Splinterlands Assets Holders Can Learn from dCity History

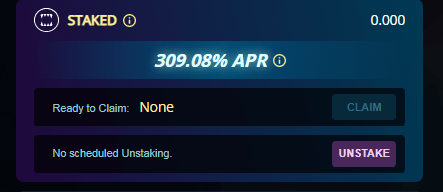

Recently, you can see a lot of screenshots of the SPS Management Page in Splinterlands game. Usually, it is just the APR of staking SPS tokens cut off the page. It probably started with six or seven digits when released a week ago but it has since settled somewhere above 300% APR. Does the number ring the bell? If you have been around dCity in late 2020, it should. I play more than I post so it is easy to remember my first dCity post was a reaction to a post that had the magical 301% APR right in the headline.

Disclamer 1: I sold my decent Splinterlands deck months ago. I wish I didn't, obviously. If I had kept it I would be selling like crazy now. I can tell you why because I am no longer invested in SL.

Disclaimer 2: I used the money to buy dCity stuff so if you decide to buy in, my dCity assets appreciate. Therefore, you should expect me to shill the game disproportinately. Run your own math.

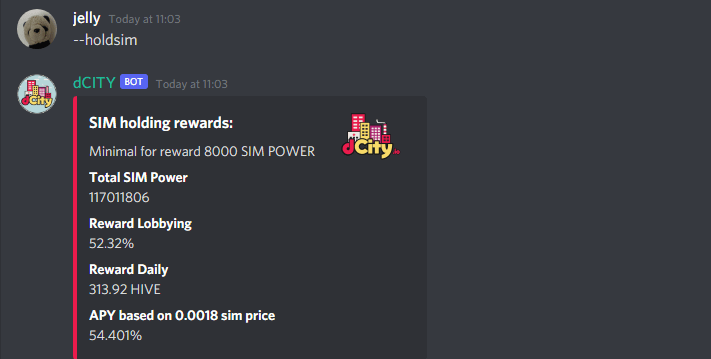

Here comes another number. The dCity game has not generated much posts recently so it is much rarer to find. If you hold the SIM token, your APR is currently in the 50% area.

Soft Peg

SPS token is brand new and difficult to assess but as it is clearly linked to DEC token, which is the major token of Splinterlands (at least for now). Both DEC and SIM are softly pegged. Certain in-game transactions are set price in both the in-game currency and a common currency. In splinterlands, it is 1000 DEC per 1 USD. In dCity, it is 200 SIM per 1 HIVE. Basically, this allows the game to regulate printing of new tokens depending on the environment status. When the game is running hot (as dCity did in November/December and Splinterlands does in August and probably September) the price can go over the peg due to the demand pressure. When this happens in dCity, players are incentivised to start buying with HIVE instead of SIM - the game's reward pool fills with money and people keep their SIM until the rush calms down and the new SIM printing can cover the demand. Price can go down below peg and things go back to normal.

If things go too cold, you need a similar mechanics on the other side. That is what taxes do - if the price is low, fewer SIM tokens are printed daily. When the SIM token went down 5x anyway (nearly 10x at ATL), the SIM holding rewards were introduced. SIM holders are paid a share of HIVE denominated rewards pool. If the price of SIM drops in half, the rewards stay the same so your SIM earns twice as much. That is why a buyer tends to be found pretty fast and the price recovers.

Running the Numbers

Before we start comparing apples and oranges, remember the two tokens are pegged to different currencies. HIVEUSD can move either way (HIVEUP good for dCity, HIVEDOWN good for Splinterlands)

So am I telling you to take 50% APR instead of 300% APR? Maybe. If you purchase DEC (or any DEC-related assets) right now at $0.006, you should be ready to see it go back to $0.001 peg at some point. Do you think it makes your unsustainable 300% APR go down six-fold? Maybe not.

Try depositing your fiat to a bank at 0.6% APR. If your central bank runs out of luck and the value of the currency goes down six-fold you do not expect to come out of this mess ahead at 0.1% APR, don't you?

If you buy $100 worth of token X, carry it through the year at 300% APR and it manages to keep the X/USD price, congratulations - you have $400 now. If the value is down six-fold, I am sorry, you only have $66.67 now. At least you are better off than anyone that held the token at 0.6% APR or not investing at all (now at $16.77 or $16.67 respectively).

Obviously, Splinterlands can grow a lot more than they already did. Or drop out off the spotlight and go well below their peg like dCity did in the first half of 2021. You need to assess the 300% APR by yourself. My best guess is that the devs are going to find the way in tough times just as dCity did.

SIM Assessment

I will take a shot at commenting the 50% APR of SIM holding. Or maybe the recent pump of the SIM token. The SIMHIVE run began at 0.001 when the SIM holding reward was tripled up with no prior warning (the daily reward is basically governed by SIM holders voting but the devs made a sudden increase of the budget). The price doubled in a week and stabilised since. Tripling the rewards makes the target price 0.003 rather than the actual 0.002 so despite a couple of regulars stacking up, the value is still in. When the move towards 0.003 happens, the holding APR goes down to 33% but I guess that is fine. If not, you can close your position with an instant 50% profit. As long as the pool stays healthy (the game assets are working in Hive curation as well as DeFi Diesel pools) you are good to go. If the Splinterlands effect kicks in and the game gets attention of the new Hiveans coming via the Splinterlands' gates, you can hit the jackpot on your second chance attempt. Feel free to make your own post about it and consider adding @dcityrewards as 5% beneficiary to show your willingness to help the game's reward pools grow.

Remeber to register for dCity sponsored Splinterlands tournaments. 10 000 Entry currently trades at 7 HIVE and you can buy it at Hive Engine market or mine it yourself setting up your own dCity and grabbing Stadiums and Gamers from the market.

Congratulations @jelly13! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 17000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Certain things just are not sustainable. 300% APR and $0.29 SPS token will not hold. One or both with go down... there is just far too much money on the table for people to not sell down.

Well, if I make 300% APR with a token, I really do not care if the profit comes from price raise or having minted a bunch of tokens that kept their individual value. I mean, they can even go down in price if I mine a real truckload of them.

300% APR usually does not happen over a year. Sometimes it does. Other times, it bursts spectacularly. Splinterlands are most likely going to have what dCity has experienced - a correction, a bunch of buy-high-sell-low people badmouthing it and a couple of smart grinders with full pockets. Or maybe something else.

People in the system can set the token value (by printing or burning) but not the value of the system - that is decided by the people outside who either join or don't. Unless the value of the system rises, there have to be losers as well.

Interesting - several months ago I also sold off about 3/4 of my main SL account, which I'd been consistently making it to Champion with, in order to build my dCities :)

I purposely held onto the rest, just in case SL mooned. So, while perhaps I'm a bit sorry I sold off so much, I'm also glad I kept what I did.

TBH, keeping a piece was not an alternative to me - spreading yourself around multiple Hive games does not feel like much of a hedge anyway. I just put it where I spend the time and effort. Two or three are probably enough.

I just sold a dCity Hospital to Rabona LoC manager from whom I had bought a goalkeeper earlier today. The way I see it, the next Hospital will be sold to someone who is currently busy deciding what level Cerberus to buy (but might notice dCity next week). Or maybe to the one that sells their Lvl10 card for a nice profit.

Not guessing the right order for the stuff to moon is no biggie. As long as we all get there.

Obviously, taking profits on what could be a peak while keeping some to shoot for the next hill is a different kind of decision.

Yeah… different strategies for different folks. I mainly wanted to hold onto some SL stuff because I'm running a bunch of bot accounts. If there hadn't been the option for passive income via bots, I likely would have sold 100%.

The release of SPS and staking was a nice perk as far as I'm concerned, because now I have two ways of earning passively through SL.

But I do think you are correct re: spreading yourself across multiple Hive games. It's probably best to keep to just a few, and hopefully pick the ones that will pay off in the end.

I currently do not play SIM City but when you mention "50% APR of SIM holding" do you mean that just by holding SIM I can get a dividend of 50%? I get a very small amount from my INDEX holding. Would it receive this 50% APR just for holding it or will I need to stake it or will I need to join the game to get this APR. Just curious. I am all about making my assets work for me. Thanks.

The principal obstacle is that your average holding over the last 30 days (daily snapshots at around 18 UTC when the game updates for a new day) has to be over 8000 SIM.

On a technical level, I am not 100% sure it works without ever owning a dCity card but holding one card for one day gets you in the database and then you can sell it and keep receiving the dividends.

You can check my old article on the topic (market related numbers have changed since, the general mechanics has not).

This post is one of the reasons I think you should talk and express your thought also on other games, the analysis above on SIM, DEC, SPS and the relation to HIVE etc is brilliant - just saying!

I do think SPS will probably go down given the current APR. At least the current marketcap doesn't really seem that sustainable. However I do think that Splinterlands might have a chance of being successful like Axie so I probably will hold the ones I get on HIVE. As for the SPS I get for depositing into Cub, I think I may sell out of it to book a little bit of profit.

Posted Using LeoFinance Beta

Sustainability is an awkward word when it comes to marketcap - that is expected to rise gradually. Is it overheated ATM? Yes! Can it come back after correction? Probably. Is it worth waiting? It is always better to sell on the top and return at the bottom - In hindsight, that is.

Very interesting analysis, especially seeing that this was from 2 months ago. Perhaps your opinion might have changed? Concerning Sps that is

SPS got some more usecases and IIUC, DEC printing pegging mechanism was abandoned since this post was written. Not sure if that was the plan or on-the-fly fix but basically the tokenomics is cleverly managed to avoid openly visible shocks. At the end of the day, you still need the system to grow to earn.

To keep looking for dCity analogies, the secondary token (ENTRY) has been abandoned long ago but the idea of re-pegging SIM/HIVE to a different ratio has appeared. I think the pressure is a bit off as the rewards moved from holding cards to holding SIM (used to be 100-0, now it is like 20-80) but that sounds like efectively loosening the peg to me.