Venture Capitals Rushing Into Cryptocurrency

This week Bitcoin and many Altcoins have been able to sustain a price rally from a massive dip over last weekend. The demand for crypto is real and today we take a look at one group in particular that is very bullish on crypto, Venture Capitalists.

Venture Capitalist Starting Crypto Funds

Marc Andreesen's (Courtesy of www.ft.com)

Andreessen Horowitz venture capital firm is planning on rolling out a new fund that it wants to take in $1 billion dollar in investments. The firm already has two successful funds and the demand is proven by the amount of $'s investors are willing to invest into Andreesen. For instance their second fund which had a set goal of taking in $450 million turn out to take in $515 million.

Set date for Andreesen's third fund has yet to be unveiled but already other VCs are hopping on the bull run in cryptocurrency.

Large VC investments in Crypto Already Double from 2020

(Courtesy of theblockcrypto.com)

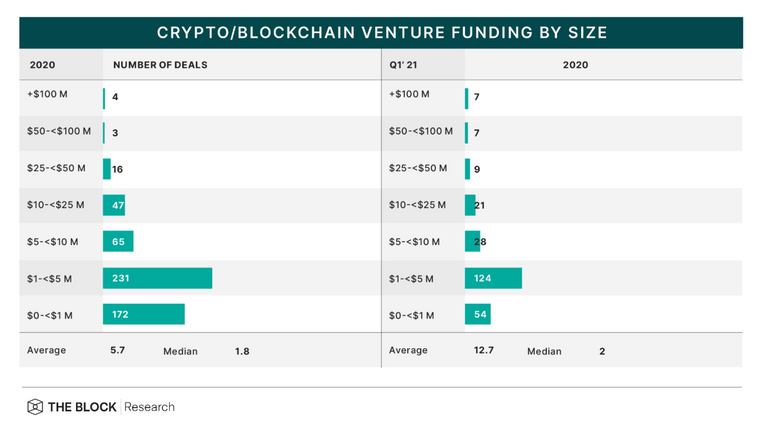

Comparing all of 2020 to the first quarter of 2021 there has been an increase in average VC firm's capital intake used to invest in cryptocurrency. From $5.7 million average for 2020 to now $12.7 million in just the first quarter of 2021. What is even more noticeable is that 2020 there were 7 VC deals at $50 million or higher but in first quarter of 2021 alone there are 14 VC deals at $50 million or more. These are signs that demand to invest in crypto is continuing higher even though BTC is near all time highs.

Look for VC to guide Cryptocurrency Investment Sentiment

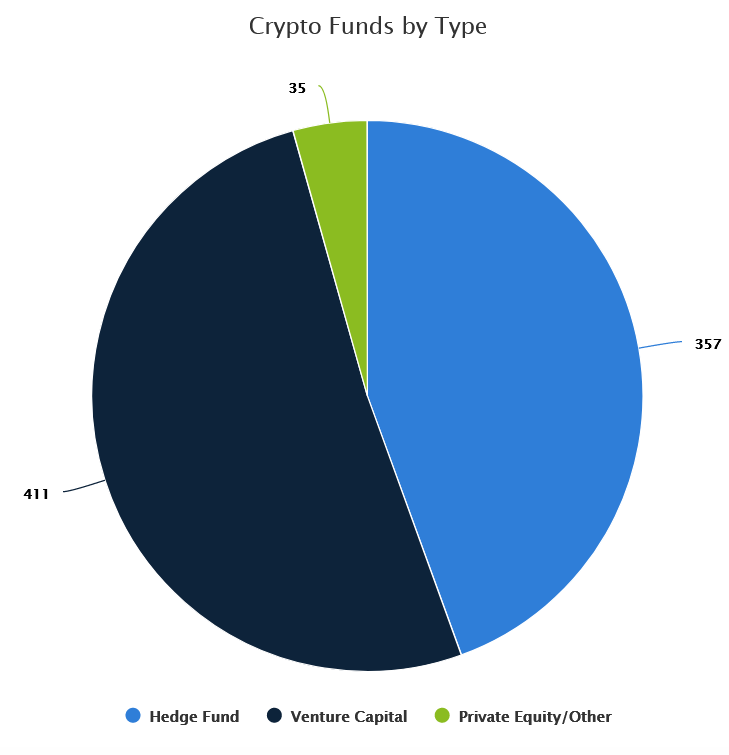

It should not be overlooked that although not your average Joe can invest with a VC the among of capital VCs have invested in crypto, based on cryptofundresearch.com, there are more VC firms investing in crypto than institutions and hedge funds.

Venture Capital funds had lagged in past years and only recently took a lead over hedge funds. To claify not all readers maybe aware the major difference between VCs and hedge funds is that VCs are basically bullish on their investments while hedge funds can either be bullish or bearish.

VC investing is Only Bullish for Crypto

Venture Capital investing in crypto related firms are in it to see crypto prosper. This type of investing reinforces the crypto market with additional assets. Whether in the short term crypto prices drop or not the long term goal for VCs is to have their investments grow into profitable entities. Bottom line more VC investment is only going to be bullish for crypto.

Thanks for reading.

The Block Crypto Source Article

Coin Telegraph News on Andreesen's VC Source Article

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token

!wine and !LUV

Hi @mawit07, you were just shared some LUV thanks to @logicforce. Holding 10 LUV in your wallet enables you to give up to 3 LUV per day, for free. See the LUV in your wallet at https://hive-engine.com or learn about LUV at https://peakd.com/@luvshares

Thanks !wine and !LUV

You cannot send the token to yourself.

Yay! 🤗

Your post has been boosted with Ecency Points, by @mawit07.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for Proposal

Delegate HP and earn more