LeoFinance - Terra Luna Pool With +20% Rewards?

One of the main reasons that got me interested in the Terra ecosystem is the Anchor Protocol offering close to 20% APY in their stable token UST. Now as I dived into more of the ecosystem I believe I have uncovered a hidden gem that not many are talking about.

Once you purchase some Luna there are multiple ways to earn passive income. The most well known way to earn is staking the Luna on the ecosystem's main wallet, Terra Station. The average APR is around 7% when you delegate it to a validator and they stake your Luna.

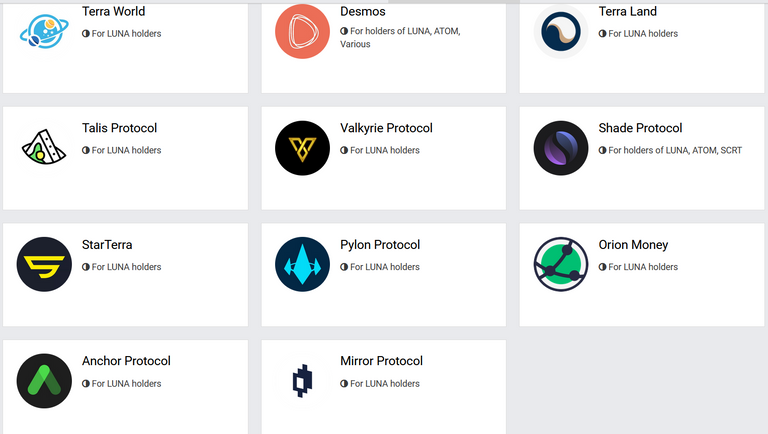

What is interesting with this form of staking is the user is earning its APR on air drops as well as Luna. That is certain terra protocols will provide airdrops of their native token to all users who stake Luna toward the ecosystem.

Some of the past and present tokens that have been airdropped for Luna stake holders are shown above. The longer you stake your Luna the more airdrops you will receive. There are over 100 Terra protocols coming out in 2022 and some will potentially be providing airdrops too.

Terraswap

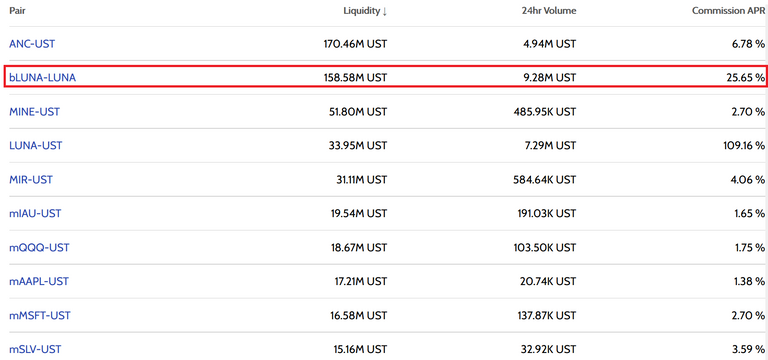

Now stopping with the tangents I would like us to look at swaps on Terra. Specifically Terraswap.io For those aware swap pools are lucrative when rewards earned from swaps are plentiful. On Terraswap it maybe so for the bLuna : Luna pair.

Based on https://alpac4.com/terraswapdashboard/ currently if you provide liquidity for the bLuna and Luna pair you will be earning close to 25% APR. The rewards are basically in bLuna and Luna as you are collection the fees from partaking in the pool. Amazing isn't!

One may notice that the Luna : UST pair pool is over 100% and why I wouldn't recommend it? If assuming Luna could potentially go a lot higher the UST earned from this pool may not cover the pace of Luna rapid rise in value. Just look at 2021 where Luna went from $1 all the way to over $100! Hence I would only recommend using the pair if you assume Luna prices are where they will be in the future.

The focus here is that bLuna and Luna is providing you over 25% per a year in Luna for almost no risk is simply too hard to ignore. The fact that APRs are not listed on Terraswap is something hidden from general public hence I would believe this sort of yield will remain stable for some time.

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token

This great info dude. I might be able to get some Luna in February but we will see. I have people asking me about Luna believe it or not and your information on posts like these is very valuable! I appreciate your hard work on Hive and staying so consistent with your informative posts!

Do you think that the dec:hive pools are better until airdrops for sps stops?

I recommend avoiding pools with hive because it seems like hive has a potential to soar a lot. Pools are good only if you do not intend to use the liquidity but want to earn some extra dividend.

This pool is pretty sweet considering you can earn PIZZA token while play 2 earn to DEC in battles. Put it together and earn close to 100% APR in other tokens as listed on the right.

Before even trying to invest in Luna Pools go look at the Hive pools. No fees and daily rewards its the best liquidity pools out there in my opinion.

https://beeswap.dcity.io/

Yeah the pizza people are awesome people! I should look into getting some pizza and dec! Been waiting to see how low dec can get before getting back in! Thanks for the heads up!

That seems like a no brainer if you have LUNA. I guess you just have to pay the gas fees and withdrawal/deposit fees.

Posted Using LeoFinance Beta

gas fees is like $0.25 UST each way. It is not like ETH where there is a huge bottle neck for transactions and people trying to outbid one another to get their transactions through.

i agree. There is a lot of people that are refusing to get into crypto because of the excuse of gas fee etc. But because of that, they are missing a whole ton of exciting earning opportunities.

The hardest argument I get is volatility is too wild for many to invest. So I never discuss it to those who worry about volatility. Their risk tolerance is low and understandable. No point to change the way they invest if they can not handle draw downs.

I think this is more of a benefit to having higher volatility. It makes us put extra effort in finding projects we believe in and willing to invest in them long term. On Hive we have a chance to make it worth our wild by posting informative content all the while playing tons of play 2 earn games. This is the future and we are at the beginning stages with lots of potential.

!PIZZA !LUV

@logicforce(2/4) gave you LUV.

PIZZA Holders sent $PIZZA tips in this post's comments:

@logicforce(2/5) tipped @mawit07 (x1)

Please vote for pizza.witness!

Luna project is getting more interesting with the recent improvement.

What you mention about Pizza DEC is true and I currently hold some stake in this pool.

Peace

The article I read before this one, was about someone that was scammed by a liquidity pool promising +20% lol.

Please do not misunderstand I am not saying this pool is a scam, the coincidence is just crazy.

Reading about a person that was scammed by a profitable tool and then the very next article is someone that made a nice profit from a similar profit tool.

No need to apologize. I know what you are trying to imply and I promise I will not post a pool I never partake in. This one, Terra Swap, is one of the oldest on the blockchain so has proven history. The 20% APR is not consistent though.