Is inflation causing less food in the plate ?

What Is inflation & How Does It Affect The economy?

For the sake of being technically correct inflation is the rate at which the prices are rising.

High inflation is a bad thing for the economy and the growth of its citizens.

For most citizen it means that you have fixed amount of money due to a limited income source however the prices of things that you want to buy keeps going up.

One can think of inflation as the rate at which the prices are running away.

This leads to the buying power getting reduced in the hands of the consumer.

Due to the inability to buy the things one needs there is an inclination to take a loan and this puts the person under the burden of debt.

If a person cannot pay for his daily needs how is he supposed to pay back the loan amount?

This results in defaults and the debt burden keeps on increasing.

Till it becomes a vicious cycle and a person may lose any precious assets like a home or anything else of value which he may have used as a collateral to get the loan.

How inflation sets off a chain reaction ?

Most people have limited means of income and have to live on a monthly budget.

If I look at the inflation numbers for India the WPI inflation has “eased” to 10.70 per cent in September 2022

WPI is the wholesale price index.

The fodder inflation was In August, this year, it stood at 25.54 per cent, which was the highest in the past nine years.

If you wonder what is the connection of fodder inflation with prices of the stuff that we buy and consume ?

The answer is it is a pretty interconnected web of things. Animals produce like milk dairy etc goes more expensive if the fodder prices go up.

Animals are also used in the farms and to carry the produce.

In the interiors often bullock carts are used for transport so if the fodder prices go up so does every thing else.

It is like a chain reaction which can set off a series of price rises across board. If the price of one commodity goes up so does the price of others.

If flour prices go up so does the price of bread and anything that uses flour.

How does inflation hits people on a day to day basis

If one compares the prices of something very basic such as vegetables and fruits then one experiences a difficult situation.

Often there are frequent price hikes for common vegetables and fruits.

The prices often go up by 50-100% in a span of a few days.

Even the most common ingredients like onions and tomatoes face such price hikes.

How does one manage the budget in such times ?

The most important priority is how to put together nutritious food on the table for yourself and for the family.

This becomes quite a challenge. The choice of food which you can buy with the money you have gets limited.

Items have to be left out from the shopping list because they have doubled or tripled in prices.

The other effect is product downsizing

For packed products manufacturers often reduce the pack size and increase the price a little.

This gives the impression of only a slight or no price increase.

The truth of the day remains that the buying power in your hand is reducing every day.

A similar approach is applied by households on a budget that they buy lesser quantity of the products that they need.

For example instead of buying 1 Kg they may buy 500 g of a vegetable.

Though this does not help in the long run however it helps to manage the budget in the short term.

Is there a silver lining to the situation

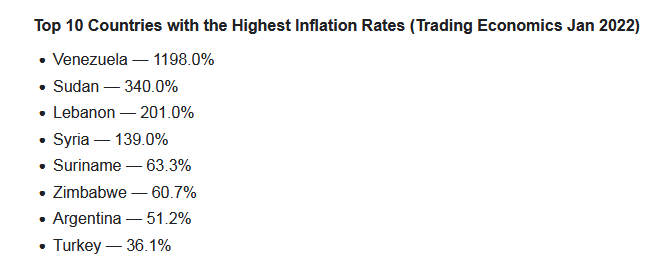

Not that it appears. Perhaps the only consolation is that we are doing relatively better than some of the other economies.

If inflation and price rises are causing you financial then look at the inflation figures of some of these countries.

Looking at the list would not put more money in your hands however it just be some consolation to know that many people around the world are facing a much more hardships.

Posted Using LeoFinance Beta

https://twitter.com/82861150/status/1581677898708451330

The rewards earned on this comment will go directly to the people( @itsme9001 ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

The impact of rising inflations is near global. In one form or another, we are all suffering from it.

I think the silver lining to the situation might be the opportunity to start looking at alternative investments that are not heavily affected by the inflation.

Thanks for sharing your thoughts