Crypto Winter Socks In Another - Poolin to 'Pause' Withdrawls

"Poolin, one of the largest Bitcoin mining pools by hash rate, has announced it has temporarily suspended Bitcoin and Ether withdrawals from its wallet service due to 'liquidity problems.” [Wright, T. Crypto miner Poolin pauses BTC and ETH withdrawals, citing 'liquidity problems'. (Accessed September 6, 2022)].

Specifically, the announcement from Poolin read as follows:

The payout of the current BTC and ETH balances on pool will be temporarily suspended. We will make a snapshot of the remaining BTC and ETH balances on pool on September 6th to work out the balances. The daily mined coins after September 6th will be normally paid out per day. Other coins are not affected. The details of payout schedule for remaining balances will be released when details are set.

a. The unpaid balance due to not reaching the payment threshold will be paid normally after the payment conditions are met, and will not be affected in any way.

b. All sub-account mining and anonymous mining are paid normally.

[Poolin. Announcement on settlement adjustment and ZERO fee promo. (Accessed September 6, 2022)].

"In its Telegram channel, Poolin support told users it was “hard to name a specific date” on which it would resume normal service, but hinted it could be a matter of days, while the help page stated, 'time and plans of resume will be released within 2 weeks" [Wright, supra].

Is this the beginning of the end for Poolin? Or is the mining pool just powering through some minor problems? The Beijing-based company recently announced, “Poolin Wallet is currently facing some liquidity problems due to recent increasing demands on withdrawals.” All hell broke loose after that and Poolin lost between 30 and 40% of its hashrate, but their clients might’ve been exaggerating. Then again, they might’ve not been [...] Even though the press release appears optimistic, it doesn’t inspire confidence. Poolin announced the withdrawals freeze in small font, while offering sweet deals to all miners that left their funds in their custody. A bad sign if we ever saw one. (emphasis added).

[Prospero, E. Poolin Mining Pool Freezes BTC and ETH Withdrawals, Cites Liquidity Issues. (Accessed September 6, 2022)].

Needless to say the actions taken by Poolin coupled with the tone of their announcements have lead to a lot of speculation:

According to analyst Dylan LeClair, there are currently “17.6k BTC currently in the known Poolin bitcoin wallet.” How could a profitable mining pool with a sizable wallet get into a situation like this? This is all speculation, but the obvious theory is that they’re China-based, and the country banned bitcoin mining a long time ago. Even though the policy hasn’t been exactly successful and Poolin moved its farms to Texas, China might have found a way to stop the pool somehow.

[Id].

But the speculation doesn't stop with LeClair as two further possibilities have been advanced.

Another possible reason has to do with this announced change: “BTC payment method from FPPS to PPLNS” Under FPPS, miners get paid whether the pool gets a block or not. Maybe Poolin faced a stretch of bad luck, couldn’t find blocks, and that’s the reason it’s changing to PPLNS, which only pays if they do. The third possible reason is that they had dealings with BlockFi and Three Arrows Capital. Maybe those companies’ demise ended up affecting Poolin’s business.

[Id].

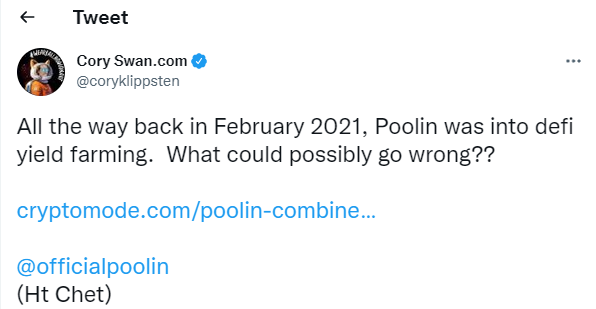

And one final possibility has been advanced by Cory Klippsten of Swan Bitcoin:

Poolin's plan with respect to DeFi Yield Farming sounds extremely complicated and overly experimental to be viable. According to the article alluded to by Klippsten:

Creating a token backed by Bitcoin mining hashrate to create DeFi yield farming incentives is unique. The purpose of this setup is to create value for its mining token – backed by 1 TH/s of hash power – and allow traders to exchange it on the open market. The pBTC35A token has a current value of $112.5 and a supply of 200,000 tokens. That means Poolin has tokenized 200,000 TH/s of Bitcoin hashing power and one that does more than just “mine”. Through the Mars Project, holders of the pBTC35A can either stake the asset to earn wBTC and MARS tokens. Another option is to add Uniswap liquidity, obtain LP tokens, and harvest wBTC and MARS. Sushiswap supports MARS as well [...] Poolin is experimenting with something rather intriguing here. Although the TVL remains a bit low – for now – there appears to be a genuine interest in this option. Depending on its success, this may become a new trend in the world of cryptocurrency mining. (emphasis added)

[Buntinx, J.P. Poolin Combines Bitcoin Mining With DeFi Yield Farming. (Accessed September 6, 2022)].

The bottom line by Poolin in this regard is: "[w]hen acquiring Poolin’s pBTC35A token, users officially own 1TH/s of mining power on Poolin. This contract also comes with an energy usage of 35W per Terahash, at an electricity price of $0.0583/kWh. These costs are deducted from the earnings automatically, yielding users a profit of roughly 568 Satoshi per day" [Id].

"However, let’s face it, it’s far-fetched to think that a failed crypto idea would compromise the health of what used to be the fourth biggest pool in the world. We could be wrong or not seeing something, though" [Prospero, supra].

Finally, Poolin attempts to assuage investors by stating: "But please be assured, all user assets are safe and the company's net worth is positive" [Poolin, supra].

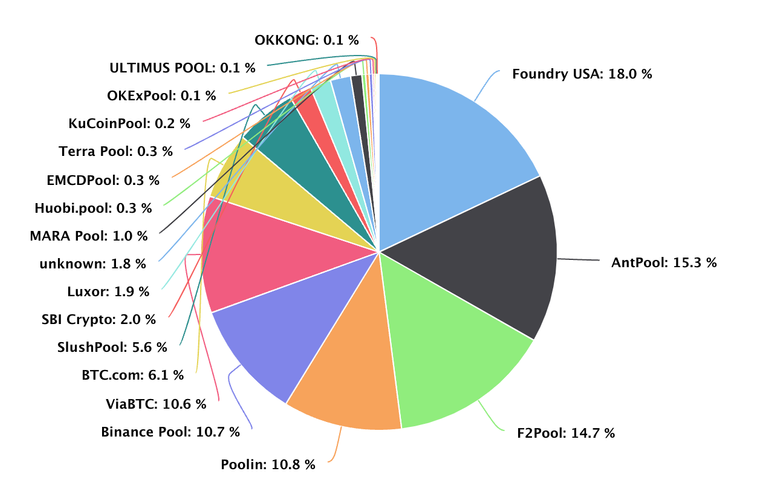

"Launched in 2017, Poolin is a China-based mining pool that operates under Blockin. According to data from BTC.com, the firm was responsible for roughly 10.8% of the BTC blocks mined over the last 12 months, coming in as the fourth-largest mining pool behind Foundry USA, AntPool and F2Pool" [Wright, supra].

Posted Using LeoFinance Beta

.png)

.png)