Markets Have Significant Pessimism

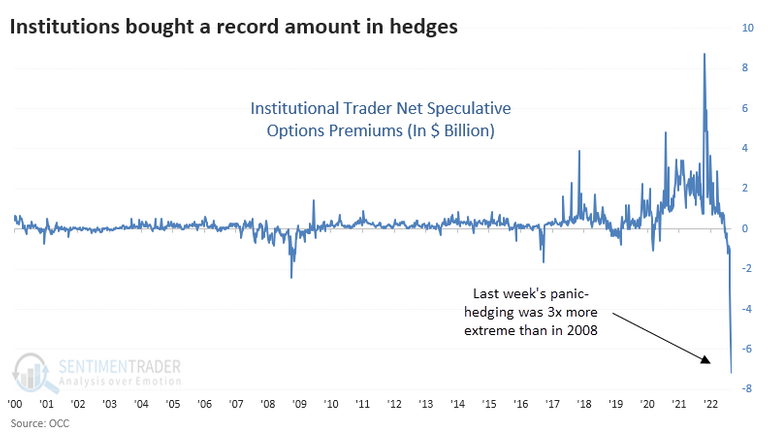

Front chart of blog post is courtesy of SentimentTrader Twitter Handle and it shows the current state of option premium placed in the markets by institutions. For a bit more clarity and significance of this chart we first talk about what institutions in trading markets are.

Institutional Investors

A general definition of institutional investors:

a large organization, such as a bank, pension fund, labor union, or insurance company, that makes substantial investments on the stock exchange.

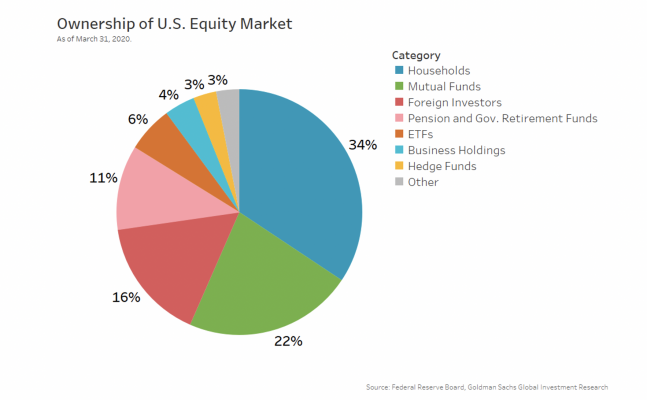

Take a step further in US stock markets institutions hold approximately 60% of all stock shares. Chart below from Nasdaq has a breakdown of stock ownership. In any case institutions have a significant sway when it comes to their positioning in the markets.

(Courtesy of Nasdaq.com Article)

Record Level of Institution's Put Options

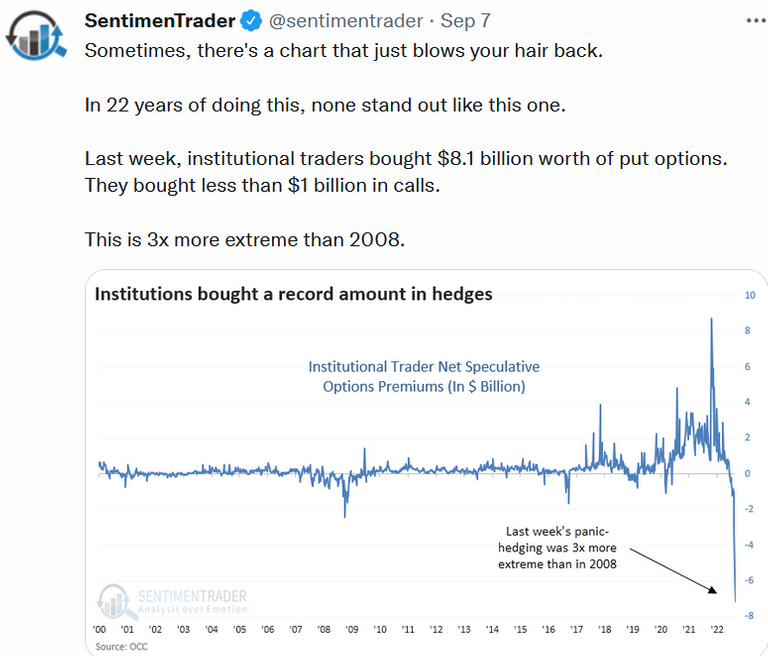

(Courtesy of SentimenTrader) Go follow SentimenTrader Twitter Handle

As latest data coming out today in regards to institutions buying hedges they are purchasing 8 times more puts than calls. For those not aware what hedges are then consider them as insurance policy bought to cover the direction they expect the stock prices would go. For purchasers of puts the insurance is to cover stock price drops, while purchasers of calls would be earning more for stock price increase.

In the case of today the institutions appear to be pessimistic as it has added significant amount of puts, 3 times as much as 2008 peak in regards to insurance of stock prices going down. Such amount of bought appears to be solid convection that markets will in the near future be in for a significant down turn.

Hedging For Downside in Indexes

An expert in hedges, Cem Karsan, today took a interview to explain what he believes to be happening based on the massive institutions purchases of puts. I would summarize the points here but for those interested in the interview link provided here.

- Sentimentrader's chart is illustrating calls and puts purchases in the order of magnitude 50 contracts or more. This does not mean they are institutions purchases.

- In addition the chart is based on calls and puts from individual stocks, and not where in the biggest trading stock S&P.

With these two points Cem is concluding the large put buying are speculators trying to front run the overall market in the near future to the down side. This does not mean markets will go down, but there are signs that it can easily fall.

Items Cem lists as to why markets are more likely to fall.

The straight out put buying on individual stocks right now is very similar to 2020 when it was straight out call buying. Back in 2020 markets roar upward creating a positive gamma squeeze. Now we have the opposite setup so there can potentially be a negative gamma squeeze. History does not repeat but rhymes.

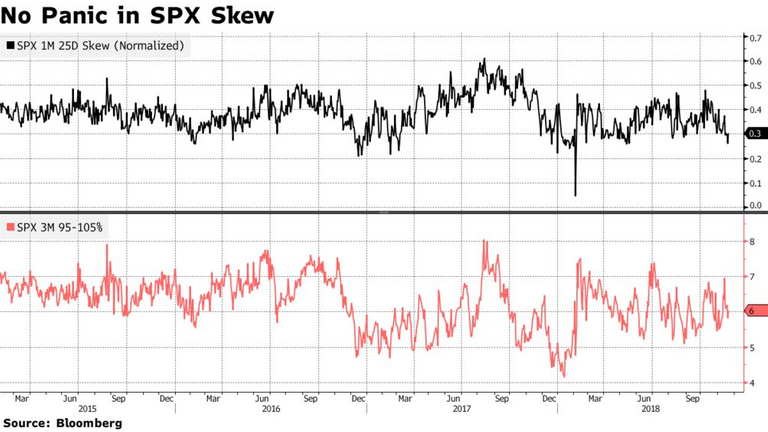

The hedging with largest equity in the market, SPX and SPY, are lack luster at best. Skew which is a ratio of puts to calls is at a yearly low, which indicates there are not a lot of puts in SPX and SPY. These trading vechicles are the largest in the market and most likely held by many institutions. For them not to be hedge leads to potential that if markets do see a negative gamma squeeze the selling within SPX and SPY will be more pronounced since there is not a lot of puts to support prices.

(Courtesy of Bloomberg Article)

- FED continues to be adamantly hawkish and expects to continue performing quantitative tightening and increasing borrowing rates. All this is a sign of going against the stock market bulls.

Conclusions

Sometimes stating the too obvious in the stock market will likely mean the opposite will happen. Through this post I have listed the alarms and warning signs that a market drop and even crash may happen, so would you believe me?

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token

!PGM Reblogged cause you are awesome, has anyone told you that today?

Thanks for your information.

This is great analysis and stats

I believe that it is possible for a crash or drop but a relief rally will happen first as they want to trap people first. The indexes have gotten 2 green days in a row and I wonder if the bears will smash it down tomorrow to make that weekly candle look nasty.

Posted Using LeoFinance Beta

Certainly anything is possible with the stock market. If we knew for certain of outcome we would all be rich !LOL !WINE

Congratulations, @mawit07 You Successfully Shared 0.100 WINEX With @jfang003.

You Earned 0.100 WINEX As Curation Reward.

You Utilized 1/2 Successful Calls.

Contact Us : WINEX Token Discord Channel

WINEX Current Market Price : 0.164

Swap Your Hive <=> Swap.Hive With Industry Lowest Fee (0.1%) : Click This Link

Read Latest Updates Or Contact Us

Thank you for your witness vote!

Have a !BEER on me!

To Opt-Out of my witness beer program just comment STOP below

View or trade

BEER.Hey @mawit07, here is a little bit of

BEERfrom @isnochys for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.