History Does Not Repeat Itself But It Rhymes...

A twitter user by the name @macroalf that I follow recently posted a short set of bullet points summarizing our current conditions in regards to the economy. To be specific he called out the dates where the an asset market bubble burst due to the FED raising interest rates. To conclude it by saying current rate hikes by the FED has yet to break any asset just yet but will more or less break something. The big questions then are what will it break and when will it break?

2000 Dot-Com Bubble Pop

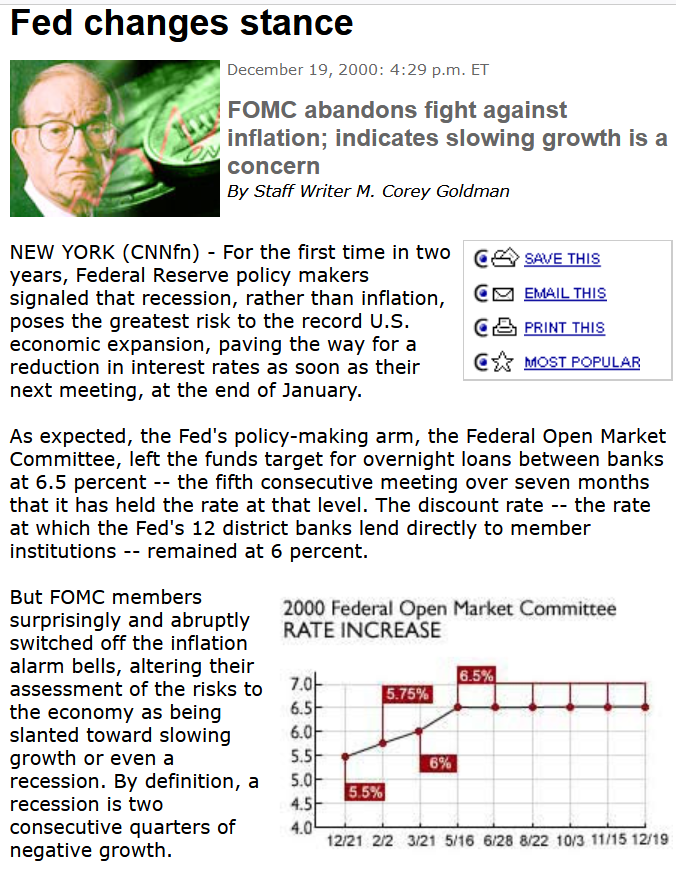

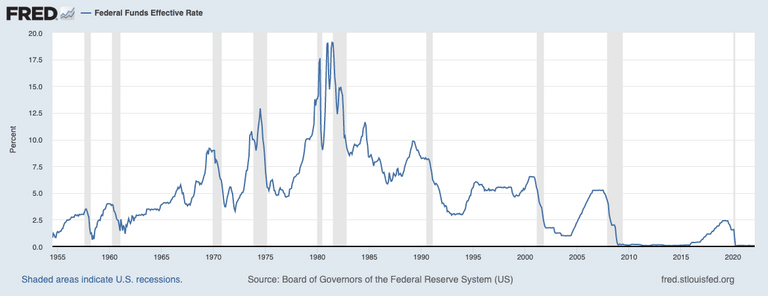

As the economy was heating up especially in the Nasdaq the FED had been pushing rates higher. By May of 2000 they had set rates at 6.5% and had openly expressed to continue raising rates with how the economy was performing.

Meanwhile many tech stocks back in March 2000 had begun to fall and fall pretty rapidly.

On Friday, April 14, 2000, the Nasdaq Composite index fell 9%, ending a week in which it fell 25%

In one week the tech sector in stock evaluation had a dramatic fall to the point where some stocks lose as much as 80% of its value. Yet by May the FED continue to raise rates and be hawkish towards the economy. This was a poor decision made by the FED as Nasdaq will go on to lose nearly 80% of its value from its peak in March 2000 when it hit a low around 1,000 in late 2002.

Chart above courtesy from Wikipedia and more in-depth story of the dot-com bubble can be read here.

The FED by end of Dec 2000 pivot to dovish to be more accommodating to the economy by intending to lower interest rates. At the time they had believe recession was more dangerous to the economy than inflation however it was too late to avoid or curb a recession as majority of 2001 the US and foreign countries doing business with US such as European Union were in recessions.

2008 Housing Market Destruction

The Atlantic back in 2014 review the 2008 financial crisis and what many today call it the Great Recession. The Atlantic story can be read here. This was one of the worse periods in USA economy and other countries as well but deeply more the USA because many banks were failing. Banks from small local areas all the way to giants that were considered too big to fail such as Bear Sterns and Lehman Brothers.

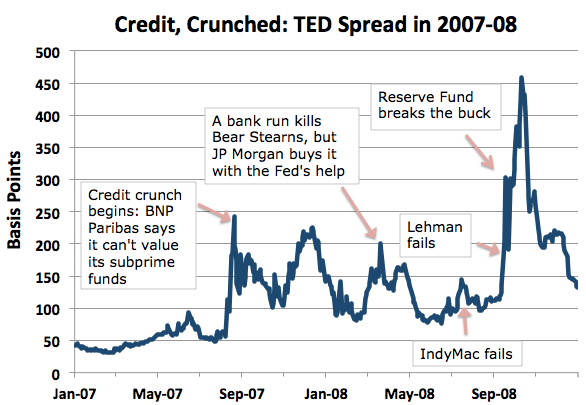

The crust of why these banks were failing goes to their aggressive investing in the housing market by raising prices to the point that was not sustainable. This led the banks not trusting each other and forcing lending rates between each other to go higher.

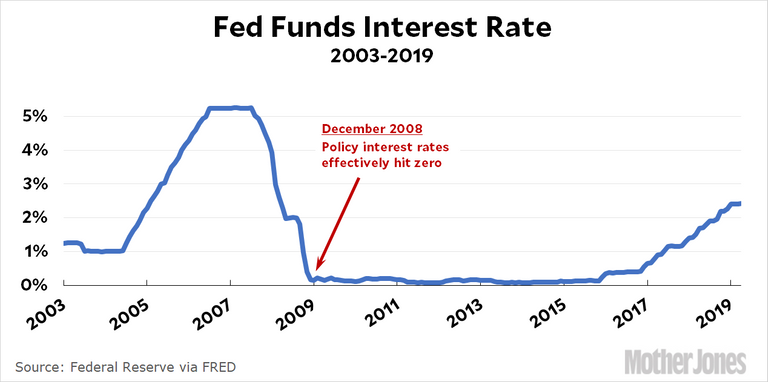

Meanwhile the FED took significant steps to ease the financial system by lowering the borrowing cost and providing much needed liquidity to keep the economy running on the dollar. Essentially by late 2008 the FED had brought rates down to zero and FED started providing liquidity to banks which we know today as Quantitative Easing.

On November 2008

The Fed announced the first round of QE, known as QE1, in November 2008. It officially kicked off in March 2009 and concluded a year later, with the U.S. central bank purchasing $1.25 trillion total in mortgage-backed securities, $200 billion in agency debt and $300 billion in long-term Treasury securities.

Today we consider QE as a form of bailout to the recipients. Banks were bailed out in 2008 and 2009 from their poor investments as losses were covered by the government.

In late 2009 then FED chairman Ben Bernanke did an interview with NPR of what was going on behind the scene during the Great Recession. Quote from him as why he had to bail out the banks:

"I was not going to be the Federal Reserve chairman who presided over the second Great Depression," Bernanke said. "For that reason I had to hold my nose and stop those firms from failing."

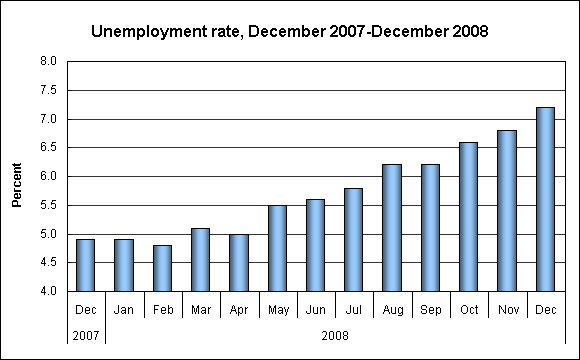

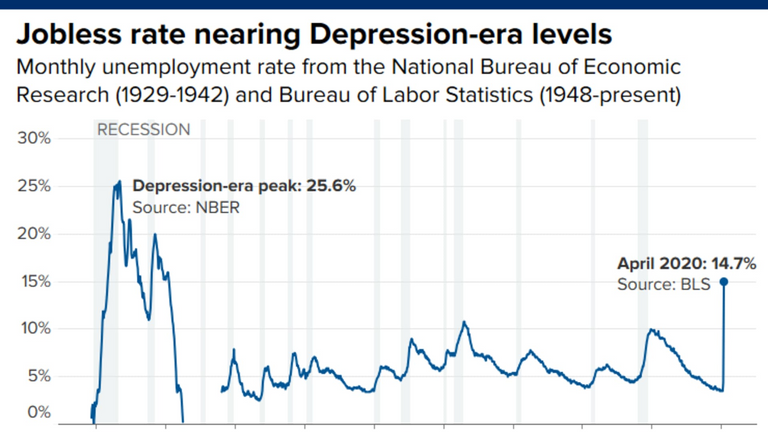

He believed the economy was in systemic risk of failing from top to bottom. Yet through all of 2008 and early 2009 the US economy had continuous rise in unemployment rate and peaked in 2009 at 10%. In addition the country's GDP fell to lowest levels since World War II.

Charts courtesy from Reeds college.

2018 FED's Directly Crashing Markets

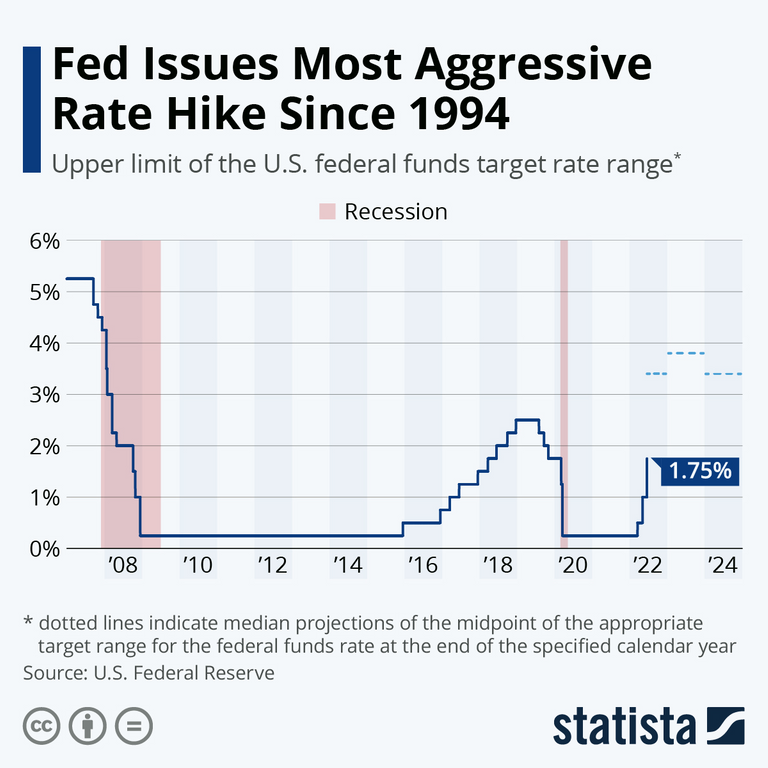

With FED rates holding near zero for almost all of first half of 2010s it came to a time where the economy appear to be in decent shape to handle higher rates. This was under the premise the inflation would be picking up and that unemployment rates would hold steady in a raised rate environment.

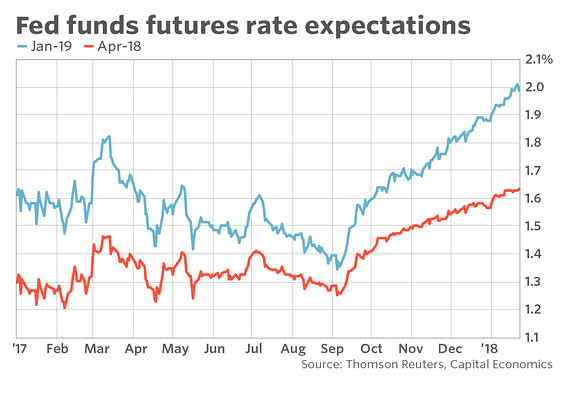

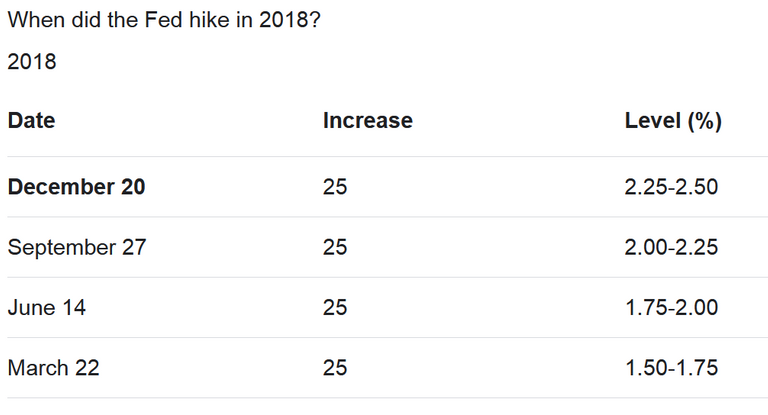

The optimism from the FED that rising interest rates would be good for the economy was expressed clearly in 2018. By the start of 2018 the data of the economy was proving to the FED that inflation was rising and they took action to raise interest rates. For all of 2018 they move rates up 4 times.

By the end of 2018 the rates were at 2.5%. Meanwhile the S&P which covers a wide range of US large cap stocks were mostly struggling in price appreciation throughout 2018 and only ending up falling fast near end of 2018.

In a span of less than 3 months the S&P had fallen more than 20% from its all time highs.

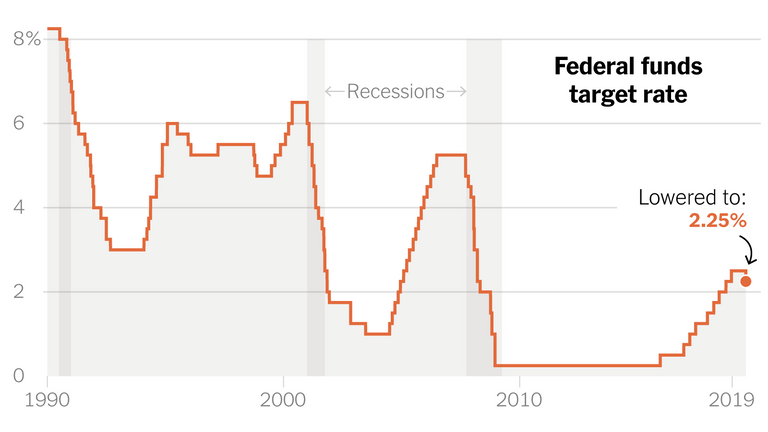

The FED pivot in early 2019 and started lowering interest rates to accommodate to the economy.

The fear that the FED created a recession with the rise in rates came to fruition as they immediately went back to 0% by 2020.

In terms of the immediate rate dropping to zero there was one particular event that made the FED decide to take such dramatic shift. It was Covid-19 that made governments lock down creating global shut down of economies for weeks to months.

With the global shutdown it force a lot of companies to layoff their workers creating a massive unemployment rate in the tune of close to 15%. Even though it would only take months to recover the damage was done on the economy. A short by painful recession took place in US during 2020.

Current 2022 FED rate hikes

The FED has been raising rates since July and further removing liquidity out of the market by not continue to purchase commercial assets through the FED. The latter essentially is a stop in QE.

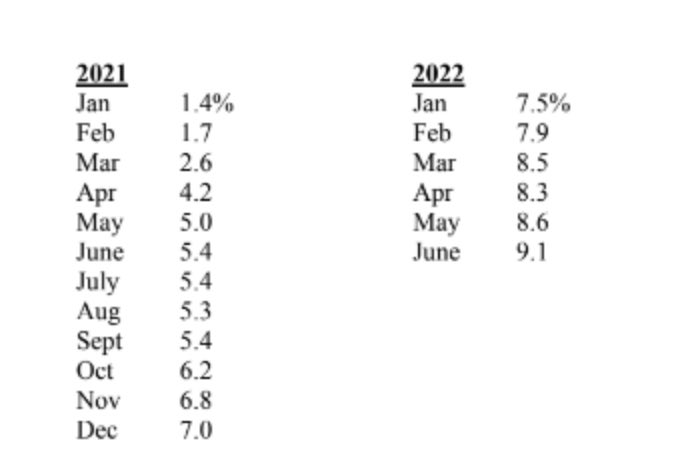

However inflation has been running rampant in the economy since middle of 2021. Note FED only started raising rates in middle of 2022. That is a full year before they reacted to the what became an overheating in price appreciation not only in US but across the globe.

The FED at the time of 2021 were calling out such inflation as temporary or "transitory" and would go away swiftly as they came. One full year into this inflation and not only has it not gone away but it has raised higher month after month.

Chart from this ZeroHedge article.

This upcoming week of July will be when the FED comes out presenting the interest rate for the foreseeable future. Predictions are that the rate will mostly like rise to 2.25% - 2.5% or a 0.75% raise in rates. No signs that the FED is abating from the hawkish tone.

Conclusions

We briefly went through the 2000 dot com bust, 2008 Great Recession, 2018 stock market crash, and now the current 2022 Post-Covid reopening. All these events coincide with the FED raising interest rates that in turn created some from of market crash. As of now 2022 is no different.

To date the S&P has hit more than 20% lower from its all time highs but recently bounced back a few percentage. Whether the markets have reach a bottom remains to be seen. What we can gather though is that in all past periods where the FED took a hawkish stance on the economy it has always resulted in something bad to a particular asset class. In turn creating a chain reaction that costs some people their jobs and life savings.

Be prepare as the week and months ahead may likely be very turbulent when it comes to pricing anything.

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.