Have We Created More Centralized Ethereum?

The historical event of Ethereum Merge successfully took place on 15th of September. The transition from Proof of Work to Proof of Stake was done to enhance the scalability of Ethereum blockchain.

Following the merge event, sharding and Layer 2 networks are the scalability solutions that will be applied on Ethereum. Having $31B Total Value Locked on the chain, the problems and the solutions of Ethereum have a direct impact on the crypto ecosystem.

Though the Merge was welcomed warmly by the majority, there are also some doubts about the well-being of the decentralized nature of Ethereum.

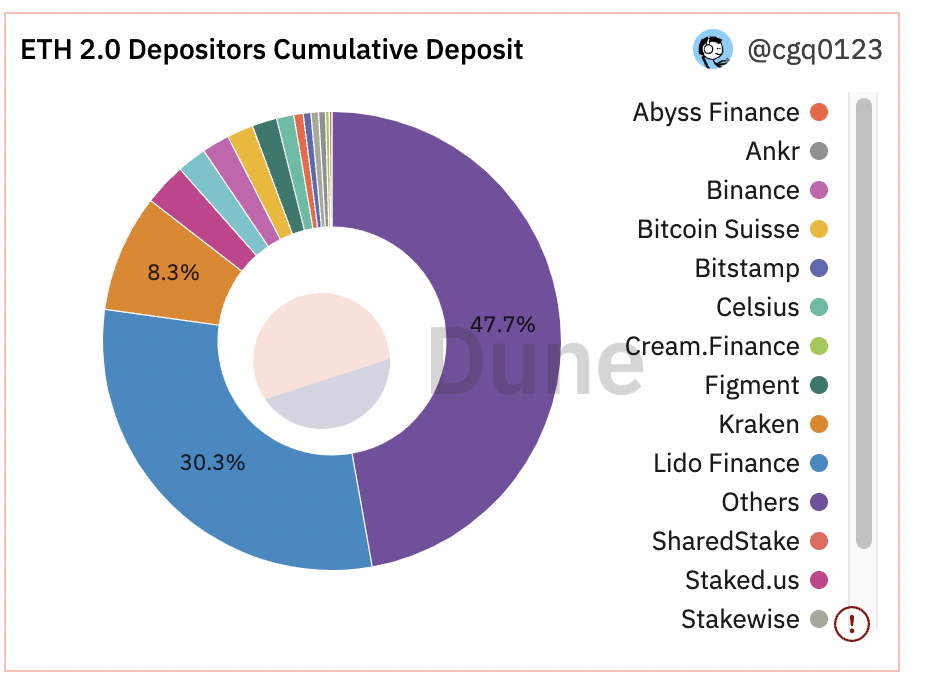

Lido & Kraken hold %39 of Deposits

Dune is an amazing website where you can find answers to your questions about the merge.

Nearly half of the cumulative ETH deposits are done by other investors who are not one of these giant pools.

In this chart, Lido's domination may not be seen as a good sign for crypto enthusiasts. Around 82k people who are in this "others" section of the column.

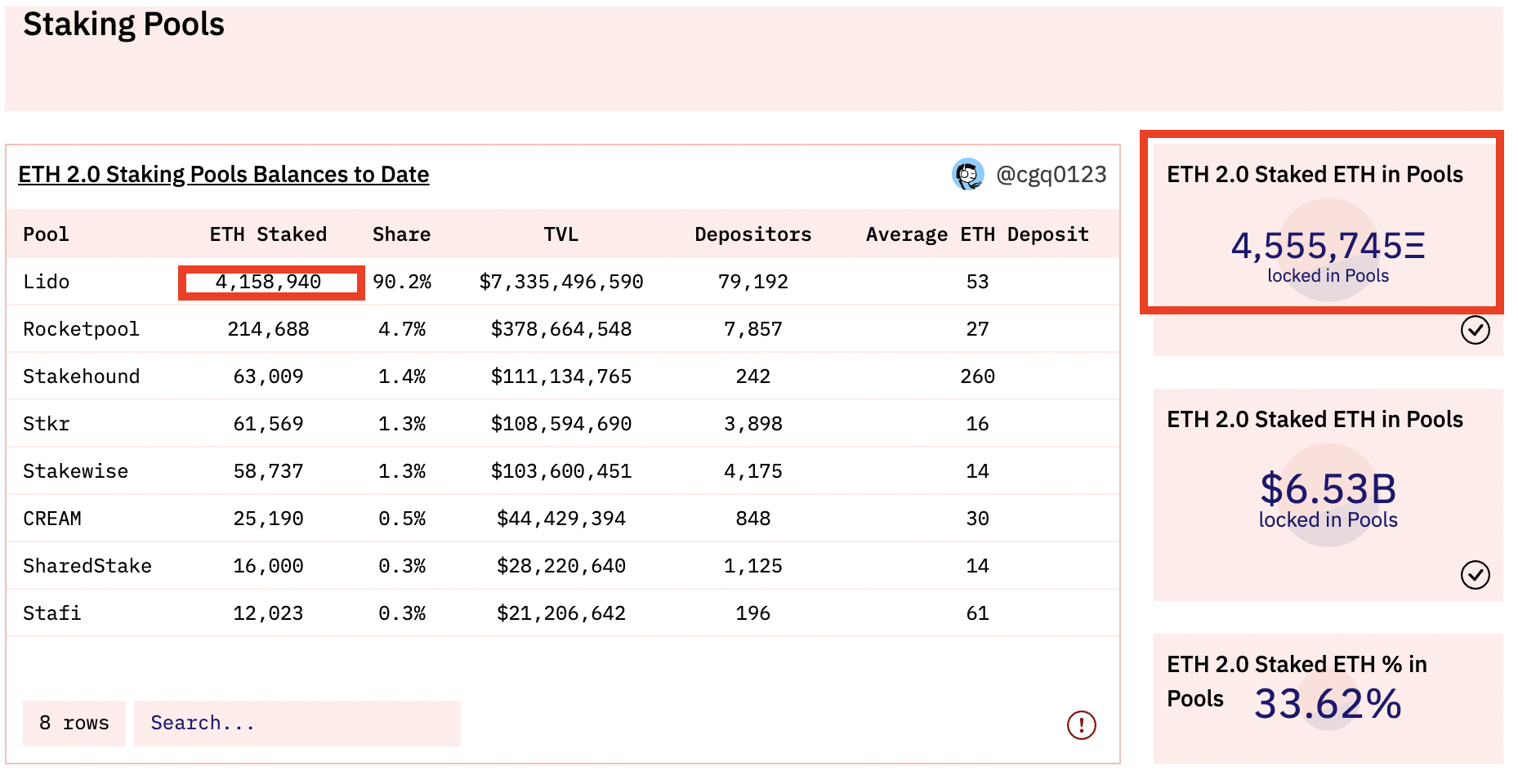

What terrified me about the decentralization of the Ethereum is the case in the staking pools.

At that point, we have to re-consider some things going on in Ethereum PoS! More than %90 of the staking pool balance is on Lido Finance alone! Basically, 79k people chose Lido to stake their precious ETH!

Imbalance towards Lido!

Like it has been speculated on many crypto news platforms, Ethereum PoS has centralization problem.

A total of 33% of this amount is held in Lido Finance, a liquid staking protocol that allows people to stake their coins without meeting the minimum 32 ETH requirement to become network validators.

At some point, we can understand the reason why something happens in crypto. As establishing your own node may require huge amount of money (32 ETH). Yet, the realm of Lido will not be hold in this situation for a long time. As the community is bothered with the new update on the chain, Lido team may come up with different solutions.

There is no good for any service provider to be seen as the monopoly of an operation. Especially when we talk about the coin with second highest market cap, the strategy of the platform will be lowering the stake on it for the sake of their branding and Ethereum. Even if it does not happen naturally, I'm sure they will take an action ✌🏼

Posted Using LeoFinance Beta

https://twitter.com/idiosyncratic1_/status/1570971442988347392

The rewards earned on this comment will go directly to the people( @idiosyncratic1 ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Yeah, I am not too impressed by a few "issues" on ETH. I rebalanced much of my ETH some time back. I am watching for now...

Posted Using LeoFinance Beta

I hope to overcome these temporary concerns without experiencing serious issues as you said ✌🏼