From ICOs to DeFi: How My Trading Approach Has Evolved Since 2017

My first foray into crypto was in 2016 when I started buying and getting heavily interested in Bitcoin. I had heard about it in various internet circles before then, but as is the case with many of us cryptonauts - it took me a few years to really believe that BTC was an actual asset worth investing in.

Shortly after I started accumulating Bitcoin, I heard about this thing called Ethereum. Ethereum promised to bring the technology of Bitcoin to a new level: creating a platform of innovation where other projects could leverage the tech to bring about new opportunities on a global scale.

This excited me and I started to accumulate both Bitcoin and Ethereum. Not too long after that, we started seeing some of those projects come to light on the ETH blockchain. New coins armed with fancy websites, lengthy whitepapers and promises of building the future started to take over the conversation.

The ICO craze didn't start out as a craze. It started out as a grass roots movement where you had real founders asking for funding to build a grand vision. Doing research on some of these projects actually made me quite bullish on them. There were clearly diamonds in the rough.

I invested in a few ICOs, but stuck mainly to BTC and ETH. I continually asked the same question that I posed to @rollandthomas on the last LEO roundtable: "what platform are all of these projects built on?" Ethereum.

Getting into some of these ICOs and early coins allowed me to make some ridiculous ROIs. I remember waking up some days and looking at a coin position I held that was up 600% on the week. It was an absolutely crazy time in my life and I remember the euphoric feeling of being a genius.

Until I wasn't.

I was fortunate to know that it wouldn't last forever, but unfortunate in thinking that I could time it well. I took more than half of all the profits that I made out of crypto entirely toward the beginning of 2018 when the hype was starting to cool off, but in hindsight, I realize that it was pretty obvious that I should've taken out all or close to all of the money I had in crypto - or at the very least, move my money out of ICOs and low-cap coins and back into BTC and ETH.

DeFi: ICOs All Over Again

The past few weeks have felt exactly like mid 2017 when the ICO craze started to hit full swing. I remember how the smart money was positioned in ICOs and small-cap coins: waiting for the dumb money to jump on the bandwagon and send the coins to the moon.

DeFi is no different: I've written about DeFi several times over the past several months. I have been following the movement of this subset of the crypto industry with a close eye, but have been hesitant to put money into low-cap coins. The fear of holding more worthless altcoins has haunted me since 2018.

I hold significant positions in BTC, ETH, BAT and HIVE. Outside of that, I see other projects as pure speculation. To be fair, there are definitely fundamentally solid projects outside of these 4. These are simply the 4 projects that I have spent a lot of time getting familiar with.

We don't have infinite time to research all of these projects under the sun, but I have learned a valuable lesson about keeping an ear to the ground and creating a small portfolio of what I will consider "hypecoins".

Coins like LINK, RUNE, SNX and others have entered this category for me. I'm now holding small positions in many of these smaller altcoins that have been continually recommended to me by the LeoFinance community and out in the Crypto Twitterverse. It is dumb of me to ignore the recommendations of people who spend countless hours a day researching these projects and investing in them.

With that said, my approach to the DeFi boom has evolved greatly since my foray into the ICO boom. I have a few more years under my belt and understand the crypto cycle to a much greater degree. I still believe that DeFi has room to go up, but I also know that holding altcoins will eventually bite you in the ass if you're not paying attention to them.

In short, my approach to investing in DeFi is to put a small amount of money in each of these "hypecoin" projects that get recommended to me by multiple different people on LeoFinance and Twitter. As these coins go up in price, I take profits into BTC and hodl that. I still think BTC is the top dog and will always remain so.

Bitcoin is the grandaddy store of value for the crypto space and is quickly becoming a viable store of value for many of the top fiat investors in the world like Paul Tudor Jones. The smart money is clearly making profits on DeFi boom/busts and then moving those profits into BTC.

DeFi Industry Snapshot

For posterity and to understand the stage that DeFi is in, here are the macro numbers:

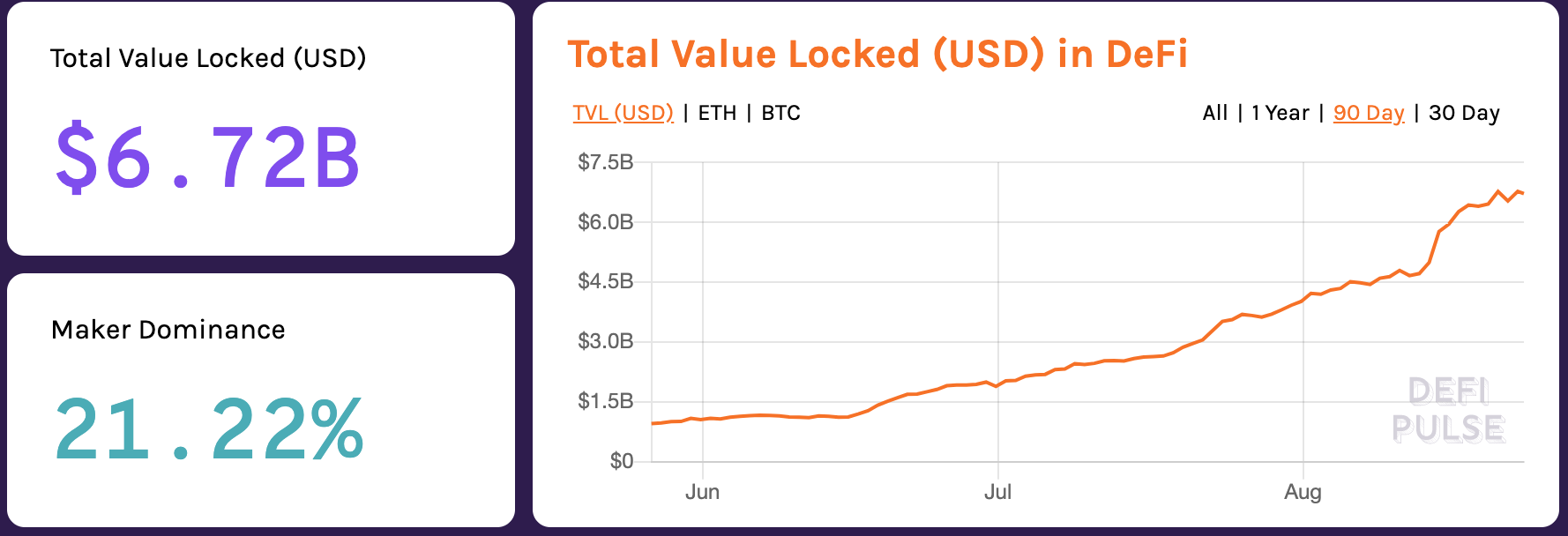

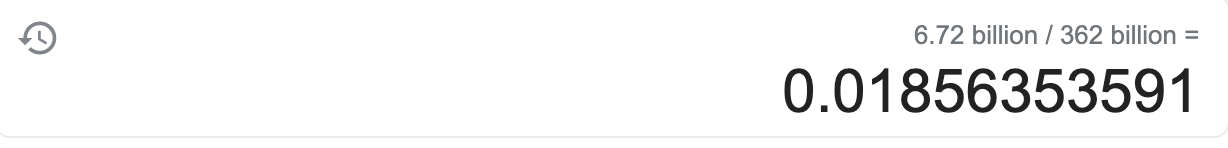

TVL is Total Value Locked which is the total amount of capital that is locked in various DeFi protocols. Lending protocols, swaps, liquidity pools, etc. The TVL has risen from $1 billion at the end of may to now $6.72 billion in late August. This represents about 1.85% of the entire crypto industry market cap.

At 1.85% of the total market cap of crypto, I think DeFi still has a lot of room to go up. Similar to ICOs, DeFi is here to stay. One of the primary missions of cryptocurrency is to bank the unbanked and provide more open and decentralized financial tools and capabilities to people across the globe. DeFi is delivering on that promise on a lot of different ways.

With that in mind, DeFi will follow a similar trajectory as ICOs - we're gonna see an explosion of investment and speculation into DeFi (as we have started to see over the past 4-5 weeks) and then we're going to see an eventual implosion. Capital is quickly flooding the DeFi space and will just as quickly flood out of the space, leaving many hodling worthless "promise coins".

If you can ride the DeFi wave, then you can make some insane profits. Just as many did during the ICO craze. As I said, my approach this time around is to take profits as I make them and quickly move back into the value staple: Bitcoin.

Join Our Hive Community & Earn LEO Rewards!

Earn LEO + HIVE rewards by creating and curating crypto and finance content in our PeakD community or directly from our hive-based interface at https://leofinance.io.

| Track Hive Data | Blog & Earn LEO | LEO FAQ |

|---|---|---|

| Hivestats | LeoFinance | Learn More |

|  |  |

| Trade Hive Tokens | Learn & Contribute | Hive Witness |

|---|---|---|

| LeoDex | LeoPedia | Vote |

|  |  |

Posted Using LeoFinance

Muchas gracias por esta valiosa información, feliz día

I'm loving that I'm able to accumulate BAT just by browsing, after I have accumulated a substantial quantity I will probably move them to one of hem staking platforms...cool stuff

Thank you. Have made some small profits with a few small cap coins. I think it may be time to cash in.

I have done the same after living through 2017/2018 and really not seeing it. one bull cycle really opens your eyes. The thing is most people here were not in it so will not really believe you. I know I did not back then.

I have taken some good profits where I have 150% of my initial buy-in back and am letting the rest ride with a stop loss (in profit). This time i intend to come out on top without getting too much FOMO

Posted Using LeoFinance