LeoFinance - Earn 50% APY Farming On Spectrum

The race for higher yields are endless and today I stumbled on another fascinating way to earn some where close to 50% APY. This is another protocol on Terra Protocol called Spectrum Protocol.

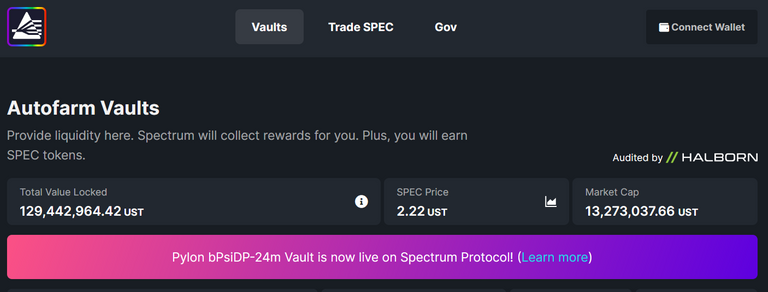

https://terra.spec.finance/vaults

Like many farms protocols Spectrum has an audit done and currently a little under 130 million in Total Value Locked. It has multiple pools to farm and its key incentive is that it will automate farming in such a way users can schedule when to reinvest earnings or not at all. The platform rewards users who provide liquidity to the platform their native token SPEC which is currently worth $2.22 each.

Protocols Tag Teaming To Earn More

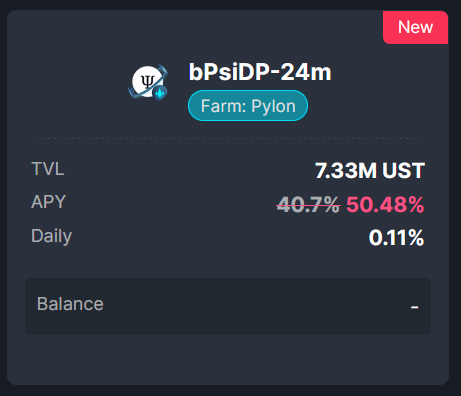

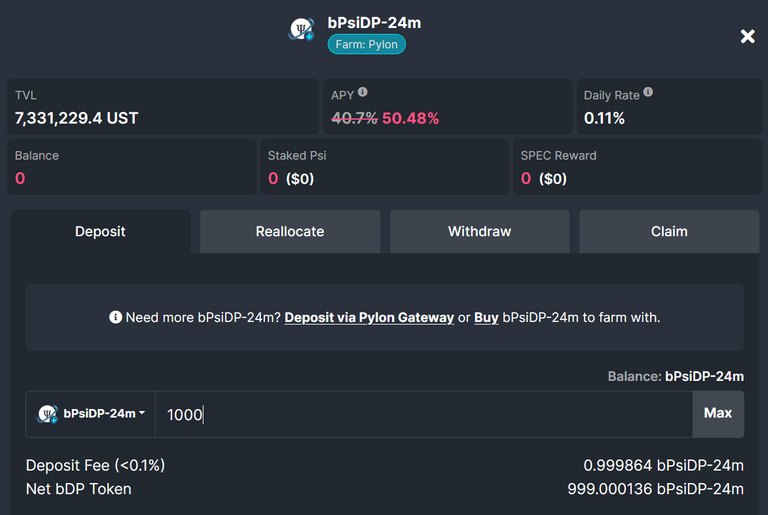

What is interesting in Spectrum is its most recent pool available for its investors.

On the surface the pool do not look like much. It is basically providing bPsi to Spectrum and farm in their pool. However for those new to Terra there is a lot more happening within the pool. Lets take a deeper dive into what makes this pool so interesting.

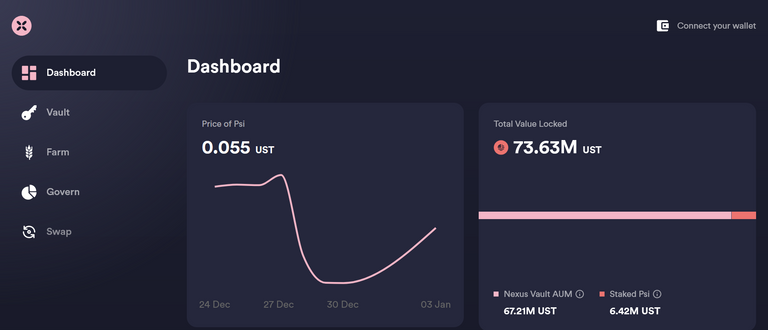

https://terra.nexusprotocol.app/

The Nexus Protocol is another Terra Protocol. This one focuses on increasing investor's yields for those who stake in its protocol on versus liquidity pool. By participating in their liquidity pools users earn native token Psi.

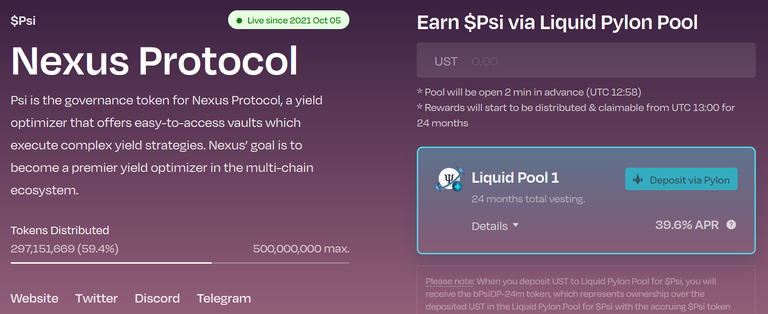

In addition Pylon Protocol another Terra Protocol focuses on holding and retaining same value of stable tokens for its investors and in return earn them dividends. Basically consider it as a loss-less investment as no matter which proposal on Pylon users onboard they will earn some sort of incentive.

Back in Oct. 2021 Pylon joined with Nexus to create a PSI token that would pegged to UST by bonding PSI tokens that would last until Oct. 2023. The tokens are labelled bPsiDP-24 in Spectrum and short for bonded Psi Pool for 24 months.

The short of it is Pylon allows investors to put in Psi and locked unto October 2023. In return users will earn approximately 37% APR of Psi tokens. What is cutting edge here is Spectrum takes the Pylon Psi Pool and automates the its investment so that end users can easily earn more yield than 37% while keeping their asset liquid!!!

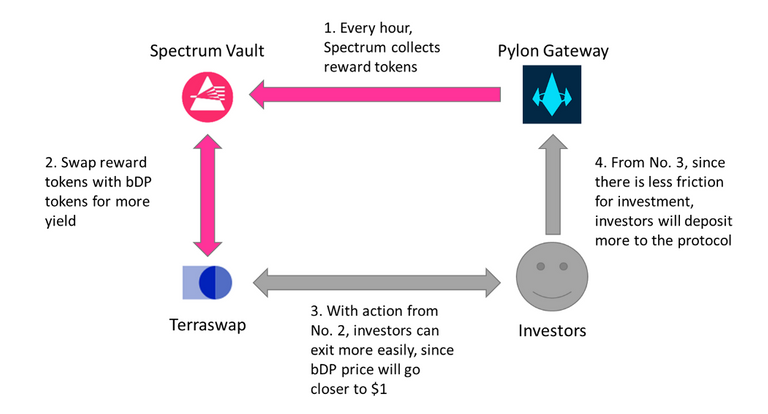

Flow chart of how this whole process plays out between Spectrum and Pylon. Courtesy of https://spectrum-protocol.medium.com/liquid-pylon-vault-when-lossless-investment-meets-auto-compound-4c682d3e6c54

Conclusions

As Pylon locks the Psi the pool can then use other protocols to earn more rewards giving the overall APY to be much higher than Pylon's itself 37% or Anchor's 20% on UST. What is even better is that bPsi would be consider a liquid asset so users can trade bPsi back to UST and vise versa. Partake in a pool that has locked up time but the asset is liquid, how ingenious!

The risk here is bPsi is not pegged to the UST. In fact in order for this to all work is that Spectrum takes its earned rewards and repurchases enough bPsiDP in the current pool to match with UST. Basically trying to balance the pool to be 50/50 all the while providing providing users Spectrum earning at a current rate of 50.48% APR.

The race for higher yields are here to stay, and can you keep up?

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token

DEFI for everyone!!! Need to look a bit more into Terra's ecosystem. Currently into BSC and the Cosmos ecosystem which is killing it. You can also cross chain Terra LUNA and UST with Cosmos through Osmosis.zone. Currently earning 165% with nearly 92 million in liquidity on the OSMO/UST pool.

I seen it but it seems a bit involved with cross chain. Heard Kepler wallets can get hacked similar to metamask so I need a ledger before I cross over. Definitely tempting with those apr

Nice gem better than growthdefi i guess

The reason I mention this is because when we stake the bPsi it is by design aiming to be a stable coin peg to UST. For those who are on Terra network and uses UST imagine earning 50% just for putting it in a pool and its liquid so if you needed to withdraw it can be done immediately. Over twice the amount in APR than Anchor. Of course there are drawbacks such as bPsi could lose its peg against UST or that enough people partake in staking in pool to drop yields down significantly.

i am a newbie , lover for defi

Posted Using LeoFinance Beta

However, because it's decentralized, that also means there are fewer protections in place if something goes wrong. Banks are highly regulated, and there are safety nets in the case of fraud or theft. If your bank fails or your money is stolen, you're protected up to a certain limit. With DeFi, you're essentially on your own.

Although blockchain technology is known for its security, it's not immune to hackers and fraud. In fact, DeFi-related fraud and theft have resulted in losses topping $10 billion in 2021 alone, up roughly 600% over last year, according to a report from Elliptic.

In addition, as DeFi increases in popularity, it's facing stricter regulation from the government. At this point, it's not a matter of if DeFi is regulated, but when. Tighter regulations could make DeFi safer, but it also means its future is uncertain.

Posted Using LeoFinance Beta

You make a lot of great points that I have ponder about and looked at. There are centralized exchanges that allow users to earn passive income even though they are less such as Celsius and Blockfi. They are backed by insurance so if token stakers have their assets stolen the companies will have some form of reimbursement. On the flip side users have reviewed and determined centralized exchanges such as Celsius has participation in some DEX exchanges and giving back to stakers the rewards while taking a small cut.

I by no means support cryptocurrency breaking the laws. Instead I am routing for sound businesses to spur up in order to gain more participation. On boarding crypto users is difficult enough by itself. To see regulation come in is a very positive sign for cryptocurrency. It means mainstream has adopted to it and become the norm. I personally believe regulation has not fully formed yet is because there is not enough people in politics realizing the potential crypto has for benefiting society.

!LUV !PIZZA

@logicforce(2/4) gave you LUV.

PIZZA Holders sent $PIZZA tips in this post's comments:

@logicforce(2/5) tipped @mawit07 (x1)

You can now send $PIZZA tips in Discord via tip.cc!

All these APYs are tempting and the main reason why I have not invested in defi is because of security and so defi can be complex as well

Posted Using LeoFinance Beta

What does mean of this

Back in Oct. 2021 Pylon joined with Nexus to create a PSI token that would pegged to UST by bonding PSI?? What bonding ?

A Pylon Pool: https://gateway.pylon.money/tokens/psi

Straight from the site:

bPsi is what they called it but basically the PSI is locked for 24 months. Similar to how on popular Anchor protocol Luna can be bonded into bLuna and it takes 21 days to unlock bLuna back to Luna. In the Pylon Pool the locked PSI for 24 months so they went with bPsi-24m. How they peg the token to UST is creative. By getting the UST fund in the pool to help repurchase Psi in a 24 month duration they can sustain the yield and keep bPSI peg to UST until Oct. 31, 2023.

Wow the Terra Protocol seems to be expanding in popularity this is the 4th post I have read about it this week :-D