Hodl Your Crypto And LPing, Which is Better?

The coming of Defi has made it possible for crypto investors to generate passive rewards with their crypto assets. Many people moved into Defi because they have seen it to be more rewarding than having their crypto assets idle in the wallet. Among several methods of generating through Defi, there is a debate on whether providing liquidity is better than hodl the crypto asset in the wallet.

The bone of contention here is the fact that providing liquidity in decentralized exchanges despite being rewarding, comes with what we call impermanent loss, while hodl your crypto asset in your wallet has no risk associated with it. The only disadvantage is that you won't be able to earn passive rewards if you are hodl.

In this post, we will compare the two strategies and see if we can conclude in the end the best strategy among them, but before I proceed, I will like to explain what impermanent loss is.

Impermanent Loss is when participants in a liquidity pool experience a price change such that the current price of deposited assets is different from the price of the assets at the time they join the pool. For example, if Mr. A joins a Liquidity pool at the time when token M is at $5 and Token N is at $2. If he joined the pool with $500 worth of M and N tokens respectively. It means that the amount of token M will be 100 pieces while that of token N will be 250 pieces. If the price of M should increase to $7, and the price of N is assumed to have a negligible rise in price, say $2.05. The impermanent loss will affect token M more such that if the liquidity provider should withdraw his tokens at this time, he will end up withdrawing 71.43 pieces of M token as against the initial 100 pieces and 243 pieces of N token as against the initial 250 pieces. This is the case because here the two tokens rose simultaneously. If we assume token N to fall to 1.80 when token M went up to $7, then as we received back 71.43 pieces of M token, we will have 277 pieces of N token as against the initial 250 pieces, and vice versa.

Having explained Impermanent Loss, let us dive into the comparison.

CASE A

Let's say we had $500 worth of A and B tokens with their entry price as $2 and $5 respectively. It means we will have 250 pieces of token A and 100 pieces of token B.

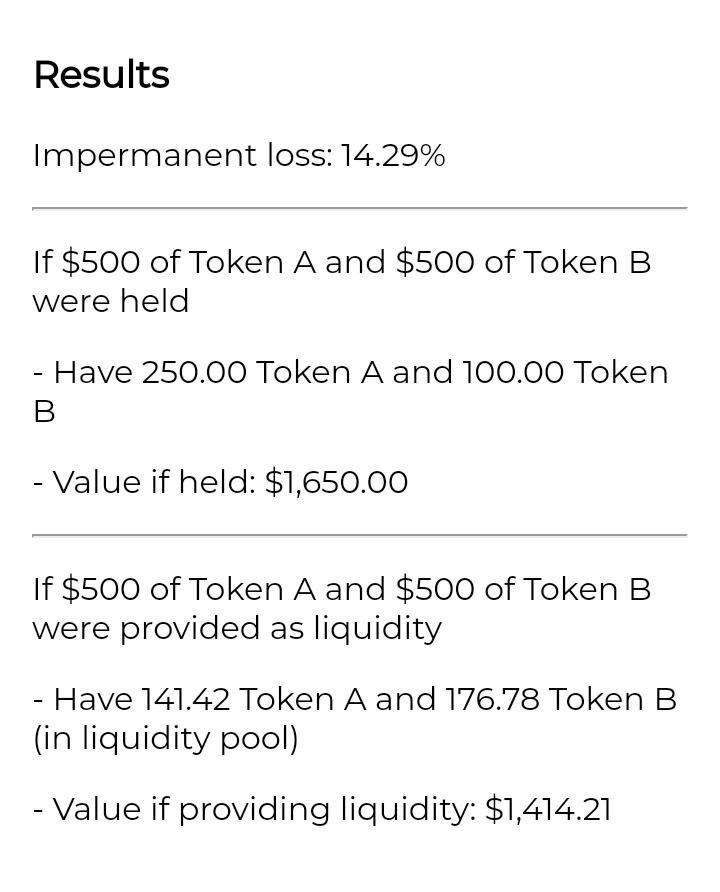

If the price of token A should rise to $5 and the price of token B drop to $4. We will have the following result.

From the data above, we can see that if the token is deposited in a liquidity pool, the person will have a 14.29% impermanent loss, making him have a total dollar value of $1,414.21 as against the $1,650 for hodl. His 250 pieces of token A have dropped to 141.42 and his 100 pieces of token B have increased to 176. In the case of hodl, the amount of his token was not affected as shown above.

CASE B

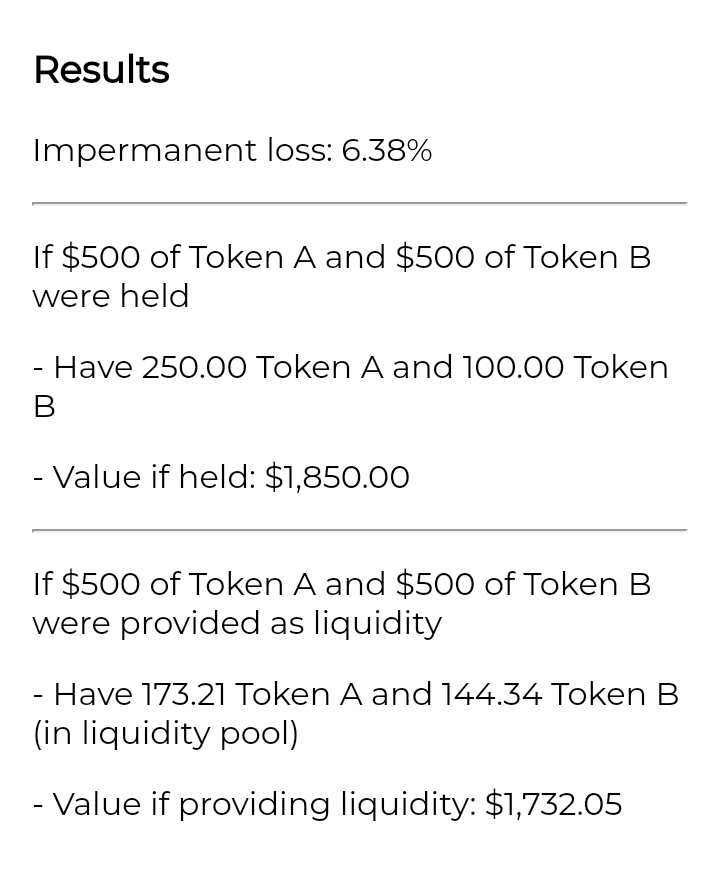

Let's say both tokens rose simultaneously such that token A moved from $2 to $5 and token B moved from $5 to $6. We will have the following result.

We can see that even when the price has risen, his total dollar value for providing liquidity is $118 short of what he could have had if he had held the tokens in the wallet.

CASE C

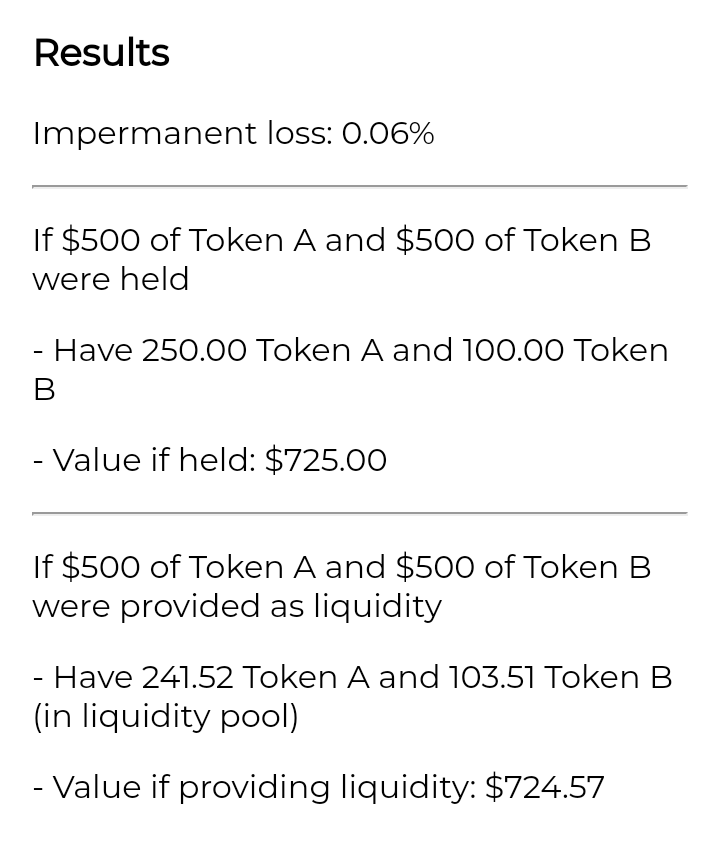

When both tokens fall simultaneously such that Token A dropped from $2 to $1.5 and token B dropped from $5 to $3.5. We will have the following result.

We can see that the result shows that the LP provider is still in the loss.

( N:B the loss we considered here is only on the dollar value of the total assets. If we consider the amount of the tokens, we can see that at some point, he had more tokens than he supplied )

Now, let's round-up.

Usually, providing liquidity comes with a high APR, so let's assume that the pool has an APR of 100%. It means that the LP provider will earn 0.27% daily, amounting to $2.7 per day. Let us also assume that this analysis is done after 3 months of providing the liquidity. It means he would have earned $243 for the three months.

For CASE A

Final result. When held = $1,650

When in a liquidity pool = $1,414.21 + 243( profit for three months)= $1,657.

For CASE B

For Hodl = $1,850

For providing Liquidity = $243 + $1732 = $1975

For CASE C

For hodl = $725

For providing liquidity = $243 + $724 = $967.

We can see that the person had more profit when the tokens were in the liquidity pool than when held. For some networks such as Cosmos, you stand a chance of getting airdrop as an LP provider which can be as high as $500 to $1000.

Some of the reasons I love providing liquidity are the high APR and the fact that I can earn daily rewards with which I can compound for a month and pay myself a salary at the end of the month.

DISCLAIMER: This is not financial advice, ensure to do research.

Screenshots we're taken from IL calculator found here

Thanks for stopping by my blog today.