The Slow Death of Centralized Finance

The world of centralized finance is coming to an end. If you’ve been paying attention you’d have seen what I’m about to point out, if you’ve not, well, here’s that chance to tag along in the most mind blowing way, whichever part you fall on, your mind is still about to be blown.

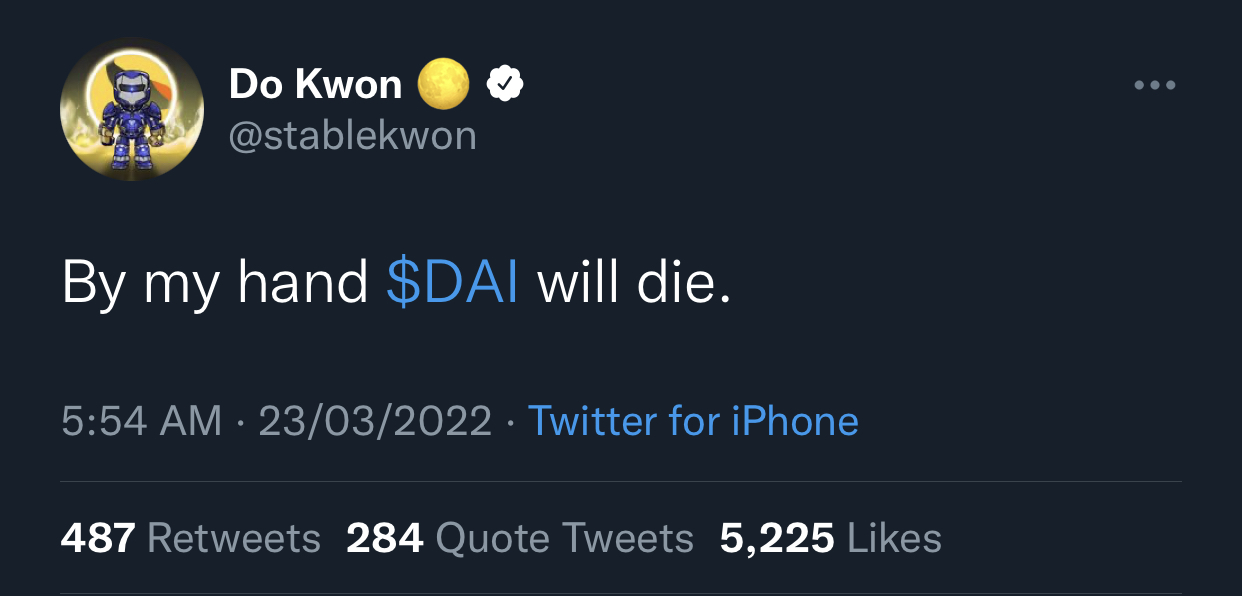

By my hand DAI will DIE

On the 23rd of March 2022, Do Kwon, the creator of UST, tweeted that DAI was going to die by his hand. DAI is an Ethereum based stable coin pegged to $1, it is created when users borrow against locked collateral, and it is destroyed when loans are repaid.

DAI uses Target Rate Feedback Mechanism to keep its peg, when DAI goes below one dollar, TRFM increases, giving people arbitrage opportunity to buy DAI under the peg, creating enough demand to push it back to the peg and then decreases TRFM.

Why DAI?

DAI was created by MakerDAO which is a supposedly decentralized autonomous organization governed by anonymous MKR holders through stake weighted voting by using smart contracts.

Like every stable coin, they have to be backed by something, either other crypto through algorithms in the case of algorithmic stable coins or are backed by real world fiat. DAI was backed by Ethereum in the beginning to ensure full autonomy and censorship resistance, but later extended its anchorage to other stable coins such as USDT and USDC which now occupy most of the systems collateral.

The Problem

The problem with this is that these stable coins are centralized and introduce centralized problems, essentially diluting the intended purpose of the system. There are also rumors undermining the decentralization within MakerDAO.

Ultimately, It is one thing to be a centralized stable coin and another thing to be a fully decentralized censorship resistant stable currency, but to be a centralized “decentralized” stable currency is an aberration and is totally unacceptable.

Referring to Do Kwons tweet, most see it as Do is saying that UST will kick DAI out of the stable coin market due to its inconsistencies, for those who don’t know, UST is an algorithmic stable coin created by Do Kwon, built on Terra chain, it boasts to be more robust and more decentralized.

The Solution/death of DAI

While some of that maybe true, seems to be coming true, in my opinion what Do could have meant was about the death coming to centralized finance. UST has grown to become the most widely adopted decentralized and 3rd largest stable coin.

The core of a decentralized system must be bereft of centralized governance and censorship, the evolution of UST and other truly decentralized stable coins open up the space to unfuckwithable level of sovereignty and several new uncharted innovations.

The evolution of UST Decentralized finance

The Death of CeFi in context is not claiming that centralized finance will be eradicated and fully replaced by DeFi, it refers to the fact that centralized finance will become obsolete, redundant, a ghost town in the future.

Decentralized finance is borderless, users are not restricted from participating through jurisdictional laws or jurisdictional regulatory bodies. Both the banked and unbanked have access to the same opportunities irrespective of their location.

Decentralized finance offers better rates. Through exploring innovative ideas, several protocols that have been developed that offer highly competitive and sustainable interest rates when compared to centralized financial systems.

Although, Decentralized finance is commonly subjected to hacks and rug pulls, security is still a matter of concern as is every other financial instruments. The amount of money that has been lost to theft and the likes in traditional(centralized) finance till date dwarfs the number of thefts recorded in decentralized financial systems.

Yet, there are protocols out there that are ultimately secure if one knows where to look. Hive platform for one, offers interest of 20% apr on HBD savings and is highly risk free.

Eventually, Do Kwon may not outrightly sole handedly kill DAI or centralized finance in context, but through UST, the creation, it’s intentions, the tokenomics, the breakthroughs and FUD’s, he has certainly drawn some attention to algorithmic stable coins and they will be the future of finance going forward.

Thank you for reading. I hope you’ve been mind blown. 🤯

Posted Using LeoFinance Beta

I see lots of updates and news about UST and even today I saw a post that its now the third-largest stable coin. Luna team is doing great it seems and It's very good I think. What you say?

Yeah they are doing a lot of new stuff, so there is a lot of misunderstanding as much as there is appraisal of what they’re attempting.

Some people think UST and therefore LUNA is a time bomb that will explode, while some others believe that it is a truly genuine innovation in the space.

Personally, I feel that if what they are trying to build works out well, we will be very grateful for it, if not, we will have to write off burn and mint mechanism and start other experiments.

Posted Using LeoFinance Beta

interesante, y tendre cuidado con mi posicion en MKR, te seguire para compartir ideas

!PIZZA 👍

Gracias.

Yeah, always be careful and not be too over exposed to one stable coin except you really trust it.

🍻

Posted Using LeoFinance Beta

!PIZZA 😎

PIZZA Holders sent $PIZZA tips in this post's comments:

@aurikan(1/5) tipped @mistakili (x1)

Join us in Discord!

with better interest rates, people are most likely going to tilt towards defi. If some of the security risks are alleviated we could see more capital flow into these protocols. So yes, DeFi is here to stay and it does offer individuals better options than CeFi.

Posted Using LeoFinance Beta

Exactly what I’m saying. I bet security will get better over time.

Posted Using LeoFinance Beta

Stablecoin like USDT, is backend by USD 1:1? Or it is just ?

That’s what they told us. They claim it’s 1:1. Nobody has actually verified that lol.

Posted Using LeoFinance Beta

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

Thanks 🙏 @bhattg

Posted Using LeoFinance Beta

The centralized finance will not go away completely. But it will definitely lose its charm. People will move to decentralized finance since they can be in control, not the big guys behind the projects. HBD has a huge potential. The future will be free from centralized control.

Posted Using LeoFinance Beta

Decentralized finance eliminates dependency on middle men, it gives people unfuckwithable control over their finances. Who wouldn’t want this? Lazy people who have bitten the apple of centralized control.

Posted Using LeoFinance Beta

Why would any project aim to kill another one?

Laws of jungle applies in crypto. If you have a better project, you get more attention 🤺

Simple and straight.

Posted Using LeoFinance Beta

It is mind blowing the journey we've embarked on by some of us that are in this space already, we are seeing the potential of decentralized finance evolve daily, this is something mind blowing given a careful look.

More users, more accessibility and your traditional banks no doubt will go obsolete!

Posted Using LeoFinance Beta

It will take a lot more than Do to kill something like DAI... TBH his comment is so cocky he managed to lose all of my respect in one single tweet. Innovating is great but shitting on those that paved the way for you is beyond my understanding.

Posted Using LeoFinance Beta