UST Ahead of the Curve

$UST Ahead of the Curve

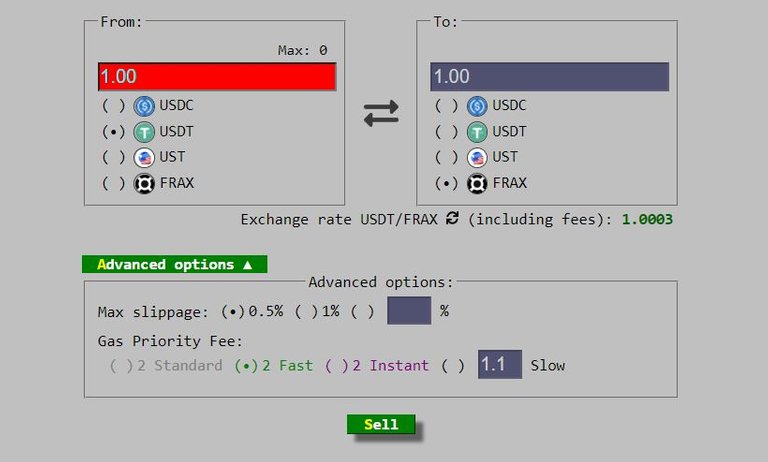

Curve is a popular Decentralised Exchange (DEX) on the Ethereum network which focuses on the trading and establishment of stable coin pools. Similar to other DEXs on the network however, with a far less slippage fee due to the fact that it provides its services for stable coins and due to Ethereum's high gas fees Curve has set a 0.04% swap fee.

Curve states that the low fees are the most efficient way to trade stable coins and ensure people participate in the trading of stable coins Source.

Curve has been a driving force on the Ethereum network to help support stable coins retaining their peg through the ability to perform arbitration at low rates and with a large variety of pools.

Users are rewarded for providing liquidity and the protocol does have a number of low risk and high risk pools that also leverage on Compound and AAVE to provide larger returns for investors.

In Feb 2021 Curve finance broke a record and became the largest DEX with over $US4 Billion worth of assets locked on the network and has maintained that level of funds ever since and continues to grow support.

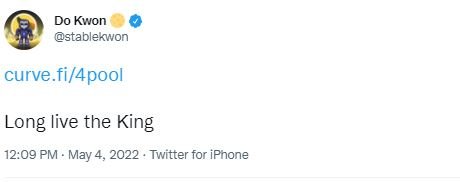

Do Kwon creates UST Pool

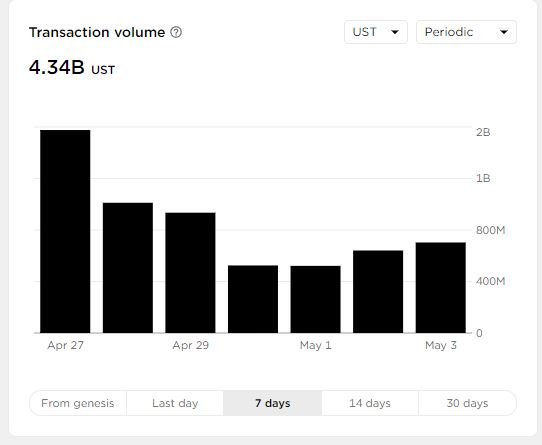

Give the long term success of Curve Finance Do Kwon the creator of Terra (Luna) Network has established a UST pool of just over 1 Billion UST tokens. This announcement comes at a great time as Terra's UST transaction volume reaches a new high of 4.34 Billion over the past 7 days.

Anchor protocol edges ever so closely to breaking a new all time high for TVL with 35 Million short of hitting the 20 Billion TVL mark.

The added exposure of having UST on Curve finance provides Ethereum users the chance to participate in UST arbitration which comes with added benefits if Luna and UST depeg and UST's value raises.

The additional 1 Billion in UST has also seen Terra's Native token spike to $US86 as the token is burned to mint more UST pulling Luna out of a slight down trend which was occurring over the past few days.

Image Source Terra Station Wallet

What are your thoughts on the expansion of UST that has been growing at a steady pace does it instil trust in the project team or are you more concerned at the recent adoptions?

MKR and Luna similarities

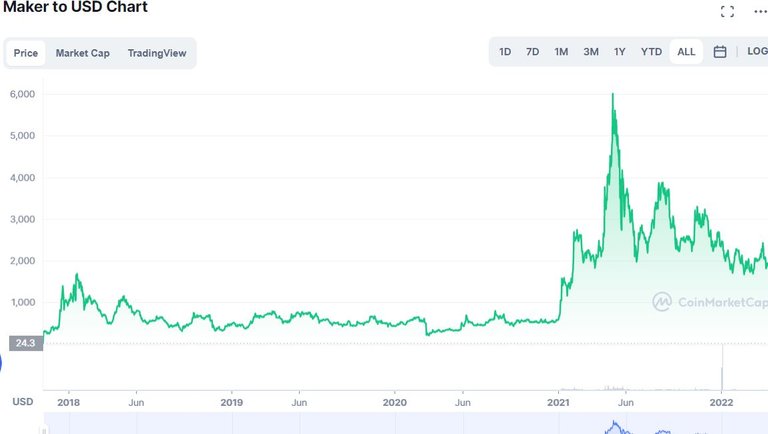

I had a quick look at the overview of MKR which, for those that don't know is the pegged token to DAI which one could argue Terra (Luna) Network was modelled on but with the addition of a functioning blockchain.

It took MKR 4 years before hitting a peak of close to $US6000 per token however, MKR didn't particularly have the same drive as we are seeing with Do Kwon and much of the blockchain sector back then was closed and owned by Ethereum.

Now with a lot more competitors and a growing sector what are your thoughts on Luna being able to match similar highs?

Image sources provided supplemented by Canva Pro. This is not financial advice and readers are advised to undertake their own research or seek professional financial services

Posted Using LeoFinance Beta

https://twitter.com/ValloneSimon/status/1521978169548750848

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Ahead of the « curve », nice one 😂

Posted using LeoFinance Mobile