Understanding Irrational Investor Behavior - Loss Aversion v Risk Aversion

INTRODUCTION

DISTINGUISHING MAINSTREAM FINANCIAL THEORY FROM BEHAVIORAL FINANCE

In mainstream financial theory, the basis for the whole arena is that the human being acts in a rational fashion. All of the assumptions made in mainstream theory find their basis in this premise. Mainstream theory likewise embraces the concepts that human beings act in a way without emotions or the biases created due to cultural or social interactions. The foregoing is carried forward in mainstream theory in its assumptions concerning efficient markets and that individual businesses are acting rationally to maximize their profits

Behavioral Finance, on the other hand, runs counter to these assumptions and focuses on human beings acting in an irrational manner. Behavioral Finance instead attempts to explain how human's finances are influenced by emotions and biases as well as the cognitive limitations of the human brain. This behavioral theory points to the fact that it is human psychology that causes prices in the markets to diverge from basic fundamental values over a period of time. But behavioral finance does not offer a magic bullet to permit capitalization on this divergence, but rather provides us with useful insight on how to avoid behavior that would otherwise decrease individual personal wealth.

THE IRRATIONAL INVESTOR AND LOSS AVERSION

To understand the concept of loss aversion, a simple example outside the field of finance will bring focus:

Offer someone a choice of a sure $50 or, on the flip of a coin, the possibility of winning $100 or winning nothing. Chances are the person will pocket the sure thing. Conversely, offer a choice of 1) a sure loss of $50 or 2) on a flip of a coin, either a loss of $100 or nothing. The person, rather than accept a $50 loss, will probably pick the second option and flip the coin. This is known as loss aversion.

[McClure, B. An Introduction to Behavioral Finance. (Accessed September 17, 2021)].

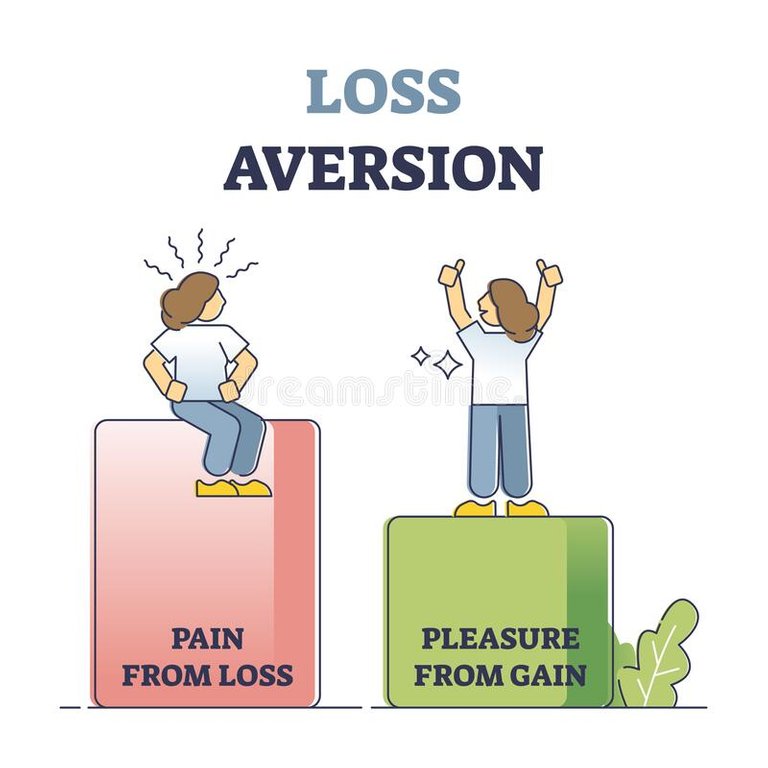

What does this example instruct us? Even though the chances of a coin landing on either side is equal, the majority of people will opt for the coin toss to avoid the sure $50 loss, knowing the possibility exists for an increased loss of $100. Why? The psychological tendency of the human mind views recouping any loss as more important than a greater gain.

In applying loss aversion to finance, loss aversion happens when an investor's concerns about losses far outweigh the pleasure derived from gains. Put another way, the investor prioritizes avoiding their losses over pursuing investment gains.

Within this concept of loss aversion exists the disposition effect. This disposition effect happens when investors sell off assets showing gains while retaining their losing assets. The psychology behind this is clear. Irrational investors desire to take their gains as fast as they can, but, with assets in the red, they tend to hold the asset in the hopes of a return in price to match the inputted investment.

When there is a potential loss at hand, the tendency for the irrational investor is the reluctance to admit an investment mistake. Simply put, the investor views the investment performance of the asset from its initial price, thereby irrationally disregarding any changes to the fundamental underpinnings of the asset itself.

THE IRRATIONAL INVESTOR AND RISK AVERSION

In economics and finance, risk aversion is the tendency of people to prefer outcomes with low uncertainty to those outcomes with high uncertainty, even if the average outcome of the latter is equal to or higher in monetary value than the more certain outcome. Risk aversion explains the inclination to agree to a situation with a more predictable, but possibly lower payoff, rather than another situation with a highly unpredictable, but possibly higher payoff.

[Wikipedia. Risk aversion. (Accessed September 18, 2021)].

This text book definition somewhat confuses what is basically a simple concept. Risk aversion occurs in finance when an investor is faced with two investments that will yield similar returns with different associated risks and the risk averse investor will always choose the investment with the lower risk. This risk averse investor only considers riskier investments if they receive compensation in the form of a risk premium.

This concept explains an irrational psychological preference to always agree to a situation that is more predictable, even if this situation yields less, totally disregarding a situation that is unpredictable but produces a higher yield. A simple example of this concept is where the risk averse investor opts to place his investment in a bank account with a guaranteed but low rate of return rather than investing in a stock (or coin) which would provide a much higher yield but may subject the investor to a loss of investment value.

Risk averse investors are conservative investors who more typically are older or retired individuals. Psychologically, they are unwilling to tolerate any volatility within their portfolios, opting instead for more highly liquid holdings.

CONCLUSION - LOSS AVERSION V RISK AVERSION

In behavioral economics both of these concepts are used to understand irrational decision making. While the two may seem similar in nature they are actually different in an important regard. While both deal with behavioral irrationalities, risk aversion is merely the general bias for safety in financial matters where loss aversion concerns a pattern of irrational behaviors which are both risk averse and risk taking. [See, e.g. Covisum. Is Loss Aversion the same as Risk Aversion?. (Accessed September 18, 2021)].

Nonetheless, it must be remembered that these behavioral finance concepts are not meant to be a panacea for irrational behavior in the marketplace. But rather, they are present to illustrate behavior to be avoided in the future should one so choose, and to instruct avoidance of such behavior that would otherwise decrease individual personal wealth.

Posted Using LeoFinance Beta

.jpg)

Electronic-terrorism, voice to skull and neuro monitoring on Hive and Steem. You can ignore this, but your going to wish you didnt soon. This is happening whether you believe it or not. https://ecency.com/fyrstikken/@fairandbalanced/i-am-the-only-motherfucker-on-the-internet-pointing-to-a-direct-source-for-voice-to-skull-electronic-terrorism