What Bitcoin Nasdaq 100 Correlation Tells Us

When things are not going well in the financial markets, Bitcoin becomes correlated with stocks. Bitcoin has a high correlation with other crypto assets. Therefore, when the downward trend in the financial markets is dominant, crypto keeps up with this situation.

Before 2022, Bitcoin was an asset that did not correlate with other assets. The crypto stock correlation only appeared during black swan events, which didn't last long. Since the last quarter of 2021, crypto has significantly correlated with technology stocks. Because high interest rates negatively affect the prices of technology-based investment instruments, where the return on investment takes a long time.

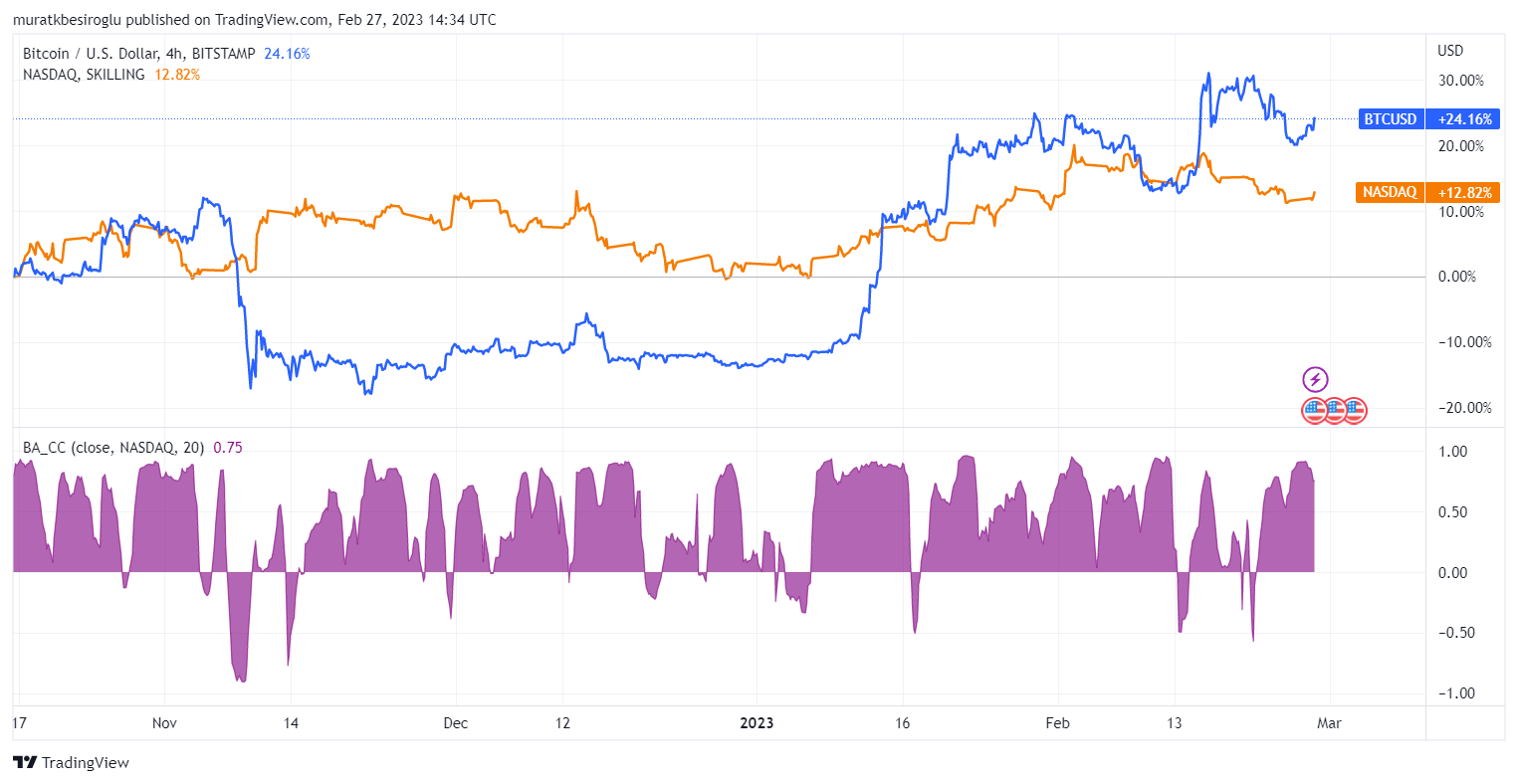

The chart below shows the relationship between Bitcoin and the Nasdaq 100 index over the last six months. The blue line shows the Bitcoin, and the orange line shows the Nasdaq 100 percent changes. The purple chart below shows the evolution of the Nasdaq and Bitcoin's correlation over time. I created the chart on 4 hours of data to see the situation more clearly.

The period when the blue line was rapidly descending marks when FTX went bankrupt. In January, we see that Bitcoin quickly rose and caught the performance of the Nasdaq 100. In the first half of February, Bitcoin made another mini-rally. In the time frame covered by the chart, Bitcoin is up 24.1%, and the Nasdaq 100 is up 12.8%. Can Bitcoin take this performance to an even better level?

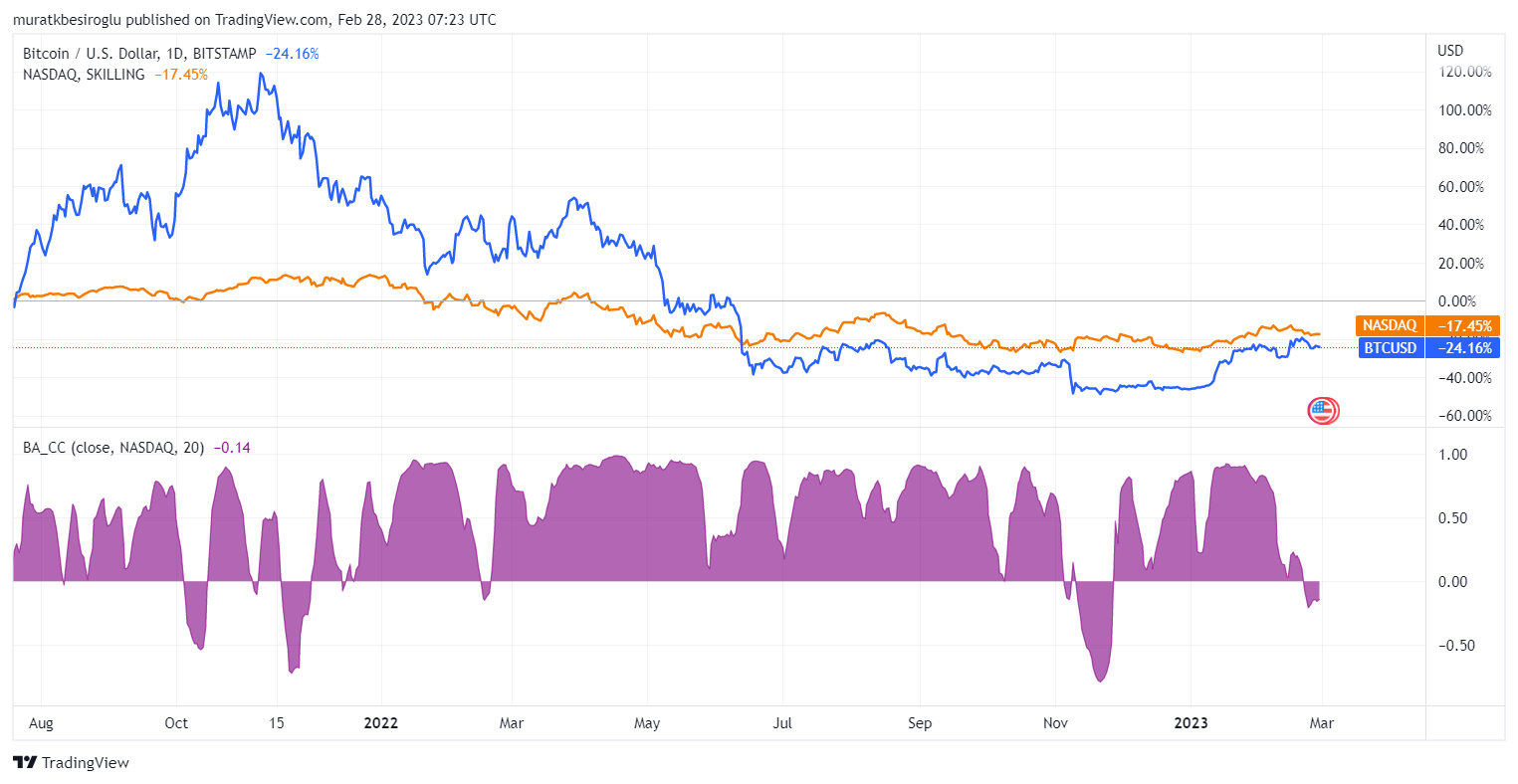

To see the landscape from a broader perspective, it would be appropriate to look at the situation from the second half of 2021.

In the second half of 2021, a strong rally occurred in Bitcoin. Starting in November, the Bitcoin price started to decline, and the rapid decline in Bitcoin price lasted until July 2022. The purple correlation chart below shows that Bitcoin's correlation with the Nasdaq continues through 2022. During the FTX crash, the correlation was reversed. While the stock prices went up, the price of Bitcoin decreased. In addition, the Nasdaq-Bitcoin correlation has been weak for the last 20 days. This time Bitcoin is outperforming the Nasdaq 100.

Conclusion

Macro trends are still influential in the market. Frequently asked questions: To what level will the Fed raise interest rates, and when the rate hike process will reverse? The inflation data announced last Friday negatively affected the market, and some claimed that the FED could increase by 50 basis points at the next meeting. The positive real interest rate zone will be entered in the USA in February or March because inflation is falling and interest rates are rising. In a positive real interest rate environment, the Fed will not be willing to raise interest rates. Because household indebtedness in the USA is high, the FED has to keep a balance. Depending on the inflation situation, the FED can end the process by increasing 25 basis points at the next meeting and 25 at the other meeting.

Once the rate hike process ends or a clear picture emerges on the interest policy, the crypto will go its own way. Many analysts state that crypto prices will remain flat this year. Because in the past, prices followed a flat course in the years following the previous bear market. Most analysts say that 2024 will be the year of the rally. On the other hand, big investors like to surprise retail investors—those who wait for 2024 risk can miss the next rally. I'm willing to spend a year sideways because I believe in the exponential growth potential of crypto.

In the last 20 days, the crypto market has diverged from stocks. If this divergence continues, we can look to the future with more hope.

Thank you for reading.

Image Source: Midjourney App

Posted Using LeoFinance Beta

If the macroeconomic indicators will turn green this year, I think we will see a rejuvenation of both stocks and crypto assets, even if slower in these phases. If all goes well, indeed, 2024 might be the year when it will fully sail ahead.

Posted Using LeoFinance Beta

The bull market was fun :)

I would love to see a situation whereby the crypto market will continue to experience such divergence.

I hope so :)

!PIZZA

PIZZA Holders sent $PIZZA tips in this post's comments:

@tin.aung.soe(3/10) tipped @muratkbesiroglu (x1)

You can now send $PIZZA tips in Discord via tip.cc!