3AC, Bad Debts & 4 Ls to Avoid 'Trouble' in Crypto Space

Three Arrows Capital is said to have filed for Chapter 15 bankruptcy on Friday in New York according to business insiders and other news around. It finally resorted to it after getting exposed as being insolvent and unable to repay its loans from different crypto lenders like Celsius, BlockFi, Babel Finance, Voyager Digital, Blockchain.com, Deribit and probably more to surface.

And Voyager was reported to have suspended depositing and withdrawals too. Things seem to be getting out of control for those companies who have been involved in crypto lending and or borrowing.

These things happening show the dark side of borrowing and getting into bad debts. It reminded me of someone I know who over borrowed until he can no longer pay and then everything started to crumble for him.

- Demand letters coming from all over the place

- Threats of being sued

- Getting summoned by the local authorities

- Being shamed

- Properties sold lower than the market price

- Assets getting seized by creditors until there is no more

and many other unpleasant experiences he had to go through and even trying to hide until he finally gave up.

Leveraging in crypto became attractive to those who have appetites for high risks. It gives them the chance to have more purchasing ability to trade with so much more than what they actually have in their account balances (under-collateralized or over-leveraged however you see it). Unfortunately, it also carries with it so much risks which more often than not, lead to big losses when the market plays the other way than what they bet on. Even experienced traders get burnt.

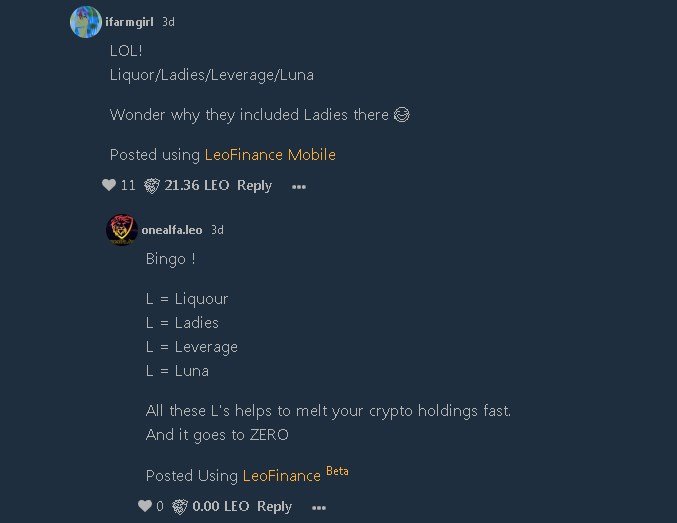

I was listening to the LeoFinance AMA recording a few days ago and got a really good chuckle on the part where Khal mentioned some 4 Ls to avoid "trouble" in crypto space as @onealfa puts it. Can you guess what are those four Ls? Here's to share :)

I encourage you to though to go watch the replay, because there are other valuable things that were discussed by @khaleelkazi in there about LeoFinance, onboarding, PolyCUB etc.

Personally, borrowing and leveraging is good as long as one knows how to avoid the underlying risks. Meanwhile, the grind continues for us whilst the market is doing what it does.

Logo/s, images and or screenshots are from LeoFinance. 4L on lead image grabbed from onealfa, edited. No copyright infringement intended. 030722/11:43ph

Posted Using LeoFinance Beta

https://twitter.com/farmgirlboss/status/1543457432781099008

The rewards earned on this comment will go directly to the people( @ifarmgirl ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

This setup is similar to the "predatory lending" practices that led to the housing crash of 2008. It is all just a house of cards.

Yes, house of cards indeed. It is just astounding how some people fall "prey" into borrowing more than what they can afford to pay.

!PIZZA

Posted Using LeoFinance Beta

PIZZA Holders sent $PIZZA tips in this post's comments:

@ifarmgirl(5/5) tipped @youngkedar98 (x1)

ifarmgirl tipped beststart (x1)

Join us in Discord!

Congratulations @ifarmgirl! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 6000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out the last post from @hivebuzz:

Awesome :) Thank you as always. Nice to know we've distributed such number of votes

Posted Using LeoFinance Beta

You're welcome @ifarmgirl, it's well deserved! Congrats on being so active on Hive 😊🌹

I think the problem with crypto borrowing and lending is that it's only favourable or profitable in a bull market. When a bear market arrrives, everything shrinks and the APRs/APYs seems unsustainable, which eventually leads into a collapse.

Posted Using LeoFinance Beta

That makes sense. Like what apparently happened to 3A borrowing from many lenders and wasn't able to pay because its investments and or businesses collapsed during this bear market.

!PIZZA

Posted Using LeoFinance Beta

Three Arrows is likely the first of many more to come. The "house of cards", made up of private equity firms, crypto exchanges, defi operations etc, as @beststart calls it, is well and truly wobbling precariously. And the "industry" can only properly recover once we have thrown unnecessary baggage overboard!

That is very likely. There will be more to come out saying they are hit by the market crash and things. I think this is one of those "cleansing" times some people talk about where, like you said, unnecessary loads are thrown away before things recover.

Posted Using LeoFinance Beta

Excellent point, @rpren

I can already check Luna and Lq on my list and not worry about the other two, but what's done it's done and that's it, mtfk Luna 😡

Voted on ListNerds!

You are right about that, the good thing is we can move on and try to do better :)

Many thanks for your support on LN :)

Posted Using LeoFinance Beta

From my limited trading experience, leverage is not the problem but managing my risk is. I just got emotional and failed to manage my risks. LOL.

Speaking of debts in general, I have this cousin and his father who are individually buried under debt and until now haven't learned their lesson. They are still willing to borrow money despite their current debt.

They also borrowed from their own relatives with a promise to pay in a month. It's been years now and they haven't even totally paid. They would also get angry and say negative things when one of us will go collect a portion of payment for the debt. I think that is the problem why most people would not advise anyone NOT to lend money to your relatives. LOL.

From the 4L that you've mentioned, I will have to make it to 1L only. I love Liquor, Ladies and Leverage. xD

Posted Using LeoFinance Beta

You are absolutely right about that. Emotions mostly get in the way. Hope you didn't lose much?

Your cousin and his father sound a lot like some people I know. They are difficult to deal when, lol! But we can still lend to relatives who truly need it and whom we know have integrity.

Since you love the 3 Ls, be careful, lol! Onealfa says they can melt your crypto hehe

Posted Using LeoFinance Beta

No worries. I just happened to blow my trading account 3 ~ 5 five times. xD

Posted Using LeoFinance Beta

Oh, you are good then hehe :)

Posted using LeoFinance Mobile

LMAO. Classic. But don't avoid the Ladies. We want more girlpower in crypto.

Posted Using LeoFinance Beta

Yes, do not avoid that L especially when they are involved in crypto, lol!

Posted using LeoFinance Mobile

Yay! 🤗

Your content has been boosted with Ecency Points, by @ifarmgirl.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

I imagine the LOH community disagreeing with the second L. 😆

!CTP

That's right, I was protesting silently, lol! It's good Finguru confirms the need for girlpower in crypto.

Posted using LeoFinance Mobile

And @farmboy-boss would be happy to testify about his experience of such girl power. 😆😄

!CTP

Hahaha, thank you :) He must or else, lol!

Posted Using LeoFinance Beta

That was a really good AMA. I always enjoy listening to them talk about pretty much anything and everything in the crypto space. It's hard to believe they sometimes last three hours! I came here via Listnerds.

It's just good they have the replay, else I'd be missing all (it's wee hours in my timezone when the AMA happens). And yes, it's quite long but still good to listen to when there's time. Thank you for coming over from ListNerds. Appreciate it :)

Posted Using LeoFinance Beta

Alcohol and Ladies is a very dangerous combination CJ

Posted Using LeoFinance Beta

You do know about it Tito Ed :)

Posted Using LeoFinance Beta

jaja Indeed I do CJ :)

Posted Using LeoFinance Beta

Thanks for sharing this informative post on Listnerds. seems like there is a bit of crypto sorting happening there are bound to be a few causalties along the way. 😎

@ifarmgirl

Have an awesome day

!ALIVE

!CTP

!BBH

@ifarmgirl! You Are Alive so I just staked 0.1 $ALIVE to your account on behalf of @benthomaswwd. (3/20)

The tip has been paid for by the We Are Alive Tribe through the earnings on @alive.chat, feel free to swing by our daily chat any time you want.

Thank you Ben :) And yes, it's like the market is cleaning and some are getting dusted off.

!CTP

Posted Using LeoFinance Beta

I think it is for the best to be honest i think some crypto has been created purely to aquire fiat, we see this kind of thing in the marketing industry all the time it just basically ponzi schemes.

Just gonna dig into being Alive On Hive ❤️

@ifarmgirl

!ALIVE

!CTP

!BBH

@ifarmgirl! You Are Alive so I just staked 0.1 $ALIVE to your account on behalf of @benthomaswwd. (11/20)

The tip has been paid for by the We Are Alive Tribe through the earnings on @alive.chat, feel free to swing by our daily chat any time you want.

Because this is such an awesome post, here is a BBH Tip for you. . Keep up the fantastic work

. Keep up the fantastic work

Because this is such an awesome post, here is a BBH Tip for you. . Keep up the fantastic work

. Keep up the fantastic work

Thank you lots!

Posted Using LeoFinance Beta

looks like more clean up still to happen