Splinterlands Pools: How to add and remove liquidity (Step by Step Guide) + Risk Evaluation + My Choice (ENG/ITA)

La versione in italiano è subito dopo la versione in inglese - The Italian version is immediately after the English version

La versione in italiano è subito dopo la versione in inglese - The Italian version is immediately after the English version

Splinterlands Pools: How to add and remove liquidity (Step by Step Guide) + Risk Evaluation + My Choice

Today I return to write about my favorite blockchain game which is Splinterlands.

The topic of my post today is liquidity pools in which you can add as liquidity a pair of token quantities of which at least one token is a Splinterlands token.

Investing in a liquidity pool requires an initial evaluation and more importantly requires a basic understanding of the mechanisms that govern a liquidity pool.

Today I will try to be helpful to those who have asked me about Splinterlands liquidity pools and to those of my readers who have never delved into this topic.

The topics I will cover in this post are as follows:

- What is a liquidity pool?

- The liquidity pools of Splinterlands

- How to add and remove liquidity from the pool SWAP.HIVE:DEC - Step by Step Guide

- Risk Evaluation

- Why I chose the SWAP.HIVE:DEC pool

What is a liquidity pool?

A liquidity pool is a deposit of tokens (usually a pair of tokens locked by a smart contract).

Liquidity pools are the basis of Decentralized Finance (DeFi) projects.

Liquidity pools allow exchanges between tokens to take place without the intervention of third parties such as an exchange or broker.

The person who adds liquidity to a pool is called the liquidity provider.

Liquidity providers may receive as reward:

- a percentage of the fees generated by the pool. The fees are paid by those who use the pool to convert one token into another (a SWAP operation)

- a quantity of one or more tokens, tokens that may be the same ones entered as liquidity or may be other tokens.

The liquidity pools of Splinterlands

Splinterlands offers many investment options to its players, and one of the options is to add liquidity to one of the liquidity pools viewable from the Dashboards-->Pools section of the Splinterlands website.

There are 8 liquidity pools to choose from:

- DEC-BUSD (Pancake SWAP - Binance Smart Chain).

- SPS-BNB (Pancake SWAP - Binance Smart Chain)

- SPS-WETH (Sushi - Ethereum)

- DEC-DAI (Uniswap - Ethereum)

- DEC-SWAP.HIVE (TribalDex - Hive Diesel Pools)

- DEC-SPS (TribalDex - Hive Diesel Pools)

- SPS-DEC (TribalDex - Hive Diesel Pools)

- SPS-SWAP.HIVE (TribalDex - Hive Diesel Pools)

- VOUCHER-SWAP.HIVE (TribalDex - Hive Diesel Pools)

Each pool has an Annual Percentage Rate that measures the percentage of return a liquidity provider can achieve in one year of pool use.

Important note: The APR value is not a fixed value but is a variable and estimated value because it depends on several factors.

How to add and remove liquidity from the SWAP.HIVE:DEC pool

- Step by Step Guide -

On August 2, 2022, I added liquidity to the SWAP.HIVE:DEC pool, and today I want to show all the steps I performed.

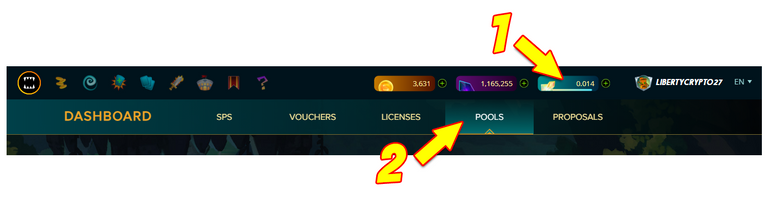

Step 1: Pool Selection.

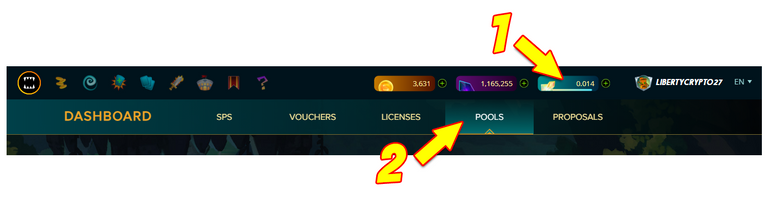

- After logging in to the Splinterlands site you need to click on the bar indicating the amount of Splintershards tokens (SPS) in your possession (arrow number 1 image below)

- On the next screen you need to click on POOLS (arrow number 2 next image)

- Then you have to choose the pool in which you want to add liquidity.

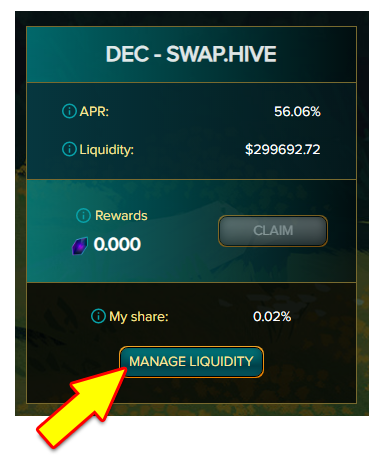

Step 2: Add liquidity.

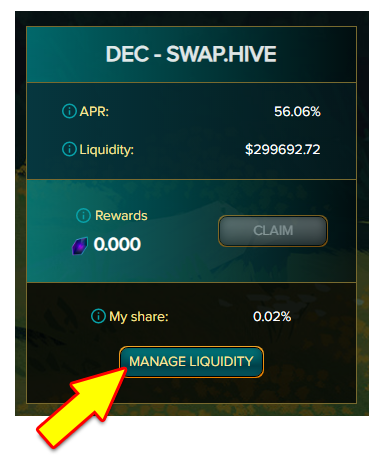

- When you have selected the pool you are interested in adding liquidity you must click on MANAGE LIQUIDITY as indicated by the arrow in the following image.

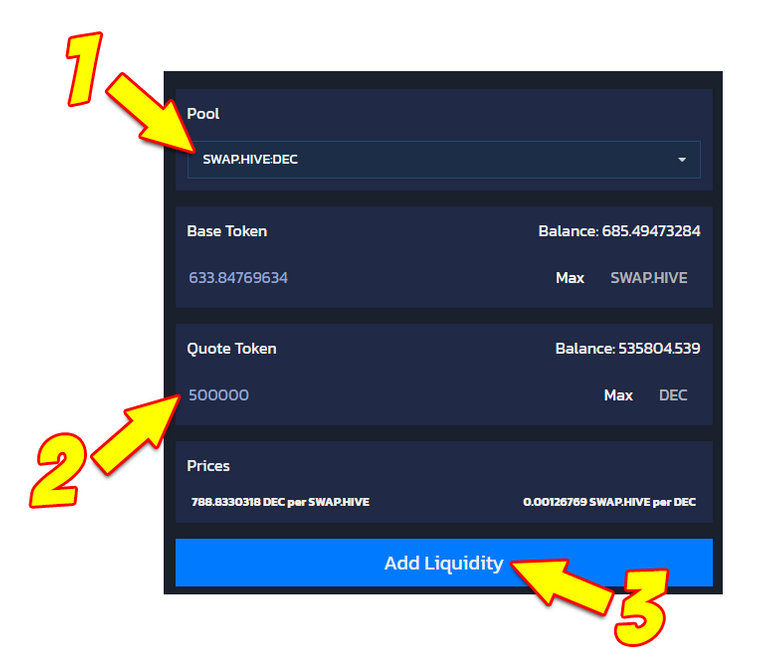

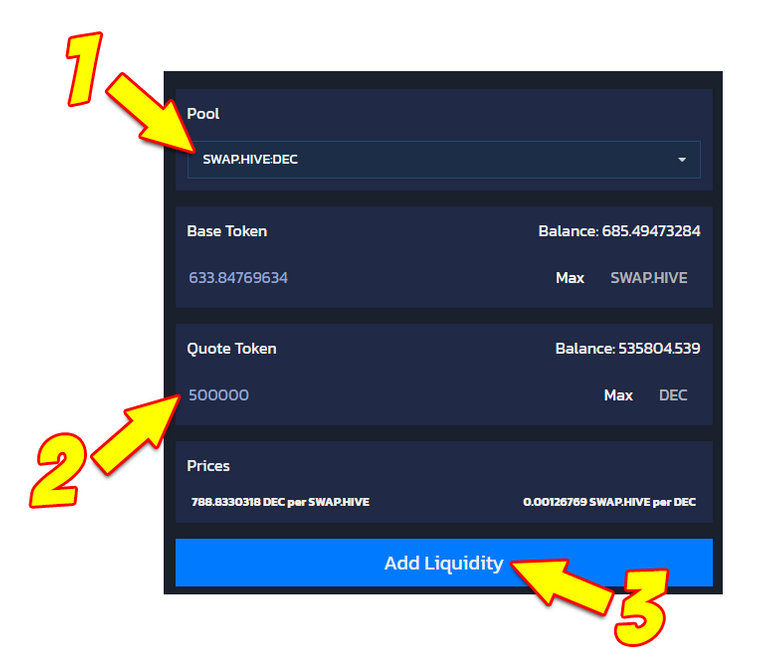

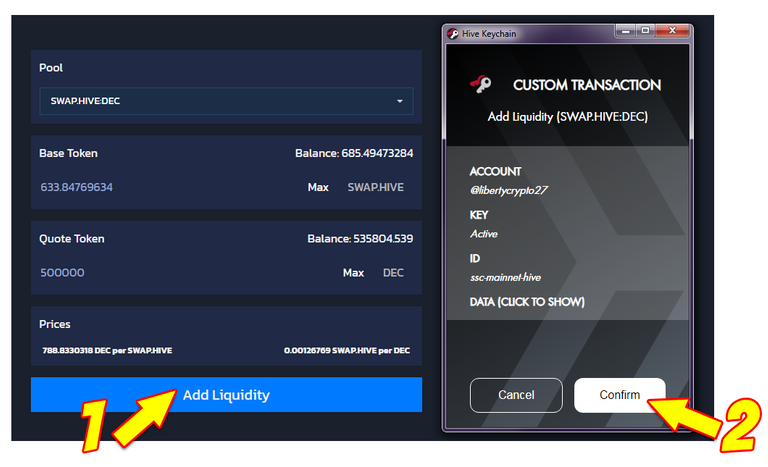

This will open the Add Liquidity section screen of TribalDex within which:

- you have to select the pool of your interest such as the SWAP.HIVE:DEC pool (arrow number 1 next image).

- Then you need to enter the amount of tokens you want to add to the pool.

You will only need to enter the quantity of one of the two tokens (Base Token or Quote Token) because the quantity of the other token will be automatically entered because the value of the quantity pair of the two tokens must be equal.

For example, I entered the value of 500000 token DEC and the Base Token field was automatically completed with the value of 633.84 token SWAP.HIVE (arrow number 2 following image). - Then you need to click on Add Liquidity (arrow number 3 next image).

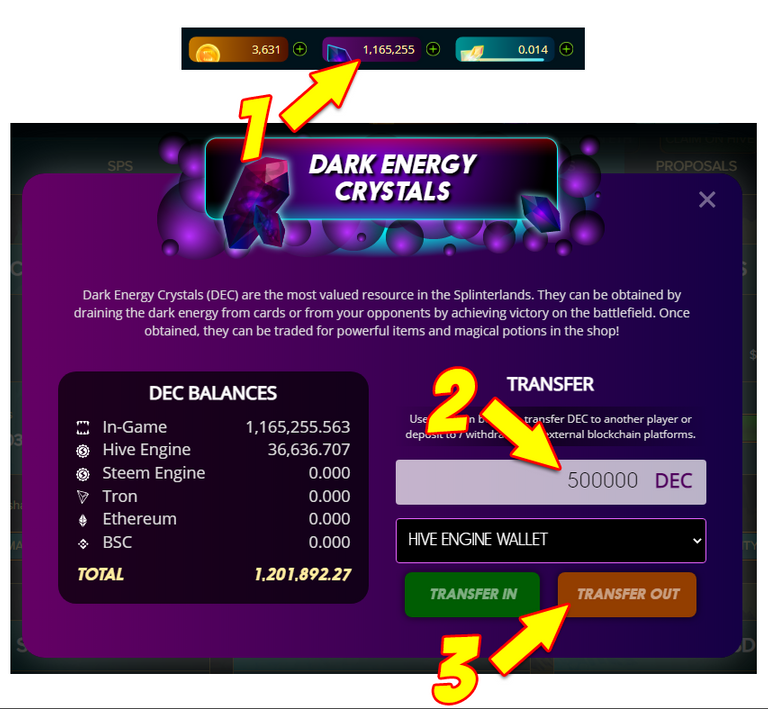

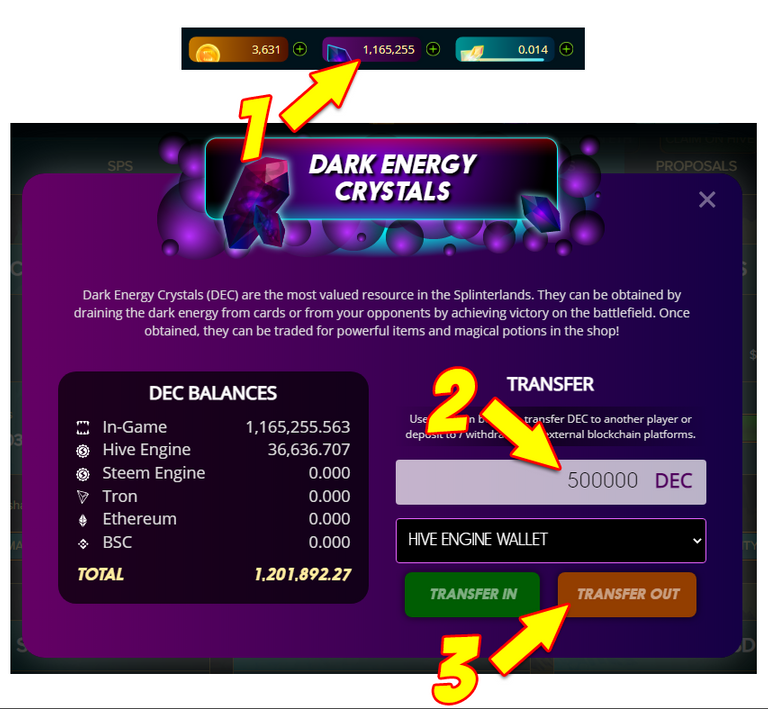

Important note: To add DEC tokens and SPS tokens to a Diesel pool on the Hive blockchain you must have them available within the wallet on TribalDEX/Hive Engine.

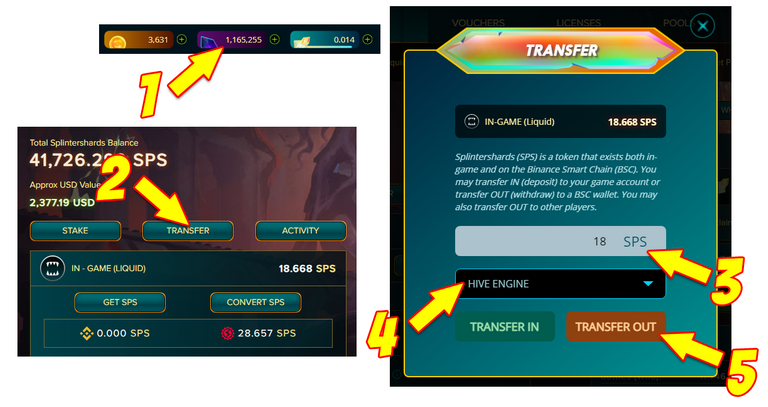

If your SPS tokens or DEC tokens are in the internal Splinterlands wallet you must first transfer them to your HIVE ENGINE WALLET.

To transfer DEC tokens from Splinterlands to Hive Engine/TribalDex follow the arrow directions in the image below.

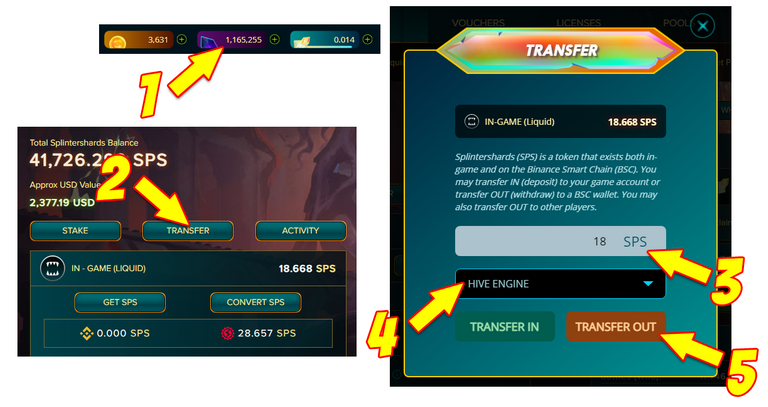

To transfer SPS tokens from Splinterlands to Hive Engine/TribalDex follow the arrow directions in the following image.

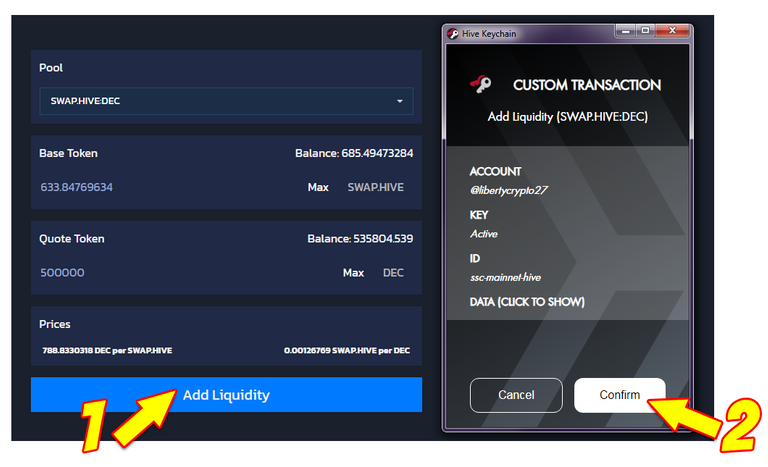

After you have verified that you have the amount of tokens needed to add liquidity to the pool you have chosen you must click on Add Liquidity and confirm your choice by clicking on Confirm within the Hive Keychain screen.

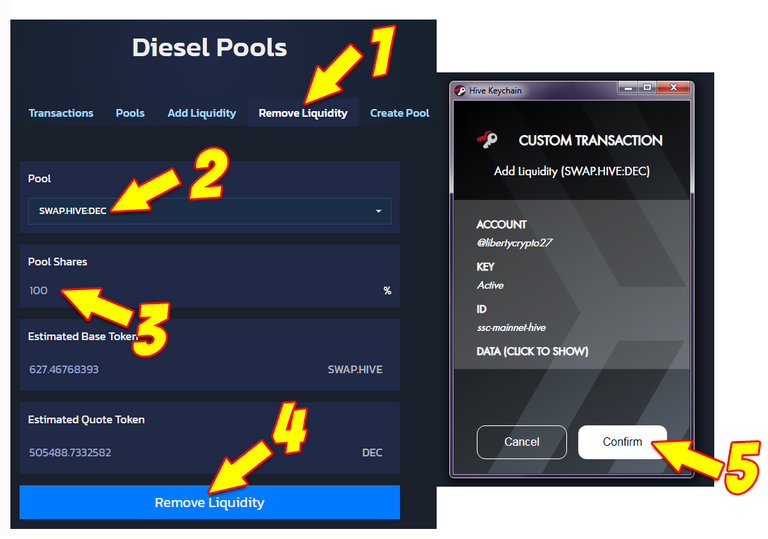

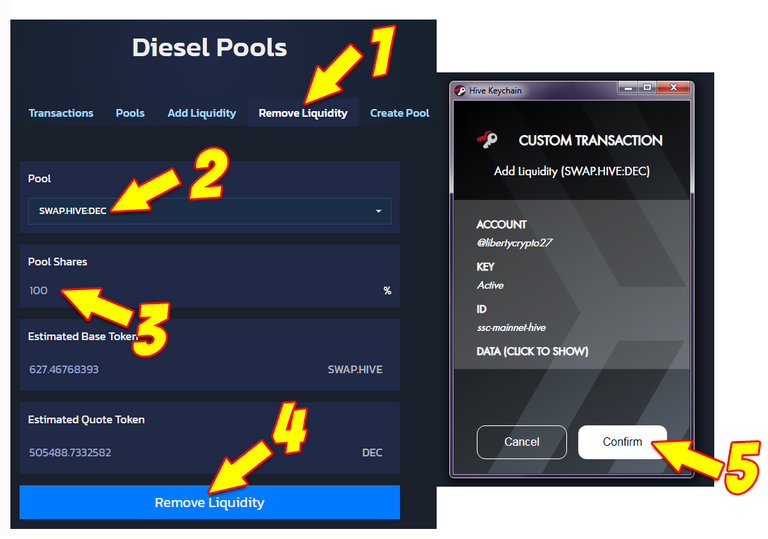

To remove liquidity from a Diesel Pool you have to go to https://tribaldex.com/dieselpools/remove and then:

- you must select the pool into which you have previously entered liquidity (arrow number 1 next image).

- then you have to enter the percentage of liquidity that you want to remove (arrow number 2 next image).

- then you need to click on Remove Liquidity and click on Confirm within the Hive Keychain screen.

Risk Evaluation

Often those who invest in a liquidity pool look only at the APR, and this is the case for the incautious investor.

The APR is certainly important but it is more important to do an evaluation and especially a forecast study:

- on the future value that the tokens placed in the pool might have.

- on the future value that tokens (if any) distributed as rewards to liquidity providers might have

The greatest risk for those who invest in a liquidity pool is the Impermanent Loss

The Impermanent Loss is the loss that occurs only when liquidity is removed from a pool and only when, at the time liquidity is removed, the ratio of the value of the tokens put into the pool has changed from the time liquidity was added.

The impermanent loss provides the answer to the following questions:

Would I have been better off keeping the tokens liquid (Hodling) or would I have been better off investing them in a pool?

Would I have done better to be a simple Hodler or would I have done better to be a liquidity provider?

I will now show some examples to make the concept of impermanent loss better understood.

Examples of Impermanent Loss = 0%

- [Token A = +100% | Token B = +100%] --> Impermanent Loss = 0

- [Token A = -50% | Token B = -50%] --> Impermanent Loss = 0

- [Token A = 0% | Token B = 0%] --> Impermanent Loss = 0

Examples of Impermanent Loss = 25%

- [Token A = +200% | Token B = -40%] --> Impermanent Loss = 25.46%

- [Token A = +400% | Token B = 0%] --> Impermanent Loss = 25.46%

Example of Impermanent Loss = 61.54%

- [Token A = +400% | Token B = -80%] --> Impermanent Loss = 61.54%

Example of Impermanent Loss = 81.89%

- [Token A = +500% | Token B = -95%] --> Impermanent Loss = 81.89%

The above examples show how it is possible but extremely improbable to find yourself with an Impermanent Loss equal to 0 when removing liquidity.

This means that every time you invest in a pool you will most likely have a loss when you remove liquidity.

Why invest in a pool if you will almost always have a loss?

The answer to this question is simple: rewards.

Without rewards no person would invest in liquidity pools.

The reason liquidity providers like me invest in pools is precisely the rewards.

In fact the impermanent loss calculation does not take rewards into consideration.

Comparing the impermanent loss with the total value of rewards received allows you to calculate the Profit and ROI of an investment in a liquidity pool.

I will always have made the right choice to put liquidity into a pool if when I remove the liquidity the value of the rewards is greater than the value of the impermanent loss:

Right Choice = Rewards Value ($) - Impermanent Loss Value ($) > 0

I will always have made the wrong choice if when I remove liquidity from a pool the value of the rewards will be less than the value of the impermanent loss:

Wrong Choice = Rewards Value ($) - Impermanent Loss Value ($) < 0

At this point, I hope it is clear why the APR indicating the value of rewards is an important element, but even more important is the prediction of the future value that the tokens put into the pool might have and the prediction of the future value that the tokens that are the rewards for putting cash into a pool might have.

In a previous post of mine I showed the profit I made by investing in the diesel pool SWAP.HIVE:LVL over a period of about 6 months.

Despite an Impermanent Loss of -5.98$ I obtained rewards with a total value of +165.57$ which allowed me to obtain a profit of +159.59$.

Why I chose the SWAP.HIVE:DEC pool

Now I want to share my personal evaluations that convinced me to invest in the SWAP.HIVE:DEC pool.

Obviously my these are personal evaluations and choices and are not financial advice because I am not a financial advisor and do not have the ability to predict the future... unfortunately :(

The reasons that convinced me to invest in the SWAP.HIVE:DEC pool are:

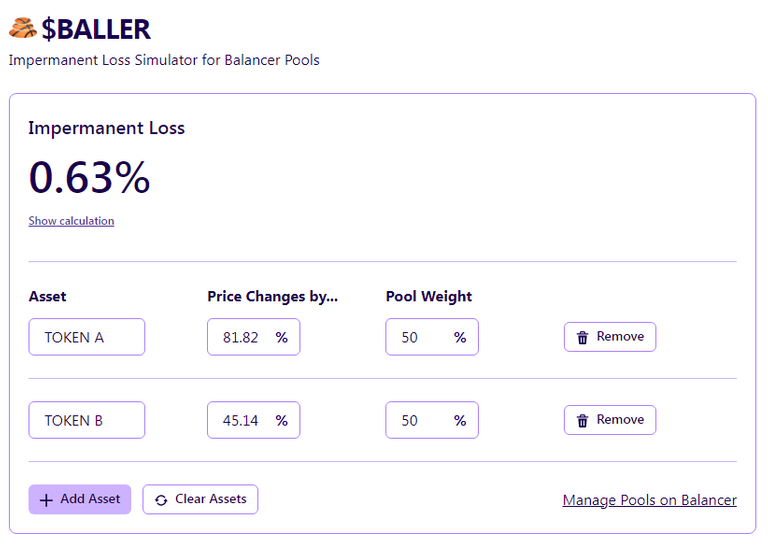

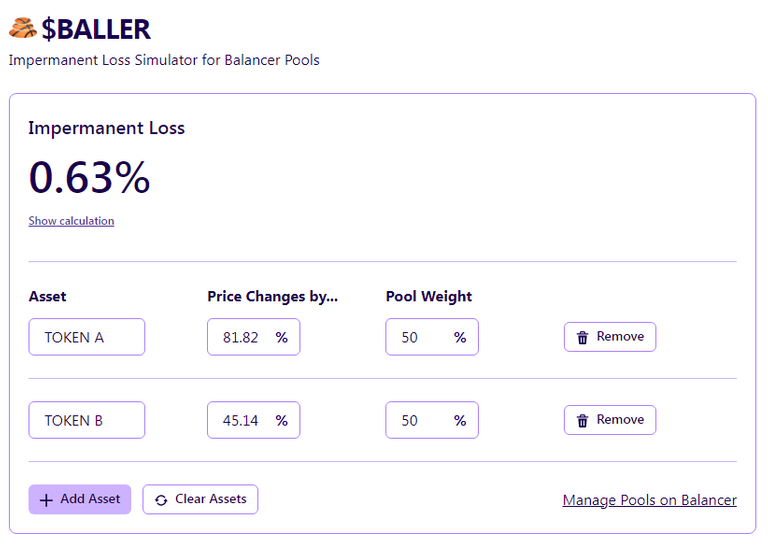

First reason: I do not foresee large changes in value for SWAP.HIVE tokens and DEC tokens in the immediate future and therefore the Impermanent Loss risk should be a small and calculated risk.

In particular I consider the HIVE token to be highly undervalued but I do not expect it to experience large changes in value in the coming months.

Also for DEC tokens I do not foresee big changes in value although an increase in value could be very likely because DEC tokens have been replaced by SPS tokens in Ranked Rewards. After this change DEC tokens retained all use cases but their emission decreased.

Although DEC tokens might increase in value this value should not deviate too much from the value of 0.001$ because the repeatedly stated goal of the Splinterlands team is to maintain the value of 1000 DEC = 1$.

If by hypothesis when I remove liquidity from the pool:

- 1 SWAP.HIVE = $1 = +81.82% compared to current value

- 1000 DEC = $1 = +45.14% compared to the current value.

I will have an Impermanent Loss of 0.63% which is a very small percentage loss that I believe will be largely offset by the rewards in DEC tokens that the SWAP.HIVE:DEC pool will have given me (54% APR).

The worst case could be realized in case the DEC tokens lose a lot of their value because the DEC tokens are the reward of the pool but I don't think this will happen for the reasons I explained earlier.

Second reason: the liquidity pool SWAP.HIVE:DEC has no transaction costs like all liquidity pools on the Hive blockchain (Diesel Pools) .

I can add and remove liquidity from the SWAP.HIVE:DEC pool whenever I want at 0 cost unlike the pools on Ethereum and BSC which always have transaction costs (Gas) and that is why I did not consider the DEC-BUSD, SPS-BNB, SPS-WETH, DEC-DAI pools.

I deliberately decided not to invest in pools that have SPS tokens as a component of the token pair because:

- the SPS tokens will have new use cases in the future and may increase in value consequently producing a higher Impermanent Loss.

- I prefer to stake the SPS tokens and although I get a lower APR than liquidity pools, I have the advantage of not having the risk of the impermanent loss.

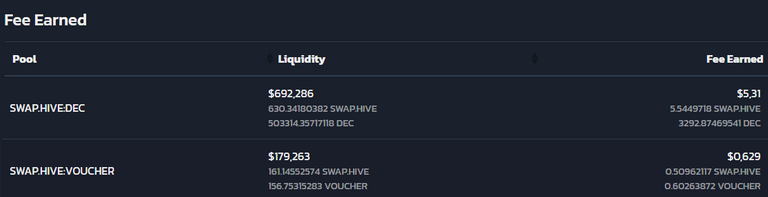

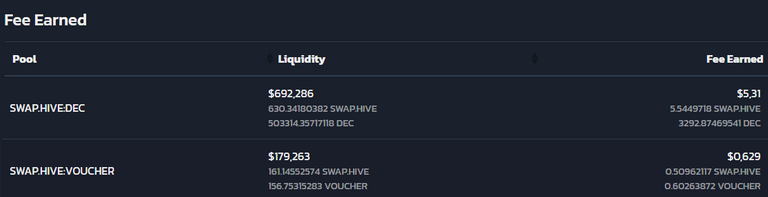

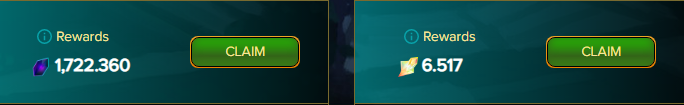

Although it has only been one day since I put liquidity into the SWAP.HIVE:DEC pool I received as a reward a total of 1722,360 DEC tokens = $1.18.

Each time I claim Rewards from the SWAP.HIVE:DEC pool I will note down the amount of DEC tokens I received on a spreadsheet and in a month's time I will show the impermanent loss calculation and the financial results (Profit/Loss and ROI) I have achieved.

Will I have done right or wrong in investing in the SWAP.HIVE:DEC pool?

Only time will show me!

I hope you liked this report and thank you for reading and taking the time to read it :)

Splinterlands = Play 2 Earn!

Are you not a Splinterlands player?

Any game that involves the purchase of cards and tokens is never a simple game but it is also an investment and should be considered as such.

I am not a financial consultant and if you decide to invest in the game of Splinterlands you do it for your own choice, after having made your personal evaluations and considered all possible risk factors.

HIVE ON and Splinterlands ON!

Spliterlands Pools: Come aggiungere e rimuovere liquidità (Guida passo passo) + Valutazione del Rischio e la mia scelta

Oggi ritorno a scrivere sul mio gioco blockchain preferito che è Splinterlands e l'argomento del mio post odierno sono le liquidity pools nelle quali è possibile aggiungere come liquidità una coppia di quantitativi di token di cui almeno un token è un token di Splinterlands.

Investire in una liquidity pool richiede una valutazione iniziale e soprattutto richiede una comprensione di base dei meccanismi che governano una liquidity pool.

Oggi cercherò di essere d'aiuto a chi mi ha chieso informazioni sulle liquidity pools di Splinterlands e a chi dei miei lettori non ha mai approfondito questo argomento.

Gli argomenti che tratterò in questo post sono i seguenti:

- Cos'è una liquidity pool?

- Le liquidity pools di Splinterlands

- Come aggiungere e rimuovere liquidità dalla liquidity pool SWAP.HIVE:DEC - Guida Passo Passo

- Valutazione dei Rischi

- L'importanza dell'APR e delle Rewards

- L'Impermanent Loss

Cos'è una liquidity pool?

Una liquidity pool è un deposito di tokens (generalmente una coppia di tokens bloccati da uno smart contract).

Le liquidity pools sono alla base dei progetti di Finanza Decentralizzata (DeFi).

Le liquidity pools permettono di effettuare gli scambi tra token senza l'intervento di soggetti terzi come ad esempio un exchange o un broker.

Chi aggiunge liquidità ad una pool si chiama liquidity provider.

I liquidity providers possono ricevere come ricompensa:

- una percentuale delle fees generate dalla pool. Le fees sono pagate da chi utilizza la pool per convertire un token in un altro (operazione di SWAP)

- un quantitativo di uno o più token, token che possono essere gli stessi immessi come liquidità oppure possono essere altri token.

Le liquidity pools di Splinterlands

Splinterlands offre tante possibilità di investimento ai suoi giocatori e una delle possibilità è quella di aggiungere liquidità a una delle liquidity pools visualizzabili dalla sezione Dashboards-->Pools del sito di Splinterlands.

Ci sono 8 liquidity pools tra cui scegliere:

- DEC-BUSD (Pancake SWAP - Binance Smart Chain)

- SPS-BNB (Pancake SWAP - Binance Smart Chain)

- SPS-WETH (Sushi - Ethereum)

- DEC-DAI (Uniswap - Ethereum)

- DEC-SWAP.HIVE (TribalDex - Hive Diesel Pools)

- DEC-SPS (TribalDex - Hive Diesel Pools)

- SPS-DEC (TribalDex - Hive Diesel Pools)

- SPS-SWAP.HIVE (TribalDex - Hive Diesel Pools)

- VOUCHER-SWAP.HIVE (TribalDex - Hive Diesel Pools)

Ogni pool ha un Annual Percentage Rate che misura la percentuale di ritorno che un liquidity provider può ottenere in un anno di utilizzo della pool.

Nota importante: il valore dell'APR non è un valore fisso ma è un valore variabile e stimato perchè dipende da diversi fattori.

Come aggiungere e rimuovere liquidità dalla pool SWAP.HIVE:DEC

- Guida Passo Passo -

Il 2 agosto 2022 ho aggiunto liquidità alla pool SWAP.HIVE:DEC e oggi voglio mostrare tutti i passaggi che ho effettuato.

Passo 1: Selezione della Pool.

- Dopo aver effettuato il login sul sito di Splinterlands devi cliccare sulla barra che indica il quantitativo di token Splintershards (SPS) in tuo possesso (freccia numero 1 immagine seguente)

- Nella schermata successiva devi cliccare su POOLS (freccia numero 2 immagine seguente)

- Poi devi scegliere la pool in cui vuoi aggiungere liquidità.

Passo 2: Aggiungere liquidità.

- Quando hai selezionato la pool di tuo interesse per aggiungere liquidità devi cliccare su MANAGE LIQUIDITY come indicato dalla freccia nell'immagine seguente.

Si aprirà la schermata della sezione Add Liquidity di TribalDex all'interno della quale:

- devi selezionare la pool di tuo interesse come ad esempio la pool SWAP.HIVE:DEC (freccia numero 1 immagine seguente)

- Poi devi inserire il quantitativo di tokens che vuoi aggiungere alla pool.

Ti basterà inserire solo il quantitativo di uno dei due token (Base Token o Quote Token) perchè il quantitativo dell'altro token sarà inserito in automatico perchè il valore della coppia dei quantitativi dei due token deve essere uguale.

Io ad esempio ho immesso il valore di 500000 token DEC e il campo Base Token è stato completato in automatico con il valore di 633.84 token SWAP.HIVE (freccia numero 2 immagine seguente). - Poi devi cliccare su Add Liquidity (freccia numero 3 immagine seguente).

Nota importante: per aggiungere i token DEC e i token SPS a una Diesel pool della blockchain di Hive devi averli disponibili all'interno del wallet su TribalDEX/Hive Engine.

Se i tuoi token SPS o i tuoi token DEC sono nel wallet interno di Splinterlands devi prima trasferirli nel tuo HIVE ENGINE WALLET.

Per trasferire i token DEC da Splinterlands ad Hive Engine/TribalDex segui le indicazioni delle frecce nell'immagine seguente.

Per trasferire i token SPS da Splinterlands ad Hive Engine/TribalDex segui le indicazioni delle frecce nell'immagine seguente.

Dopo che hai verificato di avere il quantitativo dei token necessario per aggiungere liquidità alla pool che hai scelto devi cliccare su Add Liquidity e confermare la tua scelta cliccando su Confirm all'interno della schermata di Hive Keychain.

Per rimuovere la liquidità da una Diesel Pool devi andare su https://tribaldex.com/dieselpools/remove e poi:

- devi selezionare la pool in cui hai precedentemente immesso liquidità (freccia numero 2 immagine seguente).

- poi devi inserire la percentuale di liquidità che vuoi rimuovere (freccia numero 2 immagine seguente).

- poi devi cliccare su Remove Liquidity e cliccare su Confirm all'interno della schermata di Hive Keychain.

Valutazione dei Rischi

Spesso chi investe in una liquidity pool guarda solo all'APR e questo è il caso dell'investitore incauto.

L'APR è certamente importante ma è più importante fare una valutazione e soprattutto uno studio di previsione:

- sul valore futuro che potrebbero avere i token immessi nella pool

- sul valore futuro che potrebbe avere il token (se c'è) distribuito come ricompensa ai liquidity providers

Il rischio maggiore per chi investe in una liquidity pool è rappresentato dall'Impermanent Loss

L'Impermanent Loss è la perdita che si verifica solo quando si rimuove liquidità da una pool e solo quando, nel momento in cui si rimuove la liquidità, il rapporto del valore dei tokens immessi nella pool è cambiato rispetto al momento in cui si è aggiunta liquidità.

L'impermanent loss fornisce la risposta alle seguenti domande:

Avrei fatto meglio a tenere i token liquidi (Hodling) o avrei fatto meglio a investirli in una pool?

Avrei fatto meglio ad essere un semplice Hodler o avrei fatto meglio a essere un liquidity provider?

Adesso mostrerò alcuni esempi per far comprendere meglio il concetto di impermanent loss.

Esempi di Impermanent Loss = 0%

- [Token A = +100% | Token B = +100%] --> Impermanent Loss = 0

- [Token A = -50% | Token B = -50%] --> Impermanent Loss = 0

- [Token A = 0% | Token B = 0%] --> Impermanent Loss = 0

Esempi di Impermanent Loss = 25%

- [Token A = +200% | Token B = -40%] --> Impermanent Loss = 25.46%

- [Token A = +400% | Token B = 0%] --> Impermanent Loss = 25.46%

Esempio di Impermanent Loss = 61.54%

- [Token A = +400% | Token B = -80%] --> Impermanent Loss = 61.54%

Esempio di Impermanent Loss = 81.89%

- [Token A = +500% | Token B = -95%] --> Impermanent Loss = 81.89%

Gli esempi precedenti mostrano come sia possibile ma estremamente improbabile trovarsi con un Impermanent Loss uguale a 0 quando si rimuove liquidità.

Questo vuol dire che ogni volta che investirai in una pool avrai con molta probabilità una perdita quando rimuoverai la liquidità.

Perchè investire in una pool se quasi sempre avrai una perdita?

La risposta a questa domanda è semplice: le ricompense.

Senza ricompense nessuna persona "sana di mente" investirebbe nelle liquidity pools.

Il motivo che spinge i liquidity providers come me ad investire nelle pools sono proprio le ricompense.

Infatti il calcolo dell'impermanent loss non tiene conto delle ricompense.

Il confronto tra l'impermanent loss e il valore totale delle ricompense ricevute permette di calcolare il Profitto e il ROI di un investimento in una liquidity pool.

Avrò sempre fatto la scelta giusta ad immettere liquidità in una pool se quando rimuovo la liquidità il valore delle ricompense sarà superiore al valore dell'impermanent loss:

Scelta giusta = Valore Ricompense ($) - Valore Impermanent Loss ($) > 0

Avrò sempre fatto la scelta sbagliata se quando rimuovo la liquidità da una pool il valore delle ricompense sarà inferiore al valore dell'impermanent loss:

Scelta sbagliata = Valore Ricompense ($) - Valore Impermanent Loss ($) < 0

A questo punto spero sia chiaro il motivo per cui l'APR che indica il valore delle ricompense è un elemento importante ma è ancora più importante la previsione del valore futuro che potrebbero avere i token immessi nella pool e la previsione del valore futuro che potrebbero avere i token che costituiscono le ricompense per aver immesso liquidità in una pool.

In un mio precedente post ho mostrato il profitto che ho ottenuto investendo nella diesel pool SWAP.HIVE:LVL per un periodo di circa 6 mesi.

Nonostante un Impermanent Loss di -5.98$ ho ottenuto ricompense per un valore totale di +165.57$ che mi hanno permesso di ottenere un profitto di +159.59$.

Perchè ho scelto la pool SWAP.HIVE:DEC

Adesso voglio condividere le mie personali valutazioni che mi hanno convinto ad investire nella pool SWAP.HIVE:DEC.

Ovviamente le mie sono valutazioni e scelte personali e non sono consigli finanziari perchè non sono un consulente finanziario e non ho l'abilità di prevedere il futuro... purtroppo :(

I motivi che mi hanno convinto a investire nella pool SWAP.HIVE:DEC sono:

Primo motivo: non prevedo grandi variazioni di valore per i token SWAP.HIVE e per i token DEC nell'immediato futuro e quindi il rischio Impermanent Loss dovrebbe essere un rischio ridotto e calcolato.

In particolare considero il token HIVE altamente sottovalutato ma non credo che nei prossimi mesi possa subire grandi variazioni di valore.

Anche per i token DEC non prevedo grandi variazioni di valore anche se un aumento di valore potrebbe essere molto probabile perchè i token DEC sono stati sostituiti dai token SPS nelle ricompense delle Ranked Rewards. Dopo questa modifica i token DEC hanno mantenuto tutti i casi d'uso ma è diminuita la loro emissione.

Anche se i token DEC potrebbero aumentare il loro valore questo valore non dovrebbe discostarsi troppo dal valore di 0.001 $ perchè l'obiettivo dichiarato più volte dal team di Splinterlands è di mantenere il valore di 1000 DEC = 1$.

Se per ipotesi quando rimuoverò la liquidità dalla pool:

- 1 SWAP.HIVE = 1$ = +81.82% rispetto al valore attuale

- 1000 DEC = 1$ = +45.14% rispetto al valore attuale

Avrò un Impermanent Loss di 0.63% che è una perdita in percentuale molto piccola che credo sarà ampiamente compensata dalle ricompense in token DEC che la pool SWAP.HIVE:DEC mi avrà dato (54% APR).

Il caso peggiore si potrebbe realizzare nel caso i token DEC perdano molto del loro valore perchè i token DEC costituiscono la ricompensa della pool ma non credo che questo succederà per i motivi che ho spiegato prima.

Secondo motivo: la liquidity pool SWAP.HIVE:DEC non ha costi di transazione come tutte le liquidity pools della blockchain di Hive (Diesel Pools) .

Posso aggiungere e togliere liquidità dalla pool SWAP.HIVE:DEC ogni volta che voglio a costo 0 a differenza delle pools su Ethereum e BSC che hanno sempre costi di transazione (Gas) e per questo motivo non ho considerato le pools DEC-BUSD, SPS-BNB, SPS-WETH, DEC-DAI.

Ho volutamente deciso di non investire nelle pools che hanno i token SPS come componente della coppia di token perchè:

- i token SPS avranno nuovi casi d'uso in futuro e potrebbero aumentare il loro valore producendo di conseguenza un Impermanent Loss maggiore.

- preferisco mettere in stake i token SPS e anche se ottengo un APR più basso rispetto alle liquidity pools ho il vantaggio di non avere il rischio dell'impermanent loss.

Anche se è passato solo un giorno da quando ho immesso liquidità nella pool SWAP.HIVE:DEC ho ricevuto come ricompensa un totale di 1722.360 token DEC = 1.18$.

Ogni volta che farò il claim delle Rewards dalla pool SWAP.HIVE:DEC mi annoterò il quantitativo di token DEC ricevuto su un foglio di calcolo e fra un mese mostrerò il calcolo dell'impermanent loss e i risultati finanziari (Profitto/Perdita e ROI) che avrò ottenuto.

Spero che questo mio post ti sia piaciuto e ti ringrazio per la lettura e per avermi dedicato il tuo tempo :)

Splinterlands = Play 2 Earn!

Non sei un giocatore di Splinterlands?

Ogni gioco che prevede l'acquisto di carte e di token non è mai un semplice gioco ma è anche un investimento e come tale va considerato.

Io non sono un consulente finanziario e se decidi di investire nel gioco di Splinterlands lo fai per tua scelta, dopo aver fatto le tue personali valutazioni e considerato tutti i possibili fattori di rischio.

@tipu curate

Upvoted 👌 (Mana: 30/40) Liquid rewards.

Grazie mille :)

!PGM

!LOL

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

lolztoken.com

It’s all fun and games until someone loses an I.

Credit: reddit

@astrocreator, I sent you an $LOLZ on behalf of @libertycrypto27

Are You Ready for some $FUN? Learn about LOLZ's new FUN tribe!

(5/8)

Very good post.

Thank you for explaining carefully.

!LUV

!hiqvote

@naythan(3/3) gave you LUV. tools | wallet | discord | community | <>< daily

tools | wallet | discord | community | <>< daily

HiveBuzz.me NFT for Peace

thanks to you for appreciating my post

Have a nice day

!PGM

!LOL

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

lolztoken.com

All of them.

Credit: reddit

@naythan, I sent you an $LOLZ on behalf of @libertycrypto27

Are You Ready for some $FUN? Learn about LOLZ's new FUN tribe!

(6/8)

If you have at least 10 HIQS staked, then juicy votes will follow!

Delegate [HP to @hiq.hive], [BEE to @hiq.bee], [PHOTO to @hiq.photo], [FUN to @hiq.fun] or [PIMP to @hiq.pimp] to support the HiQ Smart Bot and its trails.

For any further questions, please feel free to contact @hiq.redaktion via comment or Discord.

(This is a

semiautomaticaly created manual curation. Currently I am in the testing phase though !LOL)Check out HiQ - The Hivestyle Magazine, fomo into HiQs - The Support Token & vote our fuckingWitness!

https://twitter.com/bitinvest_news/status/1566394449629937669

https://twitter.com/libertycrypto27/status/1566527675371601922

https://twitter.com/YanPatrick_/status/1566860122353172480

The rewards earned on this comment will go directly to the people( @russia-btc, @libertycrypto27, @shiftrox ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

thanks for the support

!BEER

View or trade

BEER.Hey @india-leo, here is a little bit of

BEERfrom @libertycrypto27 for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Yay! 🤗

Your content has been boosted with Ecency Points, by @libertycrypto27.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

Solid breakdown and lesson as always my man. Ive been recently adding into the same pool. I like the dec/swap.hive pool too. Wish i held onto more of my dec tho, i had sold some off last month before the small pump. Keep rockin man.

!LOL

!LUV

!MEME

!PIZZA

!PGM

Posted using Splintertalk

Credit: wofaipeace

Earn Crypto for your Memes @ hiveme.me!

thanks captain :)

Yes the DEC:SWAP.HIVE pool is my favorite and is the one I put the most into ;)

!PGM

!PIZZA

!LOL

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

lolztoken.com

He was banned from the zoo.

Credit: reddit

@captainquack22, I sent you an $LOLZ on behalf of @libertycrypto27

Are You Ready for some $FUN? Learn about LOLZ's new FUN tribe!

(7/8)

PIZZA Holders sent $PIZZA tips in this post's comments:

captainquack22 tipped libertycrypto27 (x1)

libertycrypto27 tipped speedtuning (x1)

stewie.wieno tipped libertycrypto27 (x1)

libertycrypto27 tipped stewie.wieno (x1)

libertycrypto27 tipped captainquack22 (x1)

@libertycrypto27(5/5) tipped @pablodare (x1)

You can now send $PIZZA tips in Discord via tip.cc!

ohh i dont know that 😌

i will remove all my sps pools and invest in splinterlands game stake

thanks again 😆

Hi and thanks for your comment

My predictions may be wrong because they are predictions and the pools with SPSs could be profitable but honestly now the APR for staking SPS tokens is 40% while the pools have the following APRs:

I prefer a lower APR with low risk than a slightly higher APR with higher risk.

If the APR of the SPS pools had been much higher I would have thought about it ;)

!PIZZA

yes totally right , and you invest all your sps in stake ?

Yes ;)

!PGM

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

!PGM

pool experimentation has been an adventure

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

Yes I agree but with the right risk assessments they can be good adventures ;)

!PGM

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

Ti faccio i miei complimenti perché credo tu abbia spiegato bene e con ottimi esempi il concetto è funzionamento dell’ impermanent loss.

Non un concetto semplice, seppur logico una volta che se ne coglie il senso.

C’è anche da dire che in un mercato volatile come questo, un momento di perdita potrebbe poi voltare e tornare in attivo. L’impermanent loss lo hai solo se ritiro o tuoi fondi, se però hai una ottica di lungo periodo sicuramente puoi aspettare che la perdita si riassorba.

!LOLZ

!PGM

!LUV

!PIZZA

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

Grazie mille del commento e dei complimenti !LUV

Si hai perfettamente ragione l'impermanent loss si realizza solo quando si rimuove liquidità e quindi c'è il tempo per assorbire nel caso di investimento di lungo periodo nel quale non c'è fretta di monetizzare ;)

!PGM

!LOL

!PIZZA

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

excellent post as always! !PGM !LOL

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

lolztoken.com

Diner-saurs.

Credit: reddit

@libertycrypto27, I sent you an $LOLZ on behalf of @pablodare

Farm LOLZ tokens when you Delegate Hive or Hive Tokens.

Click to delegate: 10 - 20 - 50 - 100 HP

(2/8)

thanks a lot :)

!PGM

!PIZZA

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

!PGM

!PIMP

!LOLZ

You must be killin' it out here!

@entrepidus just slapped you with 1.000 PIMP, @libertycrypto27.

You earned 1.000 PIMP for the strong hand.

They're getting a workout and slapped 1/2 possible people today.

Read about some PIMP Shit or Look for the PIMP District

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

lolztoken.com

In a Thai con-do.

Credit: reddit

@libertycrypto27, I sent you an $LOLZ on behalf of @entrepidus

Farm LOLZ tokens when you Delegate Hive or Hive Tokens.

Click to delegate: 10 - 20 - 50 - 100 HP

(2/10)

thanks

!PGM

!PIMP

!LOLZ

You must be killin' it out here!

@libertycrypto27 just slapped you with 1.000 PIMP, @entrepidus.

You earned 1.000 PIMP for the strong hand.

They're getting a workout and slapped 1/1 possible people today.

Read about some PIMP Shit or Look for the PIMP District

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

Great guide. Is it only the DEC pools that generate DEC?

Posted Using LeoFinance Beta

thanks

No there are also:

DEC:SPS

DEC:BUSD

DEC:DAI

!PGM

!LOL

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

lolztoken.com

The Dim Reaper?

Credit: reddit

@jfang003, I sent you an $LOLZ on behalf of @libertycrypto27

Are You Ready for some $FUN? Learn about LOLZ's new FUN tribe!

(8/8)

Great and awesome tutorials for those who didn't try liquidity pools and De-Fi!

Nice touch with explaining the impermanent loss as it plays a big role in Defi, especially when you have pools with one stable token, and other extremely volatile (or shitcoin... 😀)... The thing that I had the most problems with wasn't imp. loss, but NOT taking profits... So, I do participate in 3 Splinterlands pools, but I'm doing it by selling half of the tokens (DEC, SPS, VOUCHER) and then providing liquidity to the pools... In that way, I take profits (in some way), and participate in the pools...

Don't know if that's smart or not, but it works fine for me... ;)

Thank you and I am very glad you liked my tutorial.

I think yours is a good strategy and profit at some point should be taken ;)

I have avoided pools with SPS tokens as a liquidity pair because currently staking has an APR of 40% (sps+voucher) while pools have an APR ranging from 51% to 71%:

sps-dec: 51% (rewards: sps+dec)

sps-swap.hive: 71.98% (rewards: sps)

The APR of pools is too close to the APR of staking to incentivize me to take a higher risk ;)

!PGM

!CTP

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

Yeah... Completely get your decision... I did something similar with my CUBs when the price was too volatile... I put all in staking and accumulated tokens...

The difference between now and that case with CUB is that I'm exchanging a game token for a "more valuable token" (at least for me, HIVE is on the top of the list) and pair it in the pool... And before, I was adding "valuable" tokens with CUBs in the pool (not exchanging/taking profits)...

!PGM

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

Ciao e grazie del !PGM :)

!LOL

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

lolztoken.com

He's working in the crust station.

Credit: reddit

@sissim72, I sent you an $LOLZ on behalf of @libertycrypto27

Are You Ready for some $FUN? Learn about LOLZ's new FUN tribe!

(2/8)

Mi ero perso questo post!!! Mannaggia!!! Ma questa è una novità piuttosto importante. Prima o poi dovró fare anch’io una di queste pool. Per ora rebloggo e poi rileggo con calma nel week end. Grazie Liberty