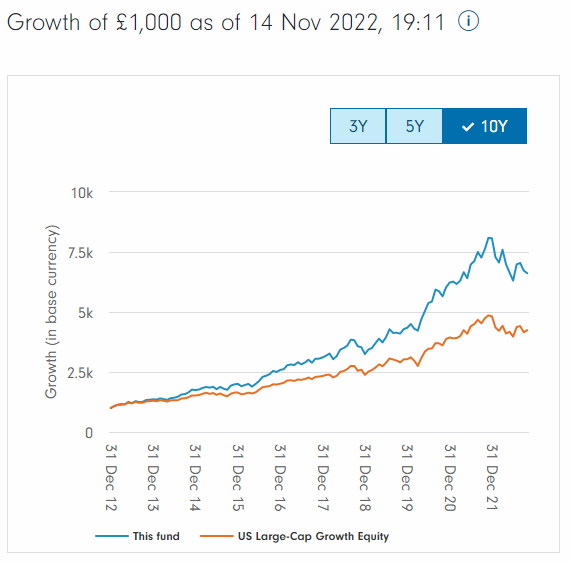

Another ETF that I use is Invesco EQQQ NASDAQ-100 UCITS ETF (EQQQ) - this gets recommended all over the place.

Source: Fidelity International UK website, accessed on 14/11/22 @19:23.

Again the same pattern is there, except that interestingly the covid dip is hardly noticeable ! The blurb on the fund is:

"The investment objective of the Fund is to provide investors with investment results which, before expenses, generally correspond to the price and yield performance of the NASDAQ-100 Notional Index (Net Total Return) in USD. The Fund may invest up to 20% of its Net Asset Value in shares issued by the same body, and up to 35% in exceptional market conditions."

So its a Nasdaq tracker, following companies we've all heard off; Apple, Microsoft, Amazon, Tesla, NVIDIA, Pepsi Co, Costco, etc. The fund is pitched at growth, but it also pays out dividends to investors quarterly, which is nice. Because its pretty much a tracker, its ongoing fees are lower at ~0.30%, ie, it does not have to pay for fat cat fund managers (or atleast not as much).

The above two funds are pretty representative of the type of funds I have invested in.

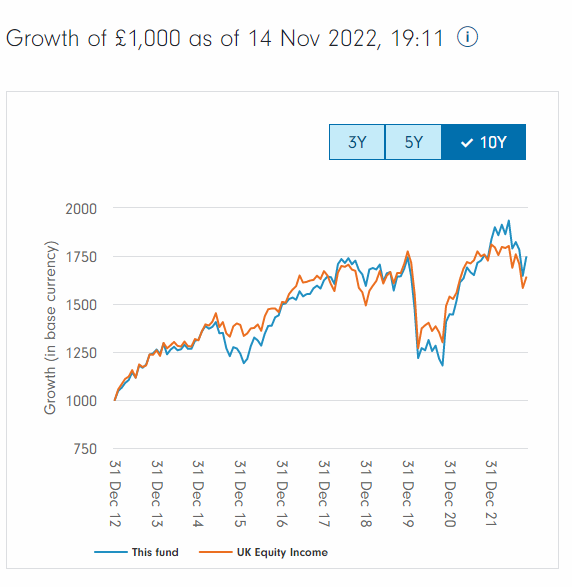

And then I have one other oddball fund that I follow - its an oddball in my portfolio because I have nothing else like it in there. It is the Schroder Income Maximiser Z Income GBP fund (SCMIZ):

Source: Fidelity International UK website, accessed on 14/11/22 @19:34.

It has a similar pattern upward trend, but it hasnt gained as much over time. However, this fund is all about dividends. It pays out at roughly a steady 7% annually, paid every quarter. In the current inflation climate that does not sound great, but its way better than banks will pay. And for me, I have enough of this fund this its dividends will pay for all of my other funds ongoing fees, plus some left over to invest further in shares.

I dont expect to get the crazy gains that some people get in crypto from this, but I aint about to sink my life savings in crypto (eg, LUNA, FTX, etc - no thanks). I reckon that I should be able to do 10% compounded annually over the long term, which is way better than a bank, so I'm happy with that. I dont have everything in there, because I believe in spreading my investments, but I have enough that it should make a difference at retirement. And I will continue to add to it. And in terms of timescales, my investment period is between 5 and 15 years, so I think things will be fine over that period.

So this post aims to provide a flavour of my stock market investment approach. If there is enough interest, I'm happy to make some further occasional posts about some of the other funds I use and how things are going with them. I find it quite interesting, and enjoying pouring over the details of the funds, comparing the performance, portfolios, etc. And then hopefully in a few years time, it will help me buy a few cocktails when I finally retire !

All the best, and take care of your investments !

Interested in the Saturday Savers Club ? Check it out at @eddie-earner.

Posted Using LeoFinance Beta

Great work. The ETFs and DCAing into them seems to be the best strategy out there. John Bogle was a wise man!

Its working for me, well atleast it should when the wrold recovers !

!CTP

Congratulations @hoosie! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 65000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPETFs are the backbone of every investment portfolio. 👍🏻

Yes, I think its a good approach !

!CTP