Mirror Finance- Terra Network

Good morning lions I trust you have been safe and well and BUIDL your portfolios.

Today we're taking a look at Mirror Finance which is a Decentralised Finance protocol on on Terra (Luna). It trades under the name Mir and can be located Here

MIR is a different kind of Decentralised Finance protocol which doesn't deal in Cryptocurrency or tokens as such. Although you can find Terra Tokens such as Anchor on the chain for staking but that's not what it is renowned for.

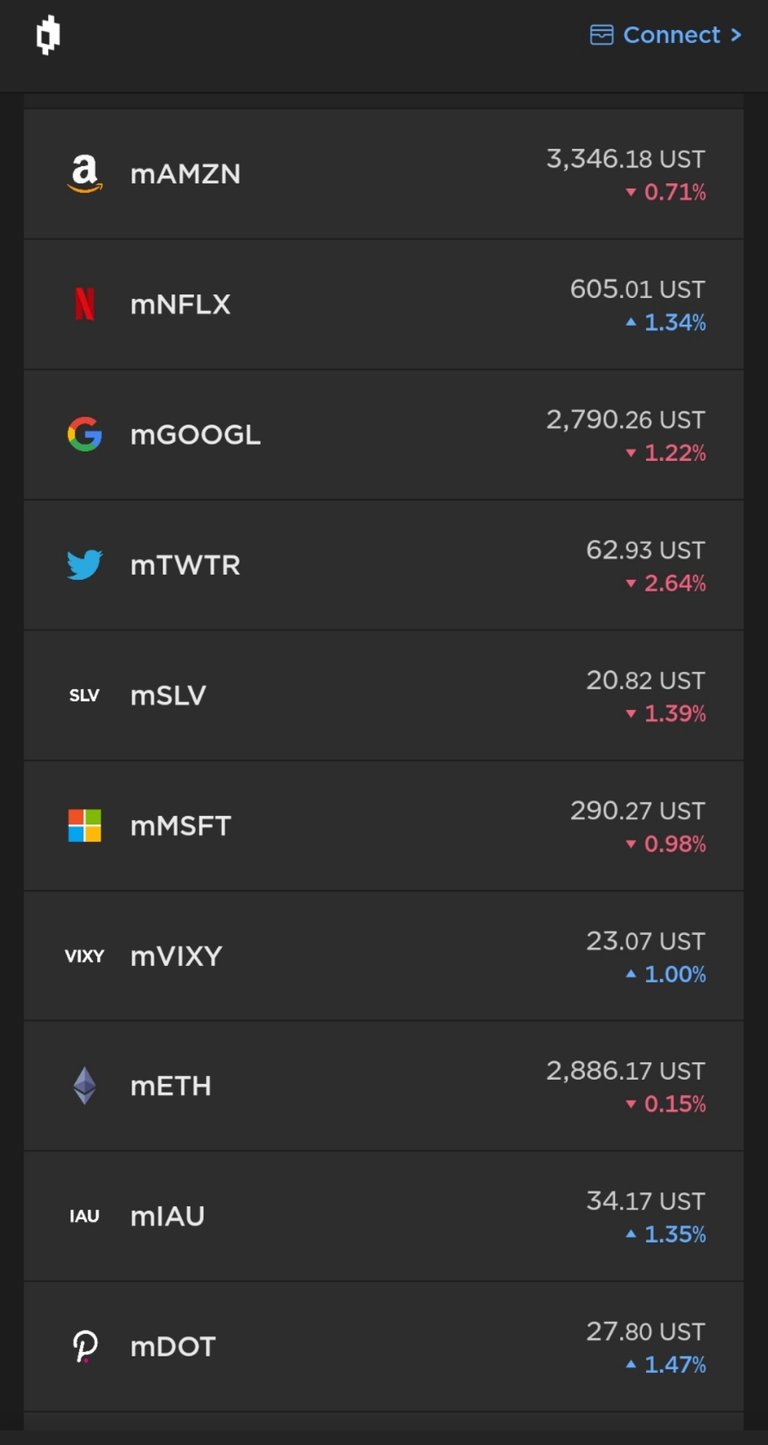

Instead Mirror Finance tracks real world assets being stocks. On their block chain you can find synthetic versions of Amazon, Google, Twitter, Netflix, Microsoft and other mainstream investment opportunities.

To participate users must mint assets on Mirror Finance to create a mAsset which is the synthetic version of the real world asset. To do this an investor provides 150% collateral in for form of Terra UST which is the Terra Network stable coin.

Investors need to be aware that if the mAsset collateralisation rises above the threshold then your stock will be liquidated to ensure solvency of the network.

Prices are updated every 30 seconds so investors are able to continue to monitor their positions.

The peg is achieved through a Decentralised price oracle and if they do begin to rise the system rewards investors or provides "incentives" for you to liquidate and claim the collateral.

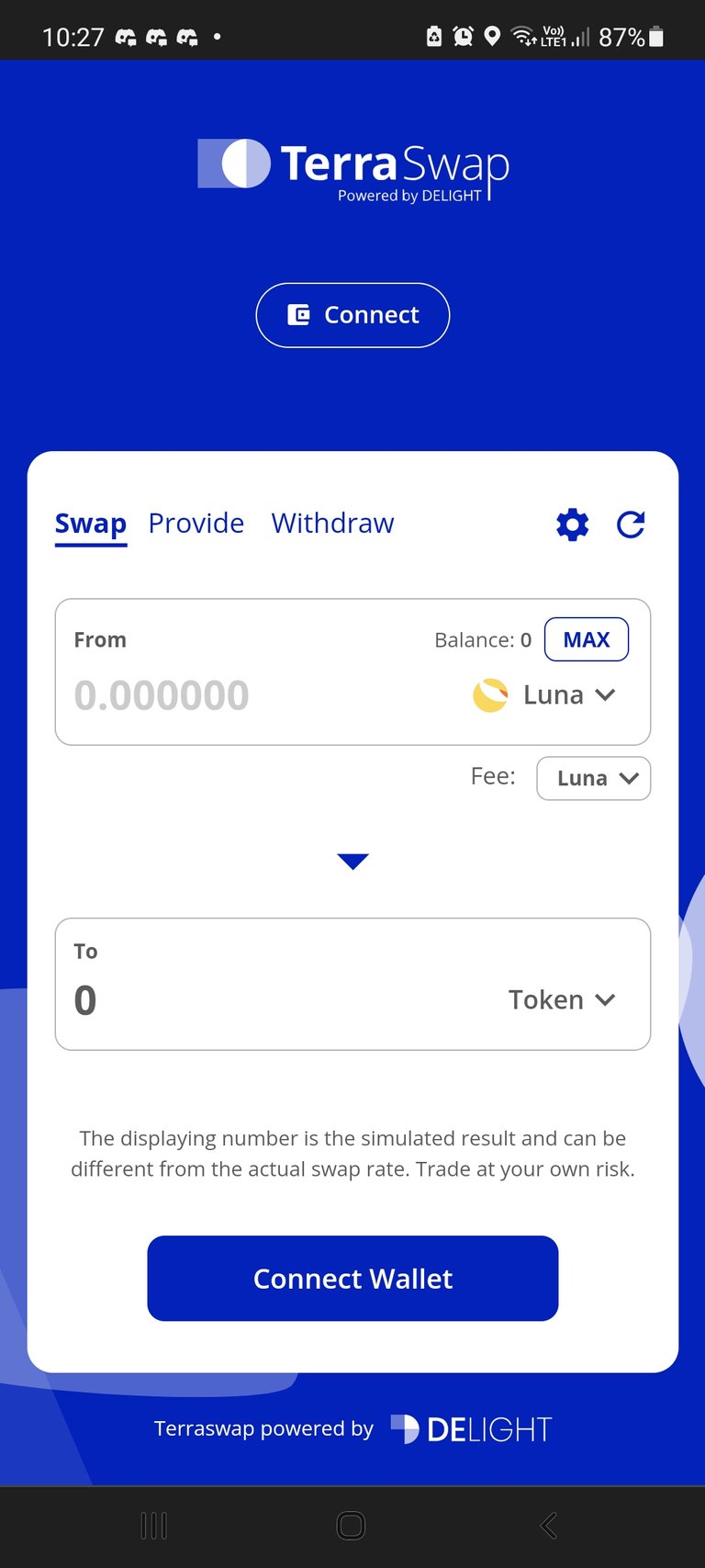

This incentive is provided through Terra Swap where investors can participate in arbitrage. If for instance you see mGoogle trading in MIR for less than the real world price you can mint the mAsset and instantly sell it for the real world price burning the token and lifting the price. You can also apply this method if MIR is trading higher than the real world price by minting it and burning it for a profit.

Mir Finance isn't just closed to Terra users, it also has a bridge to Ethereum which enable ethereum tokens and the ERC20 version of UST to be used to participate.

You can access the Ethereum version Here this is also why colombus 5 upgrade is such a big network upgrade for Terra as it will enable cross chain participation and bridge its stable coin to pretty much all block chains enabling the entire block chain to utilise Mir Finance.

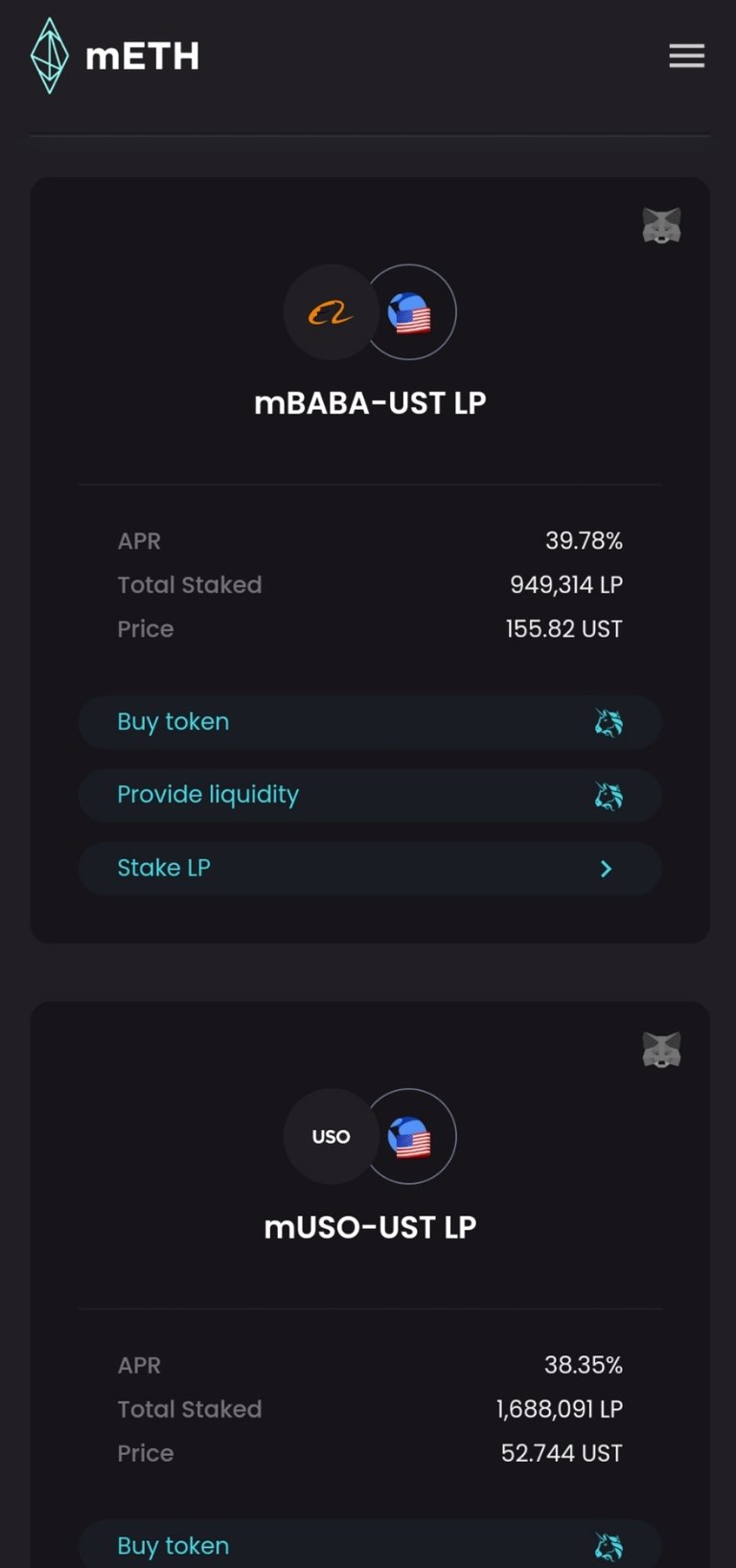

As all traditional Decentralised Finance protocols Mir Finance has LP providers which receive a portion of fees paid out to them based on their LP % of the total pool as Mir.

Mir can be traded or it can be staked to participate in the governance of the token.

The added benefit of Terra is that if you stake Luna to help secure the network Terra Labs pays Luna stakers a portion of Mir as a reward. Mir isn't the only Terra Labs token paid to stakers, so is Anchor and a number of other Terra Labs tokens.

Mirror finance is a new form of Decentralised Finance with a focus on real world assets which provide added security and investment opportunities for crypto enthusiasts a move away from the traditional pump and dump of crypto tokens.

This new form of investment should help stabilise the market and bring cryptocurrency into real world use.

Mirror finance still houses crypto assets such as Polkadot, bitcoin, ethereum and other tokens which can also be staked and it has the added option to short and long stocks.

If you haven't already picked up some Mir Finance tokens, why?

Know more about the protocol? Let me know in the comments section below.

This is not financial advice and readers are urged to do their own research

Posted Using LeoFinance Beta

Electronic-terrorism, voice to skull and neuro monitoring on Hive and Steem. You can ignore this, but your going to wish you didnt soon. This is happening whether you believe it or not. https://ecency.com/fyrstikken/@fairandbalanced/i-am-the-only-motherfucker-on-the-internet-pointing-to-a-direct-source-for-voice-to-skull-electronic-terrorism

https://twitter.com/ValloneSimon/status/1443384338658123780

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Yay! 🤗

Your content has been boosted with Ecency Points, by @melbourneswest.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for Proposal

Delegate HP and earn more

Great. I knew about the protocol but never dived deep into it. I thought there was a decision where Binance was penalized for having a synthetic tokens for real world assets on their platform. Not sure how and where that regulation would this defi platform.

Posted Using LeoFinance Beta

Not sure but it's being led in South Korea and the nation seems welcoming to it.

Posted Using LeoFinance Beta

Really cool concept! Once I have some time, I will dig into it

I see huge concerns for anyone participating here since the SEC doesn't like people making synthetic stocks. It's just calling for the regulators.

Posted Using LeoFinance Beta

The issue with SEC is that it doesn't like unregulated stocks. But South Korea has undergone a massive shift and I believe Terra is meeting regulations and working with banks.

Although I'm still trying to find some more info out about Terra meeting regulations and being accepted.

https://www.ft.com/content/dccac69e-9ebe-468a-b089-4f40d77d5a80

Posted Using LeoFinance Beta

Yea but I am wondering what draws the line even if they are in South Korea. I still foresee the US making a lot of noise to take these things down.

Posted Using LeoFinance Beta