General Pricing Model of Crypto Market

I have worked in predictive modeling for over a decade. So I'm trying to figure out how prices are formed in the crypto market. I must admit this is no easy task. Nevertheless, I believe that I have come a long way in this regard in the last four years. Thanks to this, I entered the bear market we are experiencing more prepared than in 2018-2019.

High Volatility

The main feature distinguishing the crypto market from other markets is the extremely high volatility. Therefore, while price increases or decreases in the stock market are expressed in percentages, we are talking about multipliers in the crypto market. The expectation of 5x or 10x returns in the crypto market is not strange. Similarly, losses in altcoins are also more easily expressed with multipliers. For example, the price of Hive has decreased by 6 times compared to the peak it saw last fall. On the other hand, the price of Hive is still 4 times higher than the beginning price of 2021.

Logarithmic Price Increases

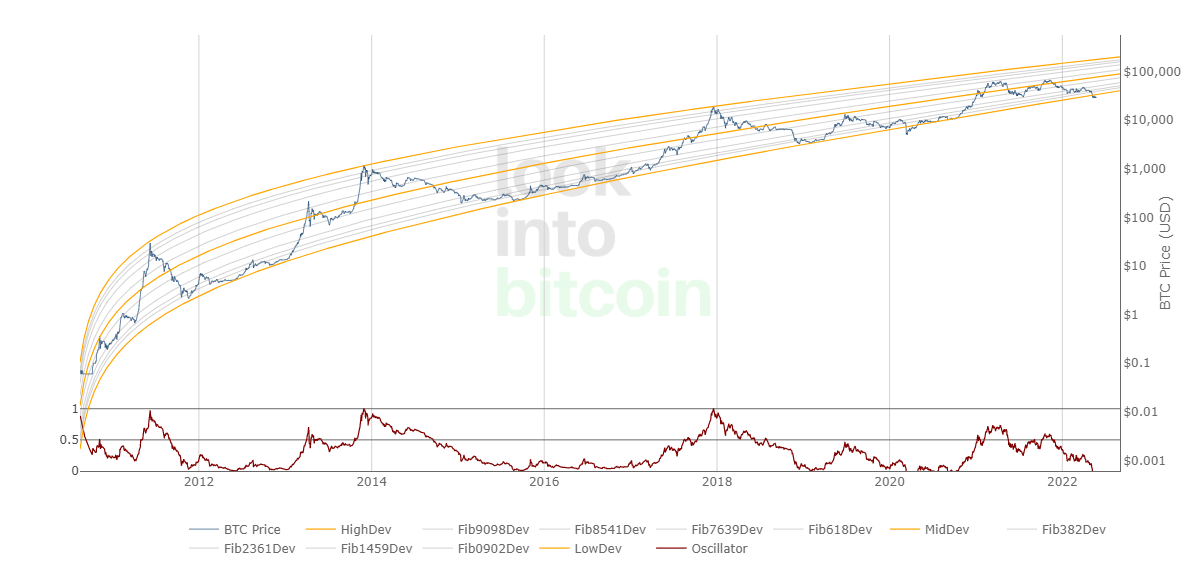

While crypto prices are fluctuating wildly, the overall trend is upwards. Prices have a general tendency to double on average every year. Crypto prices are therefore displayed on logarithmic charts. The most famous logarithmic price charts belong to Bitcoin. While all analysts agree that Bitcoin prices are increasing exponentially, there are controversial areas.

Some analysts think that the baseline of the above trend band represents the actual value of Bitcoin. They consider the other prices as hysteria. I do not agree with this view. I think pricing that has continued for close to two years cannot be interpreted as hysteria.

There is also the thesis that the rate of logarithmic increase has been decreasing over the years. I believe this is true for Bitcoin.

Offensive and Defensive Coins

The rapid increases and decreases we encounter in the crypto market do not affect all coins at the same rate. Stable coins can be seen as the most defensive coins in this context. Beyond that, the least fluctuating coin is Bitcoin. Compared to the beginning of the year, the price of many altcoins has dropped by a third or even a quarter, while the price of Bitcoin is down only 38%. Ethereum, whose price has halved compared to the beginning of the year, can be considered defensive compared to other altcoins in this context. Centralized exchanges such as BNB, FTX, Kucoin, and Huobi can be considered among the defensive coins.

When we consider the price movements of the last two years, we understand that DEFI and Metaverse coins have risen and fallen fast. Those who switch to stable coins or defensive coins during the period of optimism in the market are less affected by the bear market.

Bitcoin Domination

Until 2016, when the crypto market was mentioned, almost only Bitcoin came to mind. Bitcoin's share in crypto was higher than 90 percent. This situation changed after the bull rally in 2017. Bitcoin dominance is declining by an average of 6% each year. On the other hand, Bitcoin's dominance increases during bull markets. During bear markets similar to the one we are experiencing, Bitcoin dominance is rising. When evaluated in terms of risk-return ratio, Bitcoin continues to be one of the most attractive coins.

Correlations

Because of the strong correlation, crypto-assets gain and lose value together. Therefore, it is difficult to make money in the crypto market during the bear market period. During the bull market, almost all of the coins provide returns to their investors. Of course, the choice of the coin has a certain importance. During the bull market, rapid price increases occur at different times for different coins. Those who take advantage of the rising waves like a surfer and switch to another coin with the right timing can get astronomical returns.

On the other hand, coin prices are also linked to the money markets in general. Similar to stocks, cryptocurrency prices are also affected by the liquidity conditions in the market. As a general rule, this correlation becomes stronger during times of pessimism in the markets. When the state of extreme anxiety is over, crypto-assets start to move in their dynamics again.

Conclusion

I think crypto assets are unique in terms of return potential. On the other hand, investing in crypto requires a higher level of financial literacy compared to the alternatives. Having a long-term perspective, timing the market, and diversifying the portfolio seems to be critical success factors. It is also important to stay calm in times like today, where the sales seem like they will never end.

Thank you for reading.

Posted Using LeoFinance Beta

Yes, one day we will wake up and the market will become different, sales will become rare, for some insignificant period, it has always been like this and will be like this in the future, it turns out that we always need to adopt two desires, to get into a bull market and a bear market) .

Posted Using LeoFinance Beta

Least fluctuated coin Bitcoin and is down only 38%? Wow, that reflects how the rest of the market behaved.

Posted using LeoFinance Mobile

How good do those subheadings look! ;)

Posted Using LeoFinance Beta