BEHAVIORAL FINANCE: Recognizing (and Avoiding) Common Investor Biases

INTRODUCTION

Behavioral Finance runs counter to the assumptions of mainstream finance and focuses on human beings acting in an irrational manner.

Behavioral Finance instead attempts to explain how human's finances are influenced by emotions and biases as well as the cognitive limitations of the human brain. This behavioral theory points to the fact that it is human psychology that causes prices in the markets to diverge from basic fundamental values over a period of time. But behavioral finance does not offer a magic bullet to permit capitalization on this divergence, but rather provides us with useful insight on how to avoid behavior that would otherwise decrease individual personal wealth.

Nagoda, K. Understanding Irrational Investor Behavior - Loss Aversion v Risk Aversion. (Accessed September 28, 2021)].

In this article, let's examine several of the more common irrational biases exhibited by investors so that they may be recognized and possibly avoided with a view toward either maximizing your wealth or at least preserving it.

CHASING THE TREND

Chasing the trend could arguably be the strongest of all of the human investor biases. Examining a sample of 294 Mutual Funds, Jain and Wu found that 39% of all the new money flowing into Mutual Funds in 2000 were directed toward the top 10% of Funds with the best performance in 1999. [Jain, P. and Wu, J. Truth in Mutual Fund Advertising: Evidence on Future Performance and Flows. (Accessed September 28, 2021). Even with the standard disclaimer 'past performance is not indicative of future results' we have all seen before, retail traders, being human, still believe they can predict future performance from past results.

Being human means we all have the great talent of being able to locate patterns. Once the pattern is discovered, as humans, we believe in the patterns validity and take action on it. However, all too often, this pattern has already been priced into the market. Plus, most traders are far too stubborn to acknowledge the randomness of the markets. Studies have demonstrated that investors who chased the trends, weighting a high percentage of their investment decision on past performance, were among the poorest performers when compared to other investors.

AVOIDING THIS BIAS: Being human it is highly likely that you will at some point identify a past investment trend. Once found, however, you must recognize that the trend has already been market identified and taken advantage of. Through this recognition you avoid investing at high values just in time to watch the march back in value. Rather than focusing on the identified trend, some advice from Warren Buffett is in order: buy when other investors are fearful and sell when they exhibit confidence [See, e.g. Curtis, G. 8 Ways to Think Like Warren Buffett. (Accessed September 28, 2021).

OVERCONFIDENT INVESTORS

Overconfidence is comprised of two factors: 1.) overconfidence in the quality of the information being relied upon; and, 2.) overconfidence in the ability to take action on the information possessed at the proper time to maximize gain. The overconfident investor tends to make trades more often than the norm plus likewise exhibits a failure to exercise portfolio diversification.

A study by Odean of 10,000 clients at a large discount brokerage tested whether or not more frequent trading led to increased returns. From the data, after backing out tax loss trades and liquidity need trades, this study found that the frequent traders purchased stocks underpeformed the sold stocks by 5% in one year rising to 8.6% over two years. As such, when the retail investor trades frequently, the less money they make. [See, Odean, T. "Are investors reluctant to realize their losses?" . (Accessed September 28, 2021).

The Odean study was replicated multiple times using different markets. The results proved to be the same. Therefore, in essence, the overconfident frequent trader is simply paying trading fees with the outcome of losing money. [See, e.g. Ruggeri, K., Alí, S., Berge, M.L., Bertoldo, G., Bjørndal, L.D., Cortijos-Bernabeu, A., and Folke, T. Replicating patterns of prospect theory for decision under risk. (Accessed September 28, 2021).

AVOIDING THIS BIAS: The first necessary thing you must do to avoid the bias of overconfidence is come to the realization that your intuition and information is no better than anyone else in the market arena. In fact, you must recognize that others likely possess better information than you as they are the institutional traders using computers with powerful algorithms to drive their trading decisions. As such, the odds are heavily tipped in their favor.

As well, you must curtail your trading activity. To build wealth takes time so you should increase your investment holding time, mirror the relevant indexes, and take advantage of dividends where possible. Adopt the mantra reduce the trades and increase the investment.

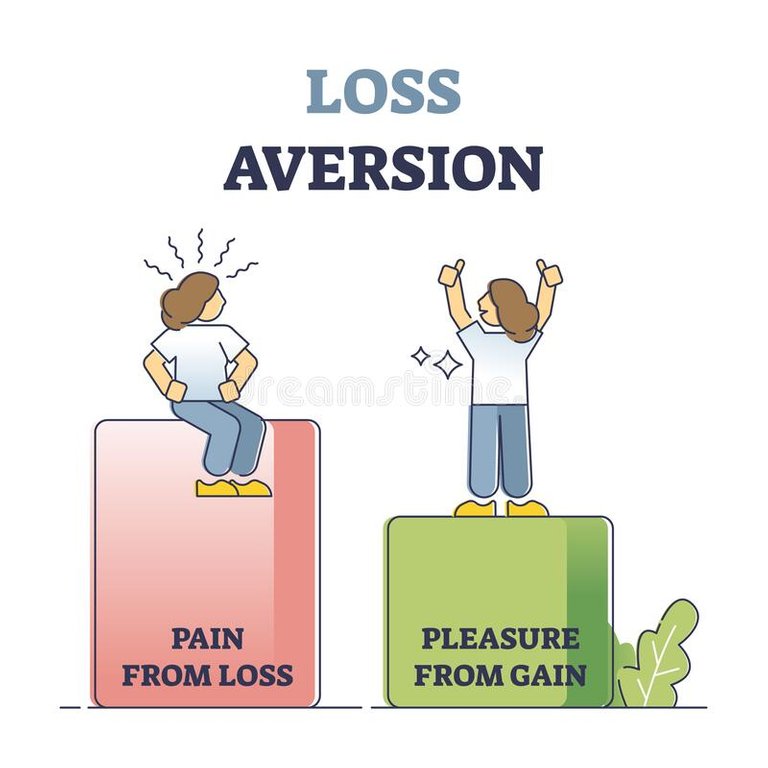

LOSS AVERSION (REGRET)

In applying loss aversion to finance, loss aversion happens when an investor's concerns about losses far outweigh the pleasure derived from gains. Put another way, the investor prioritizes avoiding their losses over pursuing investment gains.

Within this concept of loss aversion exists the disposition effect. This disposition effect happens when investors sell off assets showing gains while retaining their losing assets. The psychology behind this is clear. Irrational investors desire to take their gains as fast as they can, but, with assets in the red, they tend to hold the asset in the hopes of a return in price to match the inputted investment.

When there is a potential loss at hand, the tendency for the irrational investor is the reluctance to admit an investment mistake. Simply put, the investor views the investment performance of the asset from its initial price, thereby irrationally disregarding any changes to the fundamental underpinnings of the asset itself.

[Nagoda, supra.].

Therefore, as humans, to the greatest extent possible we try to avoid the feeling of regret with respect to a losing investment. By not selling, the investor fails to lock in a loss and exacerbates its magnitude, more than likely holding it to illogical ends to avoid the regret of recognizing the loss. Available research shows that investors are 1.5 to 2 times more likely to trade a winning position early and to hold a losing position too long [See, e.g. Qin, J. A model of regret, investor behavior, and market turbulence. (Accessed September 28, 2021); and, Zeelenberg, M., Beattie, J., Van der Pligt, J. and De Vries, N.K. Consequences of Regret Aversion: Effects of Expected Feedback on Risky Decision Making. (Accessed September 28, 2021).

AVOIDING THIS BIAS: The best way to avoid loss aversion bias to to adopt an iron clad portfolio plan that includes rules for trading that do not change (i.e. exiting a stock position if the investment loses 10% of its initial value, or, conversely, by setting a trailing stop to lock in gains earned when the gains start to be pared.) By sticking to a plan where these trading rules are unbreakable, irrational emotions are removed from your trading decision.

ANCHORING BIAS

Anchoring or focalism is a cognitive bias that describes the common human tendency to rely too heavily on the first piece of information offered (the "anchor") when making decisions. During decision making, anchoring occurs when individuals use an initial piece of information to make subsequent judgments.

[Rivera, J. What is the Power Of Anchoring Bias?: Throwback Thursday. (Accessed September 28, 2021)].

More simply put, anchoring occurs when a person values the first piece of information too much to make rational subsequent decisions. With respect to investing, anchoring can easily be demonstrated to effect the decision on when to sell an asset. As a specific example, you have an investor who holds the asset in question longer than they should have as their thinking has become 'anchored' on receiving a sum in excess of the purchase price. As such, it is the initial buying price that biases the investor from seeing the true value of the underlying investment and from selling to mitigate loss.

AVOIDING THIS BIAS: Do not let emotions guide your actions, rather take some time and do some diligent research before making your investment decision. This diligent and comprehensive assessment you make will reduce the impact of anchor bias. Then, open your mind to new information concerning the asset in question, even if the new information runs counter to your initial beliefs.

HERDING BIAS

Herding occurs when investors displace their independent investment decisions based on sound financial data and choose instead to follow what other investors are doing. A simple example of herd behavior is where an investor, planning on investing in ABC Corp., instead invests in XYZ Corp. because everyone else is investing in XYZ even though it is much more risky. "An uninformed investor who exhibits herd mentality and invests without doing their own research often loses money". [Hayes, A. Herd Instinct. (Accessed September 28, 2021)

This type of irrational behavior can create significant chaos in the market as it has a tendency to create bubbles, And as history has taught us, bubbles do burst - think back for a moment to the dot.com bubble or the real estate bubble, both yielding disastrous market results.

People tend to engage in herd behavior as they believe it is safer to follow the crowd. This is where FOMO (Fear Of Missing Out) enters the picture. if everyone is making money investing in XYZ Corp. you feel uncomfortable sitting on the sidelines while everyone else is making money - you simply join the crowd.

AVOIDING THIS BIAS: Always be skeptical and cautious when considering that 'hot investment' touted on social media. Take a breath and diligently research the 'hot investment's fundamentals as this will give you a clear picture of the solidarity of the investment. Not yielding to emotion and diligent research is the key to avoidance of herd behavior. And do not be afraid to stand apart from the crowd when fundamentals direct you in a different direction.

RISK AVERSION

In economics and finance, risk aversion is the tendency of people to prefer outcomes with low uncertainty to those outcomes with high uncertainty, even if the average outcome of the latter is equal to or higher in monetary value than the more certain outcome. Risk aversion explains the inclination to agree to a situation with a more predictable, but possibly lower payoff, rather than another situation with a highly unpredictable, but possibly higher payoff.

[Wikipedia. Risk aversion. (Accessed September 18, 2021)].

This text book definition somewhat confuses what is basically a simple concept. Risk aversion occurs in finance when an investor is faced with two investments that will yield similar returns with different associated risks and the risk averse investor will always choose the investment with the lower risk. This risk averse investor only considers riskier investments if they receive compensation in the form of a risk premium.

This concept explains an irrational psychological preference to always agree to a situation that is more predictable, even if this situation yields less, totally disregarding a situation that is unpredictable but produces a higher yield. A simple example of this concept is where the risk averse investor opts to place his investment in a bank account with a guaranteed but low rate of return rather than investing in a stock (or coin) which would provide a much higher yield but may subject the investor to a loss of investment value.

[Nagoda, supra.].

The bias of risk aversion is often confused with the bias of loss aversion. However the two are wholly different and clearly distinguishable. "While both deal with behavioral irrationalities, risk aversion is merely the general bias for safety in financial matters where loss aversion concerns a pattern of irrational behaviors which are both risk averse and risk taking. [See, e.g. Covisum. Is Loss Aversion the same as Risk Aversion?. (Accessed September 28, 2021)]." [Id.].

AVOIDING THE BIAS: Assess whether your perception of risk is based on sound financial data, or, if it is based on an external source or other emotion. An investor needs to remove emotion or external sources as being poor metrics and reliance on sound financial data should mitigate misplaced fear of risk. By weighing worse case scenarios against possible positive outcomes you may find investments once thought to be too risky may have a higher degree of producing a life changing positive result. If based on sound financial data, you need to adopt the mind set that what you thought was risky is, in fact, a huge opportunity. [See, e.g. Eliason, N. Don’t Try to be Less Risk Averse, Rethink Risk Instead. (Accessed September 28, 2021)].

CONCLUSION

As humans, we do not make financial decisions based on rational assessments of optimizing outcomes or maximizing returns as mainstream finance would have us believe. Rather, human's financial decisions are often based on emotion and biases. It is these emotional and bias interventions into the decision making process that can yield undesirable financial mistakes. Behavioral Finance can intervene to help investors recognize these biases with the goal of avoiding them and thereby maximizing financial successes.

Posted Using LeoFinance Beta

Electronic-terrorism, voice to skull and neuro monitoring on Hive and Steem. You can ignore this, but your going to wish you didnt soon. This is happening whether you believe it or not. https://ecency.com/fyrstikken/@fairandbalanced/i-am-the-only-motherfucker-on-the-internet-pointing-to-a-direct-source-for-voice-to-skull-electronic-terrorism

I am the shit-tier bag king. I don't give a flip. Form 8949 and 1099-b are important forms apparently so we can use our massive, frequent, fun losses to save a little bit of blood usury going to the hook nose clan.

Posted Using LeoFinance Beta

Never Chase a trend in forex market because you are going to lose all while chasing a trend.

Just identify the trend you want to trade, check if it fall to your strategy before executing the trade.

Always have self confidence, Never enter a trade with fear,be patient and wait for your trade to enter.

Posted Using LeoFinance Beta

Also, the excitement of getting rich can spoil investments, so it is better to think with your head and not with your heart.

Posted Using LeoFinance Beta

Great writeup, thank you! I shared this with a few people I know who highly highly needed to read it! (myself included)

!LUV

!PIZZA

Posted Using LeoFinance Beta

<><

@kevinnag58, you've been given LUV from @amphlux.

Check the LUV in your H-E wallet. (1/10)

@kevinnag58! I sent you a slice of $PIZZA on behalf of @amphlux.

Learn more about $PIZZA Token at hive.pizza (1/20)

I'm glad to hear my article was of some service to you. Thank you!

Posted Using LeoFinance Beta

I think the best investment strategy for the average joe is to buy stocks on good companies (consistent profits for ten years or more and low leverage) to become a partner and forget everything else.

Posted Using LeoFinance Beta