The Impact of Short Selling Naira on the Nigerian Economy

Nigerians are shorting the Naira

Latest concerning proceedings from Central Bank in Nigeria has it that the Governor of the CBN made a statement saying that people who take Naira from banks to buy Dollars will be arrested and prosecuted.

The continued declining state of the Naira against the USD has led people to begin shorting the Naira in traditional style by taking loans in Naira from banks to buy USD so that they can make profit in Naira when USD appreciates against the Naira.

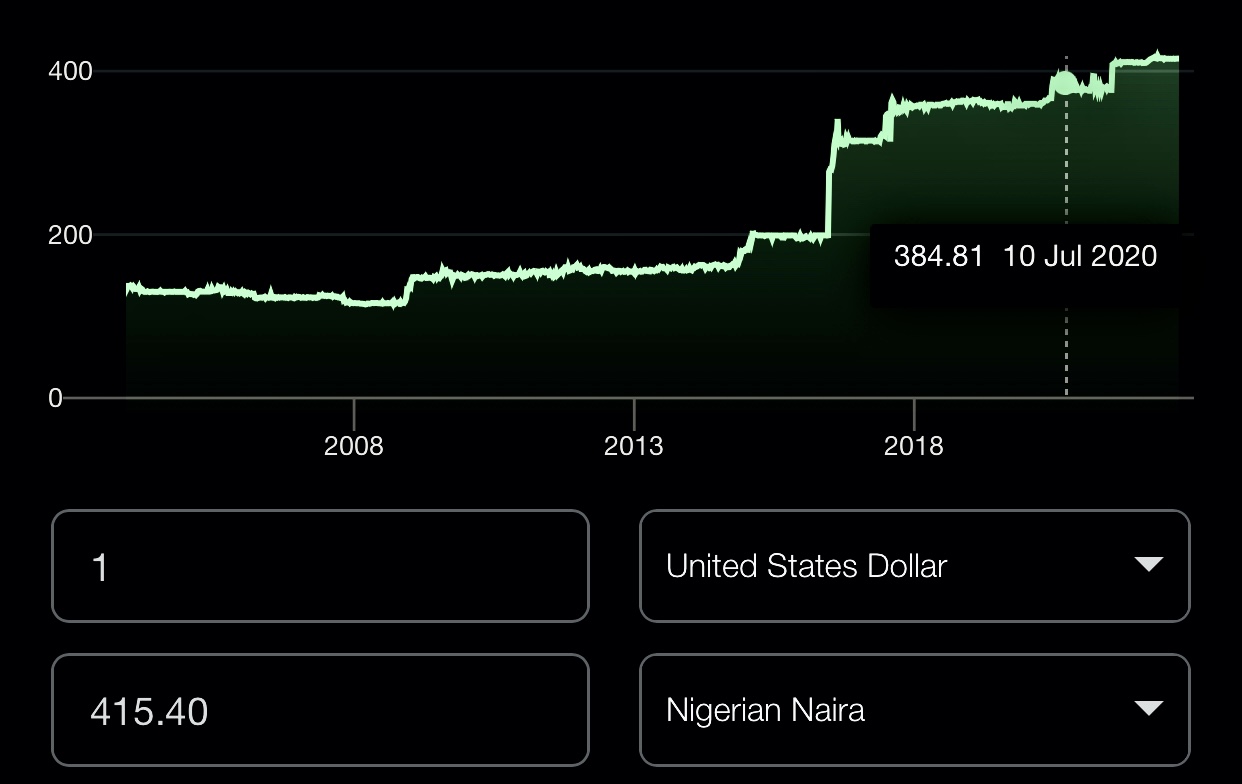

Dollar has become not just a tool to hedge against inflation for Nigerians but also an appreciating asset. This time 2 years ago $1 was equal to 384Naira (official rate). Today it is at 415N.

Whereas, at the time of writing this post, on the black market, $1 = 640Naira with possibilities of the situation getting worse before the end of year as elections draw closer. Will $1=1000Naira by EOY? People are legit taking loans to bet on this.

Implication

Shorting the Naira in this style en masse further worsens the value of the Naira, it’s like going from frying pan to fire but rather than set up ways to bring the Naira back to life, the Governor is issuing threats to the citizens who are mostly bearing the brunt of inflation all round. Let everybody be mad.

All this leads to more inflation, also, because Nigeria imports more than half of what she consumes, looking at the information on imports below,

The top imports of Nigeria are Petroleum oils and oils from bituminous minerals, not crude; preparations n.e.c, containing... ($7.75B),

Motor cars and other motor vehicles; principally designed for the transport of... ($3.03B),

Wheat and meslin ($2.15B), Medicaments; (not goods of heading no. 3002, 3005 or 3006) consisting of... ($1.38B),

and Telephone sets, including telephones for cellular networks or for other wireless networks;... ($771M), importing mostly from China ($17.4B), Netherlands ($4.58B), United States ($4.49B), India ($3.46B), and Belgium ($1.99B).

In 2020, Nigeria was the world's biggest importer of Artificial filament tow ($188M),

Embroidery; in the piece, in strips or in motifs ($143M),

Flour, meal, powder, flakes, granules and pellets of potatoes ($102M), Matches;

other than pyrotechnic articles of heading no. 3604 ($16.3M), and Phosphides ($44k)

Source

—for a country who is only best at exporting oil, prices of commodities that have already seen hikes in the past few months will only get worse over time. Many bakers have complained of shutting down their operations due to inability to make a good turn over after deducting operating costs.

The question now is “Is this the beginning of hyperinflation and we don’t know it?”. The CBN needs to device ways to stop people from taking loans to buy USD, but how? If banks don’t give loans, people wouldn’t save, if people don’t save, the banks will go out of operation.

Hence, if they can’t stop loans, then they can’t control what people buy with. Hence the only way to stop people from shorting the Naira is by saving the Naira and that my dear reader is gist for another day. E go tey. The mattér b like deadlock.

Meanwhile, in China…

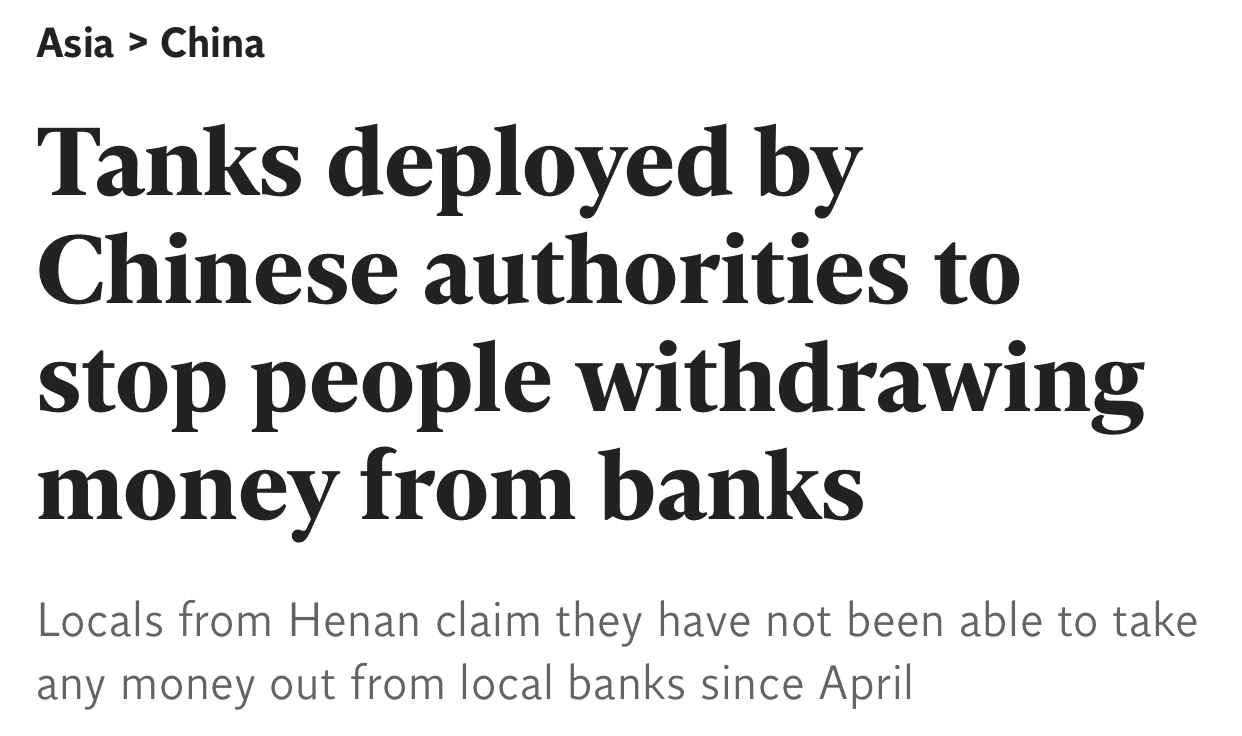

In China, a couple of banks are pulling a “Celcius” on its users. The banks were caught up in corrupt practices, got themselves insolvent and are confiscating owners money saying they’ve become bank property. Ofcourse people didn’t take it lightly and went to the banks to protest but were met with law enforcement who beat the protesters back.

Traditional banking systems are crumbling world wide and have become a shitshow, while the dollar is facing its own inflation troubles in international waters, people in Nigeria are hoarding it to hedge against inflation in their own economy. What an irony.

Hivefixes this

Getting myself acquainted with Hive’s economy and financial offerings remains one of the best things I’ve done for myself, doing this has somewhat emancipated me from a lot of frustration from traditional banking woes. I only use my bank account to hold money I want to spend or make other local transactions with.

I get better returns saving money by making use of HBD’s savings account my money is safer and cannot be frozen or accessed by the gruesome banking authorities, nor can it be diluted by poor economic decisions enacted by corrupt centralized entities.

Cryptocurrency’sprovide a host of solutions to the problems facing our financial system. Hive is a perfect use case that provides users with full financial autonomy and control, essentially allowing users to become their own banks.

Thanks for reading.

Kindly share your thoughts.

Posted Using LeoFinance Beta

https://twitter.com/Mistakili/status/1550390710058328070

The rewards earned on this comment will go directly to the people( @mistakili ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

They're all mad. They're comfortable with making monetary policies that dips the naira but they're not comfortable with people selling the naira for dollar. It's a crazy country. I blame people who are voting incompetent people into power. Anyways Hive fixes this like you've said.

Posted Using LeoFinance Beta

Exactly. Lol. Now it will affect everyone. It’s high time people emancipated themselves from the shackles of traditional banking

Posted Using LeoFinance Beta

I'm enjoying hive economy everyday and I don't for once regret my action because give me comfort and stability

Posted using LeoFinance Mobile

You’re a winner bro.

Posted Using LeoFinance Beta

This post has been manually curated by @finguru from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

HBD Savings and pHBD on PolyCUB are great sources for those who earns other fiat currencies which collapse faster than USD 🔥

We’ll put bro. Now will people embrace them or not? We shall see

Posted Using LeoFinance Beta

I like your first-four paragraphing bro looks stylish!

The Naira case is just energy draining just by reading about it let alone opening up a conversation about it, I fear it gets worse and am very concerned for my family back in Nigeria.

Thank God for us we found Hive which gives us hope and better financial standings.

Posted Using LeoFinance Beta

Thanks for the feedback my G, it was intentional, I thought I should give my readers some style while they are being entertained and informed

I'm almost sure we're getting to $1 to 1000 Naira by next year if naira cash remains this much liquid in the space of inflation. And that's likely going to be the case, especially with the 2023 Presidential elections coming up in Nigeria.

No one, both government and the people is really looking to protect the naira in anyway. Everyone wants to protect their interests and that alone.

This right here is the danger. The matter is like the death spiral situation that happened to UST token, it’s spinning out of control. Today 1$ don enter 670naira, when I wrote this post it was at 645 ishh. Madd ting bro.

Let's see how things roll out. Upcoming businesses and fintech startups might feel the brunt most when CBN starts their wahala in the name of protecting the naira

Nigerian policies won’t just stop at getting on one’s nerves. Not long I heard of an advert of the E-Naira . So amusing !

ENaira just another project to siphon money

Posted Using LeoFinance Beta

same old syphon tactics