Best Single Staking Stablecoin Liquidity Pools May 2022

To the victor goes the spoils. Scream had a hiccup in their assets and are now in need of filling its pools in stable coins. What better way to do so than to provide high APY% rates to investors.

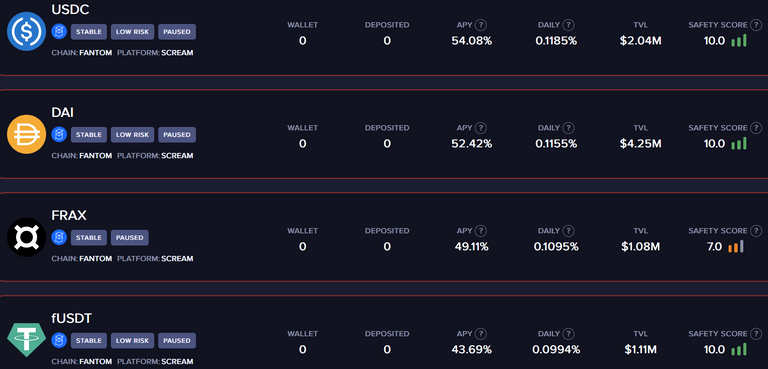

All the high market cap stable coins in USDC, FRAX, fUSDT, and DAI are in the max and each gathering close to or above 50% APY. If that is not enough remember the earned rewards can be staked to earn more on Scream.

Over on Beefy Finance one can invest the stable coins and earn daily stable coins as these pools are single asset and Beefy auto-compounds the rewards every hour.

If you fear the risk of Scream having the same liquidity pools siphoned then the next best thing with similar APR rates but different protocol:

Over on Wave or Arbitrum single staking or dual stable coin staking yielding over 30%. It is not the same as scream but high enough to still be attractive.

If security and risk is of up most concern it would be a good choice to go with some old fashion lending and borrowing protocols such as Aave and Compound.

The yields are not as attractive but with lending and borrowing platforms users can have the opportunity to borrow stables to invest in altcoins.

Conclusions

With the current cryptocurrency draw down I thought it would be a good overview at current stable coin liquidity pools out there. Although I had a bit of a hard time writing this post considering my personal losses in Terra's stable token UST.

From experience I now know not to hold only one stable coin but need to diversify. In addition make sure it is liquid where I am able to withdraw without a timer. The opportunities often are very time sensitive so every second I have to wait for access to my funds the less likely I am able to get in on a investment.

Lastly I focused mostly on single staking pools because I have seen far to many dual pools where one half is stable coin while the other half is some coin that simply drops 90% from its all time highs. There is little to no benefits of earning high APR in rewards if the assets staked in liquidity pools.

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token

Your level lowered and you are now a Minnow!

Check out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

I have a pool on Beefy Finance. I can't remember which one it was. It's value $19 so I not checked it since last month. It really important to diversify !

!PIZZA

Posted using LeoFinance Mobile

Definitely important diversify when it comes to crypto.

PIZZA Holders sent $PIZZA tips in this post's comments:

@olympicdragon(2/5) tipped @mawit07 (x1)

Join us in Discord!