LeoFinance - Why Be Bullish On Terra Blockchain?

If you have not taken a deep dive into Terra Blockchain you are in luck. Read this short post with most of the highlights and an overview of a coin. A coin that jumped over 1,000% in gains in just one year and see if it has more room to grow!

Stable Coin UST and Free Market Coin Luna

At the core of the Terra blockchain there are two native tokens in its operations. They are UST and Luna. In 2021 Luna had over 1,000% in gains due to the success of the Terra blockchain. This had to do in apart with UST.

UST is designed to be always trying to be pegged to the $USD. 1 UST = $1 USD. In simple explanation here is how UST is pegged to $USD. The Luna token is traded in the open market free to move in price. The more $USD it is worth the more UST can be created. Holders of Luna may seek to take profits if Luna rises in price. To take profits the Luna is burned and at the same time an equivalent $USD amount of is created in the token UST. In its simplest form the more Luna is removed from circulation the more UST is in circulation. The opposite is true where if investors seek to invest in Luna they burn UST to purchase Luna at open market prices. Therefore the more UST removed from circulation the more Luna is in circulation.

In essence both UST and Luna work hand in hand. If Luna is burned there is more UST and if UST is burned there is more Luna. All the while UST is always at a fixed price and Luna is allowed to move in price based on the open market. Last year the creators of Terra Block went to burning over 88 million Luna tokens, Refernce Here, and with that they created nearly 5 billion UST. Since then the UST has been in circulation on top of existing UST supply with a corresponding 360 million Luna. the Terra Blockchain remains in operation today holding UST pegged to $1 USD.

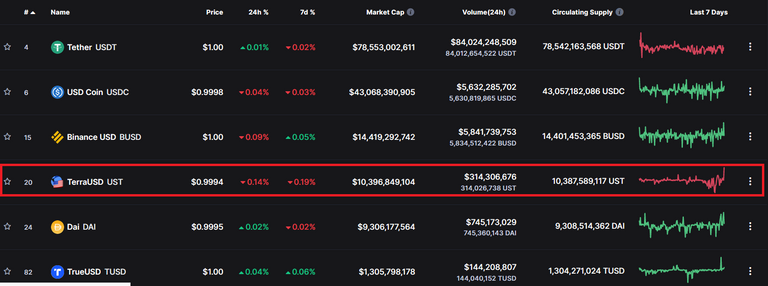

Stable Coin UST $10 Billion Market Cap

Last week UST became fourth highest in market cap in terms of stable coins and 20th overall in cryptocurrencies.

UST is currently traded on 21 exchanges. While leader of the stable coins USDT is on 126, USDC is on 60+ and BUSD is on 34. There is a pattern here. The more exchanges adopt and trade a stable token the higher the market cap. This is good news for UST bulls. Just a side note DAI stable coin is traded at 102 exchanges but it is still below market cap of now UST so it is not just how many exchanges traded that determines the demand of the stable coin. However it is still worth mentioning since demand is important to a rising stable coin's market cap.

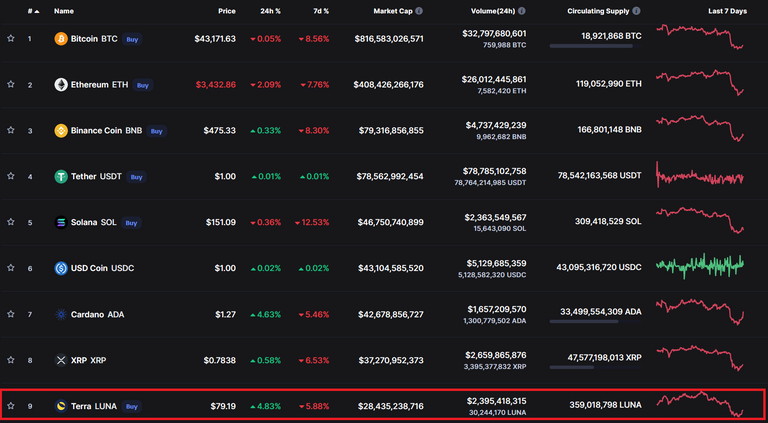

Luna Market Cap $29 Billion

As of today Luna market cap is under $28.5 billion and ranked #9 overall.

As mention in the beginning of the post Luna in 2021 rose over 1,000% in price. A major reason for such a price appreciation is likely the demand for stable coins in the crypto markets and UST is in demand. Again the more UST in circulation there will be less Luna. Mean while the higher the price of Luna the more UST can be minted. It all flows back to the supply and demand of UST.

Real User Cases For UST

The real demand for a stable coin comes at the heart of its use. If we have $USD used to purchase goods would it not be easily replicated with a stable coin? UST does exactly that and hence there is the demand.

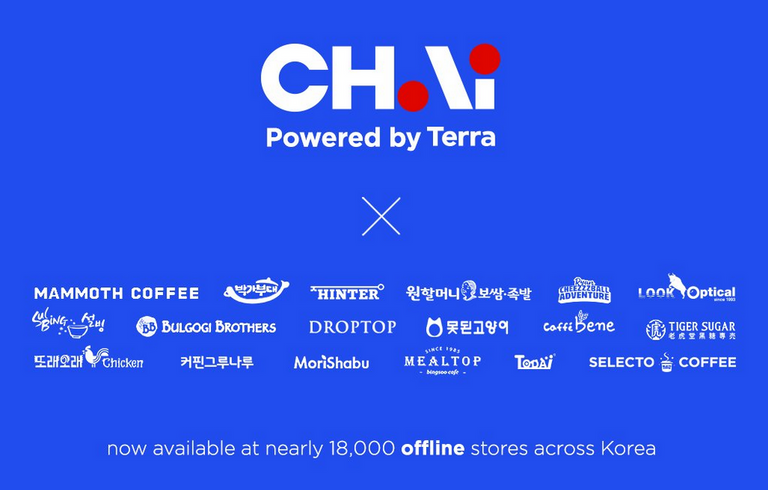

In South Korea currently there are more than 2.5 million users on an app called CHAI. CHAI is a portal to thousands of merchants who sells goods from non-durable, durable, to eatable. A full range of products offered by over 18,000 merchants.

Any merchant that makes a sale on CHAI can receive UST as payment. The best part is all merchants apart of the app will have open arms towards receiving UST. With UST pegged to $USD merchants and buyers have the comfort knowing what they hold will remain the same in spending power with the following incentives:

- Buyers can stake their UST on Anchor Protocol to earn 20% yield a year.

- Fast transactions are executed and validated within seconds.

- Merchants no longer have to pay fees or subscriptions to credit card companies such as Visa and Mastercard in order to receive payment from buyers.

Imagine such an application in the United States or even across the globe that accepts and transfers UST for goods and services. I can get a cup of coffee at Starbucks for $4 everyday if I stake 4,584 UST in Anchor protocol. Simple math I earn 4 UST in interest per a day on 4,584 UST. As long as Starbucks offers the coffee at $4 I can essentially have free coffee everyday for just staking 4,584 UST. If only CHAI was in the United States and Starbucks was a merchant on the platform :)

Conclusions

Hopefully this post was not too long and also help you in understanding Luna's current market price and the rise of stable coin UST. At the core of the Terra Blockchain there are only two tokens that matters the most. Luna and UST. The price of one is controlled by the free market while the other one is pegged to $USD respectively. All the while it plays a supply and demand game while appreciating in $USD value and user cases.

What I did not mention is neither Luna nor UST is backed by any goods or services. It is simply a blockchain running the transactions of the two tokens. The key is how much demand and supply there is for either of these tokens. If the blockchain was to fail it would be when no one is willing to trust in its use. Lose user base will in turn lose market cap. Yet in the real world many of the current fiat currency we all so trust and use are also backed by nothing. Like the $USD reserve currency. Time will tell if UST can become what $USD is today.

To learn more daily activities of Terra Blockchain please follow their twitter account Link Here.

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token

!LUV !PIZZA

@logicforce(4/4) gave you LUV.

That is really interesting spending so much time on Hive, I tend to forget there are other blockchains out there.