Gold rises as more banks struggle here's what happened

Gold rises as more banks struggle here's what happened

Good morning Lions I trust you're all safe and well these are turbulent times as we're in for a massive market correction as the economy returns to precovid times. You might recall my article at the start of the year In 2023 Liquidity will be king. The first financial quarter is almost over and we are seeing the truth behind how important liquidity is and it's damaging impacts when it is low. The Crypto sector isn't the only sector at risk of collapse.

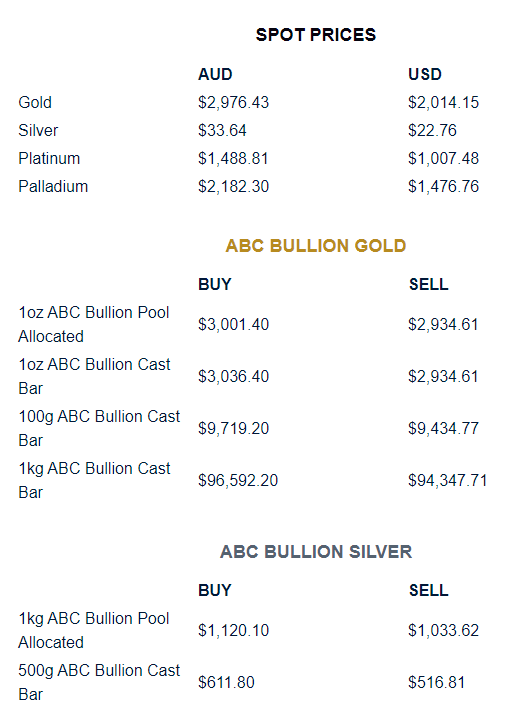

Gold surges passed $US2000 per ounce

While we experienced a decent dip in precious metals this was mainly brought on by banks selling their holdings to meet liquidity issues and has since recovered and now breached the $US2000 per ounce mark.

I don't think we will see gold drop this year until maybe December or Feb next year as interest rates continue to rise to battle inflation. Although the method sounds like a good one it is also adding to the liquidity issues and causing further financial crisis that will create their own problems in the 2024 financial year.

.jpg)

How did we get here?

During COVID the tech sector reached new all time highs as the sector pivoted to work from home and a heavy reliance on tech based businesses. This meant a large amount of deposits came into banks that specialised in technology such as Silicon Valley Bank.

The issue that arose for the banks is that they didn't have enough placed to invest the large amounts of deposits they were getting. Banks make money typically by lending out your money, for example say you deposit $1 in a bank the bank than lends that $1 to someone else through a loan. They charge interest which pays them and provides you a small return.

If a bank can't or doesn't make money off the money deposited the begin to suffer a loss as the cost to manage funds outweighs the profit. So the banks turned to Government bonds.

.jpg)

Bonds at a loss

Bonds can be a safe investment option but they can also be extremely risky as they have come to proven. As bonds have a "maturity" time period which is the length of time you must hold a bond for to gain the profit. Bonds were paying 2% interest for 10 year maturity, which is a safe bet at the time given interest rates were low.

You can always sell a bond to the market to release your gains earlier if the demand is high for the bonds. But this is where the trouble has hit the banks caused by the worlds Reserve Banks.

.jpg)

Bonds and Interest Rates

With the never before seen aggression of lifting interest rates by Reserve Banks this alters the return on investment (ROI) for new Bonds. With every interest rate rise so to is the profit for new bonds. Meaning previous bonds become worth less than newer created bonds.

This isn't always bad as these create varying price points for investment but given interest rates have grown so much in so little time they ultimately destroy previous bonds.

While many depositors began withdrawing their funds as the economy switched back from a "work from home" to "return to work" and now previous investments that suffered under lock downs were returning it provided cheaper entry points for investors.

Banks than need to sell the bonds at a loss to ensure they have enough liquidity to pay out depositors and unfortunately, they don't have enough money because they too are waiting on people to repay loans.

In short, the bank can't pay you your money because they don't have it.

Whose fault is it?

Governments for wanting a quick return to office without budgeting and planning for the financial implications and lack of a transitional phase. RBA for rapidly raising interest rates without giving the financial sector time to recover, people withdrawing and selling off assets to pay down debt due to the rapidly increasing interest rates.

I think the full brunt of the economic crisis won't be felt until 2024, hang tight. But in the mean time watch the price of Gold sore as people look to store their wealth somewhere. It will than come crashing down, to what? no one knows.

image sources provided supplemented by Canva Pro Subscription. This is not financial advice. Readers are advised to undertake their own research or seek professional financial services.

Posted Using LeoFinance Beta

https://twitter.com/1291387911238086664/status/1637627527681441793

The rewards earned on this comment will go directly to the people( @melbourneswest ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Congratulations @melbourneswest! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

Support the HiveBuzz project. Vote for our proposal!

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

I think the increase in price has more to deal with the confidence in the dollar due to bank failures instead of the interest rates. The Fed is already trying to hint that they are not going to raise the rates as high anymore because the unrealized losses for the banks are quite dangerous. The liquidity crisis is bad and the banks don't really have anything they can do to completely solve this.

Posted Using LeoFinance Beta

Banks that are sitting on low interest bearing T Bills are in trouble when deposits begin fleeing. So the question is which banks and how many?

It appears to be mainly focused on tech banks as their profits massively spiked during lockdown.

But no doubt there will be a lot more banks caught out if they aren't already starting to sweat they will be

Better regulations is needed in the financial markets to many scammy derivatives and over use of leverage these banks are greedy and this happens way too often

I'm hearing so many ads for silver and gold... people are spooked and need to spend that money they pulled from the banks on something to preserve wealth. Why not something shiny and with weight that's been "money" for thousands of years? You know, that "lawful" money that used to be mentioned on our fiat notes.