LeoFinance - Staking Versus Liquidity Pools

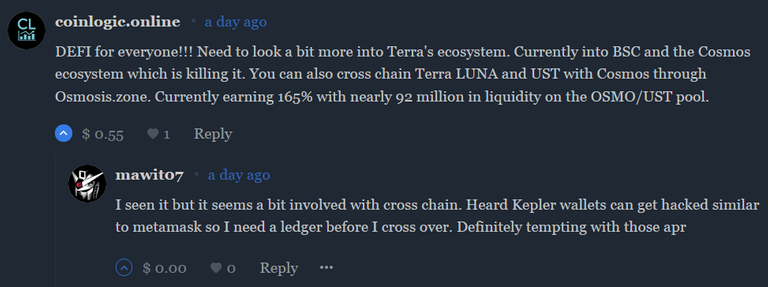

Yesterday after my post for close to 50% yield in stable coin I got a great comment from fellow hive user and responded casually.

After my initial response I ponder some more and then notice that over the course of my last few posts I did not emphasize the main reason why I was posting the specific yields I was finding. The curator's response is focusing on a liquidity pool that is different from staking. I think it all comes down to two ways of investing within Dex exchanges. We either stake or pool to earn.

In the posts I have made I have intertwine both staking and pooling but not explain which one I use to invest. In this post I want to explain each one in detail and the drawbacks of each. The key goal is to realize in my prior posts my goal was to keep the same principal while yield as much reward as possible.

Staking

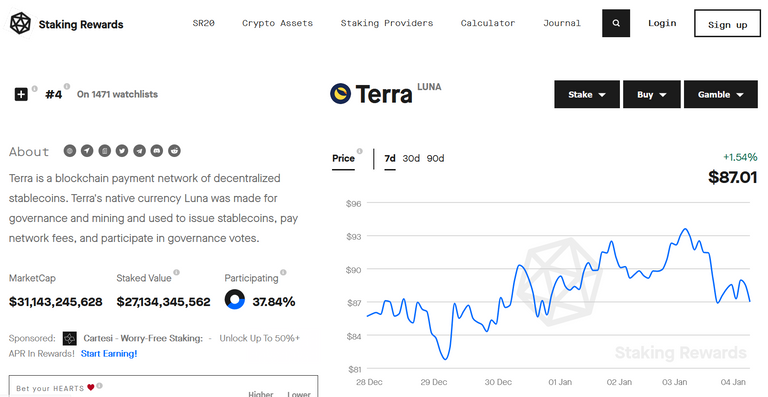

The most common way in cryptocurrency of earning is to stake. It basically means I lock up a specific coin/token and in return I earn rewards on the platform I am staking. All Ethereum users would know this as they are moving into ETH 2.0. While cryptocurrency has evolved so has the way protocols can stake their tokens. Within Terra blockchain there are many protocols with staking but at the core the native token Luna also has staking.

Staking Luna in the Terra Station wallet would allow the network to function and stakers earn rewards in the form of air drops. To unstake simply means to remove the coin/token from lock up and users will be free to move the assets where ever they please, but no longer receive any rewards.

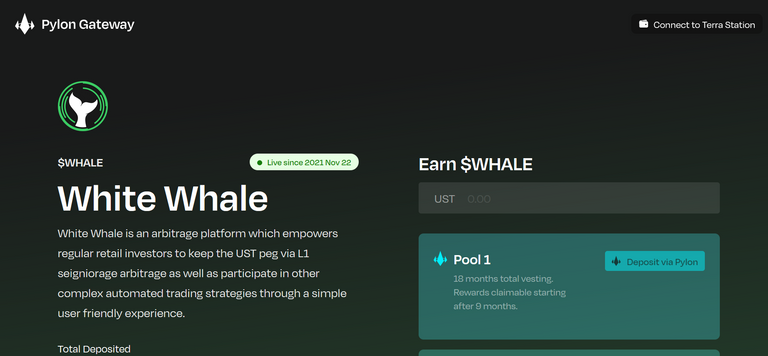

What some protocols have done are put duration terms on the staking. For instance Pylon protocol has pools where staking native MINE token for duration such as 3 months all the way up to 2 years will allow stakers to earn specific % APR in rewards. Of course the longer they stake the higher the APR. This allows platforms to maintain somewhat stable liquidity in their protocols in turn making the platforms sustainable in the long run.

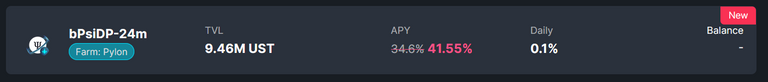

The biggest drawback with staking is that they mostly provide the low rates of return. Low as in single digit percentage to double digits. Still a lot better than a typical bank but in crypto world its mediocre. This is why when I spotted bPsi staking pool I was hooked! A pool that has a token pegged to a stable coin while earning close to 40% yield. (It was close to 50% as of yesterday so guess more people are staking in the pool.) Also easy to withdraw with no lock up time. How can I pass that up?

Liquidity Pools

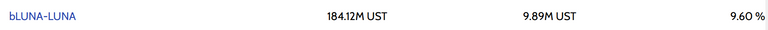

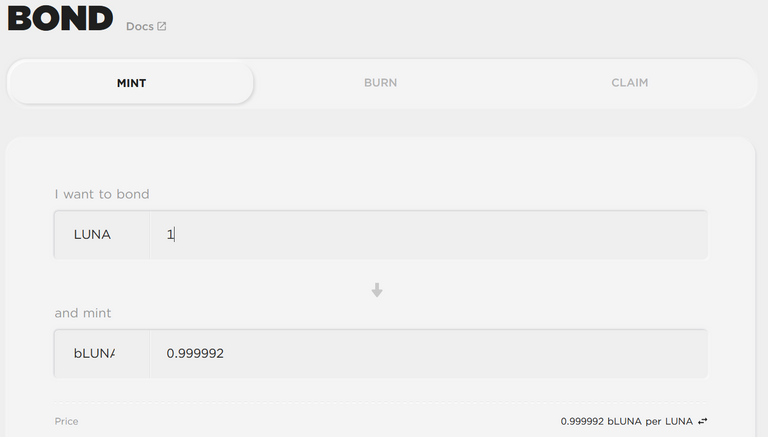

In another post of mine I had discuss participating in a bLuna and Luna liquidity pool on Terraswap protocol. The earnings were in Luna tokens but the rate at the time of the post was close to 25% APR. As of now it is under 10%. Yet I brought this up as a good investment because both bLuna and Luna are designed to be pegged to each other. The Anchor protocol is where people bond their bLuna in turn making Luna into bLuna.

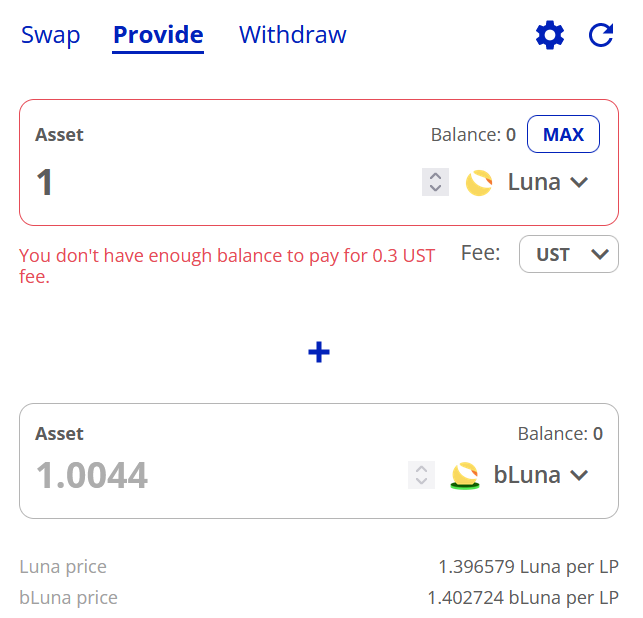

The moving parts within a liquidity pool is pretty clear once you realize how investors earn. When investing in a pair liquidity pool you put 50% of one coin and 50% of another coin at equal value in terms of $. That is providing liquidity to the pool. Then any time afterwards if someone else comes along and does a swap between those two specific coins you earn some of the fees that is incurred by the person who is swapping the tokens.

The beauty of swap pools is earning the fees when people need to swap in one coin for another. A major drawback to this is something called impermanent lose. The short answer of impermanent lose can be looked as you have the potential of losing a portion of one of your coins in the pool. Basic example if you partake in a BTC : USDT pool at $46,000. You then put 1 BTC and 46,000 USDT for the pool. BTC then shoots up to $50,000 while you are partaking in the liquidity pool. If you withdraw your liquidity you will not be getting 1 BTC but around 0.9 BTC while removing also 50,000 USDT. This is considered impermanent loss as you have less BTC even though you have more USDT.

The short of it is I try to look for pools where the rewards are high but the pair coins volatility in price is low before I partake in liquidity pool. This is so to limit impermanent loss. The bLuna and Luna is one example of a liquidity pool that interests me because I technically limited in impermanent loss because both are worth closely the same. However partaking in the pool I earn reward fees.

Conclusions

There you have it the examples and reasons I do stake or partake in liquidity pool. It can get very complicated but the bottom line really comes down to locking up coin/token or providing 50/50 of two coins to earn rewards. There are various other ways to stake and pool but I prefer to hold my principal as long as possible while earning as much yield as possible. Like Warren Buffet's old saying for investing, "Rule one is to never lose money. Rule two do not forget rule one."

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token

!WINE !LUV

Hi @logicforce, You Do Not Have Enough WINEX Tokens To Make Another Successful Call.

Please Stake More WINEX Tokens.

(We Will Not Send This Error Message In Next 24 Hrs).

Contact Us : WINEX Token Discord Channel

WINEX Current Market Price : 0.270

@logicforce(4/4) gave you LUV.

!WINE back

Congratulations, @mawit07 You Successfully Shared 0.600 WINEX With @logicforce.

You Earned 0.600 WINEX As Curation Reward.

You Utilized 2/2 Successful Calls.

Contact Us : WINEX Token Discord Channel

WINEX Current Market Price : 0.270

!PIZZA then

We should also keep in mind that when considering a strategy that it would be prudent to have a solid foundation of staked coins, before venturing out into other income opportunities, especially Hive. More Hive Power equals more power on Hive :-D