Bitcoin and Gold Rise and Banks Collapse

Bitcoin and Gold Rise and Banks Collapse

We're in the midst of another 2008 Financial Crisis and despite being told interest rates will lower you need to be prepared for when and if they don't. If 2008 taught us anything it's that the current financial systems are vulnerable and it's the people that suffer the most.

It's why in 2008 Bitcoin launched as an alternative to the current financial system as we approach the 15th year of Bitcoin it is working as intended and you would be hard pressed to say otherwise. If Bitcoin was going to fail it would have done so within it's first three years however, the market remains strong and people retain faith in the digital currency.

Bitcoin has long been promoted as a hedge against inflation and a store of value and while there have been Bitcoin loyalists and many making these statements it hasn't really been put to the test until now.

Bitcoin Rises in time of financial turmoil

Despite the Banking system collapsing we've seen a spike in Bitcoin prices within 24 hours at time of writing Bitcoin has increased by over 9% show casing the digital assets preferred option as a hedge not only against inflation but a store of wealth within an economic crisis.

It's not all good news though as Binance halts withdrawls to UK investors amidst further financial instability. With a number of banks collapsing and funds frozen this could also be what's putting a halt to Bitcoin price drops as many simply can not exit their positions, so caution must be taken in the current environment.

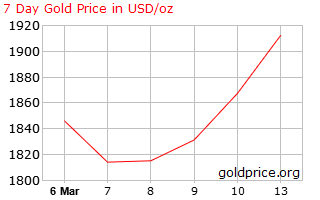

Gold Price Rally

At the commencement of the Bank collapses we saw a rally on the price of Gold after suffering a dip last week Gold has returned to it's charge towards the $US2000 mark which many had been reporting Gold would reach.

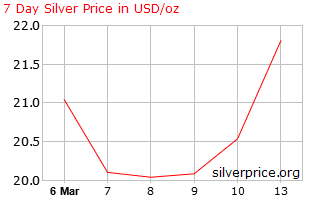

Silver Spike

Silver has had a sharper rise than gold being on the more affordable end of the investment scale a lot more people could have potentially focused their finances on the Silver market.

With Silver being used more so in manufacturing it could be foreseen as a safer investment as the overall market will continue to purchase Silver to continue mass scale production of goods.

Gold has been the better performer within the last 30 days having a 3% growth and the 6 month change has seen a 15% rise just a little more than the price of Silver.

Market Turmoil

While the end of last year and early on this year was a focus on paying down debt it appears that a number of banks undertook some high risk investments which have once again caused a spiraling financial impact.

US and UK Governments have already stepped in to attempt to prevent further damage being done to their economies but will this time around be any different to the previous financial crisis.

Stay strong all, it's about to get rough and heavy!

image sources provided supplemented by Canva Pro this is not financial advice and readers are advised to undertake their own research or seek professional financial services.

Posted Using LeoFinance Beta

https://twitter.com/1291387911238086664/status/1635794019942010880

The rewards earned on this comment will go directly to the people( @melbourneswest ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Diversification is the name of the game! I think a lot of people keep thinking the Great Depression 2.0 but far more people are diversified these days than in the early 1900’s.

The uncertainty in the market is definitely there and it's evident with everything going on. Honestly, I am unsure what will happen in the short-term though because there is just so much happening. I just don't think the government can completely stem the damage caused by the bank runs.

Posted Using LeoFinance Beta

seems to me a first clear sign of how the financial world is changing

Posted Using LeoFinance Beta

My trust in banks has broken a long time ago and I'm happy to see that others are getting the same image about them as me... When people realize how our "traditional finances" are rigged and those who make the life-changing, important decisions have no idea what they are doing, happens what happened in the last couple of days...

You don't need TRUST if you OWN Bitcoin, and the same goes for other hard assets, like gold and silver...

I have picked this post on behalf of the @OurPick project which will be highlighted in the next post!

This is what BTC was made for it's going to be interesting to see how it plays out

Agree and it looks like it is finally working, Wonder if we will breach 100k this year

I think it's fairly likely, the year is still young 😂

Are you ready?

Posted Using LeoFinance Beta

I have a small collection nothing major and been paying down debt. Would love to have a lot more. Ah one day.

Its about to breach this week!