LBI earnings and holding REPORT | Year 02 | Week 48

Welcome to this weeks LBI token earnings and holding post

What is LBI?

The LeoBacked Investment (LBI) token is the first of its kind, the 1st token to be valued completely in LEO. Each LBI token represents a percentage ownership in the overall fund including all LEO, HIVE, off-chain and wallets operated by @lbi-token. The goal is to provide a community based and ran investment vehicle focused primarily on the LeoFinance community and LEO token. We provide a weekly LEO dividend payment to all token holders whilst also increasing the value of the LBI token slowly but consistently over the long term by only investing into things that will stand the test of time.

LBI is a long term HODL token based on SPI's model. Because these tokens are backed and valued in their primary assets, the value only increases. Think of it as putting $1000 in the bank and earning interest. In theory, you should never have fewer dollars. The $1000 is the LEO you give us to buy your LBI token and the interest is the earnings we produce with that LEO.

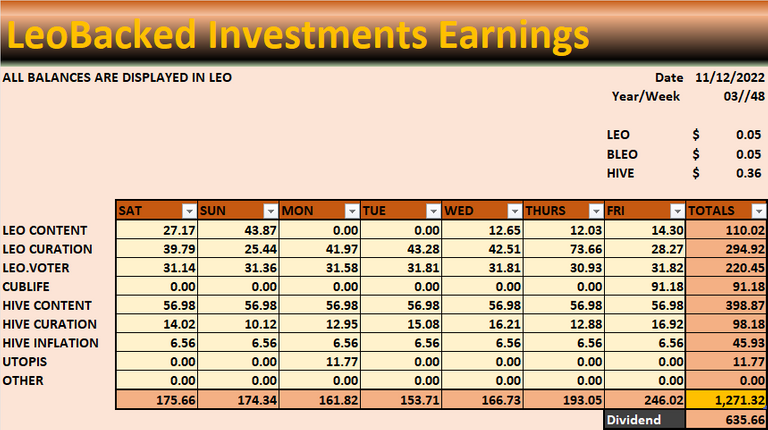

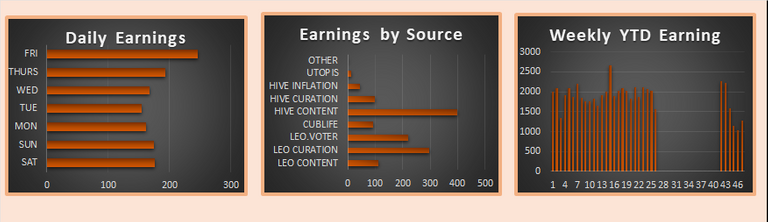

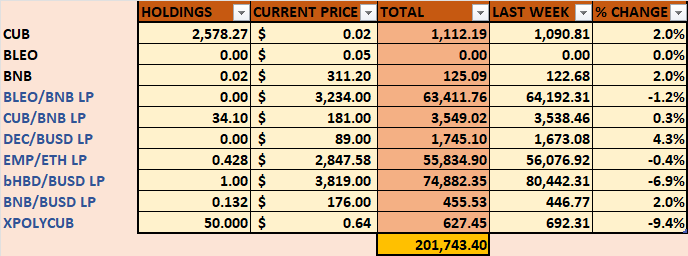

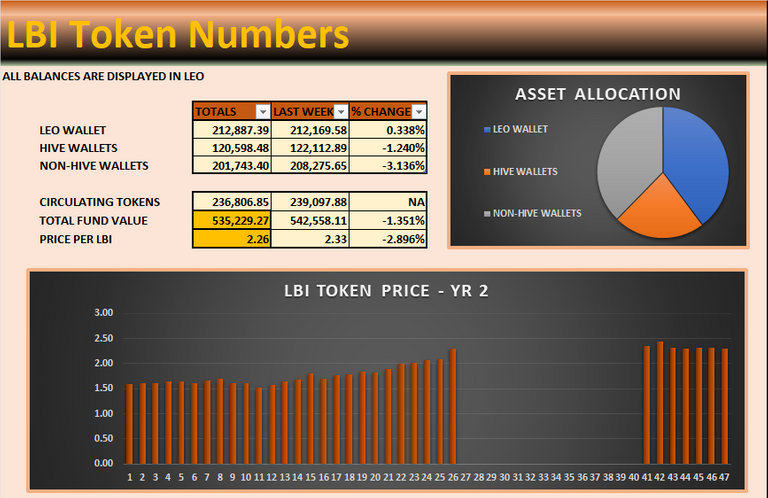

It has been an average week for LBI with nothing exciting happening. We swapped out some LBI for CUBlife tokens on Monday just past and transferred out around $330. This number was smaller than i was guessing but not many people knew about the offer at the same time.

There has not been much change in the markets and I'm guessing this is the calm before the next drop or jump.

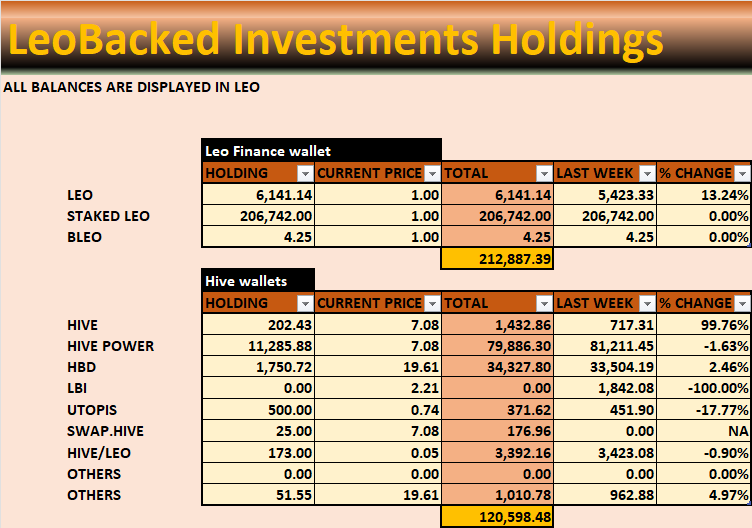

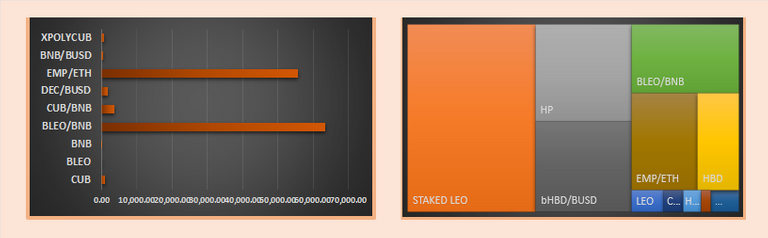

Our liquid LEO balance is over 6000 at the minute and I'm not sure what to do with it. Staking it to earn 8% from curation is not that appealing and far under the 20% growth target in place. Putting it into the bLEO/BNB LP on Leofinance sounds better. I think if we were to powerdown and add all our LEO into the LP, we'd grow much faster and beable to boast earnings from it x4. Leo on Leofinance does not have much use case other than curation.

Our last HIVE powerdown came in this week and i will leave it a week before starting the next one. Because the account is not posting as much content, our HIVE earnings are less and we are no longer adding 100 HP a week to the account. If i leave the powerdown until next week, we can do 1 last 1300 HP powerdown which will give us 100 HIVE per week. The next powerdown in 13 weeks will be maybe 60 HIVE per week unless we start to post more content. HBD growth can no longer being 50 HBD per week because of the same reason as above. It is now growing at around 10 HBD per week plus monthly interest.

I burned off the LBI tokens received as part of the LBI to CL token swap. LBI has been holding an ideal 833 LBI for some while so i decided to burn them as well. In total, there were about 3400 LBI shipped to null.

We are close to the end of the year with only 4 weeks left and currently sitting at plus 42% from year start. Looks like we will hit out 20% target this year and than we move into year 3.

We continue to grind and see where the market takes us. Thanks for checking out this weeks report. Have a great weekend.

Get LBI on LeoDex - https://leodex.io/market/LBI

Get LBI on Hive-engine - https://hive-engine.com/?p=market&t=LBI

Posted Using LeoFinance Beta

42% growth from year start is pretty impressive.

Maybe we should sell for HBD and keep the 20% growth.

Posted Using LeoFinance Beta

Go into stables at the height of the bull, not at the depths of a bear 😉.

Posted Using LeoFinance Beta

Perfect example of how sometimes common sense has to be learned.

But the thing is, we might not actually be in the depths of a bear market yet.

Yikes ;)

Posted Using LeoFinance Beta

Just remember that if we unstake and put all our LEO into the bLEO:BNB LP then you have to sell half for BNB and keep them all 'up for sale'.

Yes, we'll earn a higher yield in the short term, but we'll also miss any price appreciation over the long.

I keep coming back to the fact that if people holding LBI aren't happy about having a huge LEO exposure, then maybe the LEO Backed Investment fund isn't for them.

We definitely should be building our LP position, but not at the expense of our current stake (which we should also be building during the bear).

Posted Using LeoFinance Beta