Calculating Net Gains of PolyCUB Investment - Week 5 💰

The emission rate of PolyCUB token has been decreasing and the dynamics of our initial investment has been changing accordingly. Even though the inital weeks of our investment were too volatile to track, recent history shows that the fluctuation of price settled down.

In the 5th week of our investment, you will clearly see that the price drops and volatility are no longer effective in the price of PolyCUB token. On the other hand, the APR rate of xPolyCUB staking has been doing perfectly fine.

Similar to previous weeks, the price of PolyCUB decreased from $0.55 to $0.33 which makes about %40 price drop within a week. Here you can see the results of W4:

The sum:

-$229 from USDC Farm

-$33 from ETH Farm

+$229 from xPolyCUB staking.

Net: -$33 in value.

We can easily calculate that the drop from $0.55 to $0.33 could be hedged to great extent. You can multiply the ratio of the losses and earnings in these examples according to the amount of your initial investment.

The Fifth Week of PolyCUB Investment

There are 2 factors we will highlight this week:

- The price of PolyCUB was nearly the same with last week

- The APR rate of xPolyCUB staking

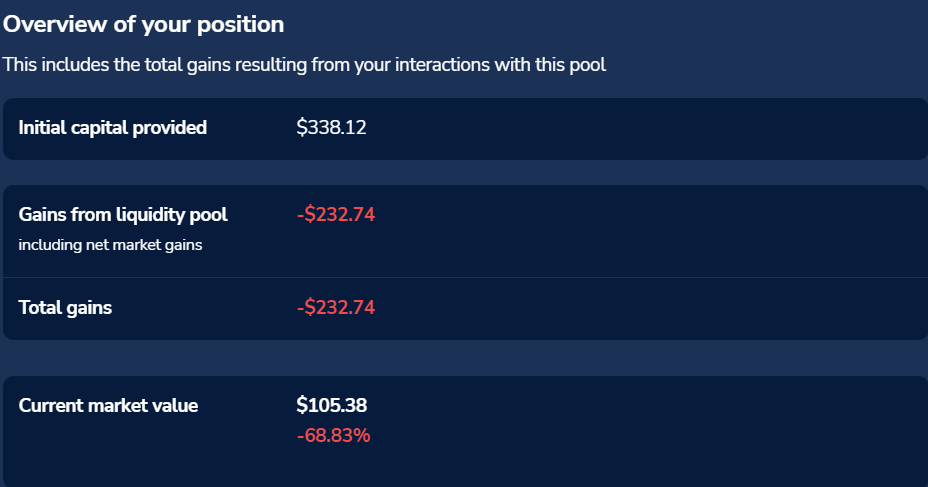

The Performance of USDC / PolyCUB Farm

The initial investment and the current market value are nearly the same with the previous week (only %1 difference). Since the farming has been done from the first minute of the investment, the performance looks negative due to the price actions. So, the drop in the price is around %68 in W5.

Note: The harvests were added to xPolyCUB staking regularly

The Performance of WETH / PolyCUB Farm

Similar to the performance of USDC/PolyCUB farm, there is only %1-2 difference in the performance of the farm. Last week the drop was %61 while this week it is over %63 in terms of current market value.

Since all the harvests were put into xPolyCUB staking, these negative results were compensated with the staking rewards. Here is the performance of xPolyCUB:

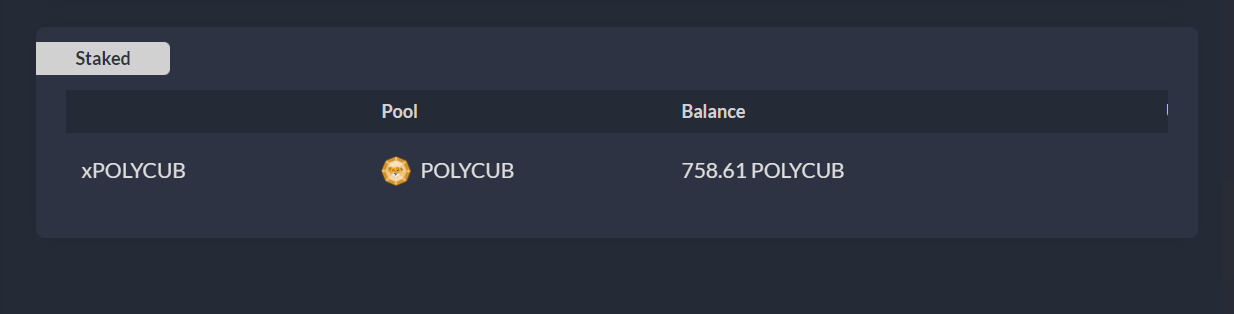

xPolyCUB Staking - The Seat Belt

What I prioritize in the xPolyCUB staking is the amount of PolyCUB that I'm going to receive if I want to turn xPolyCUB into PolyCUB token.

Last week, the number of PolyCUB that I made was 689 (made $229 at PolyCUB = $0.33)

This week, the number of PolyCUB in stake is : 758 thanks to directly re-investing strategy.

37.746 xPolyCUB makes: $236 (when pCUB = $0.31) Although the price of PolyCUB decreased 2 cents, the staking could hedge the fluctuation.

The sum:

-$232 from USDC / PolyCUB farm

-$34 from WETH / PolyCUB farm

+$234 from xPolyCUB staking

It makes -$32 in total.

(It was -$33 in W4)

The Stability ✔

The platform reached stability in terms of the price of token and the number of tokens being claimed by paying %50 penalty.

Before the launch of Bonding & Collaterals, the stability in the price (maybe the dip) is reached to aim higher with useful products. As I always mention, the re-investing in xPolyCUB could hedge the unrealized losses from farms. However, the stability may bring us opportunity to increase our shares in farms to enjoy %120+ APR.

TL;DR

PolyCUB has been performing like a stable coin for a week 😄

The results of this week is not different from W4. While having unrealized losses from PolyCUB farms (around -$266 for ~ $400 investment) and hedging the losses with xPolyCUB (+$234).

It is the first time that we did not experience any significant drop in the price of PolyCUB token. As it is nearly stable, we may acknowledge an accumulation stage before the higher levels can be reach with the help of Bonding mechanism and Collaterals.

Now that the volatility has decreased, how about increasing the liquidity shares in the LPs? I'm going to consider the re-investment strategy to enjoy APR of Farms in Kingdoms.

An interesting week for 💎🐾.

Posted Using LeoFinance Beta

Your content has been voted as a part of Encouragement program. Keep up the good work!

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

https://twitter.com/idiosyncratic1_/status/1513289451958644742

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

It is interesting how the price suddenly settled down. The emission rate along with airdrop seems about equal to the buy demand that is out there.

This bodes well when the new features are added.

Posted Using LeoFinance Beta

So far the deflationary nature is the only narrative behind the PolyCUB for external investors. However, soon it is likely to change and the price will have less pressure while testing higher levels 😎

Posted Using LeoFinance Beta

Very true. That is all we have to hang our hats on right now. The fact the token is settling down without any of the other DeFi 2.0 features being rolled out is a positive. That is where we will get an indication if the design is sound or we are in for a loss.

I am with you, I think higher levels.

Posted Using LeoFinance Beta

I have no clue how to monitor my progress. what program did you use?

Posted Using LeoFinance Beta

I use debank for staking data and apy.vision to track farming revenue 🤙🏽