What are stable coins and Hive Backed Dollar

Just as the name implies stable coin, it’s a cryptocurrency with a stable or fixed value. Due to the high volatility of cryptocurrencies like bitcoin, Etherium Dogecoin, the value of theses coins tend to fluctuate. Which is discouraging when it goes against you. Imagine the purchasing power of your coin reducing by 30% few hours later and you need to buy something urgently. Stable coins give you the opportunity of protecting your money from market fluctuations or risks.

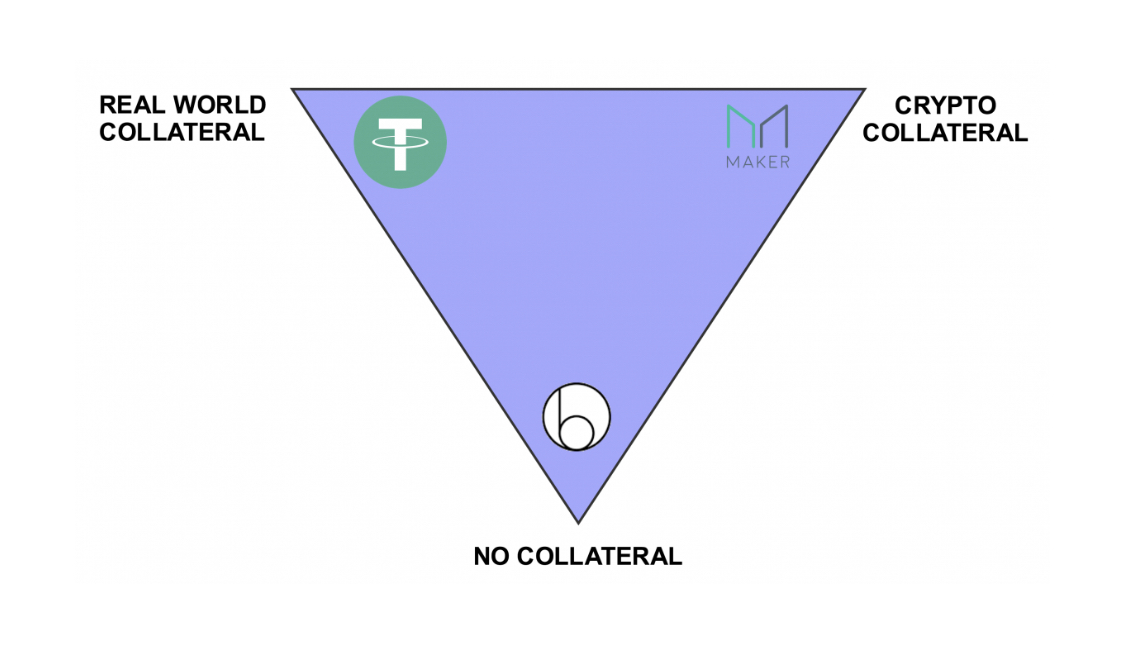

These coins have a system in which they operate to keep the price stable. There are three types of designs for stable coins.

Fiat Collateralized

Crypto-Collateralized (Hive Backed Dollar)

Non-Collateralized

Fiat Collateralized is the common one we all know such as USDT, TUSD, USDC. These stable coins require a custodian to always monitor the currency and reserve some certain amount as collateral. That is they will hold the US Dollar in a bank account and the same amount held in bank must be equal to what they issue to maintain the order of the system. This helps to prevent price fluctuations.

Crypto-Collateralized , as the name implies is backed by a cryptocurrency. Now this is where the Hive Backed Dollar comes in. Hive been used as a collateral for this stable coin. This type of stable coin use a different set of protocol to makes sure the price of the stable coin remain in the range of $1 because crypto (Hive) value is not stable.

For instance let’s assume we deposit $200 of Hive to get $100 of Hive Backed Dollar(HBD) in return. The HBD is now 200% collateralized meaning that if the price of Hive drops to let’s say 25% , HBD still retains its price stability because there are still $150 worth in Hive collateral supporting(backing) the value of HBD.

The last category is the Non-Collateralized which means it’s not backed by any collateral whatsoever. It works in the same way normal fiat currencies do. It’s usually governed by a central bank. Examples are Basis and carbon.

Posted Using LeoFinance Beta

Does that mean if I have a particular token and I wanted to keep it at a current price, say 1POB equals $1, then I change it to an HBD equivalent, no matter what happens to the market price of POB, the amount I had exchanged, doesn't change?

Exactly, the amount will remain stable.

Oh ohk

That's cool then

Is the HF today or 30th of June?