Real Economy Drop Spilling Over to Stock and Crypto Markets?

For those with short term memory loss the reason we are currently seeing inflation all over the real economy is based on the central banks actions. Two years ago right when the global economy went into lock down the FED and other central banks took action to support the financial markets and real economy.

What they did was mainly increase the supply of fiat currencies in the hopes to weather out the impending slow down with the lock down. What really happened was the slow down was temporary while the lock down got removed came the demand. On top of that facing multiple challenges in globalization the economies across the globe had trouble keeping up with demand with the supply chains. It got exhilarated when specific industries were effected dramatically due to lock down such as the microprocessor chips.

With the real economy having too much excess of fiat currency a lot of industries expanded at rapid rates.

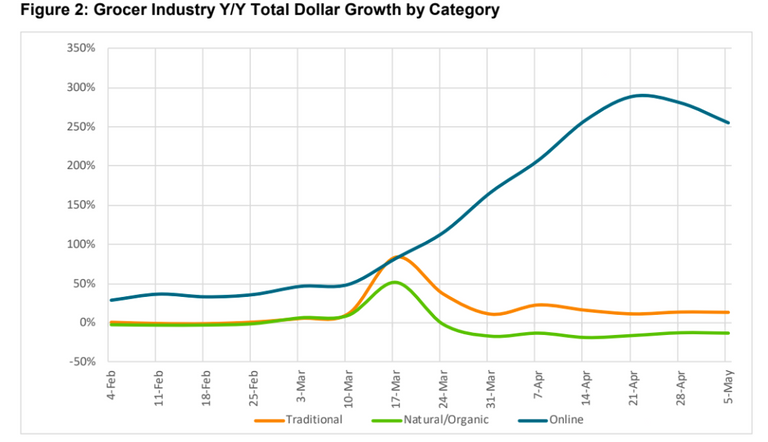

Online sales grew rapidly as eCommerce found itself having to expand to handle the demand. Amazon was planning to expand its warehouse footprint across the globe to support the demand. Yet something happened in between the reopening and current state of the economy. Something that happened showed signs the rapid growth was not only slowing but shrinking.

Amazon reportedly is looking to shed at least 10 million square feet of excess warehouse space and perhaps as much as 30 million. The company apparently over-expanded during the surge of online shopping around the peak of the COVID-19 pandemic.

With the latest financial report out from Amazon they disclosed the decrease in warehouse space due to expanding too much beyond what they have expected would be online shopping growth. So did the reopening meant retail stores were getting more sales due to higher foot traffic?

Washington Post article on Target having too much inventory:

“Goods should become an increasingly less important part of overall spending and consumption going forward,” said Kate Moore, head of thematic strategy for global allocation at BlackRock. “We are seeing consumers go back to their previous spending habits where services were much more important to their overall consumption basket.”

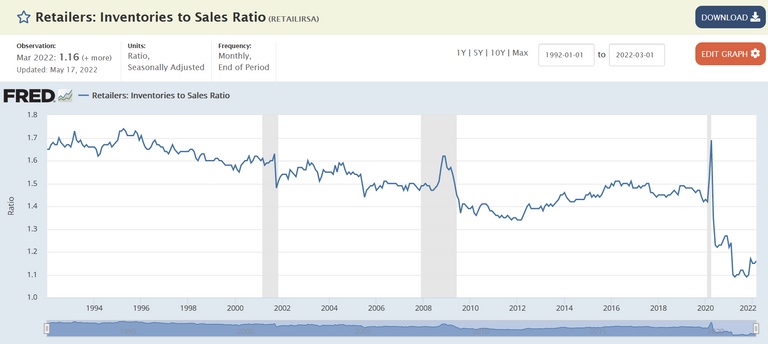

The government data of retail inventory to sales ratio has been free falling after the USA economy started reopening. This means the demand for goods have been rising while actual goods being held on to by retail was decreasing, except at the start of 2022 it has begun to rise again. The data is lagging and since early 90s the retail inventory to sales has been over 1.5 with a slight down trend. What happened during every dramatic drop was a recession as the chart shows in the gray area.

Long story short the 2020 short lived recession due to the lock down was saved by the central banks actions at the time. During that moment a lot of liquidity was supplied to support asset prices and in a short term it took out a lot of the inventory that was being supplied for over the past three decades. Yet the real economy was not qualified to have a recession that started and ended in two quarters.

Conclusions

The real economy is adjusting to what the central banks are doing. It has always been struggling since the lock down was initiated and it has been struggling to keep up running. Central banks knew this would happen and needed the economy to run overheating so to weather the troubles of the real economy. It worked but only temporary.

For you see the inventory to sales ratio dropping meant the real economy would fall in hard times. Hence it trickled into the stocks and crypto markets. Yet while the economy is now cooling off is the time where supply is needed the most. This is why oil prices and inflation as a whole is rising. The demand for goods are still there and with inventory out of whack it has become a headwind to the economy. But as a whole we are likely near the end of this headwind since during good times inventory to sale ratios should be rising. Building more means more jobs and in turn more money.

Cryptocurrency may have peaked in early November of last year 2021, but the rapid decline may also have ended here as the signs are leading me to believe a larger need for growth is coming in the short term. The central banks had caused this roller coaster of a ride in asset prices. Which side do you think asset prices end up?

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token

👍💪🇦🇷

The price increases are outpacing the wage increases so it was bound to spill over eventually. Without discretionary spending, retail money would slow down.

Posted Using LeoFinance Beta

So true. Consumers are living on borrow time as credit card spending is on a rise. Big picture if consumers stop spending the USA economy will be in a world of pain.

!LUV !PIZA !LOLZ

Posted Using LeoFinance Beta

@mawit07, @gillianpearce(2/4) sent you LUV. wallet | market | tools | discord | community | daily

wallet | market | tools | discord | community | daily

lolztoken.com

It was a knick knack paddy whack.

Credit: playbyhive

@mawit07, I sent you an $LOLZ on behalf of @gillianpearce

Use the !LOL or !LOLZ command to share a joke and an $LOLZ

(2/4)