Earn 62% APY on Your Liquid HIVE and HBD

The LeoVerse has seen some interesting times lately. We've released so many developments on the technology front. It's time to focus on deploying capital and attention to those developments to grow the entire LeoVerse Web3 Economy.

Today's post will focus on CUB. CUB was our original venture into DeFi. We built so many cool features into CUB over the years since it originally went live in March 2021.

During the development phase of PolyCUB, we decided to utilize that opportunity to test and deploy a wide number of features which had the potential to be back-ported to CUB. The goal all along was to figure out how to drive sustainability through monthly revenue that creates large-scale buyback and burns.

200,000 CUB to be Burned This Month

We're on pace to burn 200k CUB this month. Prior to the launch of the Multi-Token Bridge - bHIVE and bHBD - we burned 518,952 CUB.

This is an insane number... nearly 50% as much CUB as was burned since inception is being burned in just the 1st month of the Multi-Token Bridge being live.

The CUB DAO contract just went live yesterday and has just started to buyback and burn CUB using revenue generated by the multi-token bridge. ICYMI, the MTB generated ~$11k in revenue for POLYCUB in the month of July.

the first two burns conducted by CUB DAO

- https://bscscan.com/tx/0x59e7114914dfa50b7c2c75c44cae314b6eb1c21b937712d98b1b95a653c49b51

- https://bscscan.com/tx/0x88c05f981e32a1da22e59e98761daf722cf6f1186711bb10c3f86d40d543a858

Since this is the first month of MTB operation on CUB, we haven't yet caught up to that amount of revenue. That being said, we're quickly gaining momentum. There is already ~217,741 USD in multi-token bridge LPs on CUB and this figure grows by double-digit %s on almost a daily basis.

We believe that we've found a model for true sustainability in DeFi. It's not what any of us expected but it is almost so fundamental that it's surprising we didn't find a way to build this before: generate a surplus of revenue each month by operating a large-scale wrapping service for HIVE and HBD.

The unique opportunity that we have over any other DeFi platform is you, the Hive community. We have HBD now paying 20% APR on-chain which means that a lot of attention is being placed on acquiring HBD and earning yield on it in a way that was never done before. HIVE has always earned yield for staking and curating. bHIVE provides a way to passively earn yield on that HIVE by becoming an LP.

Growing the Multi-Token Bridge

With $217k in assets on the CUB MTB, we're burning over 200k CUB per month. What happens when that figure hits $420k? What happens when it hits $800k?

The PolyCUB MTB is over $500k and it's generating ~$11k per month in revenue. This is an incredible amount of revenue on a tiny amount of TVL. How are we achieving this?

- Wrapping Fees (0.5% on each TX)

- Oracle Staking (on-chain staking)

- Arbitrage Revenue

Arb revenue is quickly making up a large % of the total revenue. It's pretty incredible and it's growing fast.

We need your help to continue to grow the bridge and - as they say - Make CUB Great Again.

The plan was always to continue our innovation of CUB simultaneous to POLYCUB and LeoFinance. The LeoVerse is a cohesive, Multi-Chain Web3 Economy.

In order to build sustainability, we must build bridge liquidity. By building out this bridge liquidity, we have the opportunity to burn hundreds of thousands of CUB per month and millions of CUB per year.

Bearish on CUB?

A lot of people turned bearish on CUB while growing impatient with the development progress. That's completely fine, we all need to do what makes sense for us in the moment.

What many should watch now are two key metrics:

- Total Value Locked (TVL) in the Multi-Token Bridge: currently ~$217k

- Amount of CUB Burned: as seen on the bottom of the homepage of https://cubdefi.com

When sentiment flips, it is likely to flip quite quickly. The LeoVerse has seen some incredible technology released in the past few months between PolyCUB DAO, CUB DAO, LeoThreads Microblogging and more... It's time to build in this bear market.

Provide Liquidity, Earn up to 62% APY!

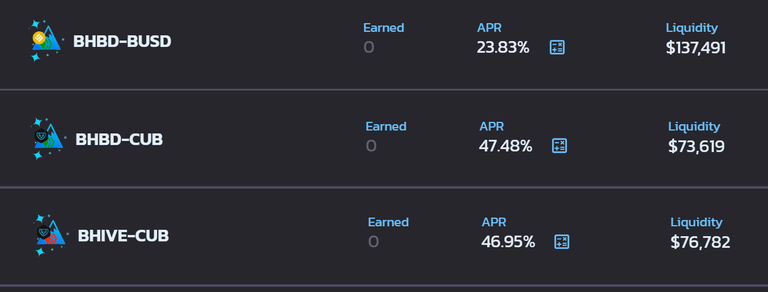

- bHBD-BUSD (StableCoin LP) is currently paying 26.75% APY ($137,491 Liquidity)

- bHBD-CUB is currently paying 60.46% APY ($74,246 Liquidity)

- bHIVE-CUB is currently paying 62.07% APY ($73,401 Liquidity)

We have so much room to grow. It's incredible to run projections of CUB burns when these numbers rise. It's been less than a month and we're already burning as much as 50% of all previously burned CUB. Insane 🤯

How to Provide Liquidity

Here's a quick tutorial on how to provide HIVE and HBD liquidity on BSC:

- Wrap HIVE or HBD to bHIVE or bHBD using https://wleo.io (LeoBridge)

- Provide Liquidity to one of the 3 pools by going to the https://cubdefi.com/farms page, clicking on one of the pools and then clicking "Get bHBD-CUB (or corresponding farm assets)" in the drop down

- This will redirect you to Pancakeswap, where you can deposit the assets

- Once deposited, return to https://cubdefi.com/farms and approve the farming contract

- Once approved, deposit the LP tokens

- 🚀

Goals for The End of the Month

It's August 24th as we're writing this. Our goal by September 1st (exactly 1 week from today) is to reach:

- $100k in bHIVE-CUB Liquidity

- $100k in bHBD-CUB Liquidity

- $175k in bHBD-BUSD Liquidity

These goals are super attainable and reaching them will put the CUB MTB at $375k in MTB TVL. This could burn over 300k CUB next month, which will double the amount of CUB burned since CUB launched in March 2021.

About LeoFinance

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage and share content on the blockchain while earning cryptocurrency rewards.

Our mission is to put Web3 in the palm of your hands.

Twitter: https://twitter.com/FinanceLeo

Discord: https://discord.gg/E4jePHe

Whitepaper: https://whitepaper.leofinance.io

Our Hive Applications

Join Web3: https://leofinance.io/

Microblog on Hive: https://leofinance.io/threads

LeoMobile (IOS): https://testflight.apple.com/join/cskYPK1a

LeoMobile (Android): https://play.google.com/store/apps/details?id=io.leofi.mobile

Delegate HIVE POWER: Earn 16% APR, Paid Daily. Currently @ 2.8M HP

Hivestats: https://hivestats.io

LeoDex: https://leodex.io

LeoFi: https://leofi.io

Polygon HBD (pHBD): https://wleo.io/hbd

Polygon HIVE (pHIVE): https://wleo.io/hive

Web3 & DeFi

Web3 is about more than social media. It encompasses a personal revolution in financial awareness and data ownership. We've merged the two with our Social Apps and our DeFi Apps:

CubFinance (BSC): https://cubdefi.com

PolyCUB (Polygon): https://polycub.com

Multi-Token Bridge (Bridge HIVE, HBD, LEO): https://wleo.io

Posted Using LeoFinance Beta

This is really awesome and an improvement and progress for CUB

Posted Using LeoFinance Beta

🦁

Posted Using LeoFinance Beta

https://twitter.com/FinanceLeo/status/1562463005769859072

https://twitter.com/Zestimony/status/1562550445326774272

The rewards earned on this comment will go directly to the people( @zestimony ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

This is great news. I think everyone will earn from it. Thanks for sharing

Posted Using LeoFinance Beta

Great move with the burns on cubDeFi. It's good to see things are getting revived over there. APR looking really good at the farms

62% Apy is really quite huge. It's a nice development and something cooking up ahead which cub project will definitely have to offer for even hive blockchain

This is great improvement . We are moving forward.

Impressive stats of burns.

Also the p rewards are very juicy.

Posted Using LeoFinance Beta

It's pretty insane to see how much it's grown so quickly. Less than a month into launch! We're going to see 1M CUB burned in the next few months or less

Posted Using LeoFinance Beta

Good choices for those who are interested in different Investment strategies. I reblogged in case some one could follow as. a guide for any pool to provide liquidity. One calling my attention is bHBD-BUSD.

Thank you for sharing

We must be patient with the development and keep stacking. Imagine burning this amount of cub every month.

Posted Using LeoFinance Beta

That 62% APR is incredible! Can't believe it's still that high. Seems like I made a great move a little while ago. ;)

Posted Using LeoFinance Beta

Great to see CUB seeing some love as it is the ancestor DeFi token that will reward future projects on this line. Strengthening CUB and PolyCUB tokenomics will ensure more investors get into these projects in the future.

Posted Using LeoFinance Beta

I agree. I think a lot of people became distraught over the CUB price and used it as a template on LEO and POLYCUB. This has led to a perpetually negative outlook and LEOVerse assets.

I think getting CUB to the place we always intended: true sustainability - is the ney

Posted Using LeoFinance Beta

It is a rare case for De-Fi project to have a strong community and token operation system at the same time. The Multi-token bridge system and Leo investors are growing the platform hand in hand 🦁

CUB in on!

Posted Using LeoFinance Beta

CUB DAO is really forming into an exchange setup like an FTX or Binance with true governance

It’s really incredible. Imagine the opportunity of buying shares of Binance or FTX when they were worth $400k market cap

Posted Using LeoFinance Beta

If I'm not mistaken, we reached $15M or $20M TVL on the first week of CUB. I think it will be nothing compared to the potential of the multi-chain CUB project 🔥

Posted Using LeoFinance Beta

Absolutely. That was an explosion of capital flowing into CUB

The MTB will bring a slow curve upward in capital flowing into CUB. Watching the TVL tick up will be game-changing

Posted Using LeoFinance Beta

This is indeed a huge update. When? xCUB?

Posted Using LeoFinance Beta

I am confused with this.This post is only 3 hours old.

Why do I see a whole different picture? This:

So much has changed in the last 3 hours?

Posted Using LeoFinance Beta

APY = compounded APR

Click calculator to see the compounded returns. APR is what you’d earn without any compounding of assets whatsoever

Posted Using LeoFinance Beta

Ohh, overlooked that APY not APR.

Yet, liquidity numbers have changed a lot too

Lots of Bhive-CUB moved to BHBD-BUSD ?

Posted Using LeoFinance Beta

In the post above we wrote the current liquidity values wrong (we flipped bHIVE and bHBD it seems. Just a typo). I’ll tell them to edit

bHBD-BUSD (StableCoin LP) is currently paying 26.75% APY ($73,401 Liquidity)

bHBD-CUB is currently paying 60.46% APY ($74,246 Liquidity)

bHIVE-CUB is currently paying 62.07% APY ($137,341 Liquidity)

I just checked now and looks like

Posted Using LeoFinance Beta

Yeah it was flipped, my bad. Updated

Posted Using LeoFinance Beta

It's the time to get my hands dirty and start getting some of those juicy rewards. Nicely done LEO! 😎

@sorin.cristescu are you in any of this?

Wow, this is awesome another massive way to earn big and better again here

I love this, it's a good one

Posted Using LeoFinance Beta

This is fantastic progress and real growth being shown by the LeoVerse. I am excited to see what the first Monthly CUB Report shows. I think the burning of CUB will be a huge gamechanger for the ecosystem as a whole, because, it's a guaranteed way to shrink the available supply of CUB.

Posted Using LeoFinance Beta

Fantastic! That's why it seems some pools on Polycub farms had lesser liquidity, some stakers may have moved theirs to CUB :)

Posted Using LeoFinance Beta

Wow I've been trying to get verified my binance smart chain to move into this with bhive

Posted Using LeoFinance Beta

62%?

Is there a whitepaper?

Interesting, I definitely need to dig a little more into this. So many things on Hive I have no idea of that exist or how they work. thank you for sharing. =)

!ctp

Posted Using LeoFinance Beta

Looks interesting , i think i will participate in stable coin liquidity.

Posted Using LeoFinance Beta

good project

Posted Using LeoFinance Beta

This takes hive and cub to the next level! Good work y’all! Appreciate these tools…

Posted using LeoFinance Mobile