Future Prosperity Always Relies On The Next Generation.

There is concern whether USA's economy will hit a slow down or even worse down turn. Presently the economy is holding up pretty well even with lock down, issues with chain supply, global shortage of food and energy, and wars. Still looking far ahead there are headwinds to contend with.

There is an old saying living "work hard, save and live with in your means" but how many in the USA follow such action? There is a requirement for a country to thrive when there are enough people participating in the work force and at the same time consume less.

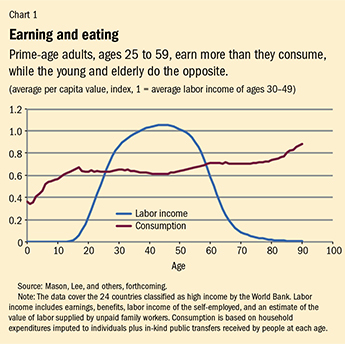

Prime Age Adults Key To Prosperity

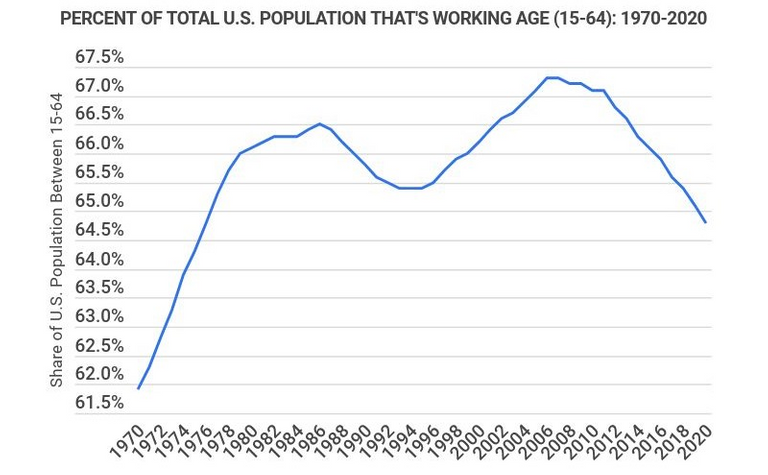

In the USA prime age for working is between 18-59. Chart above is showing ages between 15 - 64 working participation rate has been falling since the 2000s. This would be a concern considering people at their most productive years are not being productive.

Without the younger generation working then there is more burden on the remaining individuals who are still working to continue supporting the economy.

A good example is the 401k retirement plan that helps USA workers save for retirement. The key part of the 401k is that every paycheck a certain portion is taken out by the employee to invest in the stock market. This means the older generations that invested earlier in stocks will continue to have buyers from younger generation. Therefore if one reaches an age of retirement they will be able to sell their stock shares to others such as those who invested in their own 401k.

Bottom line you can see where this will lead if the labor market continue to fall. This will mean less investors in 401k and less money to go into the markets. Then those who have saved enough and wanting to retire and sell their shares will have to sell at lower prices which in turn could potentially make assets fall in price.

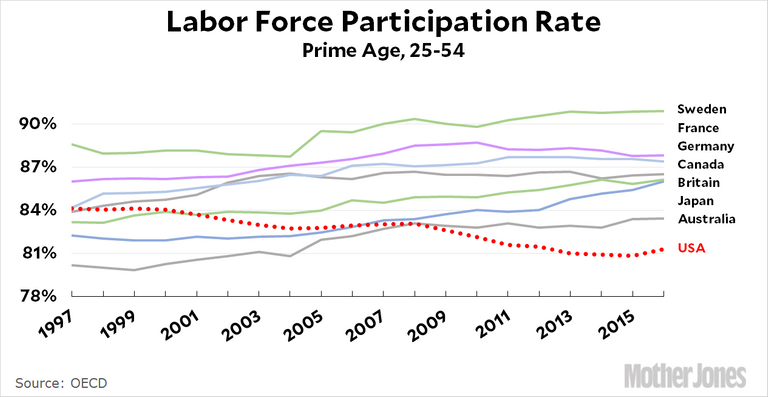

Worldwide Labor Challenges

Chart above is a bit old, 2018 last print, but it illustrates the point that USA workers are lowering a bit for the past two decades. The goal of this chart is to illustrate the challenges facing America. That is there will be less workers competing on a global scale against other develop countries.

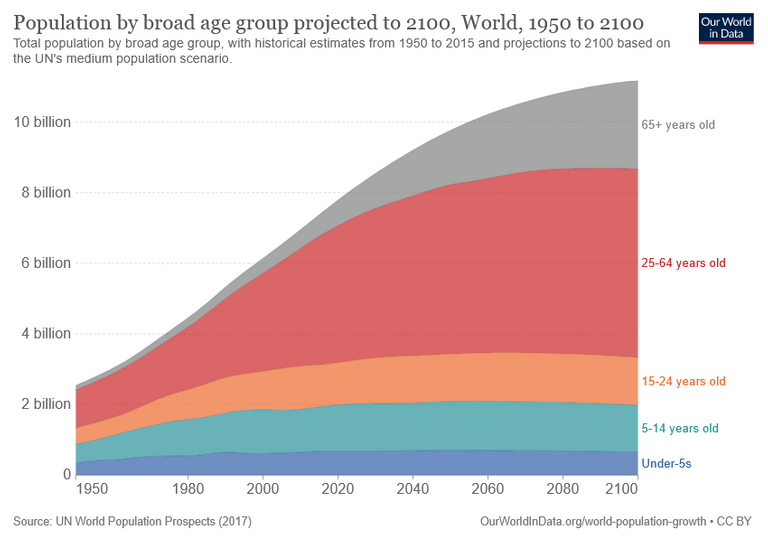

I leave it at a chart illustrating the world population in total is getting more older people and unable to partake in joining the working population. Meanwhile the working population rates flat line which would burden current and future population of workers supporting the remaining population.

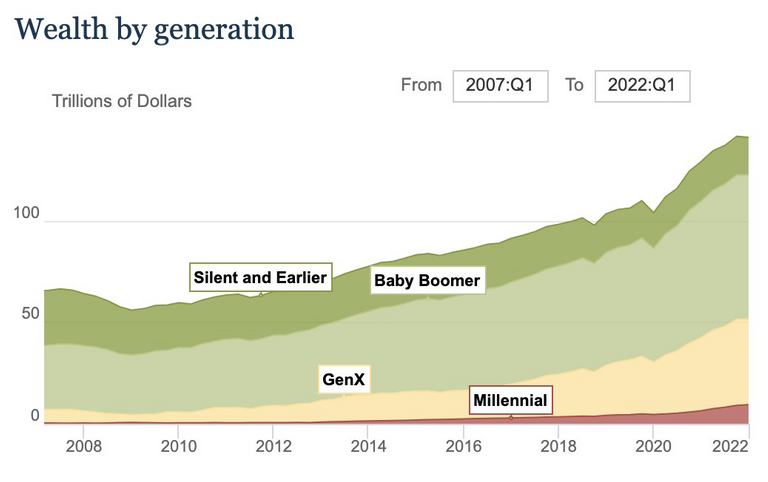

For those wondering then what about the older generation not working how they can survive then just look at the net worth between people who are retired or close to retire versus the remaining generations. The heart of the matter is less people needing to create and provide more in order for the whole system to thrive.

The older generations Silent & Earlier and Baby Boomer hold more than 70% of the global net worth. While Millennials are near rock bottom as the youngest generation of full time employees in the work force. This is not to say the younger generation are doomed. No in fact there have been thoughts put in that could lead to a decent and continuous growth in the country.

Robotics may have to be continuously used to increase productivity while potentially reducing the actual amount of individuals partaking the labor force. This is a form of deflation in the economy.

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token

Demographics aren't going to help and I don't think the labor force participation is going to help much either. From what I see, I think robots are the best solution we have to replace the working force.

Posted Using LeoFinance Beta

If the USA workers keep decreasing how does it affects the economy?

Posted Using LeoFinance Beta