Terra LUNA and Anchor ANC Crashing. How To Trade?

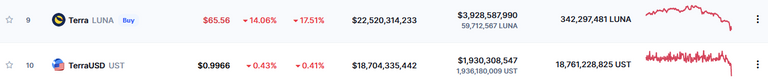

If this pass week was not bad enough for the bulls Terra chain's top tokens LUNA and ANC have seen more downward pressure on prices. Even more so than other cryptocurrencies.

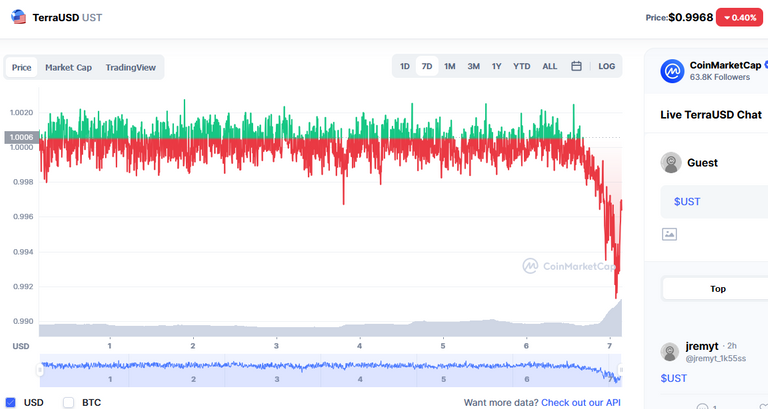

There is a slight de-pegging going on with UST that can be factored into why LUNA is falling.

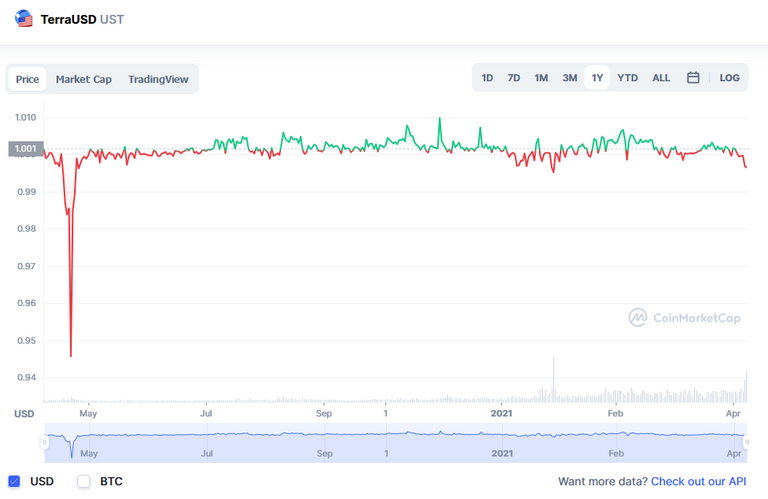

But its all relative since UST is off less than 1% from its peg. Looking back last May 2021 it was far worse which included a significant draw down in LUNA.

UST last May was off over 5% at one point. This is still in the early stages therefore we can not assume UST will not drop another 5% from here, but for now good signs that it is holding up well.

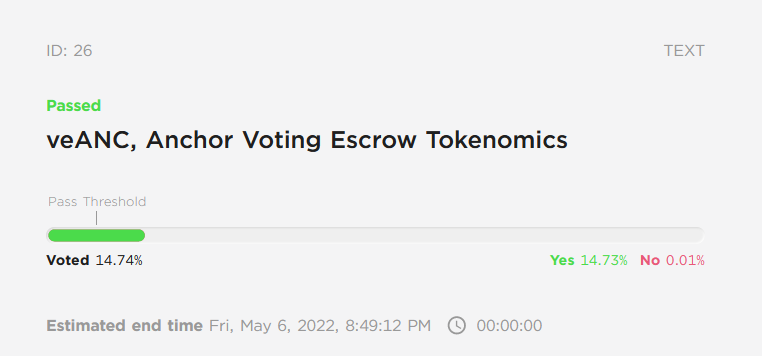

Both LUNA and ANC have lost around 20% in just one day. LUNA fall maybe caused by the UST un-pegged while ANC maybe due to the end in FOMO since the veANC proposal was just passed as of yesterday.

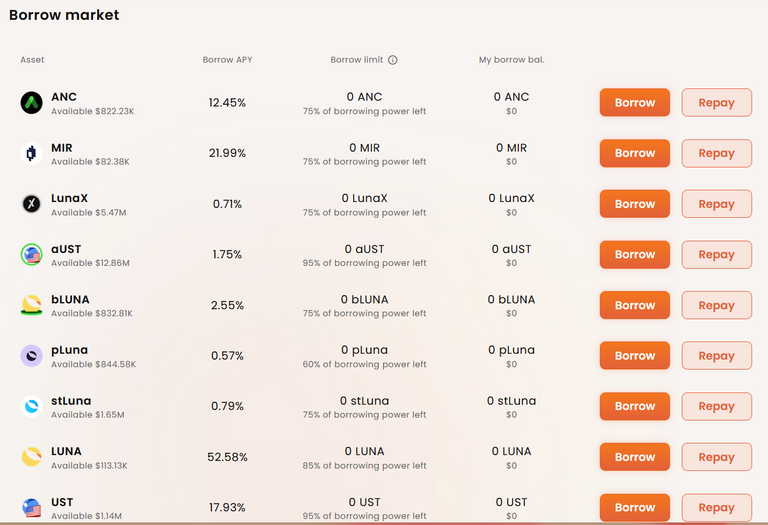

The question now is how to handle the price fall if you and I were invested in either LUNA or ANC. For one you can try Edge protocol to deposit LUNA as collateral and borrow against it. The borrow LUNA can then be use to purchase UST and stake the UST to earn a yield. Meanwhile if LUNA remains the same price or falls further you can buy back the LUNA at cheaper price. The arbitrage in price difference will cover some of the falling price in LUNA therefore mitigate some of the losses.

Another option is strictly going to stable coins and yield farming stables. This of course lives me out of potential run ups if LUNA flips positive but it will mitigate losses that could exist if and when LUNA continues to fall. I would not prefer to use this method since it will require some timing toward getting in and out of the trades to benefit from current price movements.

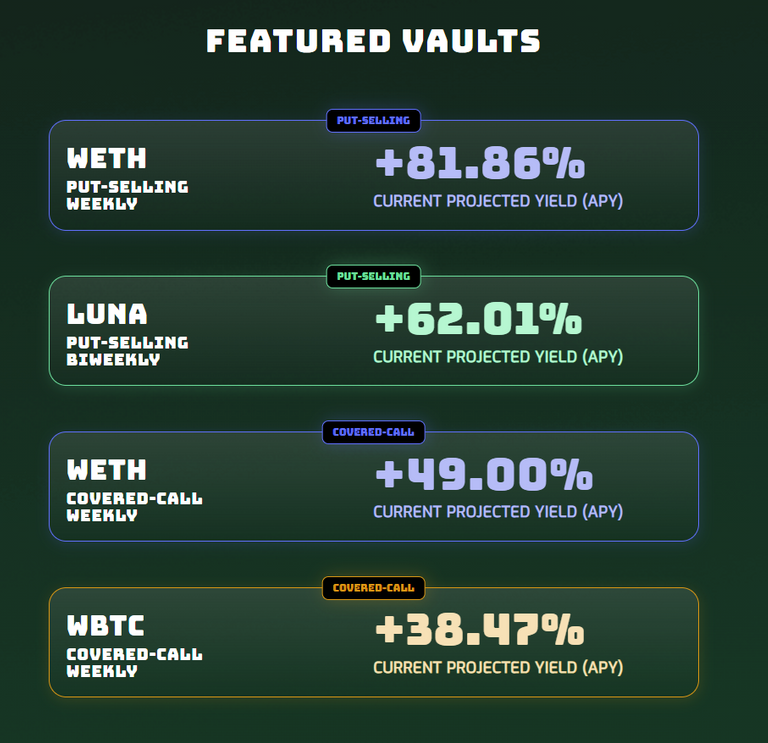

A third option is to short LUNA through perpetual swaps or leverage trades on centralized exchanges such as Binance and Kucoin. This option is likely the most risk out of all three because in this form of trade you position your assets in anticipation that LUNA will fall further. It is the option where you are trading for price to go lower.

Conclusions

We discussed three options to hedge against a crypto down fall and specifically here LUNA. Recap option 1 is to use your current LUNA holding as collateral and borrow against it the LUNA in anticipation to return the borrowed LUNA at cheaper price. Meanwhile using the borrowed LUNA to be used to collect interest. Option 2 is to sell assets or find ways to hold more stable coins to ride out the price dips. Option 3 is to bet on further price drop in LUNA either by trading leverage short positions or purchase puts and put spreads to earn profit of LUNA fall below strike price.

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token