April in Crypto(2022)

BITCOIN

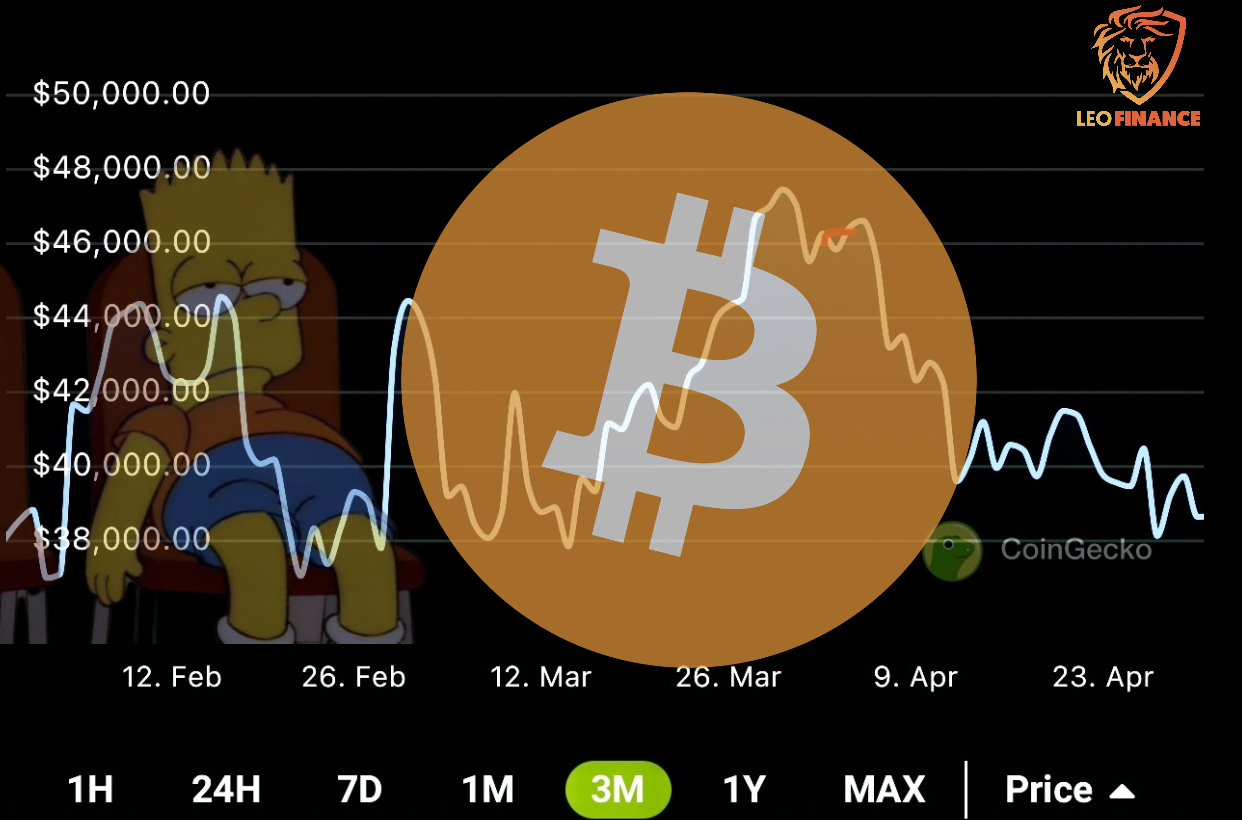

April was a drag price wise, it took away all the excitement March had built up with it, it’s been a whole month of downward trend, Bitcoin went from $46k down to $38k and has been testing that support like it’s life depends on it, it doesn’t look like it has enough momentum to break that support to the upside in the short term.

Many attribute the dull price action to the result of FUD generated by those clamoring for a change in Bitcoin code due to environmental concerns. The stunt was pulled last year by Elon Musk and most of us remember what happened to the price afterwards, here we are again in 2022 but this time the intention seems to be propaganda.....

Many have also attributed this dull market price action to tax season in the U.S of which the deadline was 15 of April, I’m not sure about their correlation myself but under normal circumstances, everything should have blown away during the early days of May so we could see some recovery, otherwise it’s going to be more blood in the market.

But as usual, you can bet that market movers will always take advantage of any FUD to attempt to shake up the market here and there. One thing that’s for sure is that price tells only one side of the story.

[creator: @BitcoinOdessey on Twitter - The orange markings denote the Bitcoined countries]

In other news, Bitcoin has yet again hit some major milestones this quarter by adding 2 more countries to the list of countries to legalize it as legal tender, Central Africa Republic and Panama, Panama also went ahead to declare tax free on crypto gains.

ALTs MARKET

Altcoins have also been pretty boring, you can say it’s the Bitcoin effect 🤷, majority of them have just been on the sidelines, algo Stable coins have been the ones in the spotlight the entire year. Speaking of UST, HBD, FRAX, FEI usd. We are seeing a great deal of attention being paid to them.

Ultimately, holding and staking these stables in several protocols could have yielded more returns in the first quarter of this year than holding most alt coins. At the time of writing this post, staking the following stables gives the following returns in APR

• Staking UST on anchor- 17.9% apr

• Save HBD on Hive - 20% apr

• LP on Polycub with pHBD-USDC +45% apr

• Stake FRAX on curve+stake DAO+40% apr

• Stake FEI on Uniswap for +16%apr

With the current high level of volatility and uncertainty in the market it is advice able for people to hold one or more of these stable coins, albeit cautiously to ensure one is not overexposed in case the markets suddenly decide to turn around.

What’s For May?

I’m not a big fan of the month of May in crypto. Bitcoin lost 70% in its price back in May 2021 and took the rest of the market with it, infact many alts are still yet to recover from that dip to their ATH’s. However, like every other month in crypto, it’s super hard to predict where the direction is going.

Nothing much from me other than hedging volatility with HBD savings on both Hive and Polycub without significantly hurting the growth of my portfolio. Hive has been pretty strong at $0.8 levels, I picked up about $200 worth with plans to sell back at $1 or more, hopefully that won’t take too long to actualize.

Thanks to the 20% APR on HBD savings and +40% APR on pHBD-USDC farm on Polycub, when people trade Hive for HBD, the Hive is removed from supply, making it deflationary. This is cool. Majority of crypto don’t know about this so there’s still little demand for hbd at the moment but it will inevitably ramp up and have a snow ball effect on the price of Hive. This is why I’m trying to accumulate some liquid Hive to take advantage of any future price swings.

A friend asked me what Alts I’m buying in these times, non bruh. I’m back to aggressively accumulating stables. Let’s see what I’ll be able to raise by the end of the month.

What are your strategies at this uncertain volatile periods in crypto? Will there be a summer run? What are your plans?

Thanks for reading.

Posted Using LeoFinance Beta

Although the crypto market may seem unpredictable, it'll be advisable to go for stables. The btc dip could also prove itself as a profitable venture if purchased now which it is at one of its discouraging range, I see btc soaring by May.

It will be fun to see a turn around in price of Bitcoin action in May. Fingers crossed. Hodl

https://twitter.com/Mistakili/status/1520554719227359233

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Congratulations @mistakili! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next payout target is 15000 HP.

The unit is Hive Power equivalent because post and comment rewards can be split into HP and HBD

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out the last post from @hivebuzz:

When I think long-term, I believe that buying BTC now will make a profit in the future. Buying BTC below $40,000 can be quite profitable in the long term. But for now it seems more logical for me to buy Hive, LEO, HBD and focus on the pHBD-USDC LP.

Posted Using LeoFinance Beta

Hive and Leo have massive potential upside long term, accumulating them in these prices make a lot of sense

@tipu curate

Upvoted 👌 (Mana: 19/39) Liquid rewards.

Thanks

Certainly will be accumulating Stablecoins all the way after all its purpose is to provide stability of price as people are transacting across coins or between fiat and digital currencies, due to crypto market’s effortless and unprovoked volatility .