Calculating Net Gains of PolyCUB Investment - Week 9 💰

PolyCUB platform on Polygon Network has been serving as a unique V2 De-Fi experience for several weeks. The initial weeks of PolyCUB investment were extremely volatile and the emission rates were relatively high similar to the majority of existing De-Fi 1.0 platforms.

As the emission rates decreased, the price settled down and the APR rates reached sustainable levels. As of writing, the emission rate is reduced to 0.5 per block from 1 per block. The deflationary nature of PolyCUB turns into a scarce token that will be needed a lot when Bonding and Collaterals are deployed.

So far we own pHBD stablecoin pool; the pHive / PolyCUB pool and pSPS pool are upcoming in addition to bonding and collaterals. Meanwhile, our goal is to grow our PolyCUB bag as much as possible. Thus, we are experimenting with re-investment strategy from the very first minute of the platform 🦁

Let's check the results of our investment.

The Performance of Last Week - Week 8

The results of week 8 were not quite positive for most of us. The net gains from pools, harvest, and xPolyCUB staking yielded above -$200 result while the token was traded @ pCUB= $0.14

Additionally, it is the first time that we harvested tokens but we did not claim them by paying a penalty. This week we received 32 PolyCUB ($4.5) besides the compounding xPolyCUB staking.

In total:

-$305 from Farms

+$127 from xPolyCUb

+$4.5 from Liquid pCUB

=-$203,5 in sum.

PolyCUB Gains Value

According to the chart, the PolyCUB token has increased by $0.12 from the bottom level before the halving takes place 😉 Smart money ✌

The Performance of PolyCUB Pools - Week 9

Each week the pools yield nearly the same results in terms of the difference between the initial capital provided and the total market value as of today.

For a long while, as long as the bear market keeps going, we may always see these letters and numbers as red. However, one day they will be green permanently. Waiting for Q4 of 2022.

Similar to previous weeks, we see around 70-73% net loss in the total gains excluding the harvests. On the other hand, liquidity pool gains are around -46% according to the data.

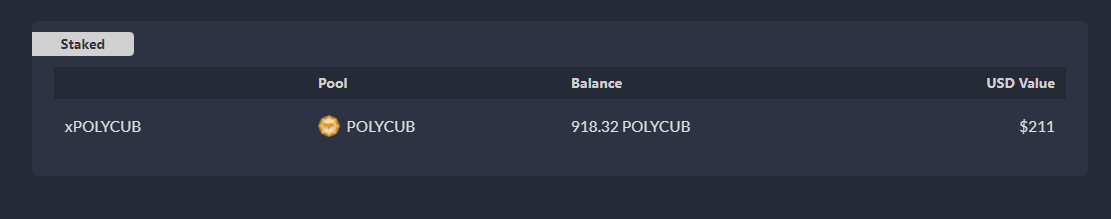

XpolyCUB Staking - Compounding Harvests

This week we own 918 POLYCUB tokens ($211) that increased from 885 tokens last week.

In addition, there are 59 PolyCUB tokens ($13.7) waiting for unlocking.

In total:

-$247 from USDC Farm

-$39 from WETH Farm

+$211 from xPolyCUB Staking

+$13.7 from locked PolyCUB

= -$61.3 Net Gains for the ninth week of investment.

Hive Savings (20% APR) vs pHBD/USDC (45% APR)

The initial investment of $137 stablecoin on pHBD/USDC farm yielded 12.2 PolyCUB ($2.82) in the second week of our experiment.

The tokens earned from harvests will be staked on xPolyCUB when the tokens are unlocked (like we do in the first experiment). Basically, we will be able to compare the performance of $137 HBD in Hive savings vs pHBD pool 🔥

TL;DR

PolyCUB token gained $0.12 value within a week and the results of farms on the PolyCUB platform reflected the recent price action positively.

Last week the return of our investment in PolyCUB pools made more than -$200 net gains for our initial capital. However, this week (@ pCUB= $0.23) the return of our investment is only -$61 though we are still at the bottom levels. You can foresee what would happen when PolyCUB is traded at $2 😉

Our second experiment, pHBD vs Hive Savings, showed that $137 of pHBD / USDC pool yielded 12.2 PolyCUB (which is great IMHO) in 2 weeks. When the tokens are unlocked, they will be staked on xPolyCUB to compare the re-investment strategy for Hive Savings and PolyCUB bags 🦁

Posted Using LeoFinance Beta

Those yields are pretty impressive. I finally got into farming Pcub recently in the phive farm as well and it looks to be a good decision.

Stacking as many Pcub as possible now that we still have a considerably high emission rate is the way to go.

Posted using LeoFinance Mobile

It's never too late to jump into the farms on PolyCUB 👊

Even with the recent pump, the return on investment gained a nice amount of value. I'm excited for $2 - $5 even higher levels 🤤🤤

Posted Using LeoFinance Beta

https://twitter.com/idiosyncratic1_/status/1523347493940973571

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Your content has been voted as a part of Encouragement program. Keep up the good work!

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

The impact the new PHive-Polycub listing had on the price of Polycub is quite interesting. I like how every new listing will be paired to Polycub...we will likely see such price action again for SPS, I’m anticipating the pcub bottom to pick some again as I already have some liquid SPS I’ll want to put in.

Another thing is that this bear market is making a lot of people reluctant in participating due to impermanent losses here and there. But it won’t matter when the bull market takes over, everything will be super up. It’s a matter of investing and forgetting for now while the market ‘markets’...

Posted Using LeoFinance Beta

PolyCUB will be too scarce to find in the market below a couple of bucks😉

Can't agree more! In the bear market, people make the most fruitful investment though everyone feels desperate for the future of the market. At that point, we are deploying new features + decreasing the inflation of the token (2 strong narratives for De-Fi, obviously). I'm looking forward to sharing positive net gains very soon ^^

Posted Using LeoFinance Beta

Good luck! Thanks for the informative update.

Posted Using LeoFinance Beta

Thank you for your attention mate ^^

Posted Using LeoFinance Beta