TerraLand: Real Estate on a Block Chain

Good morning Lions I trust you are safe and well as you scope the Savana for the next block chain project to sink your teeth into. Do we have a wonderful project to report on that is in the midst of launching over on Terra Network that bridged real world assets with block chain technology.

Terra Land

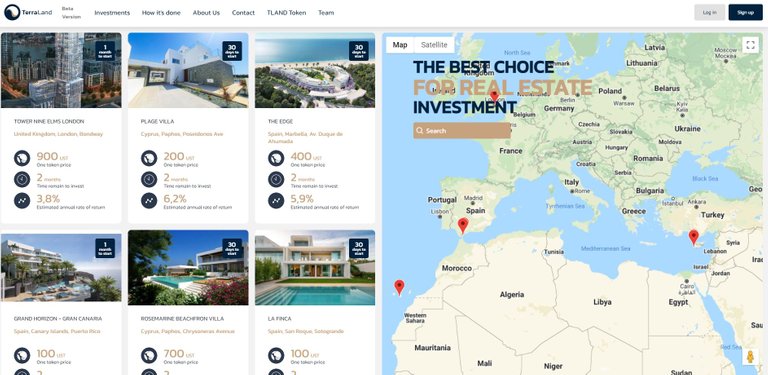

Launching in around 30 days time on the Terra (Luna) network is Terra Land an online real estate project that aims to offer crypto enthusiast the ability to own shares of homes across the globe. There is even the ability to purchase an entire home if you wish.

The sales are all organised via public transactions and settled in UST unfortunately the offer isn't available to everyone as it is KYC which strikes out American, Belarus, Sudan, Syria, Venezuela, Zimbabwe, Burma, Cote D'Ivoire, Cuba, Democratic Republic of Congo, Iran, Iraq, Liberia and North Korea. The last one quite obvious as they are currently experiencing sanctions.

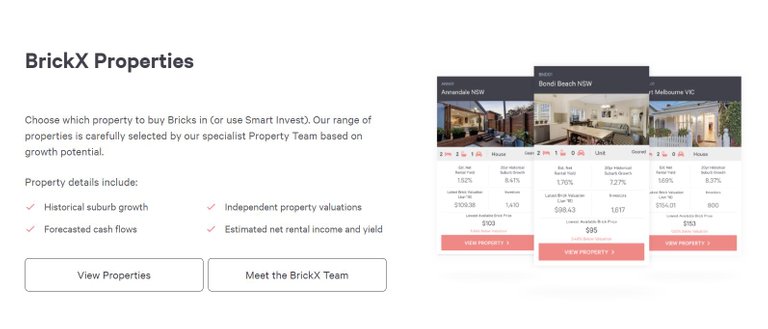

If you're an Australian you might already be familiar with how this is going to work as it is very similar to BrickX but on a block chain. Similarly to BrickX investors are able to purchase shares in a property which are listed as tokens that correspond to that specific investment. Depending on the price of the home is how many tokens are available.

source

source

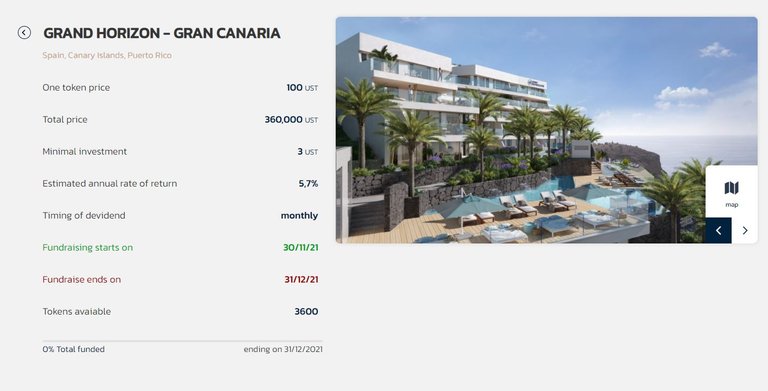

For example the above property listed on TerraLand is selling for 360,000 UST each token is 100 UST with a total of 3600 tokens available. An investor can choose to buy part of the property or all of the property with ownership being proven on the block chain. What is also interesting is that you don't have to purchase an entire token as you can purchase parts of it with this properties minimum buy in at 3 UST.

Also available is the estimated annual rate of return and for this property it is listed as 5.7% which is a significant ROE for real estate as a quick look on Real Estate Websites in Australia many are below 5%.

Much like a Real Estate business the listings have images, information and even a virtual walk through.

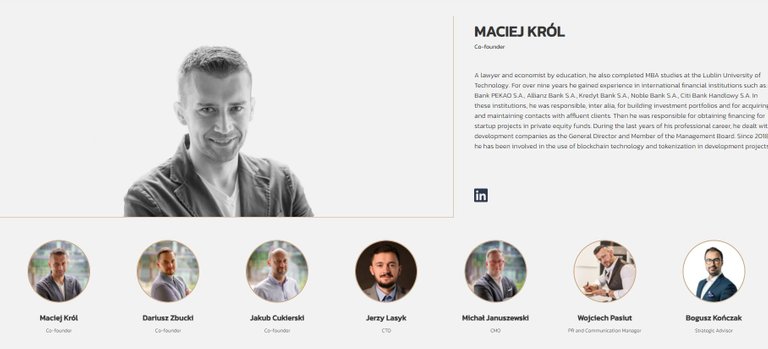

The Team

source

source

The team are quite a mix of people with varying skills and expertise in mathematics, Law, Economy and even a musician in charge of PR and Communications. Despite the broad range of skills on offer it appears that none are from the real estate sector itself. that might be worth noting for people who wish to invest in the project. Although it does note that their Strategic Advisor, Bogusz Kończak has been actively investing in real estate and crypto start ups.

Other offerings

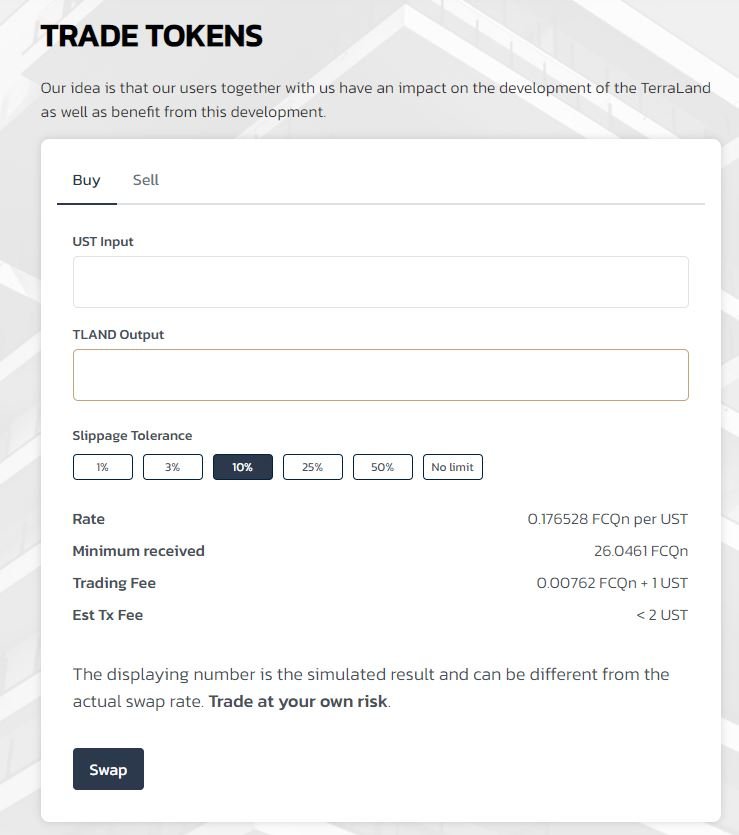

As other block chains and projects TerraLand does have its own token called TLAND and you will be able to stake it and provide liquidity to the project. There is also an airdrop tipped but with no date which can be located here

The investments offer one off payments which has me thinking about how the project would operate and raise funds for maintenance and upkeep of the property however, noting the project has LP and staking available I would assume the team is anticipating investment in the project with liquidity providers coming to stake.

The Verdict

I think the concept is good and will enable people to access real estate and with the current housing issues being felt across the world this might be a way into the market for a lot of people. However, with that in mind there are still a large amount of unknowns and I am unable to locate any further information on a few things that first come to mind. for example how will the token price increase in value if real estate owned does, what legalities are involved, am I acknowledged legally as an investor and what are my protections? amongst many more which I am sure you have a few coming to mind.

It is also important to note that this company has rebranded from FCQPlatform that original launched in 2018 and experienced a significant amount of set backs which you can read their blog post about it here.

With all that in mind and the ever expanding metaverse which is offering virtual land it is quite nice to see real world assets being traded on a block chain and bringing in new use cases and I am sure investors will purchase some of the tokens.

I'll be keeping an eye on this project and assessing how it goes, I am also keen to see how governance and funding is utilised by the team and how investors find it. With all things crypto they are always quite risky but with a read world asset to back the price, will it succeed is the question?

Image sources provided. This is not financial advise and readers are urged to undertake their own research or seek professional services

Posted Using LeoFinance Beta

https://twitter.com/ValloneSimon/status/1451323680240242690

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

I think the legalities are the issues. As you know the current system has a lot of copyright and etc also going on so I don't even know if they are allowed to just copy it directly onto their site either.

Posted Using LeoFinance Beta