Average American Economic Hurdles As Of 2022

I am not trying to be doom and gloom here with my economic posts. Instead posting what is real data and my interpretation of the data. Not all news is bad but it is worth mention the core reasons as to why so many Americans are feeling financial strain in the current economy.

Yesterday I posted about the current FED raising rates and how it can potentially led to some sort of bubble burst for asset prices. Today I briefly talk about what some of the pains and struggle Americans are facing and what may likely be asset bubbles bursting.

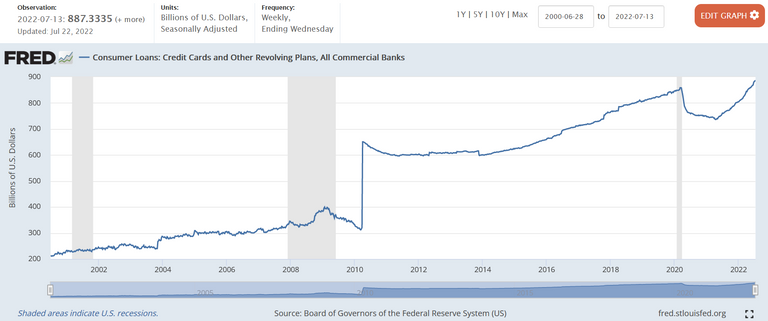

Credit Rising = Borrowing Rising

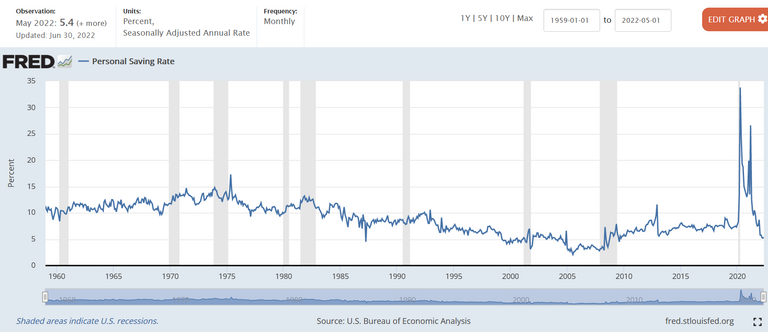

Front page post image is showing the current personal savings rates near all time lows at zero. This mean majority of Americans are not saving any money in the current economy. To look further we also have credit loans rising.

To date the American population as a whole has borrowed the most ever since records have been kept. Credit loans is reaching close to $1 trillion marker.

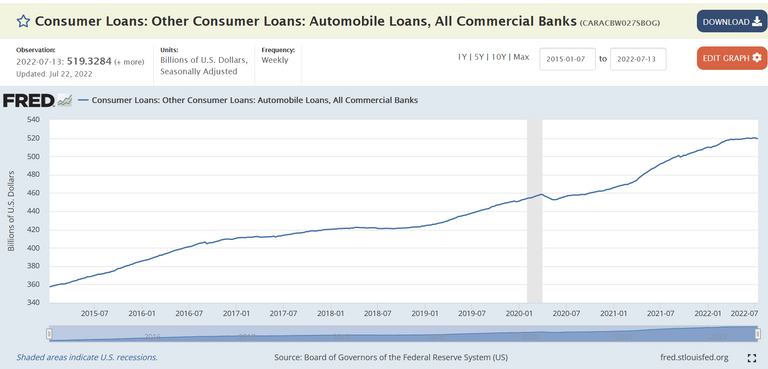

A large portion of the loans are on automobiles.

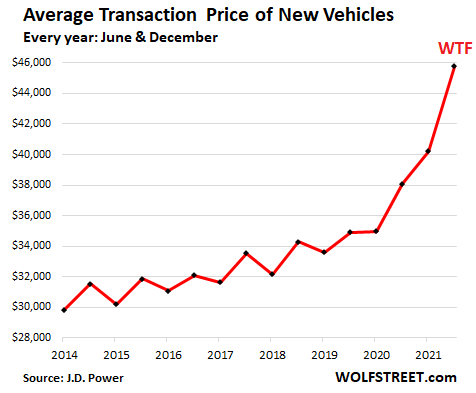

With a staggering $500 billion in auto loans it is near all time highs. This comes off the back of record average price for an automobile.

With prices likely peaking and interest rates rising the auto loan bubble has all the recipe to burst. If this does happen a significant amount of auto loans will lose face value and commercial banks will have to take the losses.

Retail Housing Bubble

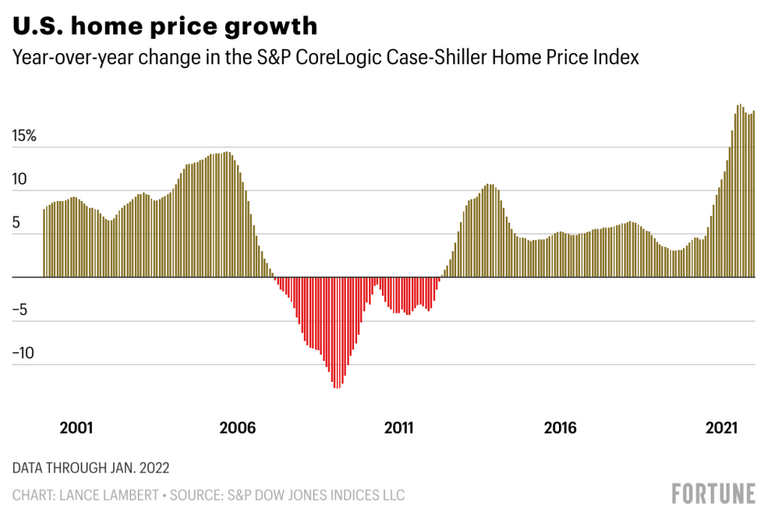

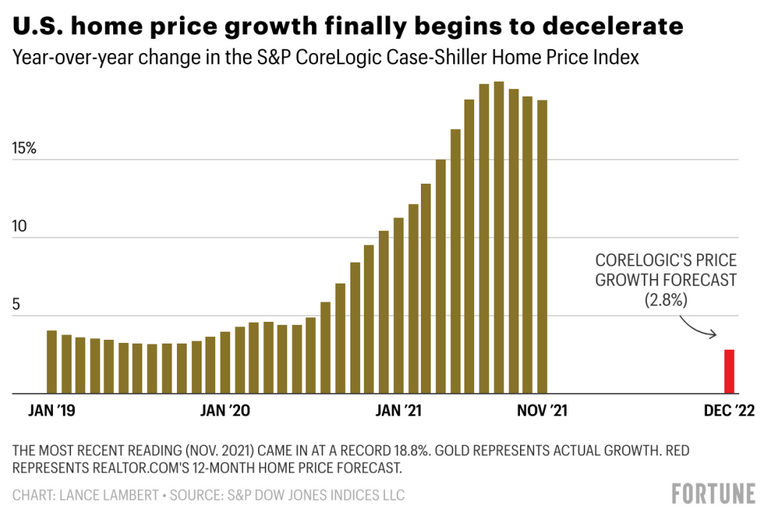

2008 the financial crisis was mainly on the housing market overheating. Now in 2022 the supply of houses is at record lows while housing prices are at record highs.

Covid-19 essentially boosted housing prices rather than slowing it down as some may have assumed. Since lock down mean less people had jobs the assumption was people would not have the money to continuously out bid each other for real estate. This was a wrong assumption.

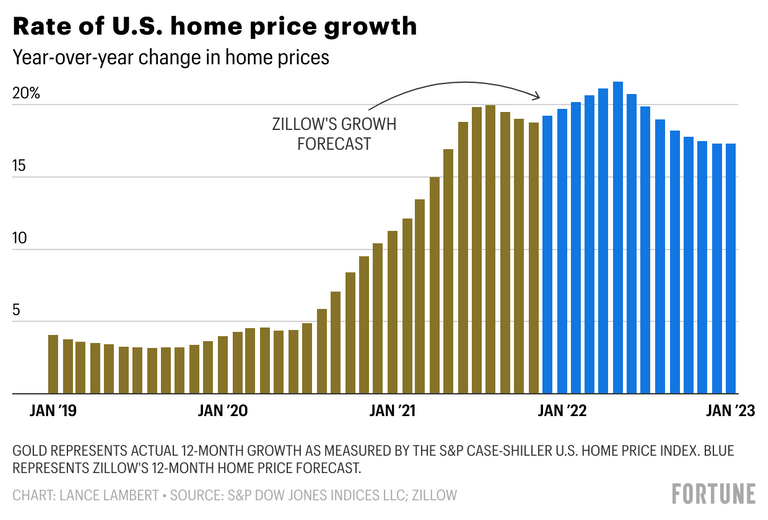

However headwinds are coming or already here in the real estate market. With experts at housing prices Zillow and RedFin producing lower price growth in the future quarters. However growth still existing even though it is slowing for the end of 2022.

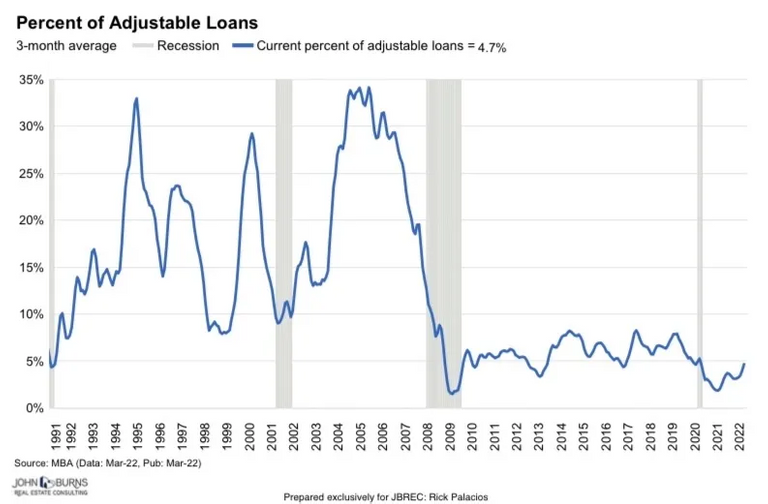

Still with slowdown in price appreciation the demand for housing is still high. Therefore some Americans are using adjustable mortgages in order to get enough equity to purchase a home.

Adjustable mortgages is what brought down the banks in 2008 as many who took out loans did not have the equity to back up their borrowing. Now in 2022 with bank rules in place the borrowing is much stricter therefore another 2008 housing crash is unlikely. Yet it is worth noting adjustable mortgages are on the rise meaning Americans are taking on more risk in borrowing.

The FED has been increasing interest rates for few months and may likely raise rates this week. That will factor in on the adjustable mortgages down the road and can be a potential bubble burst for if FED rates are too high the adjusted mortgage rates could push home buyers out being able to afford paying their monthly payments.

Inflation at 40 Years High

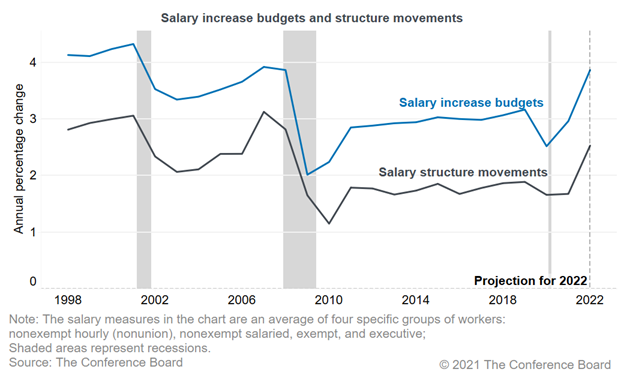

The consumer price index which is a reading on how much goods and services have increased in price year over year has risen every month for the past twelve months. This has caused a lot of essential goods and necessities higher in price. The US consumer's rise in wages has been rising but not as fast as the CPI therefore a lot of Americans are feeling the burden of meeting ends meet.

Conclusions

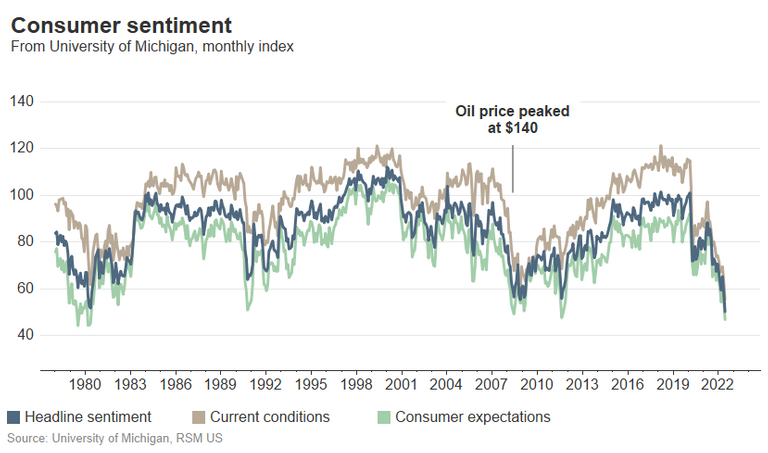

With housing prices still rising, inflation at 40 year high, and credit loans at all time highs it is no wonder US consumer sentiment are at an all time low. In fact sentiment currently is lower now than even in 2000, 2008 or 2018. Clearly the average US citizen is not feeling optimistic with where the country is heading.

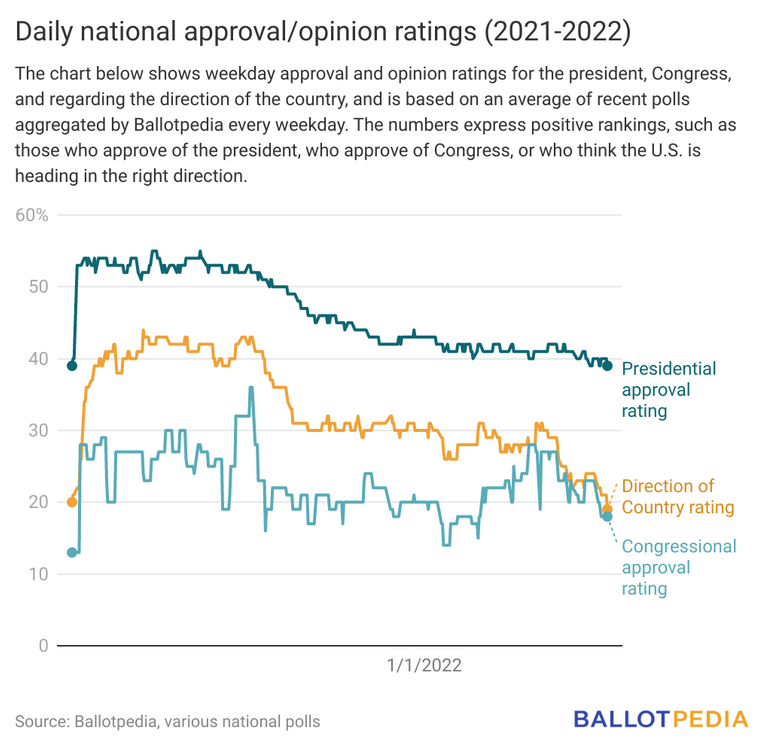

President Biden's approval rating continues to fall even as he has proven to had started lowering oil prices and trying to pass supporting bills to stimulate the economy.

Americans are facing a difficult and challenging period in economics history. The current data on US consumers are bleak but can it go lower is the bigger question. Asset prices have not burst in regards to any of the items I mentioned whether it is housing, auto, or equities. So it remains to be seen how this will all play out, but for now with what we have for data it is enough to prove that it won't be an easy road ahead.

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token

All the debt and loans that people are taking will be dangerous. From what I have seen, auto loans are getting into danger because people weren't making payments for their cars. Before the banks weren't as worried but now they are getting worried and taking back cars for auctions.

Posted Using LeoFinance Beta

Does sound like asset bubbles bursting. !LOL !PIZZA !WINE

Congratulations, @mawit07 You Successfully Shared 0.100 WINEX With @jfang003.

You Earned 0.100 WINEX As Curation Reward.

You Utilized 1/2 Successful Calls.

Contact Us : WINEX Token Discord Channel

WINEX Current Market Price : 0.200

Swap Your Hive <=> Swap.Hive With Industry Lowest Fee (0.1%) : Click This Link

Read Latest Updates Or Contact Us

lolztoken.com

“Odor in the court!”

Credit: reddit

@jfang003, I sent you an $LOLZ on behalf of @mawit07

Are You Ready for some $FUN? Learn about LOLZ's new FUN tribe!

(1/4)

PIZZA Holders sent $PIZZA tips in this post's comments:

@mawit07(1/5) tipped @jfang003 (x1)

Learn more at https://hive.pizza.