Best Ways To Invest in a Consolidating Crypto Market?

For over a year BTC price has remain mostly ranged bound. It is currently sitting around $47.5k mark which is literally the middle of the range. I remain bullish optimistic that BTC will break out of its range, meanwhile what can we each do in this type of crypto market in order to be profitable? I mean the whole goal of investing into crypto is for the sake of making money, right?

Lending Assets

Day traders can make swings between prices such as that seen in BTC but it takes effort and screen time to make it possible. Of course there are also bot trading to extract some of the price movement into profit such as Poloneix or Kucoin. But what if a crypto you want to invest in is not within a consolidated range even if BTC is?

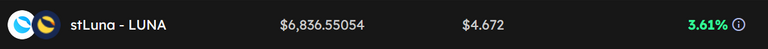

What if you invest in an asset that is steadily rising even in an overall consolidating market such as that of Luna. One way to maintain profitability is to lend out the Luna to earn more Luna or use it as collateral over on Anchor protocol or other platforms to earn more. That way it is much easier to timing buys and sells of the asset as price continues to trend upward.

Staking Assets

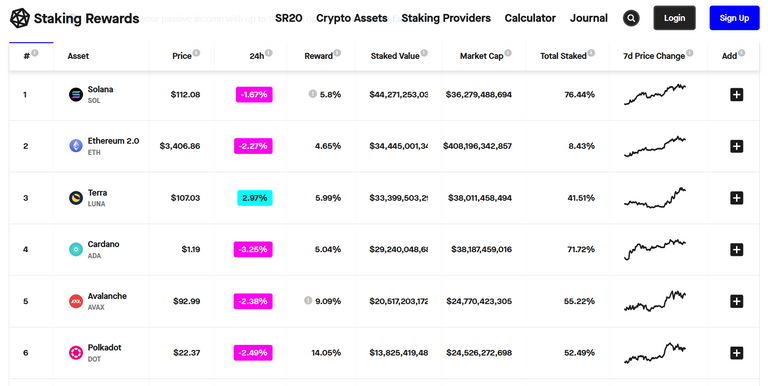

A lot of the top cryptocurrencies has the option of staking its native token on the main net blockchain. This enhances the blockchain by having more native token validating assets being transfer and less likely to see false transactions sneak through.

In addition no traditional investment can be said to allow investors to maintain a yield even if holding the traded asset like cryptocurrency. As you can see staking the token will earn you a yield and if the price remains flat or rises you still benefit by having more of the same token at the end of the year.

Liquidity Pools

Not all pools are one and the same, but if look into some pools where both underlying assets are similar in value it maybe worth participating in a farm to earn a yield. The benefit of such pools is that the assets remain liquid while holders earn daily interest in the pool's trading fees. This is useful for those who wish not to be timing the markets but feel the need of flexibility to trade out of their assets into stable coin at any moment. Liquidity pools are perfect for that.

Conclusions

Back even in 2018 right before the Crypto bust set in there were no such things as trading bots for retail or lending and borrowing protocols easily accessible to retail. Furthermore the platforms for liquidity pools were non existent. It is amazing how far just a few years have gone and how much more ways users can now invest in cryptocurrency while remaining optimistically bullish.

I think with all the new ways we now have in investing in cryptocurrency as of 2022 it has allow the market to digest its run up in 2020 and in all likelihood be able to continue its upward price trajectory. This is because there are simply enough instruments for crypto investors to hodl their tokens and earn more even if prices remain flat of slightly down only to await for the inevitable pump in price.

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token

Du wurdest als Member von @investinthefutur gevotet!

Dazu noch ein kleines !BEER & VOIN-Token

View or trade

BEER.Hey @mawit07, here is a little bit of

BEERfrom @investinthefutur for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.