A Stable Coin Portfolio With %16,5 APR

.png)

The importance of stable coins is increasing year by year, as they partially solve the problem of crypto price volatility. Recently, algorithmic coins have been added to stable coins supported by dollar-based assets such as USDT, USDC, and BUSD. Thus, the crypto market has also become attractive to investors who like to invest in fixed-income assets. It is possible to earn returns ranging from 3% to 20% by investing in stable coins. In certain special cases, stable coin returns can even go up to 50%.

Although stable coins minimize the risk of depreciation, they can lose their value in financial extreme situations. There are also risks arising from the applications used. Therefore, it seems more appropriate to make these investments within a portfolio.

Let's say we have a $5,000 cryptocurrency portfolio. We can divide this money into 5 parts and direct it to different stable coin investment alternatives.

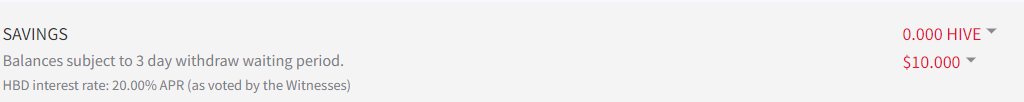

HDB Investment on Hive Blockchain: 20% APR

Currently, up to ten percent of the total value of the Hive blockchain, HBD price is guaranteed. Since current usage is less than a quarter of that level, HBD holders can get a $1 Hive if HBD drops in value. A fund has also been created that helps the HDB value approaching $1.

The most important advantage of HBD is that the return is generated directly on the native blockchain. We can achieve a fixed return of 20% without using any application or Layer 2 blockchain. The disadvantage of HBD compared to other alternatives is that its price fluctuates in a wider range. On the other hand, it is possible to buy HBD at a level like 0.97 by following the prices closely for a few days. If the same follow-up is made during the sales phase, the annual return can be increased even above 20%.

UST Investment on Terra: 19.5% APR

Terra is a blockchain whose specialty is generating algorithmic stable coins. Terra's best-known coin, UST, is valued at $1 and is backed by Luna. Using the Anchor Protocol on Terra, a 19.5% annual return on UST can be achieved. This practice, which has been going on for a long time, has made significant contributions to Luna's steady price increase.

DAI-USDC Investment on Moonbeam: 17.4%

There is a DEX called Stellaswap on Moonbeam, an EVM-compatible blockchain. The DEX in question still provides 17.5% returns to the DAI-USDC stable coin pair. Transactions can be made on the Moonbeam blockchain through the Metamask wallet, and it is possible to make transfers to the blockchain through the Multichain application.

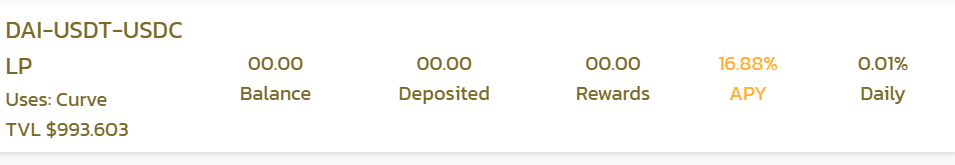

DAI-USDT-USDC Investment on Polygon: 16.9% APR

To invest DAI-USDT-USDC on the Polygon network using the PolyCub application developed by the Leo Finance community, first of all, it is necessary to create the relevant LP on Curve. An important advantage of this investment is that the return is auto-compounded.

DAI-USDC Investment on Fantom: 8.8% APR

The Wigoswap dapp on the EVM-compatible Fantom blockchain provides 8.8% returns to the DAI-USDC liquidity pool. Similar to the applications mentioned above, Wigoswap's code has also been audited by a legitimate firm.

Conclusion

In this article, I created a portfolio that envisions dividing $5000 into 5 parts and investing it in 5 separate blockchains. The average annual return of the portfolio in question is 16.5%. To create the portfolio, it is necessary to use the Terra Trust Wallet, Hive Keychain, and a Metamask wallet. It is possible to use the same Metamask wallet for the Moonbeam, Polygon, and Fantom networks. These transactions can be made by buying Hive, Luna, Matic, GLMR, and Fantom worth 1000 dollars each from a central exchange and sending them to the relevant wallets. Although it takes a lot of effort to complete the installation, an experienced person can complete the process in half a day.

The rationale for creating such a portfolio was that in the event of a black swan event, only a portion of our principal would be lost. Having a fixed income potential of 16.5% per annum by bearing a very low risk is an important opportunity.

Thank you for reading.

Cover Image Source: unDraw

Posted Using LeoFinance Beta

excellent!

Have a great day.

!LOLZ

!PIZZA

!PGM

Posted Using LeoFinance Beta

100 PGM token to send 0.1 PGM three times per day

500 to send and receive 0.1 PGM five times per day

1000 to send and receive 0.1 PGM ten times per day

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get votes from @ pgm-curator by paying in PGM, here is a guide

Create a HIVE account with PGM from our discord server, here is a guide

I'm a bot, if you want a hand ask @ zottone444

lolztoken.com

I only have my shelf to blame.

Credit: reddit

@muratkbesiroglu, I sent you an $LOLZ on behalf of @steem82868

Use the !LOL or !LOLZ command to share a joke and an $LOLZ. (10/10)

PIZZA Holders sent $PIZZA tips in this post's comments:

@steem82868(9/10) tipped @muratkbesiroglu (x1)

Please vote for pizza.witness!

For sure stablecoins should be part of any portfolio and now that we see appealing returns that should be the letter of the law. Wished just I understood this earlier to build up a bigger part of my portfolio with stablecoins, but I am on a good path to doing that. Besides the sole returns, I think there are/will be solutions to harvest more value from stablecoins: ThorChain has a UST pool provided 33% APR and PolyCUB will build a pool for HBD which probably move the APR up above the 20% return provided on Hive Savings.

Posted Using LeoFinance Beta

Stablecoins are huge. They’d should be a big part of any crypto portfolio in my opinion. I’m excited to see all of these new options start to pop up like UST on Thorchain, HBD hitting 20% APR and now pHBD coming to PolyCub.com

Posted Using LeoFinance Beta

Stable coins, especially algorithmic ones, have become one of the numerous innovations of the crypto industry. They undertake the important mission of adding risk-averse investors to the crypto ecosystem.

You’ve got a great diversification here with DAI, USDC and HBD. The interest-bearing strategies that were once dominated by big banks and hedge funds are now in our hands. I’m stacking HBD to the moon right now

Posted Using LeoFinance Beta

Stablecoins shouldnt moon. That is the opposite of stable.

We want HBD not to moon but to remain calm, cool, and be collected.

Posted Using LeoFinance Beta

It should be the amount of HBD to moon, NOT price of HBD to moon

Posted Using LeoFinance Beta

I was not aware that I included DAI in the last three investment alternatives, it was an interesting coincidence. My goal was to include USDT as little as possible. After the last rate hike, HBD has become an attractive alternative for me too.

The Stablecoin market is only going to get bigger. There is no way we are going to see things slow down. It is the transition the industry is making. This moves everything away from speculation to those seeking yield.

Posted Using LeoFinance Beta

Stable coins are high-yield financial products that risk-averse investors can also choose. They are expanding the investor base of the crypto industry.

Once there is more HBD liquidity out there, which should be very soon... It will be even easier to build a savings account paying 20% APR without even leaving the Hive ecosystem.

Posted Using LeoFinance Beta

Stable coin is the best now.investing in stable coin especially now HBD is giving 20% is the best now.

Posted Using LeoFinance Beta

Looks solid and stable coin investment will continue being a worthy investment for as long as the asset they're based on doesn't go to shit.

Algo stables have the most potential because their algo can easily be tweaked to mirror another asset if the original fails.

Posted Using LeoFinance Beta

Love it! As I red on, I was going to ask, why split all these around instead of into one place, then I got to the last part which indicated that they were options incase of a black swan event, and I agree these are excellent choices, I will go by these as well. There’s also talks of a Stargate stable coin offering 21% apr. but I won’t move close to it with a 1mile long pole

Posted Using LeoFinance Beta

Playing devils advocate here.

What if the black swan event hits USD itself? ;)

Posted Using LeoFinance Beta

I have nothing to do with fiat currencies that have negative real interest.