Best Ways to Borrow Money for College

There are several options as to how you can pay for college. Before you look to borrow money, ensure you have thoroughly investigated all the “free money” options at your disposal, including scholarships, grants, and paid internships. Carefully and thoroughly research these options online, and if you need additional assistance, consult your school’s financial aid office.

Regardless of your success in attaining grants and scholarships, you’re likely to wind up short of having enough money to pay for your tuition and living expenses. At this point, you’ll want to investigate borrowing. Each option has different benefits, so be sure to look into each before making your final decision.

Parents

While they may not be in a position to do so, it never hurts to ask your parents for a bit of cash loan to help get you through college. The loan process will be much less formal and confusing with your parents than if you borrow from a financial institution or the government. Also, your repayment options will likely be much more convenient!

Private Loans

Depending on your situation, you may need to borrow from a financial institution. However, these loans work much differently than federal loans.

- Variable Interest Rate. Almost all private loans come with variable interest rates. This could significantly increase the total amount of what you must pay back over the life of the loan.

- Increased Risk. With private loans, they may consider you to be in default after only a few missed payments. A bad credit score may affect future interest rates and insurance premiums.

Final Thoughts

Once you’ve obtained financing, you’ll want to devise a plan to save as much money as possible while attending school. With some research, you can find lots of great ways to save on housing, textbooks, and entertainment during your college years.

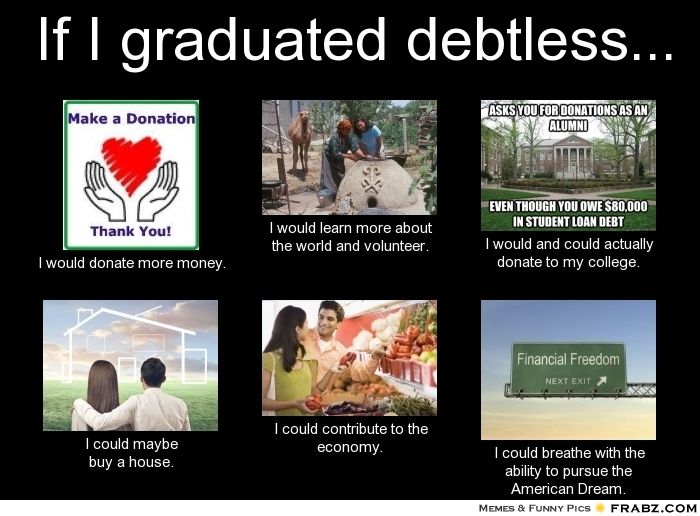

Maintaining a frugal lifestyle for the few years, you spend in school will make your financial life much easier to manage after graduation. The last thing you want is an excessive student loan balance hanging over your head years after graduating.

Thank you for reading and hope you have a good rest of the day!

Follow me on these other platforms where I also post my content: Publish0x || Hive ||Read.Cash || Noise.Cash || Twitter || Torum

Posted Using LeoFinance Beta

https://twitter.com/minimalistpixel/status/1538819099391836161

The rewards earned on this comment will go directly to the people(@mercurial9) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.