The era of cefi custodianship is coming to an end as THORChain moves to launch Single sided savers vault

The wait is finally coming to an end. THORChain’s revolutionary single sided savings vault upgrade is about to be released. The first vaults to be launched will be BTC vault and ETH vault with others to come afterwards.

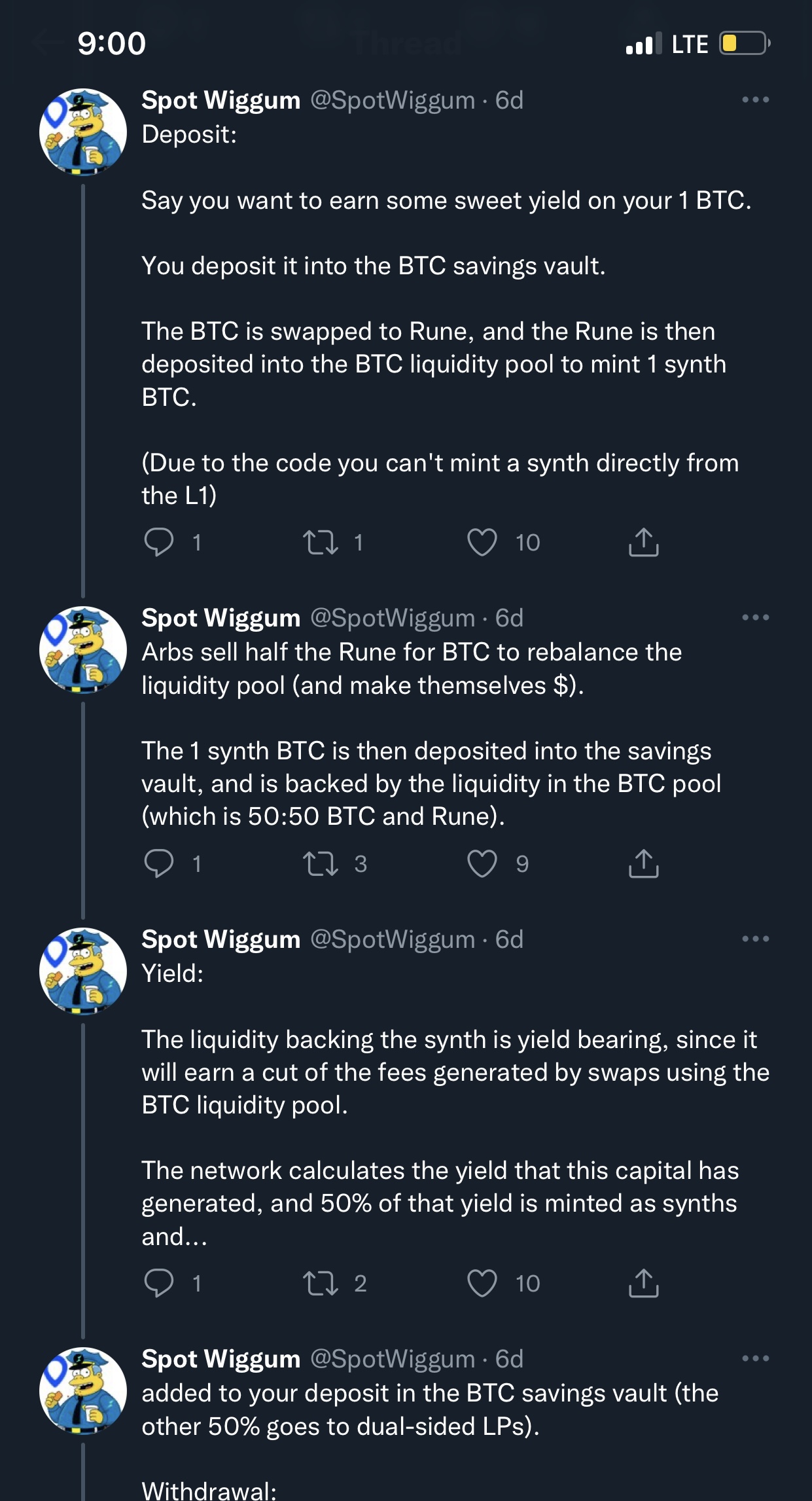

Deposit BTC to earn yield in BTC or deposit ETH to earn yield in ETH. Sounds simple on the surface, but if you’re interested in going into the mechanics, you might want to read this documentation.

For normies like myself, when someone deposits BTC into the savings vault, the BTC is sent into the liquidity pool, when trades are made, fees are accrued and shared between normal Liquidity providers and savers. In theory, savers will earn 50% less than what LP’s earn from fees.

Essentially, in full details.

LP’s earn more than savers because they are exposed to impermanent loss of dual sided pooling which is covered by the treasury.

Will Savers Vaults reduce demand for native RUNE?

No, Savers Vaults means minting/holding Synths, which will be split into 50:50 Asset:RUNE in the LP. Therefore, a user minting Synths with assets will drive buy pressure for RUNE.

According to information from defirate.com, the highest yields one can get from staking BTC or ETH is around 5-6% on Nexo which is a very centralized platform and this year showed us how risky that can be with many Cefi platforms crumbling. THORChain’s savers vaults eliminates such threats by providing a secure trust less protocol to earn yield on native BTC, ETH and so on.

The program is ready to be shipped, Nodes are currently voting on it.

Share your thoughts guys….will you be using this savers vault over Cefi custodianship?

Posted Using LeoFinance Beta