Anchor Protocol Loans Liquidating...

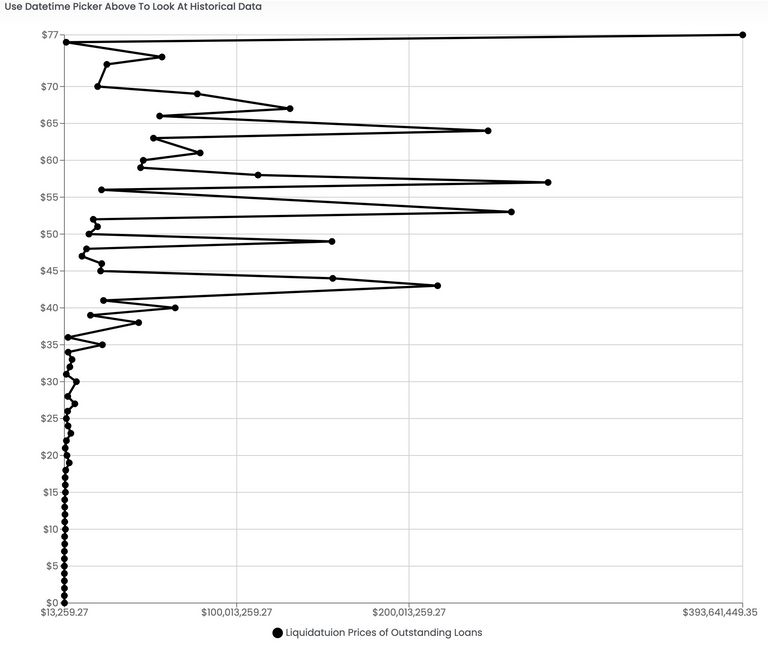

A quick description of the front post chart is in order. Currently on Anchor there are bLuna collateral provided to borrow UST up to 80% of the bLuna value. The current amount of loans and at what price bLuna hits to liquidate that collateral is shown in that chart.

bLuna is pretty much the price of Luna excepted that its bonded. The immediate drop in Luna price has cause many loans in the past few days to be liquidated.

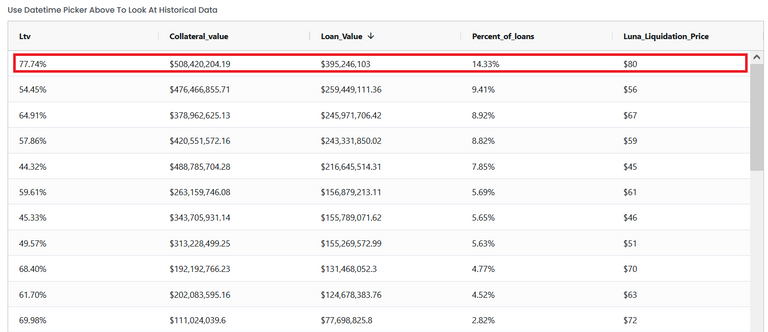

The list of loans and their LTV as it currently stands it is clear to see the nearly $400 million of bLuna as collateral is in danger. It is not that far away from $80. This is by far the biggest loan to potential be liquidated since the start of the Luna all time high price dip from $119.

You can check you the loans yourself through this free website link:

https://app.alphadefi.fund/liq-profile

Personal Experience

I focus today's post specifically on Anchor loans getting liquidated is because I myself am holding on a loan that is currently at around 70% LTV. Anchor will liquidate the loan if its over 80% LTV. This is how close I am treading and likely will need to immediately pay down my loan to reduce my LTV.

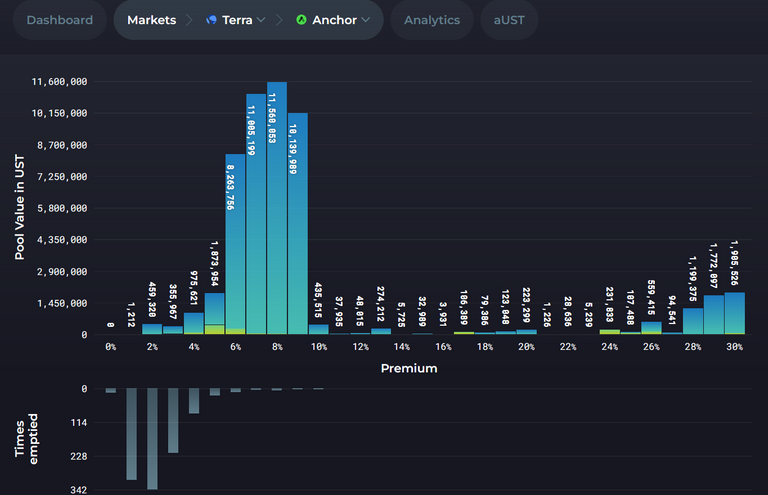

Over on Kujira is where we can see the bids to get the liquidated bLuna on anchor. A lot is at stake here for the $400 million amount of bLuna if it does get liquidated. There is not that many UST to purchase all that bLuna. This will for prices down significantly.

Conclusions

Lesson learned here for me is be the Orca Killer Whale not the borrower. The timing of these dips come and go but each dip its is difficult to determine how low prices can go before the next up turn.

Earlier today Luna was priced around $88 per chart above but now closer to $81. There is no clear sign where a bottom can be but crypto never goes in a straight line. I still would have to be careful with my loan as uncertainty lies ahead.

Stay safe everyone who is investing in cryptocurrency.

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token

I think this has been the 2nd or 3rd post I have seen about people getting liquidated. So it seems like the market price changes are starting to take their toll on the people in the market. It's probably one of the reasons why I avoid leverage in crypto.

Posted Using LeoFinance Beta

Without leverage growth slows. In crypto a lot of what is invested technically is leverage onto something else. Some leverage is good but I agree the dangers of over leveraging is what we are witnessing now hence a speedy drop in crypto prices. Hopefully most are already deleveraged but if not more price drop to come.

Congratulations @mawit07! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 50000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

Yay! 🤗

Your content has been boosted with Ecency Points, by @mawit07.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more