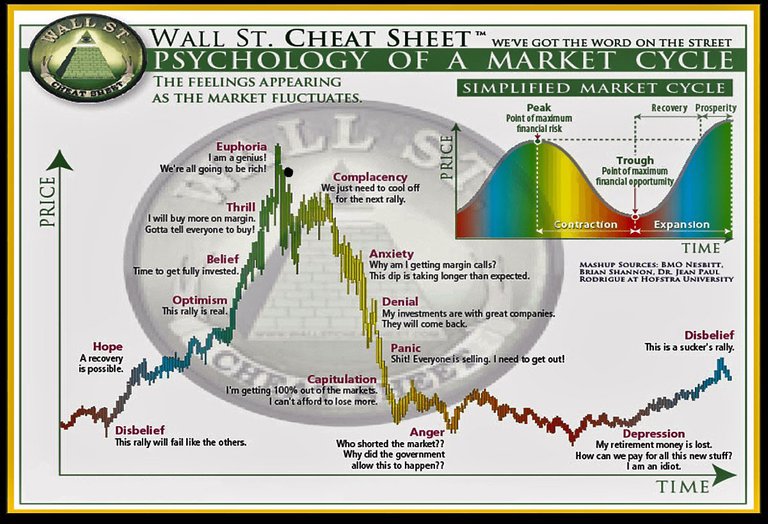

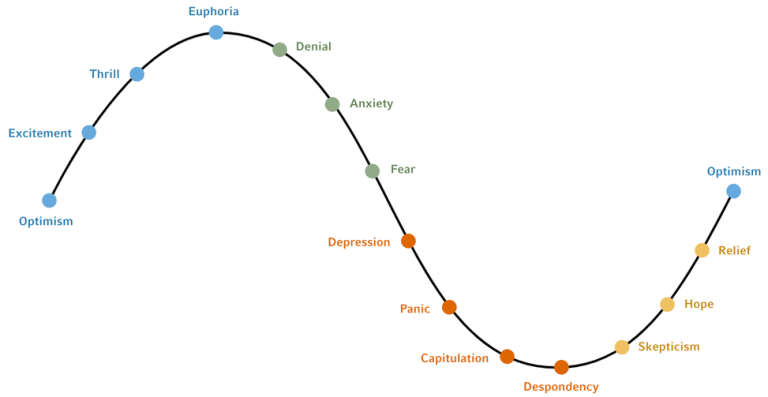

Behavioral Finance: The Psychology of a Typical Market Cycle

INTRODUCTION

It is a given that the markets expand and contract. Underlying this fact, capital moves through markets in a cyclical pattern. This is nothing more than the operation of supply and demand as a function of price. The market continuously is seeking out 'fair value', which rallies and declines form the observed cycles.

But the operation of supply and demand is driven by irrational human emotion rather than the rigid rational investor/efficient markets influences classical economists would have us adopt. Thus, it is impossible to know the feelings and motivations of each individual market participant to reach a consensus. However there exists certain sentiments and emotions that are shared by participants at various stages of the market cycle.

It is through the observation of these shared emotions that 'crowd psychology' may permit an investor to gain an emotional edge in trading over an investor thinking solely of the investor's self interest. By understanding and identifying the psychological mechanisms present at any stage of the market cycle, we can remove the emotional pitfalls from our own trading regimen, and respond in actions more consistent with the actual market moves.

THE PSYCHOLOGY OF A TYPICAL MARKET CYCLE

A typical market cycle may be broken down into four distinct stages:

- Accumulation: After a period of decline; it is the process of buyers fighting for control of the trend.

- Markup: Once buyers have gained control of the stock, a bull market begins as price expands higher in search of supply.

- Distribution: After the market has exhausted the majority of buying demand, sellers become more aggressive, which turns the market neutral.

- Decline: Price expands to the downside in search of demand to satisfy the aggressive supply being offered.

[BSIC. Market Cycles and Their Psychological Interpretation — Part 1. (Accessed October 5, 2021)].

And within these stages, we can observe various human emotions at play influencing price movement within the market. These psychological emotions are as follows:

ACCUMULATION

- OPTIMISM: The accumulation phase starts with the completion of a down cycle and is a transitional stage demonstrating a shift from seller control to a neutral market. This is a healing period, not only for the price of the asset, but also for investor's perception of the asset. Sellers begin to ignore past negative news concerning assets and become forward thinking. It is this forward thinking coupled with a positive market/asset view that begins to drive purchases.

MARK-UP

- EXCITEMENT: With optimism entrenched, prices begin to rise and the markets begin to meet investors expectations. Within the range of human emotions excitement begins to build. The investor looks at the market with hope and anticipation of the future as investments appreciate. This is the start of a bull market.

- THRILL: The market continues to climb and investors grow more confident in their investing capabilities. Investors are earning into profit and become more and more confident in their trading choices. Some investors at this point will be willing to accept unreasonable risk. A strong surge in price may catch investors off guard causing them to become emotional and lose discipline and haphazardly chase higher prices.

- EUPHORIA: Investment opportunities seem limitless and most investments yield easy and quick profit. Greed, a huge motivator, is prevalent here. As a result of this greed, this period is where maximum financial risk is present. Asset fundamentals are not considered by most and trading occurs primarily based on human emotion. In the late stages of a bull rally, late significant gains well exceeding rational valuations are common. There is misplaced market sentiment that even with irrational asset valuations, prices will continue to rise.

DISTRIBUTION

- ANXIETY: An asset entering the Distribution stage has temporarily exhausted its price run and is entering into a correctional phase. These corrections occur to address the extreme price levels reached as a result of the actions of emotional and undisciplined investors. There is a shift from a bullish sentiment to a market neutral sentiment. In the first emotion exhibited in the Distribution phase, anxiety, investors see the markets begin to turn but with their emotions in charge they cling to the bullish sentiment. The investors exhibiting anxiety convince themselves they are seeing only a short term correction.

- DENIAL: The investors believing that the correction was short term now recognize it is taking longer than originally perceived. Doubt in the long term bull market grows and investors begin a growing hope for a short term price improvement. During this middle period of Distribution demand for assets become exhausted and the available supply becomes made more methodically. The market becomes indecisive and conflicting emotions present themselves all leading to a fragile asset environment moving in the direction of a breakdown.

- FEAR: At some point, smarter investors will be forced to reconcile their emotional market perceptions with the realities present in the market (some investors, however, will continue to hold their unrealistic perceptions). During this period of Fear, investor uncertainty is at its maximum. Most would like to exit their positions with either a small profit or minimal loss, but most do nothing as they simply do not know what to do under the circumstances present.

DECLINE (Mark Down)

- DESPERATION: At this point, investors have realized that any chance at realizing a profit on the investment is gone. Accordingly, the investors hopes turn to any possible scenario imaginable that will return their investment back into profitable territory.

- PANIC: This panic period is marked by great emotional impact due to feelings of a loss of control. Investors feel helpless and without direction as to what way to react. The investors typically believe they have wholly lost control over their investments and the market. While the investor may want to sell to cut losses, emotion leads the investors to hold out of fear of looking stupid by selling just before a turn around.

- CAPITULATION: In the Capitulation period, emotional investors have finally reached their breaking point. The last of the uninformed emotional investors exit their long positions exhibiting relief and happiness that they sold to avoid incurring greater loss.

- DESPONDENCY/DEPRESSION: Investors are feeling the effects of incurring their loss as well as having their emotional expectations dashed. Some investors feels so bad from the loss they no longer wish to invest in asset markets. However, knowledgeable contrarian investors will find this to be the point of maximum financial opportunity in the market. This period marks the end of the downturn and investors start to contemplate how they could have been so stupid to play into their emotions. During this period of introspection, smarter investors will look back and analyze their errors and start to learn remedial lessons on how to avoid the same emotional mistakes in the future.

- HOPE: The markets gradually improve and the entire situation looks brighter from the investors viewpoint. Investors come to the realization that markets do in fact act cyclically, and with their new found knowledge and experience gained from their lessons learned, they begin their search for new investment opportunities.

- RELIEF: Investors observe the markets returning to positive territory and with renewed faith in the underlying market, the investors convince themselves in their renewed ability to invest appropriately. It is at this point the market cycle begins again.

CONCLUSION

It must be remembered that we are all human and that the human mind works in strange and mysterious ways. Contrary to classical thought, as investors we act irrationally letting our decisions be guided by our emotions.

It is for this reason that being able to recognize and understand the emotions present is important to being able to divorce ourselves from our emotions when making financial decisions. In this way, we may all become better investors with the hope of maximizing our financial gains.

Posted Using LeoFinance Beta

.png)

.png)

Electronic-terrorism, voice to skull and neuro monitoring on Hive and Steem. You can ignore this, but your going to wish you didnt soon. This is happening whether you believe it or not. https://ecency.com/fyrstikken/@fairandbalanced/i-am-the-only-motherfucker-on-the-internet-pointing-to-a-direct-source-for-voice-to-skull-electronic-terrorism

Where do you reckon we stand currently? I have seen similar pictures regarding the stock market, like at which point of the cycle what assets perform better and what's to come next...

Personally I am torn between two stages in the present cycle, but if pressed to give an answer I would say we are in a recovery which would place it in the mark-up stage.

Here is an article I found with respect to BTC which may help you: The Bitcoin and Crypto Market Cycles: What You Need to Know.

Thanks for taking the time to read this piece.

Posted Using LeoFinance Beta