Anchor Protocol (ANC) - A Gem on the Terra Blockchain

INTRODUCTION

Can you just imagine at this point in time discovering a DeFi platform that offers you 20% APR on your deposited assets? Well its time you checked out Anchor Protocol on the Terra blockchain. Anchor is a true savings protocol. "Anchor savings has no minimum deposits, account freezes, or signup requirements - it can be used by anyone in the world with access to the internet" [Anchor. Anchor - Better Savings. (Accessed October 27, 2021)].

In this article, let's take a deep dive into everything relevant regarding Anchor Protocol to aid you in deciding if it is an investment destination for you. This article is submitted as a supplement to the Leo Finance Terra (LUNA) Coin Guide and should be your first stop in completing your diligent research on Anchor Protocol prior to investing.

WHAT IS ANCHOR PROTOCOL?

Anchor Protocol is a savings platform built by South Korea based Terraform Labs. Anchor was launched on March 17, 2021 so it is a relative newcomer to the DeFi cryptoverse. Originally Anchor Protocol was built to aid in increasing the demand for the UST token (TERRA blockchain's US Dollar pegged stablecoin), but its ultimate goal is to become an interchain platform where investors can borrow covered layer-1 tokens in their native form.

At inception, Anchor Protocol only provided returns on UST token deposits, But soon thereafter and as a result of a partnership with Orion Money, ETHAnchor was launched permitting investors to deposit Ethereum based stable assets such as USDC, USDT, DAI, BUSD, and wrapped UST for returns.

The present yield on wrapped UST ranges between 19.5% to 20.5% and the yield on all of the other covered stablecoins is approximately 16.5%. Anchor's future plans include the introduction of coverage for non US Dollar pegged stablecoins such as KRT, THT, and EUT. Given the current state of the rates of return offered by traditional finance, Anchor's yield return is particularly attractive. And in the DeFi sphere the rates are at worse competitive and at best attractive as well.

HOW DOES ANCHOR PROTOCOL WORK?

ANCHOR PROTOCOL LENDING

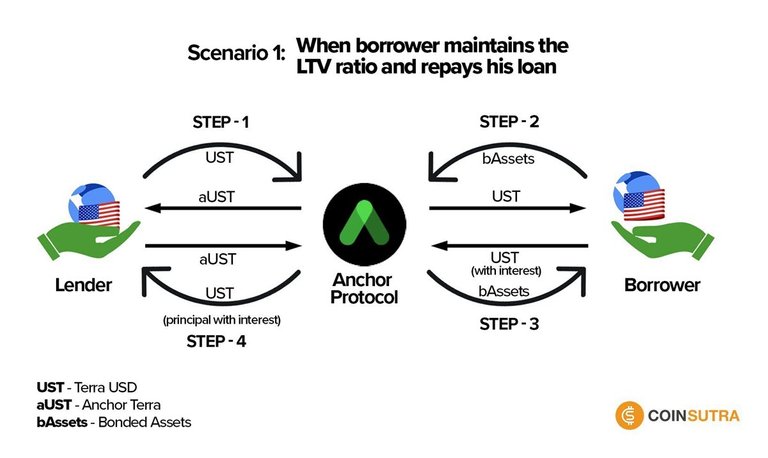

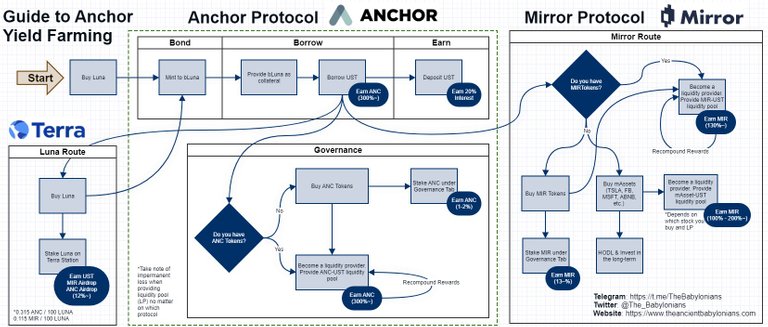

Anchor Protocol acts as an intermediary money market between various lenders and borrowers relative to its covered stablecoins. Lenders deposit stable assets on the platform and earn interest on the value of their deposit. In turn, by posting stakeable assets as collateral on the platform, borrowers can borrow offered stable assets from the platform. The assets borrowers stake as collateral are called 'bonded assets' and at present, bLUNA is the sole asset accepted as collateral on Anchor Protocol.

Once deposited, bonded assets are locked and UST is borrowed against the collateral at a Loan-to-Value (LTV) ratio which is presently set at 40%. Anchor utilizes a liquid staking mechanism where the staking rewards earned on bLUNA are liquidated and converted into UST for the benefit of depositors. This process facilitates the ability to pay the target yields of 20%.

This 20% consistent yield is sustainable. Anchor Protocol is capable of producing a minimum of 24% staking rewards as a result of the 12% LUNA staking yield plus the maximum LTV rate. Additionally, all loans on the platform are overcollateralized, thereby magnifying the staking rewards and adding to the high interest rate. While the system is capable of generating returns in excess of 20%, limiting the return to the target 20% ensures payment of consistent and stable yields.

In the near future, Anchor Protocol intends to add bETH as a collateral element on its mainnet. Future intentions also include the deployment of other such Proof of Stake derivatives like BATOM, bDOT and bSOL as collateral elements.

THE ANCHOR TOKEN

The Anchor token (ANC) is the native and governance token of the protocol. ANC must be deposited to allow users to create and/or vote on governance polls exercising control over the future path of the platform.

However, ANC's importance extends well beyond its governance functions. The Anchor token, by design, captures a portion of the generated yield which permits its value to scale in linear proportion to Anchor Protocol's assets under management (AUM). In other words, ANC stakers receive a portion of protocol fees pro rata to their stake and receive additional benefits as Anchor Protocol grows and expands.

Likewise, ANC tokens are distributed to system borrowers of UST stablecoins in proportion to the value borrowed. Anchor Protocol has a set total supply of 1,000,000,000 ANC tokens of which 40% has been reserved for these borrower incentives payable over a four year period. As such users are rewarded for using the platform to borrow UST and both lenders and borrowers benefit and earn from Anchor.

EARNING USING ANCHOR PROTOCOL

There are four basic ways to earn yield using Anchor Protocol. These are:

- DEPOSITING: The simplest available method of earning on this platform is by depositing UST. The platform, being a savings product, returns a highly competitive, superior 20% yield on this deposit.

- BORROWING: Investors may deposit bLUNA as collateral and borrow UST from the protocol. ANC tokens are distributed as the reward and the value of the ANC tokens will exceed the loan interest returning a net APR to the investor.

- STAKING Investors can purchase and deposit ANC tokens on the platform to earn staking rewards and as well participate in platform governance. The APR for staking ANC tokens is presently 6.91%.

- PROVIDING LIQUIDITY Rewards may also be earned by providing exchange liquidity for the ANC token. This is accomplished by purchasing and staking ANC-UST liquidity tokens. The APR for staking ANC-UST LP tokens is presently 50.8%.

Use of the Anchor Protocol website is intuitive and is actually quite easy to use. There are no minimum amounts to deposit before earning, account freezes, and investors may withdraw funds instantly under most circumstances. To engage Anchor Protocol all potential investors must do is follow several easy and basic steps and within minutes are ready to utilize the platform.

ASSOCIATED RISKS OF USING ANCHOR PROTOCOL

Anchor Protocol shares the same major risk as all other DeFi providers. Loan liquidation. Loan liquidation occurs when the value of the staked collateral falls below the loan's value. As this is a common problem to all DeFi platforms, a general rule of thumb is to borrow at a LTV ratio of 45% or lower even though the liquidation threshold is 60%.

Anchor Protocol has employed several measures to aid investors in mitigating liquidation loss. A major measure has been the addition of the availability to set a LTV notification. Investors can choose a LTV threshold they are comfortable with, set it, and be notified once the set limit has passed. This provision permits investors to manage their risk more efficiently.

TOKENOMICS

Per CoinMarketCap, at the time of the writing of this article (October 28, 2021 at 07:12 EDT) there is a circulating supply of 132,821,754.58 ANC. With the current price of $3.02 the market capitalization of Anchor Protocol (ANC) is $400,746,411. There is a total supply of 1,000,000,000 Anchor Protocol (ANC) tokens authorized yielding a fully diluted market capitalization of $3,017,123,997.

A review of the Anchor Protocol (ANC) price chart for the entire history of the project demonstrates its current price is well off the all time high reached in February 2021 right after launch. Following the crash earlier this year, ANC price appears to have stabilized in the range of $2.00 to $3.00:

PRICE PROJECTIONS FOR ANCHOR PROTOCOL

A sampling of some of the current expert predictions on the price of Anchor Protocol (ANC) include:

Priceprediction.net predicts the price of ANC for the years 2022 through 2025 as follows:

- Anchor Protocol Price Prediction 2022

The price of Anchor Protocol is predicted to reach at a minimum level of $4.72 in 2022. The Anchor Protocol price can reach a maximum level of $5.61 with the average price of $4.89 throughout 2022.- ANC Price Forecast for 2023-2024

As per the forecast price and technical analysis, In 2023 the price of Anchor Protocol is predicted to reach at a minimum level of $6.77. The ANC price can reach a maximum level of $8.40 with the average trading price of $6.96.

The price of 1 Anchor Protocol is expected to reach at a minimum level of $10.04 in 2024. The ANC price can reach a maximum level of $11.78 with the average price of $10.32 throughout 2024.- Anchor Protocol Price Prediction 2025

Anchor Protocol price is forecast to reach a lowest possible level of $14.00 in 2025. As per our findings, the ANC price could reach a maximum possible level of $17.04 with the average forecast price of $14.42.

[Priceprediction.net. Anchor Protocol Price Prediction 2021, 2025, 2030 | ANC Price Forecast. (Accessed October 28, 2021)].

CoinArbitrageBot predictions through 2025 are:

And although no specific price prediction is given, Prasm.io characterizes the future of Anchor Protocol as follows:

Anchor Protocol price prediction 2021 – 2025

Anchor Protocol is a fast-growing blockchain project. Their community is growing exponentially as they have a highly skilled blockchain team, and they have acquired more and more partners within the industry. More and more companies and individuals are using Anchor Protocol. It is very difficult to determine a specific future price, as it depends on several factors. The best way to predict the future price is to review the business plan, the project and the long-term developments. The more successful the team is in implementing and carrying out the business project, the more people will acquire Anchor Protocol, which will lead to an increase in demand for the coin and result in a price increase. It is very likely that Anchor Protocol can increase in value by 100 – 300% in the short term.

[Prasm.io. Anchor Protocol (ANC) price prediction. (Accessed October 28, 2021)].

Please keep in mind that while these price predictions paint a rosy future for Anchor Protocol (ANC) as an investment, they are just that - predictions. No one has a crystal ball that can guarantee future performance. As such, as a potential investor, you may take the prediction for what it is, as the same is no guarantee of future price performance of Anchor Protocol (ANC) due to the volatility of the cryptocurrency markets.

CONCLUSION

Anchor Protocol is a unique savings vehicle providing excellent returns. It has been designed to be sustainable for the long term yielding stable and dependable investment returns. Plus, in that it has been built on the TERRA blockchain, scalability is present, as well as low fees.

The stated purpose of this article was to provide you, the potential Anchor Protocol investor, a deep dive into everything relevant regarding Anchor Protocol to aid you in deciding if it is an investment destination for you. Whatever decision you reach concerning Anchor Protocol, best of luck to you.

DISCLAIMER:

- Your author holds a long position in Anchor Protocol (ANC).

- The content herein is presented for educational purposes only and should not be construed as investment advice. Any loss incurred as a result of investing in Anchor Protocol (ANC) is yours and yours alone and may not be imputed to this author. Any foregone gain by not investing in Anchor Protocol (ANC) is yours and yours alone and may not be imputed to this author.

Posted Using LeoFinance Beta

.png)

.png)

I tell myself that I need to get some UST and put them to work for that 20% return as it is pretty sweet for a stablecoin. This should be part of anyone's portfolio, on the stable side of it.

Posted Using LeoFinance Beta

I put some there to squirrel away for a rainy day, oh, and to grab that 20% yield. Then I got carried away and staked some ANC plus added some liquidity to the ANC-UST Pool.

Now I need to figure out how to leverage the aUST tokens I got from the UST deposit.

Posted Using LeoFinance Beta