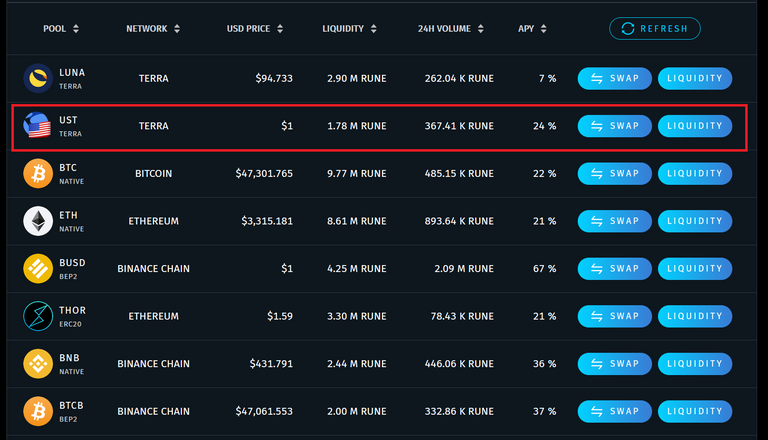

24% APY on UST and its not Anchor!

Anchor protocol maybe having some real competition now when it comes to earning yields on UST. Over on Thorswap the yield for UST is at 24% APY. Now the rate is taken as an average over 7 day period and since UST has only just started in the first on Thorswap the rate % still needs time to adjust, more likely be raised!

Terra on Thorswap Game Changer

Yesterday I talked about why Thorchain has big potential and briefly went over Thorchain. The day before that I discussed specifically the initial launch of Terra on Thorswap. Yet how is this such a big move? Well when Terra was set in the main net the Thorchain community pulled out the limitation of Thorswap's cap.

The main reason Thorswap could not rise in TVL, total value locked, was not because of lack of interest, but was limited due to a cap in place on the platform. Since Luna and UST has been setup on the exchange the cap has been removed and with that Thorswap is now holding over $1 billion in TVL. This makes it rank 41th in overall defi projects based on DefiLlama for 7 day TVL change. However the data is a little delayed over on DefiLlama.

First Truly Decentralized Exchange?

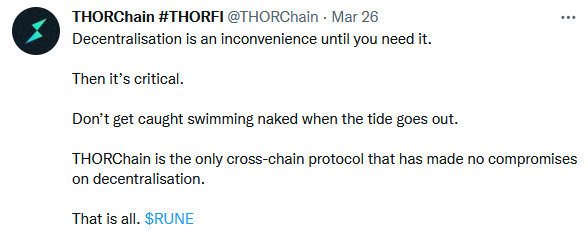

I post this next part of the blog as a question. That is because if those reading this post still has it as a question then they do not realize what Thorswap has achieved. Although the project has been in existence for multiple years the fact that native tokens can be swap on the exchange and stored directly at users' directed wallets it is a true decentralized exchange.

Do not get confused with the word swap when it comes to swapping between tokens. Over on Thorswap it is quite literally from one coin into another. There is a whole part of synthetics too but that is for a different post. For now the realization that you can put BTC, LTC, or ETH and swap for native UST or USDC, or USDT without limitation on the swaps is extremely encouraging.

There is no KYC, know your customer, with Thorswap and the ease of linking various wallets to obtain specific native tokens is straight forward and easy to use. This is a big step against centralized exchanges. No more heavy fees or restrictions that centralized exchanges can do to your cryptocurrency assets. Thorswap lets you take control of your own assets as you choose.

As more chains onboard onto Thorswap there will be more ways to swap in and out of all kinds of native coins and tokens. This is the potential of Thorchain as a whole.

Conclusions

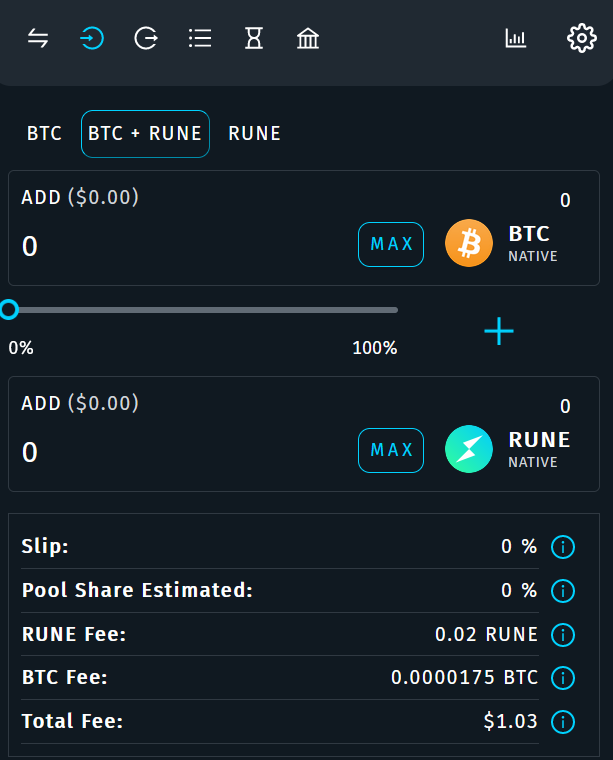

I live with one final example in regards to Thorswap pools and why they are extremely attractive to invest into.

The pool we will focus on is BTC : RUNE. All pools is some form of native token against RUNE. You would notice that the pools can be partaken as single sided where one can invest just RUNE or UST instead of a split 50 / 50. This will still yield the same earnings to the investors in terms of $ percentage. Therefore BTC pool currently is yielding 22%. Stake 100% of your BTC and you will get 122% of BTC in the value of $ at the end of one year.

Now if BTC prices rises significantly it is beneficial to have held the BTC in wallet rather than partaking in pool, however if BTC price remains flat or lower you would gain more BTC over the year of participating in the pool. What should be clear now is that when partaking in these pools you are actually earning the native token, no chain made up token or no RUNE if you did not put any RUNE into the pool. That is right! If you invested 100% into the pool when you withdraw from the pool it is only BTC that you will be withdrawing!

It goes the same for the remaining native tokens, such as Luna, ETH, BSB, and so on. Staked those in single sided you earn only that specific token's asset. Trading fees is what the investors of the pools earn from all the daily swaps. Since the protocol's cap has been removed there is a lot of potential for a lot more currency to flow through Thorswap.

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token

!LUV !LOL !PIZZA !WINE

Congratulations, @logicforce You Successfully Shared 0.100 WINEX With @mawit07.

You Earned 0.100 WINEX As Curation Reward.

You Utilized 1/2 Successful Calls.

Contact Us : WINEX Token Discord Channel

WINEX Current Market Price : 0.274

Swap Your Hive <=> Swap.Hive With Industry Lowest Fee (0.1%) : Click This Link

Read Latest Updates Or Contact Us

@logicforce(1/10) gave you LUV. H-E tools | connect | <><

H-E tools | connect | <><

HiveBuzz.me NFT for Peace

lolztoken.com

He's working in the crust station.

Credit: reddit

@mawit07, I sent you an $LOLZ on behalf of @logicforce

Use the !LOL or !LOLZ command to share a joke and an $LOLZ. (1/10)

!LUV !WINE !LOL

Congratulations, @mawit07 You Successfully Shared 0.100 WINEX With @logicforce.

You Earned 0.100 WINEX As Curation Reward.

You Utilized 1/2 Successful Calls.

Contact Us : WINEX Token Discord Channel

WINEX Current Market Price : 0.274

Swap Your Hive <=> Swap.Hive With Industry Lowest Fee (0.1%) : Click This Link

Read Latest Updates Or Contact Us

@mawit07(1/4) gave you LUV. H-E tools | connect | <><

H-E tools | connect | <><

HiveBuzz.me NFT for Peace

lolztoken.com

Lack of concentration.

Credit: reddit

@logicforce, I sent you an $LOLZ on behalf of @mawit07

Use the !LOL or !LOLZ command to share a joke and an $LOLZ. (1/6)

PIZZA Holders sent $PIZZA tips in this post's comments:

@logicforce(1/5) tipped @mawit07 (x1)

Join us in Discord!

Compared to this, the 12% APR interest on the Hive Dollars (HBD) sounds low. Some of the witnesses are already voting for 15% APR interest. Hopefully soon it will be increased soon.

That would be great for HBD to get 15%. More will stake it for sure with only a 3.5 day waiting period for withdraw.

Congratulations @mawit07! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

Your content has been voted as a part of Encouragement program. Keep up the good work!

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more