How Does Ripple (XRP) Work?

INTRODUCTION

It is no secret that today's international payment system is too fragmented and causes delays and frustrations for the users. People have to jump through a lot of hoops to make cross border payments, and these everyday transactions set them back a lot of money apart from long wait times. Ripple delivers a platform for instant, reliable, and low-cost financial transactions to address the issues associated with the current payment systems.

[Toti, B. What Is Ripple and How Does It Work?. (Accessed October 31, 2021)].

Essentially, Ripple is a peer-to-peer network which functions to provide a digital technology for financial institutions to use for payments. Ripple permits seamless digital money transfers of fiat or cryptocurrencies on a global scale.

To understand how Ripple works, it is necessary to examine it from two points of view, to wit: Ripple as a payment system; and, Ripple as a cryptocurrency. In this subsection of the Leo Finance Ripple (XRP) Coin Guide let's examine both these points of view separately in order to gain a true understanding of just how Ripple works.

RIPPLE AS A PAYMENT SYSTEM

THE BASICS

To begin with, in the Ripple ecosystem, actual money is not transferred from one place to another. It is the promise of money that is transferred within the protocol.

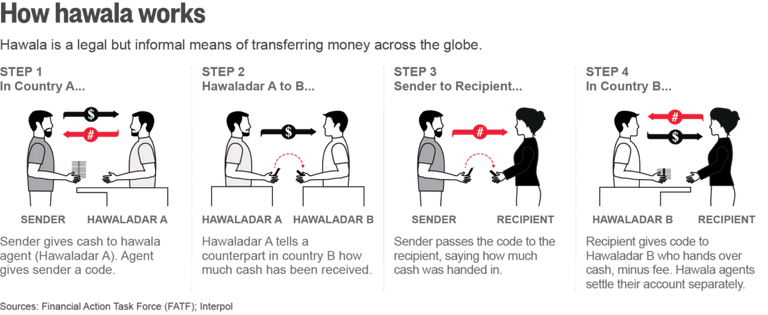

Now, how this is accomplished relates back to an 8th century South Asian transfer schemata known as the Hawala System. This system is still used today, mostly in Islamic countries, and by immigrants living in developed areas who wish to send funds to their home country where there is limited and expensive bank access. In each and every Hawala transaction there are at least four participants: the Sender; Hawala Dealer A; Hawala Dealer B; and, the Recipient. The following diagram depicts a typical Hawala System transfer:

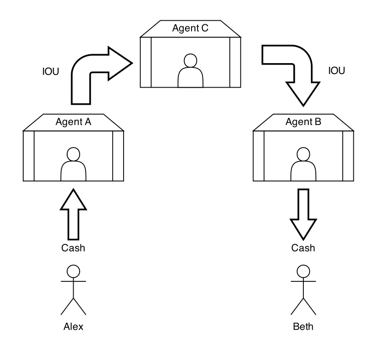

You might be thinking this author is crazy, but the Ripple protocol operates in much the same way as the Hawala System, but in place of the Hawala Dealers there are Ripple Gateways. These gateways are validators and/or servers which typically are financial institutions the likes of Bitstamp. Ripple is quite large and not everyone in the system trusts one another. To alleviate this trust dilemma, Ripple utilizes 'chains of trust' or links between gateways that trust one another. The following diagram shows how this works where there is an indirect link of trust present in the scenario:

In this diagram, Gateway B does not directly trust Gateway A so a direct link is missing to complete the transfer. But Gateway A does trust Gateway C, which in turn trusts Gateway B, creating the indirect link between Gateways A and B.

The Ripple Gateways transfer this 'IOU' information using the https protocol (already in use for secure credit card payments). Three to four seconds following the making of a payment, Ripple's network causes the gateways included in the transaction to make a ledger update. On average, each such transaction costs 0.00001 XRP but may be increased during times of high system load. These fees are neither retained or distributed but burned thereby benefitting all XRP holders by way of a decrease in token supply.

VERIFICATION OF TRANSACTIONS

Ripple works by consensus rather than by mining [see, e.g. Schwartz, D., Youngs, N., and Britto, A. The Ripple Protocol Consensus Algorithm. (Accessed October 31, 2021). Ripple is a peer-to-peer system where all participating devices must be connected to the network. Some of the nodes present in the Ripple system exist solely to make and receive payments while other nodes operate solely as validators to facilitate the consensus process. It is the function of the validators to view a snapshot of the ledger and come to an agreement on the current state using the RPCA (Ripple Protocol Consensus Algorithm).

Prior to the verification event, each validator takes the verified transactions it viewed that have not as yet be added to the current ledger and makes them public as the 'candidate set'. Then each validator groups all of the validators candidate sets on its UNL (Unique Node List) thereafter voting on the accuracy of all of the transactions listed.

At this stage one of two results are possible: transactions receiving more than a minimum percentage of affirmative votes proceed to the next round; or transactions receiving insufficient affirmative votes are either rejected and discarded or moved to the candidate set for the beginning of this process on the next ledger. The final round requires 80% of a validator UNL agreement on a transaction and each transaction satisfying this requirement are applied to the ledger.

RIPPLE (XRP) AS A CRYPTOCURRENCY

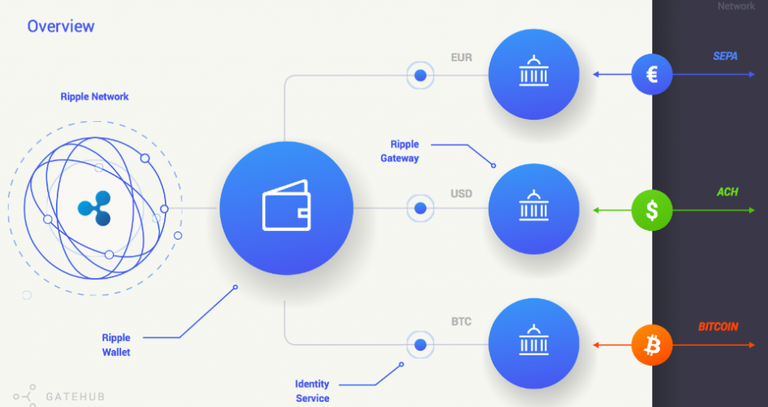

The XRP coin is the native utility coin on the Ripple network, but the Network can be utilized for any type of asset or currency the gateways are willing to accept. If the network is unable to establish a chain of trust between two gateways, the two gateways may still conduct the transaction using only XRP coins. The gateways actually have the functionality to send and receive XRP. However, other currencies used by the Ripple System must rely on the 'IOU' Hawala System discussed above. A diagram displaying an overview of the Ripple currency system follows for your information:

CONCLUSION

It is very true that for many reasons, Ripple (XRP) has gained a poor reputation within the cryptosphere. Nonetheless, in light of the foregoing, it can not be said that the working mechanics of the Ripple System, in all its simplicity, has contributed to this reputational failure. Ripple's underlying mechanics appear to be sound.

Posted Using LeoFinance Beta