Micro/Mid Cap Bets For Long Term Accumulation

Even though the market looks like shit at the moment I am still convinced that we are at the middle of a super cycle for Bitcoin and crypto in general. If this proves to be true a face-melting alt season should ensue as soon as BTC starts hitting new highs. In case you want to prepare for such a scenario with minimal investment here is a list of ideas from Jerry's playbook.

Energy Web

A crypto-based energy market will have to be created by someone and EW seems like the best candidate for this project. If you look at their list of partners you will see many familiar names including Vodafone and Wolkswagen.

And if you keep digging deeper you will find ties with Google and other energy/tech giants.

EWT Token price: $10.44

EWT Max Supply: 100M

Fully Diluted Market Cap: $1B

Carbon Swap

Carbon Swap is the only dex deployed on Energy Web so far. It offers the same functionality as Uniswap and any other AMM. Farming is still somewhat underway but at current prices, I'm accumulating SUSU on the spot market only.

SUSU is the governance token of Carbon Swap. It can be used for raming, staking, or trading on the NFT marketplace. The price of the token went through a major correction when the whole market tanked and it is slowly recovering.

SUSU Token price: $0.03

SUSU Max Supply: ~300M (token burn included in tokenomics)

Fully Diluted Market Cap: $9M

Agave Lending on xDAI

Agave is an AAVE fork deployed on xDAI. The platform launched recently and attracted a bit below $5M in liquidity. It is still very small compared to other lending platforms but xDAI isn't a very busy chain so it's still something.

The Governance token is Agave which can be staked in the protocol for a small yearly percentage. It is still not used as collateral on the platform but expansion is in the works.

AGAVE Token Price: $150

AGAVE Max Supply: 100k

Fully Diluted Market Cap: $15M

Cream

Speaking of lending protocols, I know that Cream may be a risky play after the exploits they encountered but judging by their liquidity providers, there isn't much fear in the streets.

Cream is a multi-chain lending platform that has over $2B in liquid assets deposited in the protocol. After the last exploit the price took a huge hit and went from the $100 range below $50.

I personally feel like this one is too big to fail and the current TVL/MC ratio is insanely low. Sitting at 0.02 at the moment... I don't think I have seen a gap this big ever since DeFi became a thing.

Cream Token Price: $43

Cream Max Supply: 2.9M

Fully Diluted Market Cap: $125M

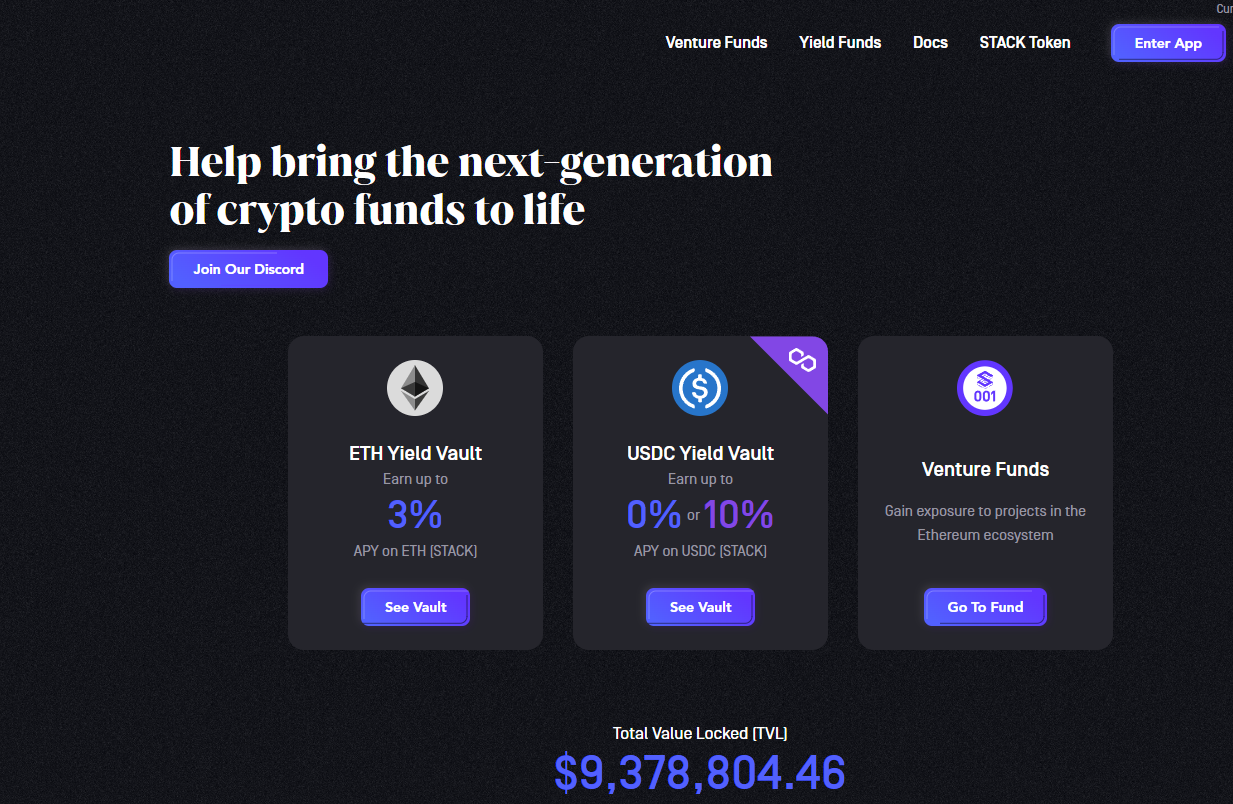

Stacker Ventures

Stacker has been under the radar for a while now. It is a venture fund DAO that brings value to token holders and liquidity providers on Ethereum and Polygon.

Moonshot potential is huge because very few people are actually utilizing the strategies offered by Stacker even though the website and project are very solid.

STACK Token Price: $4.4

Cream Max Supply: 1M

Fully Diluted Market Cap: $4.4M

Posted Using LeoFinance Beta