Optimum Cosmos Airdrop Strategy: Budget ==> 170 USD

In February, I invested in the Cosmos ecosystem to take advantage of its airdrops. Although I loved this ecosystem, things did not go as I expected financially. There is often quite a distance between theory and practice. I got to know the Cosmos ecosystem in the past five months. Therefore, I have optimized my investment strategy.

Why Do I Care About the Cosmos Ecosystem?

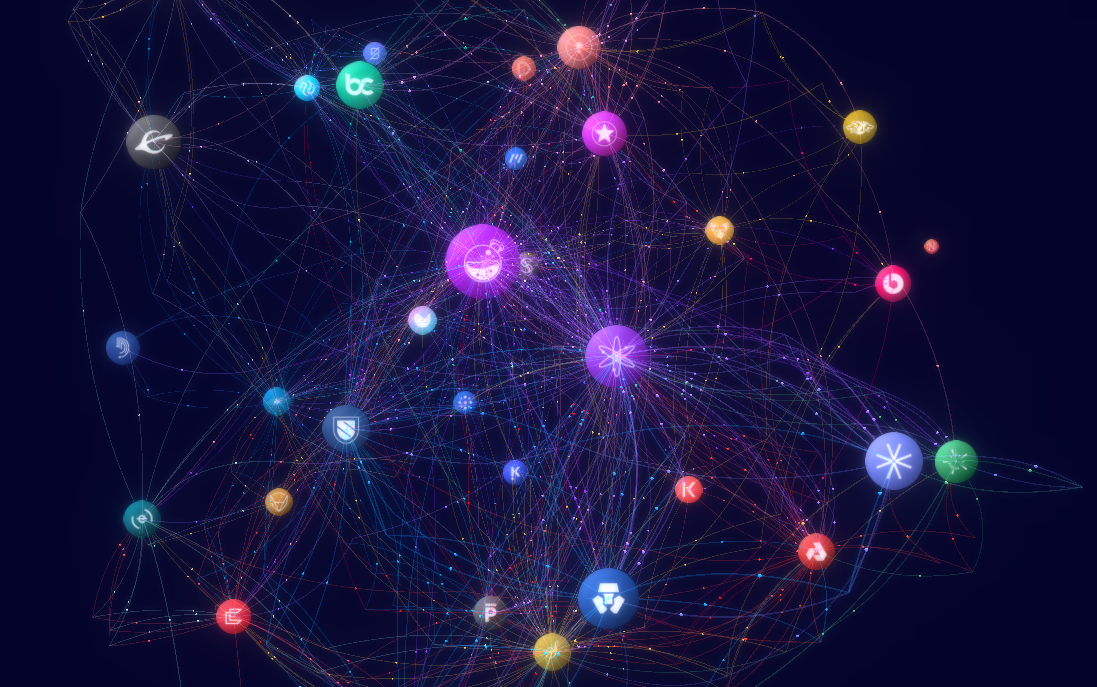

Famous for its airdrops, the Cosmos network describes itself as the internet of blockchains. One of two significant ecosystems, along with Polkadot, are candidates for solving blockchain interoperability. In structures such as Cosmos, called Layer 0, blockchains can easily integrate. Coins are transferred between blockchains in the Cosmos ecosystem via the IBS protocol. These transfers happen in a matter of seconds. Fund transfers between layer one blockchains must be done through applications that act as bridges. These bridges both create hacking risks and take a long time to transfer funds.

Cosmos software development kit(SDK) allows for creating optimized blockchains for different purposes. Blockchains on the Cosmos network use the Tendermint consensus algorithm.

The leading blockchains in the Cosmos ecosystem can be listed as Binance, Crypto.com, Cosmos Hub, Osmosis, Juno, and Thorchain. ATOM, the native coin of Cosmos Hub, is the 27th most valuable coin. Cosmos' rival, Polkadot, is in 10th place by market capitalization. The difference is due to the design of the ecosystems. While DOT is required to use the Polkadot ecosystem, blockchains in the Cosmos ecosystem are not required to use ATOM. Cosmos Hub is one of the blockchains in the ecosystem. Every blockchain has independent validators.

On the other hand, Cosmos is developing an infrastructure that the other blockchains will use. With this infrastructure, which is planned to be completed this year, Cosmos Hub validators can provide security for other blockchains. In this way, ATOM is intended to be in greater demand.

The Cosmos ecosystem seems to have solved the interoperability problem, at least among its networks. Blockchains such as EVMOS and KAVA, which connect Cosmos to networks using Ethereum Virtual Machine are not missing.

Using Cosmos Blockchains

To use the blockchains in the Cosmos ecosystem, it is necessary to download the Keplr wallet. Keplr supports major blockchains in the Cosmos ecosystem. Staking can be done using this wallet, and transfers can be made between blockchains via Keplr.

It is possible to make our transactions more secure by using Keplr together with Ledger Nano. Each Cosmos blockchain has its cryptocurrency, and transaction fees are paid with that cryptocurrency. I started by purchasing Cosmos Atom from Binance and sending it to the Cosmos Hub in my Keplr wallet. From Cosmos Hub, I then sent Cosmos ATOM to Osmosis via IBC and converted Atoms to Osmo in Osmosis Dex

Through Mintscan, we can access information such as inflation, staking returns, and transaction statistics about the Cosmos ecosystem blockchains. In this article, I will focus on the Cosmos Hub, Osmosis, and Juno networks that are the most subject to airdrops.

Optimum Cosmos Airdrop Strategy

In the Cosmos ecosystem, there is a tradition of distributing coins of newly produced blockchains to community members. There is an airdrop on the ecosystem almost every month. A certain amount of Atom, Osmo, or Juno must be staked to benefit from these airdrops. Although the minimum quantities vary on an airdrop basis, 10 Atom, 20 Osmo, and Juno each seem to be enough numbers. It is possible to buy these coins at today's prices for less than $200.

Not every airdrop happens to the stakes of all three networks mentioned above. There may also be airdrops for only one or both of these networks. The majority of Cosmos airdrops are done through a method called fairdrop. This means that everyone who meets the minimum conditions will be given equal coins. There are, of course, instances where investors receive airdrops proportional to the amount they stake. You can follow past and future Cosmos airdrops on this excel sheet.

If you don't want to stake coins on multiple networks, you can choose to stake only on Cosmos Hub. That's how I started. Staking across multiple networks provides advantages such as capturing all airdrops and claiming airdrop coins from various networks.

Yearly staking returns of Atom, Osmo, and Juno are 18%, 34%, and 81%, respectively. Airdrops provide $5-10 worth of coins per network on fairdrops. Given the frequent occurrence of these airdrops, I think it's worth the effort, especially for those who have the time.

Conclusion

Coins claimed through airdrops can sometimes become more valuable than the coins that led to their acquisition. The most recent example is that Hive has become more valuable than Steem. I don't think any coins should be invested just for the airdrop because airdrop amounts can be at the level of 1% or 2% of the coins that form their basis. That's the situation I've experienced with Spk.Network, Ragnarok, and a few Cosmos airdrops. However, the initial prices of the coins can be misleading. Projects with serious teams behind them gain value over time.

Thank you for reading.

Posted Using LeoFinance Beta

Great writeup

So this investment on Cosmos has been profitable for you? Did you get any valuable airdrop?

Posted Using LeoFinance Beta

I have got several airdrops worth of ~ 20 usd. My initial investment was over 1000 usd. So it was not a profitable investment. If I had invested the way I explained in my post, airdrop based apr would be higher.